Click here to Fixed Deposit Rates in Malaysia V3

Malaysia Major Commercial Banks and Foreign Banks Fixed Deposit / Time Deposit Rates as of 1st July 2012.

Bank - FD rates for 1 month, 3 months, 6 months and 12 months.

Affin Bank - 3.05%, 3.1%, 3.25% and 3.6%

Alliance Bank - 3%, 3%, 3.1% and 3.25%. FD Gold 12 months 3.3% (Interest paid monthly).

AmBank - 3%, 3%, 3.15% and 3.2%. Am50Plus 12 mths 3.25% (Interest paid monthly, FREE PA).

Citibank - 2.9%, 3.00%, 3.0% and 3.10%

CIMB Bank - 3%, 3.05%, 3.1% and 3.15%

Hong Leong Bank - 2.9%, 2.95%, 2.95% and 3.1%

HSBC Bank - 2.75%, 3%, 3% and 3.15%

Maybank - 3%, 3.05%, 3.1% and 3.15%

OCBC Bank - 2.85%, 2.95%, 3% and 3.10%

RHB Bank - 3%, 3.05%, 3.2% and 3.2%.

Public Bank - 3%, 3.05%, 3.1% and 3.15%. PB Golden 50 Plus 12 months 3.25%.

Standard Chartered Bank - 2.90%, 2.95%, 2.95% and 3.10%

UOB Bank - 2.9%, 2.95%, 2.95% and 3.10%

QUOTE(BoomChaCha @ Feb 20 2012, 02:03 PM)

Schedule of Monetary Policy Committee Meetings for 2012

1st ---- 31 January 2012 (Tuesday)

2nd ---- 9 March 2012 (Friday)

3rd ---- 3 May 2012 (Thursday)

4th ---- 5 July 2012 (Thursday)

5th ---- 6 September 2012 (Thursday)

6th ---- 8 November 2012 (Thursday)

Source: http://www.bnm.gov.my/microsites/monetary/03_schedule.htm

1st ---- 31 January 2012 (Tuesday)

2nd ---- 9 March 2012 (Friday)

3rd ---- 3 May 2012 (Thursday)

4th ---- 5 July 2012 (Thursday)

5th ---- 6 September 2012 (Thursday)

6th ---- 8 November 2012 (Thursday)

Source: http://www.bnm.gov.my/microsites/monetary/03_schedule.htm

Fixed / Time Deposit and Savings Account Promotions July 2012.

Please call the nearest bank to reconfirm the rates (go to the bank website for bank contact number where you can also get the contact number of the branch nearest to you) before going to the bank to check if promotions are still valid.

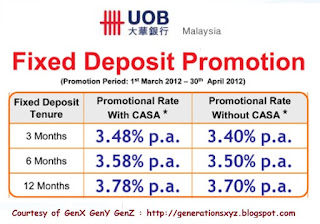

UOB Bank Latest Fixed Deposit Promotion Rates - Minimum RM10K. Effective 23 July 2012 till end of August 2012

1 mth 3.25%

3 mth 3.55%

12 mth 3.65 %

For PB customers add 0.05% to above rates.

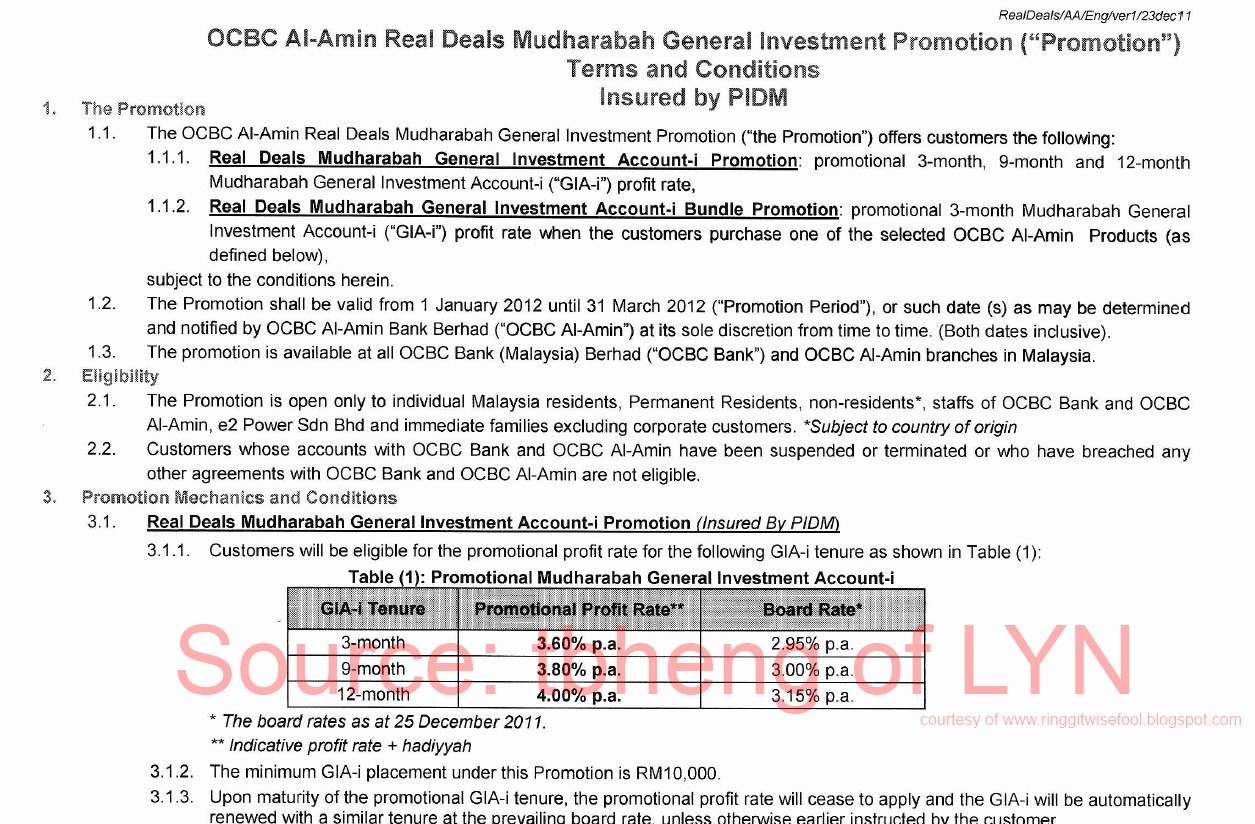

OCBC Bank Malaysia Promotion until end September 2012. Minimum Fresh Fund RM10K

3 Months 3.50%

9 Month 3.60%

Combo FD and Savings - 3 Months FD 4.5% where 20% equivalent amount deposited into FD must be deposited into a NEW Savings Account and maintain for 90 days.

Click here to OCBC Promos and T&C

Want to earn up to 4.25% for 3 months, thanks to MGM

QUOTE(MGM @ Jul 3 2012, 05:28 PM)

Say FD rm10000 at 4.5% and SmartSaver rm2000(20% of FD) at 3%, average out

(10000*4.5%+2000*3%)/12000= 4.25%

After checking the HLB website,

the effective rate from the promo is 3.9455%, based on FD rm10000 @ 3.95% and JuniorAccount rm1000 @ 3.9%.

.(10000*4.5%+2000*3%)/12000= 4.25%

After checking the HLB website,

the effective rate from the promo is 3.9455%, based on FD rm10000 @ 3.95% and JuniorAccount rm1000 @ 3.9%.

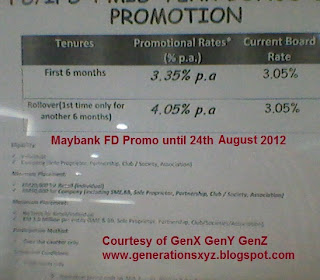

Maybank FD Promo Until 24 August 2012

1st 6 Months 3.35% and roll over (allowed 1 time only) for 6 months 4.05% and applicable for over the counter placement only.

Minimum Fresh Fund Individual RM20K

Minimum Fresh Fund Company RM50K

Based on above, average 3.7%

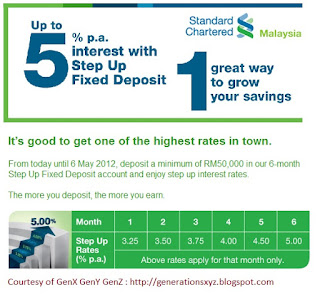

CIMB Bank Step Up 6 Months FD Promo Until 31 December 2012

QUOTE(gark @ Aug 1 2012, 12:13 PM)

STEP UP FIXED DEPOSIT OFFER (UNTIL 31 DECEMBER 2012)

Up to 5.00% p.a. on a 6-month Step Up Fixed Deposit** with a minimum placement of RM50,000 for new and existing CIMB Preferred members.

Month 1-5 = 3.10%, Month 6 =5%

Average ... 3.42% p.a... for 6 months.

Up to 5.00% p.a. on a 6-month Step Up Fixed Deposit** with a minimum placement of RM50,000 for new and existing CIMB Preferred members.

Month 1-5 = 3.10%, Month 6 =5%

Average ... 3.42% p.a... for 6 months.

For Non Preferred members, the CIMB Step Up FD Promo until end of the year is as follows:

1-5 Months 3.1%

6th Month 4.88% (slightly lower than Preferred)

Minimum RM5K and in multiples of RM5K

Click here to CIMB webpage on Step Up FD PRomo.

Hong Leong Bank 3 Months 3.95% till end of October 2012

(Note: I got no control on the image size here - previously when we click on image here can see actual size, so if you want to see actual size go to my Fixed Deposit Page at my blog and click on it).

HLB is offering extra 1% interest for 3 months FD on the following conditions:

Non Priority Banking Customers - Must deposit RM10K to with FD and RM1K into Savings Account.

Priority Banking Customers - Must deposit RM50K into FD and RM5K into Savings Account.

Click here to HLB website to see T&C

And for Seniors, HLB offering 3.6% for 12 months FD Click here for T&C. Minimum Fresh Fund RM10K

And for kids, they get 3.65% for 12 Months Junior FD click here for T&C

Kuwait Finance House Deposit Promo until end of August 2012

Those of you who are near to a KFH branch, go check out Kuwait Finance House International Commodity Murabahah Deposit i Promo until end of August 2012. 3.85% for 6, 12 and 24 months tenure.

Check this out - contributed by tbheng

QUOTE(tbheng @ Jun 25 2012, 02:01 PM)

Hi all, just for sharing....

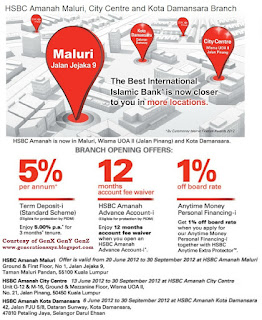

I've just returned from HSBC Amanah Kota Damansara.

Took their new branch opening offers: 5% 3 month TD-i for non-premier category.

The requirements and process seems rather straight forward.

Required the following 2 products to be openned:

1. Term Deposit-i: min RM5k, max RM50k.

2. Amanah Advance Acct-i: min RM100.

(I have highlighted about the T&C said min RM500, the teller said RM100 is enough. RM500 is for Amanah Advance Acct-i alone.).

She said the TD-i slips will be ready when my cheque cleared. I requested her to mail it to me instead of collecting at branch.

I also requested for internet banking. It is FOC.

I was given a big golf umbrella and recycle bag as welcome gifts.

This should be the highest FD rate for the moment. Highly recommended.

I've just returned from HSBC Amanah Kota Damansara.

Took their new branch opening offers: 5% 3 month TD-i for non-premier category.

The requirements and process seems rather straight forward.

Required the following 2 products to be openned:

1. Term Deposit-i: min RM5k, max RM50k.

2. Amanah Advance Acct-i: min RM100.

(I have highlighted about the T&C said min RM500, the teller said RM100 is enough. RM500 is for Amanah Advance Acct-i alone.).

She said the TD-i slips will be ready when my cheque cleared. I requested her to mail it to me instead of collecting at branch.

I also requested for internet banking. It is FOC.

I was given a big golf umbrella and recycle bag as welcome gifts.

This should be the highest FD rate for the moment. Highly recommended.

QUOTE(tbheng @ Jun 25 2012, 09:37 PM)

But thanks to all the sifu here that share the promo link

Should be for the 3 new branches as detailed in the promo.

According to the teller, the Kota Damansara branch is < 1 month old.

Should be for the 3 new branches as detailed in the promo.

According to the teller, the Kota Damansara branch is < 1 month old.

QUOTE(tbheng @ Jun 26 2012, 06:59 AM)

It is for these 3 branches in KL/PJ:

1. HSBC Amanah Maluri New Branch Opening Promotion

2. HSBC Amanah City Centre New Branch Opening Promotion

3. HSBC Amanah Kota Damansara New Branch Opening Promotion

Please click the link I provided above to read more.

According to HSBC website, the New Branch Promo offer ends 30 September 2012 for above mentioned 3 branches.1. HSBC Amanah Maluri New Branch Opening Promotion

2. HSBC Amanah City Centre New Branch Opening Promotion

3. HSBC Amanah Kota Damansara New Branch Opening Promotion

Please click the link I provided above to read more.

Other Promotions

Some banks are also offering step up interest rates (with or without condition, e.g. some banks require that you deposit x amount in savings or current account), so you better average them out and I would think they still won't be able to beat Affin 12 months Fixed Deposit rate of 3.6%.

To read my comments on FD promos click >>> Malaysia Latest Fixed Deposit Board and Promotion Interest Rates by Major Commercial and Foreign Banks. New - with comments on Bank Rakyat Qiradh Investment Accounts

Click here to read my article titled Australia Education, Term Deposit, Savings Account and Credit Card Interest Rates In this article I have tables of interest rates from several banks in Australia and also a Table for UOB, OCBC and RHB Foreign Currecny Time Deposit Interest Rates.

Banker's Cheque Fee purely for FD Upliftment/Withdrawal

Affin - ?

Alliance - FREE

AmBank - RM2.15

CIMB - FREE

Citibank - RM0.15

HLB - RM5.15 (PB Customers RM0.15)

HSBC - RM5 same day or RM2 next day (no RM0.15 Stamp Duty??)

Maybank - RM5 or RM5.15?

OCBC - FREE or RM2.15 Conflicting reports.

PBB - RM2.15

RHB - RM5.15

SCB - RM2.15

UOB - RM0.15 or RM2.15 Conflicting reports.

Others - please state bank and amount.

This post has been edited by Gen-X: Aug 1 2012, 02:28 PM

Oct 14 2011, 05:46 PM, updated 14y ago

Oct 14 2011, 05:46 PM, updated 14y ago

Quote

Quote

0.0286sec

0.0286sec

0.24

0.24

6 queries

6 queries

GZIP Disabled

GZIP Disabled