V1 by (forgotten) replaced fairylord

QUOTE

Announcement ::

Official BigPay Telegram Channel - Daily Exchange Rate Updates for International Bank Transfer

Updates are on Mon-Fri at 11am.

Official BigPay Telegram Channel - Daily Exchange Rate Updates for International Bank Transfer

Updates are on Mon-Fri at 11am.

BIGPAY Prepaid MASTER Card that collaborating with AirAsia.

Use this card at any merchant that accepts MasterCard worldwide.

Enjoy good cash back by reloading selective credit card (Gives you cash back up to 10%* literary)

By BigPay Malaysia Sdn Bhd (formerly known as Tpaay Asia Sdn Bhd)

*The purported 10% is actually from the source cards (depending on the credit card used, cash back is up to 10%) used to reload the BigPay.

Official Website : https://www.bigpayme.com/

Historical evolution of product : 1- 4 as in Thread V1

» Click to show Spoiler - click again to hide... «

Benefits

• Exempt from the SST RM25, as it is a Prepaid Card.

• Annual Fee waived unconditionally.

• AirAsia flight processing fees waived if using BigPay to pay. - [See Details]

• RM2 Discount on purchase flight meal and luggage. - [See Details, tan_aniki, fruitie]

• AirAsia deals will be offered to BigPay holders, usually a day in advance.

• Remember to paste the Referral Code for Free RM10 while sign up.

• Credit card (Max

• Enjoy cash rebate by reloading with selected cash rebate credit cards.

• Good foreign exchange rate (almost equivalent as in XE.com) for oversea usage. [Example, official tips, blog]

• Instant transfer money to anyone (BigPay users) for Free. Max Daily Limit : RM2,000.

• Link to your BigPoints Account and earn BigPoints while

• BigPoints validity is 24 months.

• RM30

• RM20 Pay Bills in-app = 1 BigPoints - GrumpyNooby

» Click to show Spoiler - click again to hide... «

• Maximum wallet amount : RM10,000

• Contactless Payment (PayPass) Max Daily Limit : RM250 - Auto-enabled upon 1st pin-based usage

• Local Bank Transfer : Max RM1,000/

• Oversea Bank Transfer : Max RM20,000/day, RM30,000/mth, Remittance Fee : Refer to BP Apps [fixed at RM5 - RM23/each transaction]

• Oversea Bank Transfer : China, Indonesia, SG, Aus, India, Nepal, Bangladesh, Philippine, Vietnam, Thai

[Join Official Telegram for exchange rates - updated daily 11AM]

• Worldwide selected ATM withdrawal : RM10,000 or 10 withdrawals daily whichever come first

Selection of Bank (Try below) when make online payment if requested :

• CIMB - sendohz, sendohz

• Type "BigPay" - hye

• Tune Money Sdn Bhd or TPaay Asia Sdn Bhd - rap7733

How to apply?

• Download BigPay Apps from Google Store (Click Here) Or Apple Store (Click Here)

• Open the App then click "Sign Up"

• Key in Mobile Number

• Fill up simple personal details (and Referral Code)

• Snap image of your ID/Passport and Selfie

• Wait for In-Apps Notification / Email on Document Approval in 24hr

• Go to App, reload RM20 (will be in your BigPay Card for your use) by credit/debit card only

• Wait 3-5 working days for BigPay Card deliver to you (so far as per member, by Citylink)

How to activate the card?

• Once received BigPay Card, open the App click to acknowledge receipt of BigPay Card

• Fill up the CVV to activate it

• You may now set 6-digit pin for the ATM and POS or do it later in Setting

• You may now link to your BigPoints Account or do it later in Apps

Fees and Charges : (Latest refer to official Webpage)

• Domestic ATM withdrawals - RM6

• International ATM withdrawals - RM10 or 2% of withdrawal amount, which ever is higher [RM10 only until further notice]

• Currency Conversion Fee [applied when the purchase is effected in currencies other than MYR - 1% + network charges (only network charges until further notice)]

• Cross Border Fee [applied when the purchase is through merchant acquired outside of Malaysia but charged in MYR (waived until further notice)]

• Lost Card Replacement - RM20

• Sales Draft Retrieval - RM15

• Inactive Fee - RM2.50/month [waived until further notice]

