Original FD Thread

Fixed Deposit Rates in Malaysia V2

Fixed Deposits Rates in Malaysia V3

Fixed Deposit Rates in Malaysia V4

Fixed Deposits Rates in Malaysia V5

Fixed Deposits Rates in Malaysia V6.1

Fixed Deposit Rates In Malaysia V.7

Fixed Deposit Rates in Malaysia V.8

Note: Until further notice, please refer to Post#3 for current FD Promos compiled BoomChaCha in V.8 -

Notice / Disclaimer:-

Call & Visit the respective banks for confirmation & latest promotion.

We are not liable to any misinformation which might cause any financial or opportunity loss (which include FD rates & any others information).

Malaysia Major Commercial Banks and Foreign Banks Fixed Deposit / Time Deposit Rates as of 18 October 2014.

Bank - FD rates for 1 month, 3 months, 6 months and 12 months.

Affin Bank - 3.25%, 3.3%, 3.40% and 3.7% (Revised 18/7/14)

Alliance Bank - 3.15%, 3.2%, 3.25% and 3.3% (Revised 21/7/14). FD Gold 12 months 3.40% (Interest paid monthly).

AmBank - 3.15, 3.2%, 3.25% and 3.35% (Revised 18/7/14)

Citibank - 2.95%, 3.10%, 3.10% and 3.20% (Revised 17/7/14)

CIMB Bank - 3.15%, 3.2%, 3.25% and 3.30% (Revised down 7/10/14)

Hong Leong Bank - 3.05%, 3.1%, 3.2% and 3.30% (Revised 16/7/14)

HSBC Bank - 2.90%, 3.10%, 3.15% and 3.25% (Revised 16/7/14)

Maybank - 3.15%, 3.20%, 3.25% and 3.30% (Revised 16/7/14)

OCBC Bank - 2.75%, 2.85%, 2.9% and 3.05%

RHB Bank - 3.15%, 3.20%, 3.25% and 3.45% (Revised 18/7/14)

Public Bank - 3.15%, 3.20%, 3.30% and 3.35%. PB Golden 50 Plus 12 months 3.45% (Revised 16/7/14)

Standard Chartered Bank - 2.95%, 3.10%, 3.15% and 3.25% (Revised 23/7/14)

UOB Bank - 3.05%, 3.10%, 3.10% and 3.30% (Revised 18/7/14)

Fixed / Time Deposit and Savings Account Promotions September and October 2015.

Please call the nearest bank to reconfirm the rates (go to the bank website for bank contact number where you can also get the contact number of the branch nearest to you) before going to the bank to check if promotions are still valid.

*

Alliance Bank - eTerm Deposit-i Promo until end of August 2015. Contributed by Nauts.

QUOTE(Nauts @ Aug 18 2015, 05:29 PM)

*AmBank - Merdeka FD Promo. Contributed by cybpsych.

QUOTE(cybpsych @ Aug 14 2015, 09:35 PM)

OCBC BANK - FD Promos Valid until 30 November 2015. Contributed by magika.

QUOTE(magika @ Aug 14 2015, 10:42 AM)

UOB BANK FD Promos- Minimum Fresh Fund RM10K.

No Stupid CASA Requirements, No Step Up Rubbish and No need to deposit a single sen into Savings or Current Account!

3 Months - 3.85%

5 Months - 4.0%

8 Months - 4.1%

12 Months - 4.2%

*

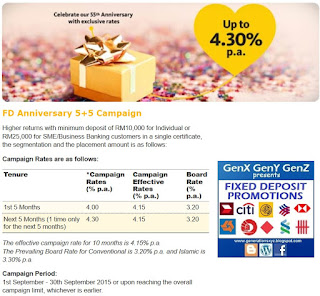

MAYBANK - 5+5 Months FD Promo until 30 September 2015.

*

PUBLIC BANK - 6+6 Months TD Promo until 30 September 2015.

