Outline ·

[ Standard ] ·

Linear+

Prepaid Cards BigPay - Prepaid MasterCard (with Mobile Apps) V2, CashBack, BigPoint & Remittance

|

Fortunekl

|

Jul 25 2018, 02:27 PM Jul 25 2018, 02:27 PM

|

|

QUOTE(tan_aniki @ Jul 25 2018, 02:02 PM) Can make this to RM20k/month rather than the same as the wallet limit? I use more than RM10k/month sometime... I think you should revise to withdrawal limit rather than credit card top up limit, the fair game should be using it but not withdraw it... Please kindly revise ya... Agree with you bro, if the cardholder unable to withdraw beyond 10k, he wont reload above that amount. So nobody will abuse the limit. now they are killing off the genuine spender and force them go back to the credit card. BigPayJonathan |

|

|

|

|

|

Fortunekl

|

Jul 25 2018, 06:17 PM Jul 25 2018, 06:17 PM

|

|

QUOTE(tan_aniki @ Jul 25 2018, 06:13 PM) Yes, that's why those who comfortable is the one who abuse the system, genuine spenders like you and me would have now limit by this new implementation… Yes. My spending on July also beyond their new threshold. What’s the point of reloading by CASA? I can just pay by other CC. This post has been edited by Fortunekl: Jul 25 2018, 06:18 PM |

|

|

|

|

|

Fortunekl

|

Jul 25 2018, 08:04 PM Jul 25 2018, 08:04 PM

|

|

QUOTE(BigPayJonathan @ Jul 25 2018, 07:08 PM) Yes. We've actually focused a lot of our attention on building up the infrastructure and our customer support team rather than marketing in the past few weeks. You're 100% right and your concerns are legit! You can still top up with no limit in the app using your banks debit card or online bank transfer. Why? Banks charge us fees for credit card top ups. We absorb these fees so that you can top up easily and for free. We think limiting monthly credit card top ups is a fair way for us to continue to provide a convenient top up method in a sustainable way. That's why we've introduced unlimited online bank transfer at no charge. See my reply above! Thanks for the support! You can still spend and top up more than RM10K per month... The only thing we're limiting is the amount you can top up with credit card per month. (sorry it took me some time to reply, but Tony made an unexpected appearance in our office so things got a little out of hand haha) Thanks Jonathan for the explanation. I will rather go back to CC once my cc reload was exhausted. At least other cc still give me some TP/cashback. CASA reload will give nothing. |

|

|

|

|

|

Fortunekl

|

Jul 26 2018, 12:27 AM Jul 26 2018, 12:27 AM

|

|

QUOTE(fruitie @ Jul 26 2018, 12:25 AM) I was referring to those big whales in this thread.  Not everyone is into airmiles and all. I don't have time to travel, so cash back is more relevant to me. I'm not a big whale also la.  Sister you are not whale but buaya with 20-30 cards. Lol |

|

|

|

|

|

Fortunekl

|

Jul 26 2018, 12:32 AM Jul 26 2018, 12:32 AM

|

|

QUOTE(fruitie @ Jul 26 2018, 12:29 AM) That's why SST comes, I'm the first to die.  Will try to shift my usage to BigPay if possible. Don’t panic, bank should be the one who panic before us. I remember they do offer low TP to redeem for service tax rebate. So you admit you are the buaya. Lol |

|

|

|

|

|

Fortunekl

|

Jul 26 2018, 03:01 PM Jul 26 2018, 03:01 PM

|

|

QUOTE(tan_aniki @ Jul 26 2018, 01:32 PM) Maybe BP WMC lol~ With priority pass as well~ With min salary of RM10k/month with EPF uploaded for verification~ New market segment for BP👍👍 |

|

|

|

|

|

Fortunekl

|

Jul 27 2018, 10:21 AM Jul 27 2018, 10:21 AM

|

|

QUOTE(tan_aniki @ Jul 27 2018, 10:05 AM) no choice lo, later money stolen blame BP pula... for the time being just use another phone to snap the screen... amex charge more than visa/mc, don't think they will allow that to happen... I don’t mind to pay annual fees to get in different BP segment if they allow Amex reload/unlimited cc reload. As long as the cashback/rebate we get is greater than the fees we pay to BP. |

|

|

|

|

|

Fortunekl

|

Jul 27 2018, 02:00 PM Jul 27 2018, 02:00 PM

|

|

QUOTE(BigPayJonathan @ Jul 27 2018, 01:24 PM) That's a really cool suggestion. Just forwarded it to our product team! We don't have any relationship as far as I'm aware... Though I'm conscious that we're sometimes identified as CIMB online. Not sure of the reason why, I'll ask. Pls add the button to delete the unwanted cc |

|

|

|

|

|

Fortunekl

|

Jul 27 2018, 02:24 PM Jul 27 2018, 02:24 PM

|

|

QUOTE(donhue @ Jul 27 2018, 02:17 PM) Can be done via Settings > Top Up Sources. Then tap on the card you want to delete, and you'll have the options to "Make default" or "Delete this card". BigPayJonathanPlease request a way for us to add a description to the cards on the top up sources. You are right. 👍 |

|

|

|

|

|

Fortunekl

|

Jul 27 2018, 02:25 PM Jul 27 2018, 02:25 PM

|

|

QUOTE(almeizer @ Jul 27 2018, 02:17 PM) There is delete button once you select the card. Only can see in setting page |

|

|

|

|

|

Fortunekl

|

Aug 1 2018, 03:19 AM Aug 1 2018, 03:19 AM

|

|

Is the BP system down?

|

|

|

|

|

|

Fortunekl

|

Aug 2 2018, 03:01 PM Aug 2 2018, 03:01 PM

|

|

QUOTE(rapple @ Aug 2 2018, 12:04 PM) Make another payment with this card this time is to LHDN. As usual lhdn still charge the 0.08% fees. Bigpoints is credited a few days later? Irb charge 0.8% or 0.08%? |

|

|

|

|

|

Fortunekl

|

Aug 9 2018, 10:25 PM Aug 9 2018, 10:25 PM

|

|

QUOTE(tan_aniki @ Aug 9 2018, 08:31 PM) Just got my Ambank True Visa and now enjoying another extra RM30/month~ Total = RM38 (PBBVS) + RM30 (PBBQMC) + RM200/250 (PBB CB4U) + RM50 (SCCB) + RM85 (SCJOP) + RM50/100 (MBBFCBVS) + RM200 (HLB Fortune) + RM30 (Ambank True) = RM683/783 - RM6 X 2 or 3 (BP Withdrawal) - RM2 X 4 (Boost Withdrawal) = RM663/757 CB earning/month~ Good la. Can get 2biji free Samsung note 9 liao💪💪💪 |

|

|

|

|

|

Fortunekl

|

Aug 17 2018, 03:38 PM Aug 17 2018, 03:38 PM

|

|

not receive TAC for online purchase, BP system down???

|

|

|

|

|

|

Fortunekl

|

Aug 17 2018, 04:02 PM Aug 17 2018, 04:02 PM

|

|

QUOTE(laymank @ Aug 17 2018, 03:49 PM) I tried to pay maxis also failed. I think BigPay itself is the problem to various online payment issues, i.e. Boost. system up, payment successsful |

|

|

|

|

|

Fortunekl

|

Nov 9 2018, 04:16 PM Nov 9 2018, 04:16 PM

|

|

QUOTE(BigPayJonathan @ Nov 9 2018, 04:14 PM) Technically, if you think of it... There isn't really any difference between a prepaid and a debit card  Hi Jonathan, any updates on the PREMIER BIGPAY card with higher CC reload limit? |

|

|

|

|

|

Fortunekl

|

Nov 9 2018, 04:36 PM Nov 9 2018, 04:36 PM

|

|

QUOTE(BigPayJonathan @ Nov 9 2018, 04:31 PM) A bigger wallet limit is being lobbied to the authorities  Edit: just out of curiosity, who here would be interested in being able to store more than RM10K in their BigPay account? I know many are waiting |