• Card Cancellation - Free

• Card to Card Transfer - No

Reload BigPay to enjoy Cash Rebate (CB)

CC that entitle CB :

•

• PBB Quantum Master (5%) - celaw

• PBB Quantum Master (5%) - weejin2000, joevo2

• PBB Visa Signature (6%) - LostAndFound

• PBB Visa Infinite (0.3%

• SCB Liverpool FC (previously known as SCB CB Gold) - ckweng

• SCB JOP (1.87%) -

• ÆON BiG Visa Gold (2%) - MiKE7LIM, first come first serve

• AmBank True Visa (3%) - alexanderclz, CB, CB

• HL Essential (0.4% for $7000, then 1% unlimited) - cybpsych, dkwan87

• HL Fortune (1%) - chlee87, snowswc

• RHB Signature Visa (1%/2%/6%) - ClarenceT

• Alliance You.nique (1.2%, 3%, 0.3% unlimited) -

• OCBC World Master (1.2%,0.6% unlimited) - simonmada

• OCBC Titanium (1% unlimited) - hebe87, hebe87,

• OCBC 365 (1%) - baocord

• OCBC Cashflo (0.5%) - shadoe

• UOB One (0.2%) - terry5695

• HSBC Amanah (0.2%) - terry5695

• HSBC VS 5X point

• AmBank Bonuslink (=

CC that might entitle CB : pending (re)confirmation

• TBA

CC that entitle Miles/Points/etc :

• NEW LIST - come come come, member share your information

• Citi Rewards - 1:1

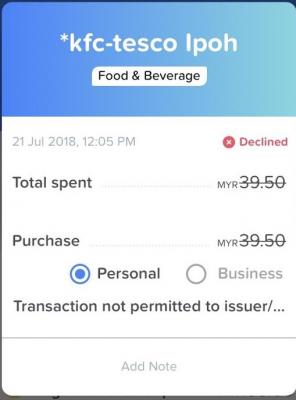

Merchants Issue

NOT APPLICABLE for : - see request

• Terminal that do not accept MasterCard cause BigPay is a MasterCard.

• Car workshop (unknown merchant) - MGM due to terminal can't support 'prepaid' type of transaction - Ambank Terminal

• Shabu Garden - Kuchai Lama - sendohz - PBB Terminal

• Mara Ibu Pejabat - slayersssss

• WeChat Pay - fruitie

• TGV (via MasterPass) - szejz123

• Traveloka - MilesAndMore, due to "Cybersource"

• RedBus - web and apps also not applicable

Previously/Occasionally N/A > Now Applicable ! :

• Grab - refer to 1st Post Special Updates bottom of this post

• Homecafe Taman Midah - stargate8

• Boost - sailou, fruitie, see how codeiki had successfully topped up.

• TM/Unifi -

• mobile@unifi app - alternative by borneoman1

• (ipay88) Touch n Go eWallet -

• Agoda -

Applicable but sometimes Hit-And-Miss:

• Shopee - shmily86, Cybersource ! TIPS : Work Around - spyrr

• myeg - drbone & cybpsych, successfully paid summon - yhtan

Oversea Withdrawal

Oversea ATM that charged fee on Withdrawal (+RM10 by BigPay): - see request

• Singapore $3 ~ $5 overall, DBS $5 Max $2k

• Singapore Changi Airport S$5 - DBS

• Thailand 220 Baht - Thai Bank, Citibank (200 Baht), UOB, Max 25,000 Baht, Max 50k Baht

• Thailand 150 Baht - Aeon Thai, Aeon

• USA $3 - PNC, Max $500, $800

• Australia - ANZ AUD2 (cheapest), Comm AUD3, Max $2,000, avoid Westpac & Bank of Melbourne - use own rate way higher

• Canada CAD$3 - CIBC, BMO Bank of Montreal, RBC Royal Bank

• Seoul, South Korea (near myeongdong) 3500 won - KB BANK

• Prague czk 99 - Euronets ATM

• Philipines - 250 peso - BDO, Max 10,000 pesos

• Vietnam - ANZ Max 5m VND, other usual Max 2~3m VND, Extra Fees abt RM10

• Cambodia - USD 5-6

• Taiwan - NT100 @ China Trust Bank, Max NTD 20k

Oversea ATM that charged ZERO fee on Withdrawal (only RM10 by BigPay):

• Japan - pending more info, SevenBank@7-11, Narita Airport, Max 100k Jpy@SevenBank

• Singapore - HSBC | Max $1k, OCBC | Max $1k, ICBC@Sentosa | BOC Max $2.5k BOC | Citi Max $3k

• Seoul, South Korea - KB Bank, Don't withdraw at Airport, Max 700k Won

• Taiwan (Max NTD 20k, Airport @ Tao Yuan / Kao Shiung Max NTD 20k, banks), list of banks

• Indonesia - CIMB Bank Niaga@Jakarta T3 Airport

• Oman - International Airport Arrival Hall - HSBC

• Salzburg, Austria - see this, Max EUR 300

• UK - avoid ATM in Bars/OneStop -£2.50

• Thailand - MBB ATM

• China - ABC, BBC, BOC & ICBC ATM, to be testified using BP card

• Swiss - Duetsche

• HongKong - HSBC

• Germany - Sparkasse Max EUR 600

• Turkey - Ziraat Bankasi @ Istanbul Airport

Oversea ATM Withdrawal : pending (re)confirmation any fee

• Singapore Changi Airport - BOC $2.5k | MBB $1.5k

FAQ in Thread : for official FAQ - link

Q1 : How much BigPoints awarded if i spend less than RM20?

A1 : The point will be round down. Example, pay with big card with amount RM19.99=0 point.

Q2 : How soon the BigPoints awarded upon Reload and Spend?

A2 : 3-5 days on Spending, 1-2 days on Reload.

Q3 : How to link BigPay to AirAsia BigPoints?

A3 : Use the same email address that you used to registered AirAsia BigPoints account, the point will then sync automatically. Or you may link it in App Setting if it doesn't sync by itself.

Q4 : Can I reload BigPay with other's credit card?

A4 : BigPay FB replied to drbone that no issue to use other's cc to reload. [MGM, glauncher, BP is monitoring]

Q5 : What's the maximum amount withdrawn via ATM?

A5 : Maximum withdrawal allowed is RM10,000 [BigPayJonathan per day, daily capping. Subjects to individual ATM or CRM, how many notes that ATM/CRM dispenses once (eg: 30,35,40,50,99), what is the max denomination notes that ATM/CRM dispenses (eg RM50 or RM100), SO same bank different ATM/CRM may have different limits on max withdrawal allowed. AVOID RHB & PBB ATM for withdrawal - makan BP card

» Click to show Spoiler - click again to hide... «

Q6 : How long would it takes for the status of a transaction to changed from "Pending" to "Settled"?

A6 : It may take up to 5 days or more to update the status to "Settled".

Q7 : How long would it takes for the BigPoints to be reflected after "Settled"?

A7 : It may take up to 2 days after Settled (latest as per members).

Q8: Do I need to have more than RM200 to pump petrol?

A8: Yes, If your pump at petrol island which terminal need pre-aut RM200. Unless you pump at petrol island (like Petron) which terminal allow you to pre-set amount to pump OR you pay at cashier by informing the amount to pump in prior. Further explanation see - [ClarenceT & cybpsych, BPJonathan].

Q9 : Can the card be over swipe if to spend amount more than balance amount in card?

A9 : Yes, BUT the second transaction decline automatically.

Q10 : Can I Top Up, Large Amount, Withdraw via ATM, Very Frequently (defined by provider), merely to enjoy the cash rebate under top up source card?

A10 : Not Advisable. Please read the following posts for reference as advises. To read the original post of the quoted, please click the

at bottom right of every quoted post.

at bottom right of every quoted post.By Moderator :

» Click to show Spoiler - click again to hide... «

By members :~

» Click to show Spoiler - click again to hide... «

~ cybpsych» Click to show Spoiler - click again to hide... «

By keyword search in Thread V1 : ~ TaiSong (for withdraw 60k in 2mths)

~ ATM

~ Susp* (for Suspension/Suspended)

~ Ban* (for Banned/Ban)

.

This post has been edited by fairylord: Jan 11 2021, 10:57 AM

Jul 22 2018, 01:37 PM, updated 5y ago

Jul 22 2018, 01:37 PM, updated 5y ago

Quote

Quote

0.1726sec

0.1726sec

0.96

0.96

6 queries

6 queries

GZIP Disabled

GZIP Disabled