QUOTE(cybpsych @ Sep 12 2015, 10:03 AM)

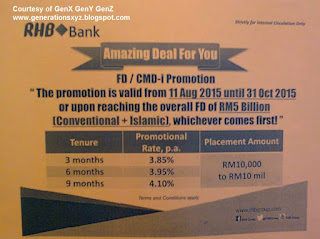

*RHB FD Promotions until 31 October 2015. Minimum Fresh Fund RM10K.

3 Months - 3.85%

6 Months - 3.95%

9 Months - 4.10%

*

BANK RAKYAT - NOT Eligible for PIDM

If you are willing to go deposit with a non PIDM member, then check out Bank Rakyat Deposit Account -i which is based on Islamic Principles and like all Islamic banks' products, the profit rate cannot be guaranteed.

Thanks to all members who highlighted that deposit more than RM5K with BR is now eligible for monthly dividend. However, please note that many members here reported that their monthly dividends were not be credited monthly but they have to call up BR staff to have it done manually every month!!!

Special thanks to bbgoat for reporting the tenure to be eligible for monthly dividend:

QUOTE(bbgoat @ Apr 16 2014, 06:45 PM)

**eFD or eTD. Contributed by Nom-el

QUOTE(Nom-el @ Aug 20 2015, 02:56 PM)

Banks that offer true eFD (can do placement & uplift online)

i) AmBank

ii) RHB

iii) Maybank

iv) CIMB

v) Alliance Bank

vi) Hong Leong

vii) UOB

viii) OCBC

Banks that offer online FD placement (cannot uplift online)

i) Affin

ii) Public Bank

iii) Citibank - contributed by bbgoat

I think HSBC can do online placement too but not sure if can uplift online or not. Confirm by cklimm placement only and cannot uplift.

i) AmBank

ii) RHB

iii) Maybank

iv) CIMB

v) Alliance Bank

vi) Hong Leong

vii) UOB

viii) OCBC

Banks that offer online FD placement (cannot uplift online)

i) Affin

ii) Public Bank

iii) Citibank - contributed by bbgoat

I think HSBC can do online placement too but not sure if can uplift online or not. Confirm by cklimm placement only and cannot uplift.

QUOTE(ikanbilis @ Aug 20 2015, 11:00 PM)

For HSBC eFD, no need go branch for uplifting. You can do the uplifting through phone banking. Tested it myself yesterday for my pre-mature eFD. Everything is done within minutes for me to giro the money to another bank.

**

For more Fixed Deposit Promotions and my comments on them, please click here to my FD Page. In my FD Page I also touched on Maybank Q-Cash where you can deposit your money short term ( minimum 1 day up to 29 days or more and earn "interest rate" similar to 1 Months FD's rate.

If you are new to Fixed Deposit or even a serious FD fan, click here to my article Get More FREE MONEY With The Right Fixed Deposit Promotions.

And if you want to know the quickest way get Fresh Fund to be eligible for Fixed Deposit Promotion without even leaving the bank where you are withdrawing your matured FD; click here to my article titled A Little Bit Of This and A Little Bit of That - Vol.1, Chapter IV. In this article I will show you how to be eligible for FD Promo with fresh fund using GIRO plus Current Account with Over Draft Facility (to be on the safe side). And the transfer fee may cost less than what your bank impose for a Banker's Cheque. Updated timetable for GIRO cut off time for same day transfer.

If you want to know more about the pros and cons of Statement Based FD versus Cert Type click here to my article A Little Bit Of This and A Little Bit Of That - Volume 1, Chapter VII. And the flip side of me telling you the pros and cons of Statement Based FD is that I have unintentionally taught an evil person how to con his parent(s) off their hard earned money! Plus why you should have money in FD, lots of it actually; instead of having so many properties which are not liquid and can't assist you to prolong your life. I will tell you how to get funds to pay for the mountain high hospital bills while your liveless body lay in the Intensive Care Unit.

This post has been edited by Gen-X: Sep 13 2015, 09:12 AM

Jun 9 2015, 10:09 AM, updated 11y ago

Jun 9 2015, 10:09 AM, updated 11y ago

Quote

Quote

0.0283sec

0.0283sec

0.49

0.49

6 queries

6 queries

GZIP Disabled

GZIP Disabled