|

|

|

|

|

Fortunekl

|

Jan 20 2019, 11:03 AM Jan 20 2019, 11:03 AM

|

|

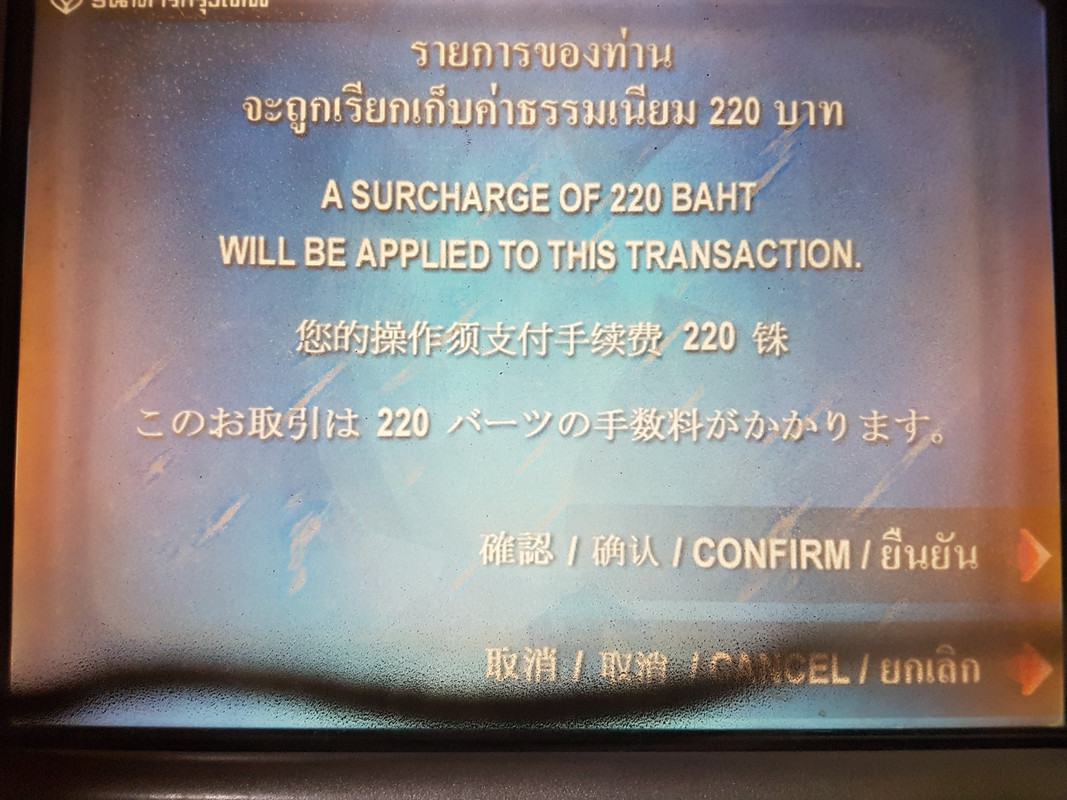

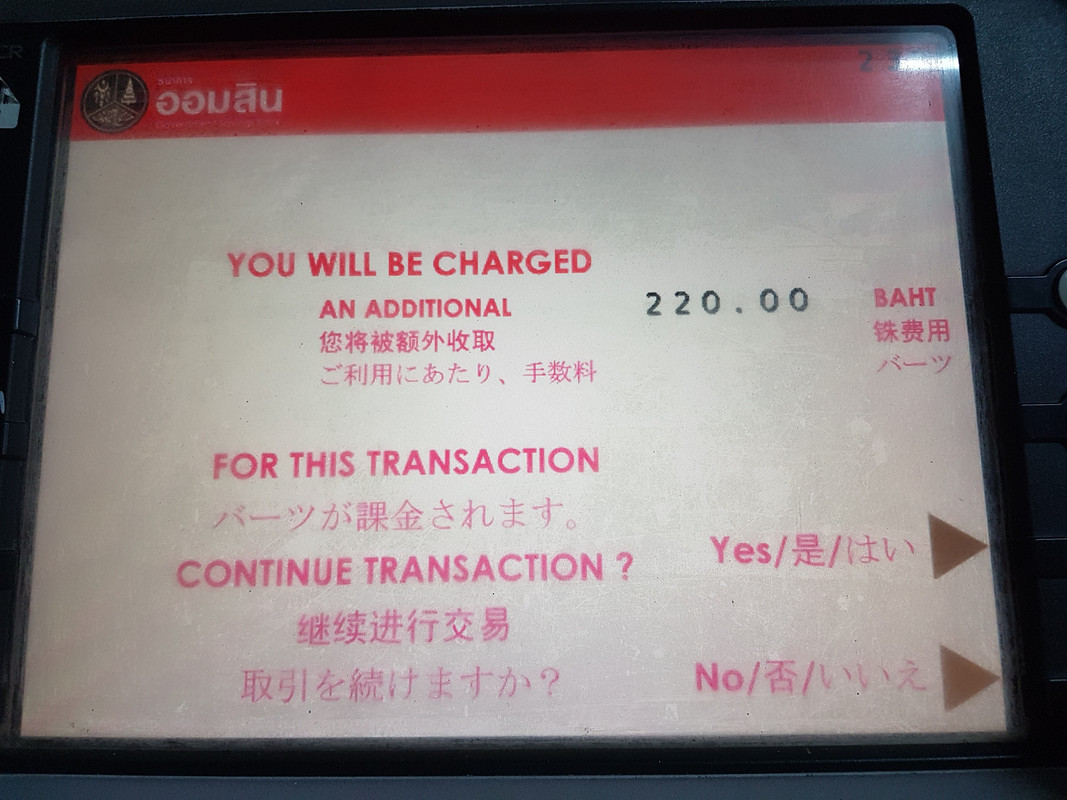

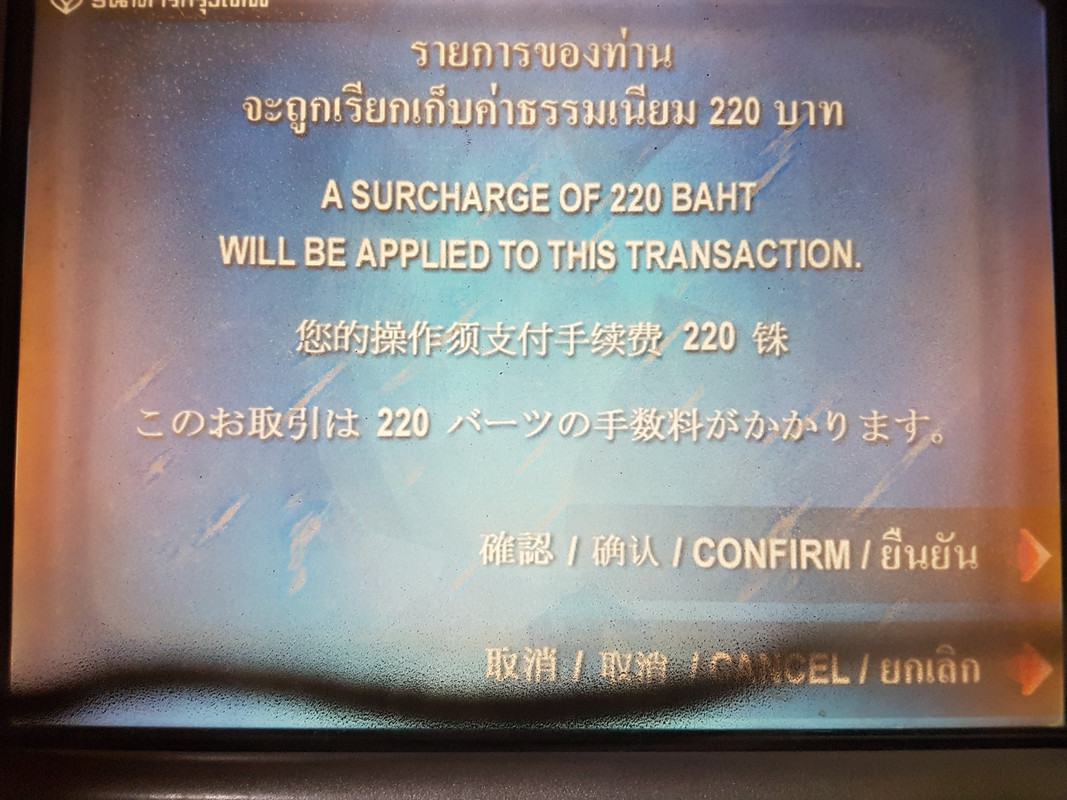

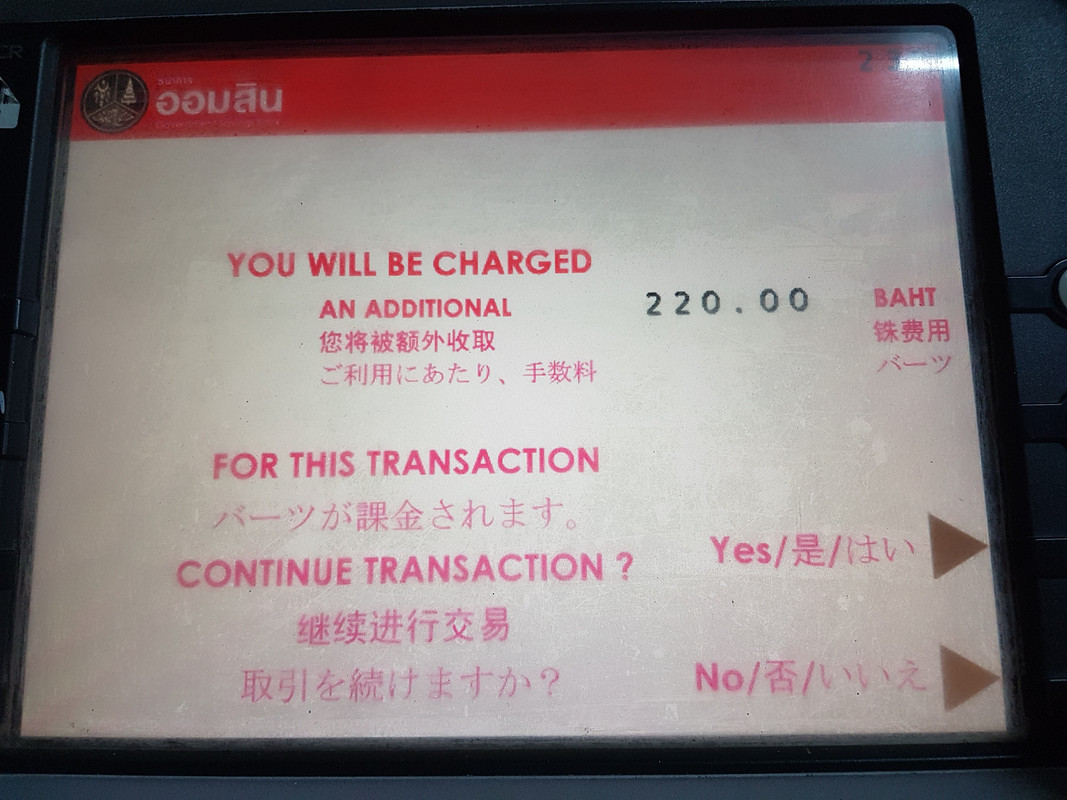

QUOTE(#Victor @ Jan 20 2019, 01:22 AM) BigPay is not so friendly in Thailand. Tried to use at 7-Eleven but need minimum 300THB purchase to use card. While hotel charge additional 3% for card usage 😑 end up withdraw at ATM with 220 baht charges.   I remember someone mention using Thai mbb/cimb won’t be charge for additional withdrawal fees🤔. Can someone confirm?? |

|

|

|

|

Jul 25 2018, 02:27 PM

Jul 25 2018, 02:27 PM

Quote

Quote

0.0558sec

0.0558sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled