Original FD Thread

Fixed Deposit Rates in Malaysia V2

Fixed Deposits Rates in Malaysia V3

Fixed Deposit Rates in Malaysia V4

Fixed Deposits Rates in Malaysia V5

Malaysia Major Commercial Banks and Foreign Banks Fixed Deposit / Time Deposit Rates as of 16 July 2014.

Bank - FD rates for 1 month, 3 months, 6 months and 12 months.

Affin Bank - 3.25%, 3.3%, 3.40% and 3.7% (Revised 18/7/14)

Alliance Bank - 3.15%, 3.2%, 3.25% and 3.3% (Revised 21/7/14). FD Gold 12 months 3.40% (Interest paid monthly).

AmBank - 3.15, 3.2%, 3.25% and 3.35% (Revised 18/7/14)

Citibank - 2.95%, 3.10%, 3.10% and 3.20% (Revised 17/7/14)

CIMB Bank - 3.25%, 3.30%, 3.35% and 3.40% (Revised 16/7/14)

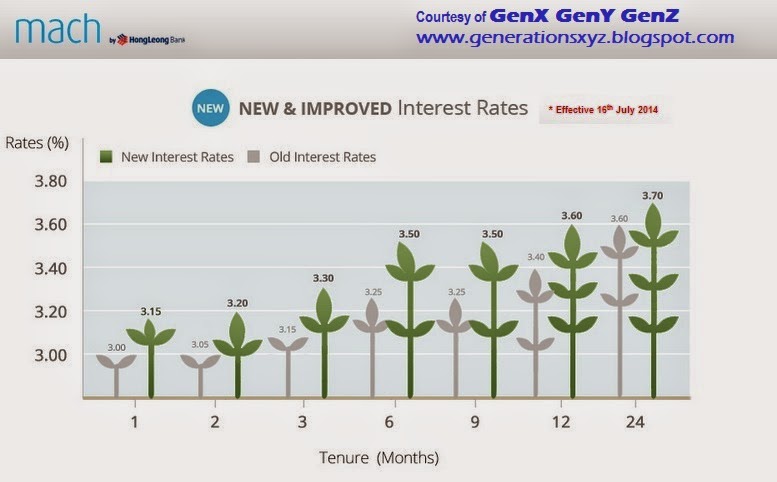

Hong Leong Bank - 3.05%, 3.1%, 3.2% and 3.30% (Revised 16/7/14)

HSBC Bank - 2.90%, 3.10%, 3.15% and 3.25% (Revised 16/7/14)

Maybank - 3.15%, 3.20%, 3.25% and 3.30% (Revised 16/7/14)

OCBC Bank - 2.75%, 2.85%, 2.9% and 3.05%

RHB Bank - 3.15%, 3.20%, 3.25% and 3.45% (Revised 18/7/14)

Public Bank - 3.15%, 3.20%, 3.30% and 3.35%. PB Golden 50 Plus 12 months 3.45% (Revised 16/7/14)

Standard Chartered Bank - 2.95%, 3.10%, 3.15% and 3.25% (Revised 23/7/14)

UOB Bank - 3.05%, 3.10%, 3.10% and 3.30% (Revised 18/7/14)

Fixed / Time Deposit and Savings Account Promotions 2014

Please call the nearest bank to reconfirm the rates (go to the bank website for bank contact number where you can also get the contact number of the branch nearest to you) before going to the bank to check if promotions are still valid.

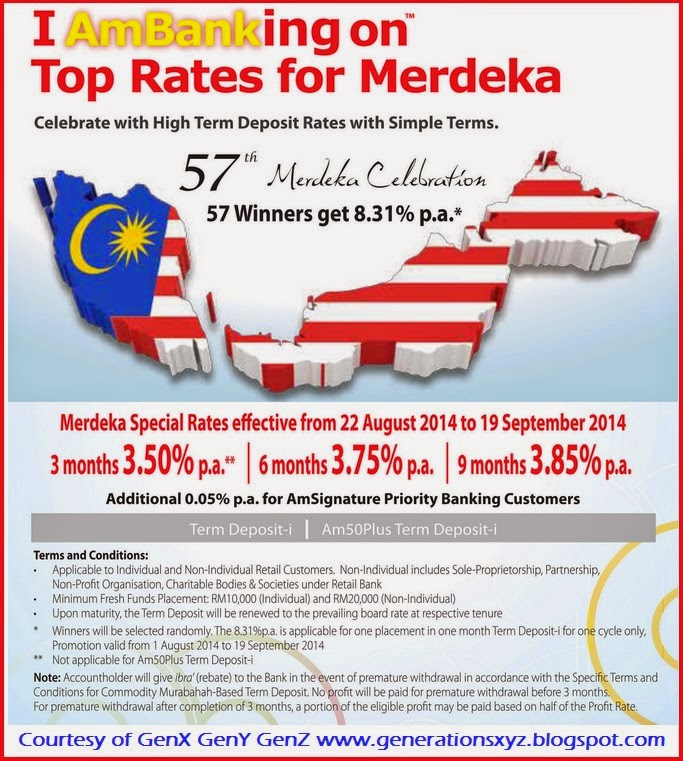

AmBANK - Valid until 19 September 2014.

HONG LEONG BANK

15 Months - 4% with 10% into CASA

12 Months - 3.85% with 10% into CASA

CASA amount to be earmarked for 6 months.

*

MACH by HLB - MACH revised up their online interest rates for FD effective 16/7/2014 and they are now as competitive as Affin Bank.

OCBC BANK - Minimum RM10K. Promo ends 31st July 2014. Please call OCBC for latest promos.

Fresh Funds Options

Option 1 (REVISED IN JUNE) - 18 Months Tenure. First 12 months 3.6% and remaining 6 months 4%.

Option 2 - 12 Months 3.65% Islamic Banking "FD". No need to worry about stupid CASA thingy.

Option 3 - 3 Month 4.3% But you go to place equal amount in CASA. If you are new to OCBC Combo FD Savings Deal, please click here to my blog and read my comments.

Existing Funds - No need stupid CASA thingy.

3 Months - 3.2%

12 Months 3.4%

UOB BANK - Please call UOB for latest promos.

QUOTE(BoomChaCha @ Sep 2 2014, 02:05 PM)

UOB FD Promo - Effective from 2 Sept until 30 Nov[/u]

(1) 3 Months - 3.7% and 4.00%

(i) 3.7%, 8% in CASA. This means 92% in FD, 8% in CASA and hold for 3 months.

(ii) 4.00%, 30% in CASA and hold for 3 months.

(2) 6 Months - 3.75% pure FD (was 3.7%)

(3) 13 months - 3.95% (was 3.9%), FD interest will deposit to saving account every 6 months.

Open a saving account requires min RM 2K, but can withdraw it during the second day.

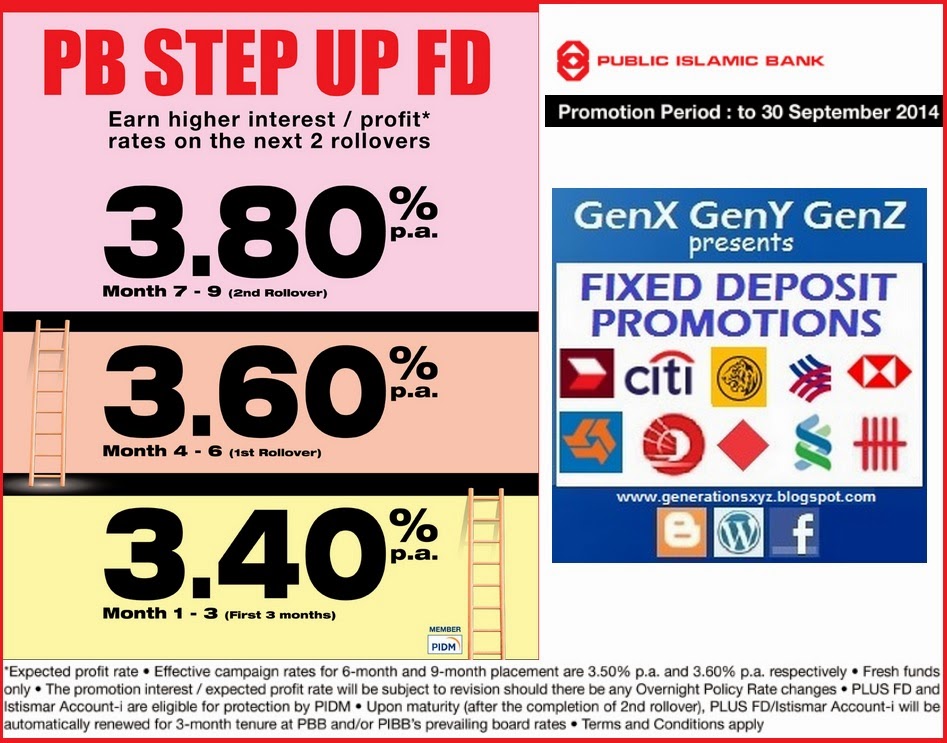

PUBLIC BANK ISLAMIC - 9 Months Step Up FD. Rates revised 1st July 2014. Valid until 30 September 2014(1) 3 Months - 3.7% and 4.00%

(i) 3.7%, 8% in CASA. This means 92% in FD, 8% in CASA and hold for 3 months.

(ii) 4.00%, 30% in CASA and hold for 3 months.

(2) 6 Months - 3.75% pure FD (was 3.7%)

(3) 13 months - 3.95% (was 3.9%), FD interest will deposit to saving account every 6 months.

Open a saving account requires min RM 2K, but can withdraw it during the second day.

Public Bank Islamic has a Step Up FD without the stupid CASA requirement.

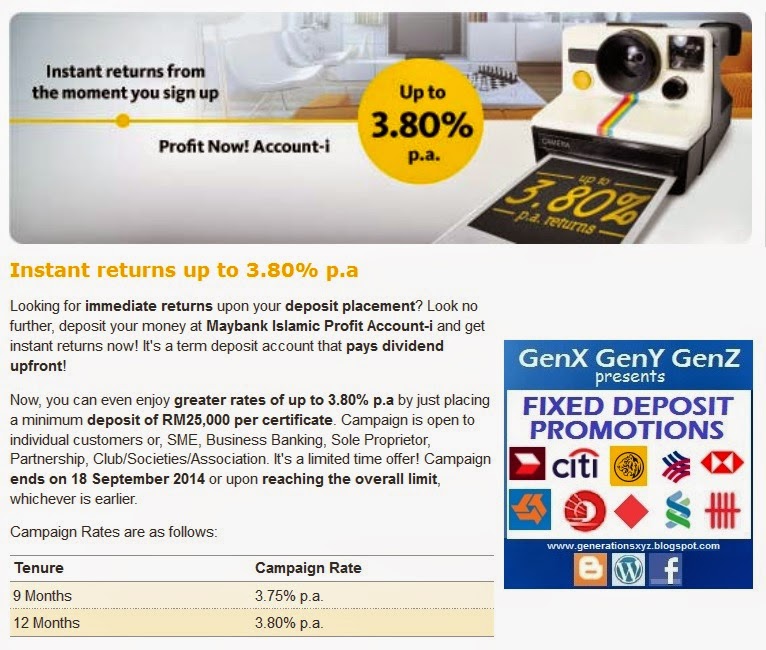

Maybank

*

BANK RAKYAT - NOT Eligible for PIDM

If you are willing to go deposit with a non PIDM member, then check out Bank Rakyat Deposit Account -i which is based on Islamic Principles and like all Islamic banks' products, the profit rate cannot be guaranteed.

Thanks to all members who highlighted that deposit more than RM5K with BR is now eligible for monthly dividend. However, please note that many members here reported that their monthly dividends were not be credited monthly but they have to call up BR staff to have it done manually every month!!!

Special thanks to bbgoat for reporting the tenure to be eligible for monthly dividend:

QUOTE(bbgoat @ Apr 16 2014, 06:45 PM)

Important dates in regard to possible interest rate changes: QUOTE(BoomChaCha @ Apr 22 2014, 02:13 AM)

Bank Negara MPC Meeting Schedules 2014

3rd --- 08 May 2014 (Thursday)

4th --- 10 July 2014 (Thursday)

5th --- 18 Sep 2014 (Thursday)

6th --- 06 Nov 2014 (Thursday)

Source:

http://www.bnm.gov.my/index.php?ch=mone&pg=mone_mpc&lang=en

Fantastic compilation by BoomChaCha3rd --- 08 May 2014 (Thursday)

4th --- 10 July 2014 (Thursday)

5th --- 18 Sep 2014 (Thursday)

6th --- 06 Nov 2014 (Thursday)

Source:

http://www.bnm.gov.my/index.php?ch=mone&pg=mone_mpc&lang=en

QUOTE(BoomChaCha @ Aug 22 2014, 11:55 PM)

Thank You

Best 1 Month

(1) Affin 3.25% - by michaelho

(2) CIMB 3.25% - by michaelho

(3) Mach 3.15%

Mach FD Rates

https://www.machbyhongleongbank.com/mach-fixed-deposit

Best 3 Months

(1) OCBC, 4.5% + 3.0% (Premier Save Gold) = approximately 3.75% effective rate, valid until 30 Nov

(2) OCBC, 4.5% + 2.9% (Smart Saver) = approximately 3.7% effective rate, valid until 30 Nov

*ocbc Fd + smart saver applies to new smart saver or dormant account holders only. Those with previous FD + smart saver package when mature are not allowed to take up this package. - by gsc

(3) OCBC Islamic 3.55%, valid until 30 Nov

(4) Am Bank 3.5%, valid until 19 September

(5) Mach 3.3%

Best 6 Months

(1) May Bank, 3+3, effective rate 3.73%, valid until 16 August.

(2) UOB, 3.7% pure FD, valid until 30 August

(3) Ambank 3.65%, valid until 19 September

(4) Ocbc Mederka promo at 3.75% (was 3.6%), pure FD, valid until 15 Sept - by gsc & munkeyflo

(5) RHB (3.48+3.68)/2= 3.58% with 5% FD in CASA – by gsc

(6) Mach 3.5%

Best 9 Months

(1) Am Bank 3.7%, valid until 19 September

(2) RHB (3.48+3.68 + 3.88)/3= 3.68% with 5% FD in CASA – by gsc

Best 12 Months

(1) OCBC Islamic 3.9%, pure FD, valid until 15 Sept or 30 Nov? – by gsc & munkeyflo

(2) RHB conventional RHB Islamic 3.88% pure FD – by gsc

(3) May Bank 3.85%, promo is tiered rate. Minimum 10k. One cheque one receipt - by munkeyflo

[attachmentid=4105225]

(4) Affin 4.10%, additional 20% fund in CASA, effective rate up to 3.85%, valid until 31 Dec 2014

(5) HLB 3.85%, Ends 31 Nov. T & C applies - by gsc (New added)

(6) RHB (3.48+3.68 + 3.88 + 4.08)/4 = 3.78% with 5% FD in CASA – by gsc

(7) Mach 3.6% - by FDInvestor

Best 13 Months

(1) UOB 3.9%, interest paid every 6 months, need RM 20 to open a SA, valid until 30 August - by X_hunter

Best 15 Months

(1) Affin pure FD, 4.05%, valid until 31 December

[attachmentid=4105229]

(2) RHB (3.48+3.68 + 3.88 + 4.08 + 5.38)/5 = 4.08% with 5% FD in CASA – by gsc

Best 24 Months - by munkeyflo

(1) OCBC, valid until 30 Nov

First 12 months @ 3.8%

Next 12 months @ 4.20%

(effective rate for 24 months @ 4%)

OCBC Existing Funds - valid until 30 Nov - by munkeyflo

3 months @ 3.3%

12 months @ 3.5%

Thanks so much to below Contributors:

munkeyflo

McFD2R

pinpinmiao

gsc

cybpscyh

kingofong

FDInvestor

michaelho

wil-i-am

X_hunter

HJebat

**Best 1 Month

(1) Affin 3.25% - by michaelho

(2) CIMB 3.25% - by michaelho

(3) Mach 3.15%

Mach FD Rates

https://www.machbyhongleongbank.com/mach-fixed-deposit

Best 3 Months

(1) OCBC, 4.5% + 3.0% (Premier Save Gold) = approximately 3.75% effective rate, valid until 30 Nov

(2) OCBC, 4.5% + 2.9% (Smart Saver) = approximately 3.7% effective rate, valid until 30 Nov

*ocbc Fd + smart saver applies to new smart saver or dormant account holders only. Those with previous FD + smart saver package when mature are not allowed to take up this package. - by gsc

(3) OCBC Islamic 3.55%, valid until 30 Nov

(4) Am Bank 3.5%, valid until 19 September

(5) Mach 3.3%

Best 6 Months

(1) May Bank, 3+3, effective rate 3.73%, valid until 16 August.

(2) UOB, 3.7% pure FD, valid until 30 August

(3) Ambank 3.65%, valid until 19 September

(4) Ocbc Mederka promo at 3.75% (was 3.6%), pure FD, valid until 15 Sept - by gsc & munkeyflo

(5) RHB (3.48+3.68)/2= 3.58% with 5% FD in CASA – by gsc

(6) Mach 3.5%

Best 9 Months

(1) Am Bank 3.7%, valid until 19 September

(2) RHB (3.48+3.68 + 3.88)/3= 3.68% with 5% FD in CASA – by gsc

Best 12 Months

(1) OCBC Islamic 3.9%, pure FD, valid until 15 Sept or 30 Nov? – by gsc & munkeyflo

(2) RHB conventional RHB Islamic 3.88% pure FD – by gsc

(3) May Bank 3.85%, promo is tiered rate. Minimum 10k. One cheque one receipt - by munkeyflo

[attachmentid=4105225]

(4) Affin 4.10%, additional 20% fund in CASA, effective rate up to 3.85%, valid until 31 Dec 2014

(5) HLB 3.85%, Ends 31 Nov. T & C applies - by gsc (New added)

(6) RHB (3.48+3.68 + 3.88 + 4.08)/4 = 3.78% with 5% FD in CASA – by gsc

(7) Mach 3.6% - by FDInvestor

Best 13 Months

(1) UOB 3.9%, interest paid every 6 months, need RM 20 to open a SA, valid until 30 August - by X_hunter

Best 15 Months

(1) Affin pure FD, 4.05%, valid until 31 December

[attachmentid=4105229]

(2) RHB (3.48+3.68 + 3.88 + 4.08 + 5.38)/5 = 4.08% with 5% FD in CASA – by gsc

Best 24 Months - by munkeyflo

(1) OCBC, valid until 30 Nov

First 12 months @ 3.8%

Next 12 months @ 4.20%

(effective rate for 24 months @ 4%)

OCBC Existing Funds - valid until 30 Nov - by munkeyflo

3 months @ 3.3%

12 months @ 3.5%

Thanks so much to below Contributors:

munkeyflo

McFD2R

pinpinmiao

gsc

cybpscyh

kingofong

FDInvestor

michaelho

wil-i-am

X_hunter

HJebat

Last but not least, for more Fixed Deposit Promotions and my comments on them, please click here to my FD Page.

This post has been edited by Gen-X: Sep 2 2014, 08:21 PM

Apr 12 2014, 09:59 AM, updated 12y ago

Apr 12 2014, 09:59 AM, updated 12y ago

Quote

Quote

0.0316sec

0.0316sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled