Original FD Thread

Fixed Deposit Rates in Malaysia v2

Fixed Deposit Rates in Malaysia v3

Fixed Deposit Rates in Malaysia v4

Fixed Deposit Rates in Malaysia v5

Fixed Deposit Rates in Malaysia v6.1

Fixed Deposit Rates in Malaysia v7

Fixed Deposit Rates in Malaysia v8

Fixed Deposit Rates in Malaysia v9

Fixed Deposit Rates in Malaysia v10

Fixed Deposit Rates in Malaysia v11

Notice / Disclaimer:-

Call & Visit the respective banks for confirmation & latest promotion.

We are not liable to any misinformation which might cause any financial or opportunity loss (which include FD rates & any others information).

Malaysia Major Commercial Banks and Foreign Banks Fixed Deposit / Time Deposit Rates as of 10 October 2015.

| Bank | 1 month | 3 months | 6 months | 12 months | Remarks |

| Affin Bank | 3.25% | 3.3% | 3.40% | 3.7% | |

| Alliance Bank | 3.15% | 3.2% | 3.25% | 3.3% | FD Gold 12 months 3.40% (Interest paid monthly) |

| AmBank | 3.15 | 3.2% | 3.25% | 3.35% | |

| Citibank | 2.95% | 3.10% | 3.10% | 3.20% | |

| CIMB Bank | 3.15% | 3.2% | 3.25% | 3.30% | |

| Hong Leong Bank | 2.95% | 3.00% | 3.10% | 3.30% | |

| HSBC Bank | 3.00% | 3.10% | 3.15% | 3.30% | |

| Maybank | 3.15% | 3.20% | 3.25% | 3.30% | |

| OCBC Bank | 2.90% | 3.00% | 3.05% | 3.25% | |

| RHB Bank | 3.15% | 3.20% | 3.25% | 3.45% | |

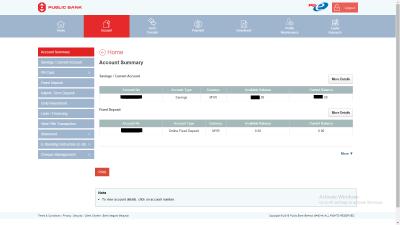

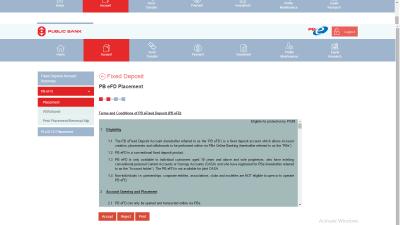

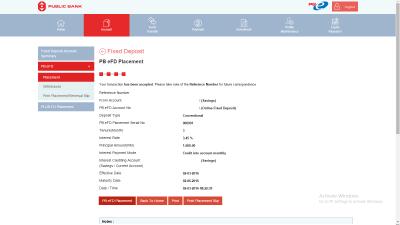

| Public Bank | 3.15% | 3.20% | 3.30% | 3.35% | PB Golden 50 Plus 12 months 3.45% |

| Standard Chartered Bank | 2.95% | 3.10% | 3.15% | 3.25% | |

| UOB Bank | 3.05% | 3.10% | 3.10% | 3.30% |

Fixed / Time Deposit and Savings Account Promotions 2016.

Please call the nearest bank to reconfirm the rates (go to the bank website for bank contact number where you can also get the contact number of the branch nearest to you) before going to the bank to check if promotions are still valid.

*

Alliance Bank FD Promotion. Minimum Fresh Fund RM10K. Valid until 30 June 2016 - Contributed by poor man

12 months - 3.90%p.a.

QUOTE(poor man @ Apr 15 2016, 07:52 PM)

“Alliance 12 Months Fixed Deposit Campaign” 12 April 2016 to 30 June 2016

12 months 3.90% p.a. minimum of RM10,000 in Fixed Deposit (FD)

t&c

https://www.alliancebank.com.my/ABMB/media/...-months-3-9.pdf

*12 months 3.90% p.a. minimum of RM10,000 in Fixed Deposit (FD)

t&c

https://www.alliancebank.com.my/ABMB/media/...-months-3-9.pdf

Alliance Bank e-Fixed Deposit/e-Alliance Term Deposit-i. Minimum Fresh Fund RM10K. Valid until 30 June 2016

1 month - 3.40%p.a. - Minimum Fresh Fund RM20K

2 months - 3.60%p.a. - Minimum Fresh Fund RM20K

12 months - 3.90%p.a. - Minimum Fresh Fund RM10K

1 Month & 2 Months T&C | 12 Months T&C

*

Affin Bank FD Promotion. Minimum Fresh Fund RM10K. Earmark RM5K to Savings Account. Valid until August 2016 - Contributed by BoomChaCha

3 months - 3.85% p.a.

6 months - 3.95% p.a.

9 months - 4.00% p.a.

12 months - 4.2% p.a.

13 months - 4.3%p.a.

QUOTE(BoomChaCha @ Apr 4 2016, 09:58 AM)

Affin Bank FD Promo, valid until August 2016

(1) 3 months: 3.85%

(2) 6 months: 3.95%

(3) 9 months: 4.00%

(4) 12 months: 4.2%

(5) 13 months: 4.3%

Minimum FD deposit RM 10K

Each FD promo needs to put additional RM 5K to saving account and earmark

to follow FD tenure.

A free gift of this FD promo is something like Micro Fiber Mop

*(1) 3 months: 3.85%

(2) 6 months: 3.95%

(3) 9 months: 4.00%

(4) 12 months: 4.2%

(5) 13 months: 4.3%

Minimum FD deposit RM 10K

Each FD promo needs to put additional RM 5K to saving account and earmark

to follow FD tenure.

A free gift of this FD promo is something like Micro Fiber Mop

Bangkok Bank. Promo until 30 June 2016.

12 months - 4.35%p.a.

QUOTE(poor man @ May 4 2016, 07:53 AM)

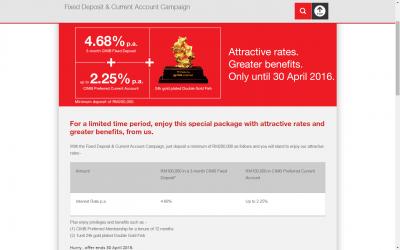

*CIMB FD Promotion. Minimum Fresh Fund RM10K.

QUOTE(bbgoat @ May 3 2016, 06:43 PM)

*Hong Leong Bank. Minimum Fresh Fund RM10K. Promo until 30 June 2016.

3 months - 4.15%p.a.

6 months - 4.25%p.a.

QUOTE(cybpsych @ May 19 2016, 06:58 PM)

here's the website and T&Cs...

HLB: 3-month and 6-month FD Promotion [ HLB | T&Cs (EN) | T&Cs (BM) | T&Cs (CN) ]

02 May 2016 - 30 Jun 2016

HLB: 3-month and 6-month FD Promotion [ HLB | T&Cs (EN) | T&Cs (BM) | T&Cs (CN) ]

02 May 2016 - 30 Jun 2016

QUOTE(bbgoat @ May 3 2016, 06:43 PM)

HL: (as some reported)

3 mth 4.15%, 6 mth 4.25% min 10k

till end of June. No more 3 mth 4.3% for >100k.

*3 mth 4.15%, 6 mth 4.25% min 10k

till end of June. No more 3 mth 4.3% for >100k.

Hong Leong Mach FD. Minimum Fresh Fund RM10K. Promo until 30 June 2016.

3 months - 3.90%p.a.

6 months - 4.05%p.a.

QUOTE(cybpsych @ May 21 2016, 01:28 PM)

here's the website and T&Cs...

Get up to 4.05% p.a. fixed deposit rates and grow your savings.

HLB | T&Cs (EN) | T&Cs (BM)

Visit any of our branches before 30th June 2016 to enjoy high interest rates.

Make a minimum placement of RM10,000 and enjoy:

4.05% p.a. fixed rate for 6-month.

3.90% p.a. fixed rate for 3-month.

*

Get up to 4.05% p.a. fixed deposit rates and grow your savings.

HLB | T&Cs (EN) | T&Cs (BM)

Visit any of our branches before 30th June 2016 to enjoy high interest rates.

Make a minimum placement of RM10,000 and enjoy:

4.05% p.a. fixed rate for 6-month.

3.90% p.a. fixed rate for 3-month.

Hong Leong Bank. Minimum Fresh Fund RM10K. Promo until 31 August 2016.

1/2/3 month(s) - 3.30%p.a.

QUOTE(cybpsych @ May 27 2016, 03:38 PM)

Hong Leong Connect: Exclusive promo rate for online Fixed Deposit/-i

27 May 2016 - 31 Aug 2016

HLB | T&Cs (EN) | T&Cs (BM)

*27 May 2016 - 31 Aug 2016

HLB | T&Cs (EN) | T&Cs (BM)

Kuwait Finance House. Minimum Fresh Fund RM10K. Promo until 1 July 2016.

6 months - 4.15%p.a.

12 months - 4.25%p.a.

QUOTE(poor man @ May 7 2016, 09:38 PM)

kfh malaysia fd promo

Deposit Today. Get Paid in Advance!

12 mth - 4.25%

6 mth - 4.15%

The Campaign shall run from 6 April 2016 until 1 July 2016

T&C http://www.kfh.com.my/kfhmb/ep/images/v2/d...2016_060516.pdf

2.2 New Participants opting to participate in this Campaign shall be required to open AND

maintain an account with KFH Malaysia such as KFH SURE Savings or Current

Account-i during the Campaign Period for the purpose of crediting the profit.

This post has been edited by Ah SiAnG: Jun 1 2016, 05:30 PMDeposit Today. Get Paid in Advance!

12 mth - 4.25%

6 mth - 4.15%

The Campaign shall run from 6 April 2016 until 1 July 2016

T&C http://www.kfh.com.my/kfhmb/ep/images/v2/d...2016_060516.pdf

2.2 New Participants opting to participate in this Campaign shall be required to open AND

maintain an account with KFH Malaysia such as KFH SURE Savings or Current

Account-i during the Campaign Period for the purpose of crediting the profit.

Feb 21 2016, 02:47 PM, updated 10y ago

Feb 21 2016, 02:47 PM, updated 10y ago

Quote

Quote

0.2402sec

0.2402sec

1.36

1.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled