FD Promo - Please let me know if below info is not updated. Thanks

What are Hot..?(1) OCBC 13 Months - 4.06% effective rate

(2) OCBC 3 Months Islamic - 3.85%

(3) OCBC 6 Months - 4.00%

(4) RHB 6 months - 4.00% p.a.

(5) RHB 9 months - 4.15% p.a.

---> Super Hot(6) Affin for 24 Months - 4.38% p.a.

---> Super Hot(7) Am Bank for 6 Months - 4% (4.05% for AmSignature - Priority Banking)

(8) Am Bank for 12 Months - 4.1% (4.15% for AmSignature - Priority Banking)

(9) HSBC Advance Account for 3 Months - 5%

(10) UOB 3 Months - 3.85%

(11) UOB 6 Months - 4.00% --> Christmas Promo, valid until 24th Dec 2014

(12) UOB 12 Months - 4.20% ---> Christmas Promo, valid until 31th Dec 2014

---> Super Hot (13) Am Bank 36 Months - 4.5%

---> Super Hot Hong Leong Bank - Business Deposit - “CNY Great Fortune” Campaign -

New added by cybpsych on 30 December 20142 Jan 2015 - 8 Feb 2015

HLB CNY VoucherT & CPublic Bank Step-up FD

HLB CNY VoucherT & CPublic Bank Step-up FD, valid from 24 Dec 2014 to 28 Feb 2015 -

New added by cherroy on 29 December 20149 months effective 4.11%

Public Bank FD LinkOCBC

Public Bank FD LinkOCBC, valid from 15 December until 31 December 2014 -

New added by dEviLs on 26 December 201413M promo, effective rate of 4.15%

Equaliser Treat

The OCBC Great Savings Treats is here! Restore the value of your money with Fixed Deposit rates of 4.00% p.a. for the first 12 months and 6.00% p.a. for the subsequent 1 month.

May Bank

May Bank -

New added by kyenli on 26 December 2014 Hong Leong

Hong Leong Happy Friends Little Fluffy Promotion -

New added by cybpsych on 24 December 2014Junior Fixed Deposit - 15 December 2014 till 31 March 2015

Minimum JFD Placement Amount: RM1,000

Tenure: 24 Months

Promotional Interest Rate:

4.28 p.a.

The Promotion is open to all existing HLB and New-To-Bank (“NTB”) Malaysian and non-Malaysian Individuals who are below eighteen (18) years of age (“Customers”) whereby the 3-in-1 Junior Savings Account (“3-in-1 JSA”) opened or will be opened by their parents or legal guardian for the Customers as beneficiaries of the 3-in-1 JSA.

Mach by Hong Leong

Mach by Hong Leong with monthly interest + Free RM200 Petrol Gift Card (For first 100 FD placements) from Ringgit Plus -

New added by Mansamune on 17 December 2014 (1) 6 months 3.80%

(2) 12 months 4.00%

Min RM 10K

Am Bank

Am Bank, valid from 15 Dec until 31 January 2015 -

New added by cklimm on 16 December 20144.5% for 3 years

Min fresh fund RM 10K

RHB with Conventional* & Islamic*

RHB with Conventional* & Islamic*, valid until 31 December (was 15 December) -

Updated by by bbgoat on 16 December(1) 6 months 4%

(2) 9 months 4.15%

Min 10k (was min 50k)

-

Updated by dagdag1 on 7 NovemberStandard Chartered Bank, available till quota filled -

New added by McFD2R on 4 December 20143.75% for 3 months

*Available for existing customer with their fixed deposit only -

Updated by by munnie on 16 DecemberHong Leong 12-Month Festive FD Promotion, valid from 15 December 2014 to 31 March 2015 (both dates inclusive) -

New added by cybpsych on 12 December 2014 12 Months @ 4.08% p.a.

● Fresh fund required.

● Min RM10k. Max RM5mil.

● Required to nominate a CASA Account for the purpose of crediting the FD interest.

● FD interest must be credited into the CASA on a monthly basis.

● Interest to be added-on to the FD principal sum is not allowed.

● Upon maturity, the Principal FD amount shall be auto-renewed at the prevailing 12-month Conventional FD board rate.

Affin Bank

Affin Bank, valid until 31 Dec 2014 -

New added by cybpsych on 12 December 2014(1) 3.90% for 6 months

(2) 4.10% for 12 months, need to put additional 20% of FD amount to CASA

(3) 4.18% for 15 months, need to put additional 20% of FD amount to CASA

Fresh fund with min. RM10k per customer.

Affin Bank, valid until February 2015 -

New added by Ramjade on 11 November & cybpsych on 12 December 2014(1) 4.18% for 15 months, need to put additional 15% of FD amount to CASA

(2) 4.28% for 18 months, need to put additional 10% of FD amount to CASA

(3) 4.38% for 24 months, pure FD. No need CASA. Just normal account for them to deposit interest

Fresh fund with min. RM10k per customer.

Opening account Rm100

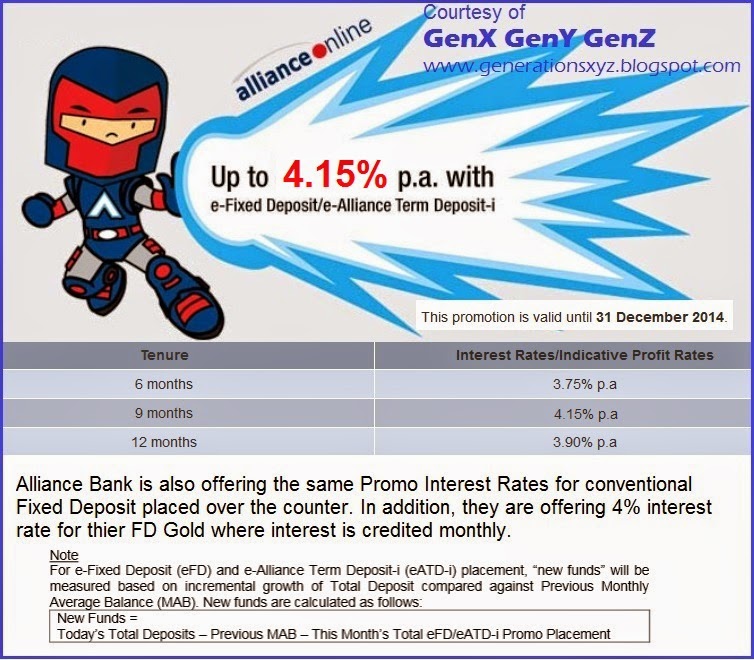

Alliance Bank e-FD

Alliance Bank e-FD, valid until 31 Dec 2014 -

New added by almeizer on 12 December 2014(1) 4.15% for 9 months (was 3.90%)

(2) 4.00% for 6 months (was 3.75%)

Min 10k of new fund

Maybank

Maybank FD "Countdown 1" Campaign -

New added by cybpsych on 9 December 20149 December - 31 December 2014

Sweeter rate for 1 month @ 3.40% p.a.

To participate in the Campaign, the minimum placement amount is:

-- RM25,000 per receipt for Retail/Individual customers, or

-- RM50,000 per receipt for SME/Business Banking, Sole Proprietor, Partnership, Club/Societies/Association.

The promotional rates are offered for fresh funds only.

OCBC

OCBC, valid until 31 March 2015 -

New added by gsc on 1 December 2014(1) 13 months FD promo ---> 12 months @3.9% p.a + 13th month @6% p.a = Effective rate is 4.06% -

Updated by hcolin on 6 Dec 2014(2) 3 month Islamic 3.85%

(3) 6 month 4%

(4) 1 month 6% investment bundle

(5) 1 month foreign currency additional 5%

(6) For Existing Funds - 12 months @3.5% p.a -

Updated by hcolin on 6 Dec 2014 Mach Fixed Deposit Money Box Campaign -

New added by cybpsych on 6 December 2014Effective 6 December 2014 and ends on 28 February 2015, both dates inclusive

Min FD placement RM 1000.00 and up to RM250,000

With Monthly Interest

(1) 6-month @ 3.80% pa

(2) 12-month @ 4.00% pa ---> effective rate 4.07% (including monthly compound interest) -

Updated by aeiou228 on 6 Dec 2014UOB -

New added by BartS on 5 December 2014UOB FD Chinese New Year Promotion, valid until 28 Feb 2015

(1) 3.85 for 3 months

(2) 4.10 for 12 months

Min placement RM 10K

UOB FD Christmas Promotion, valid until 24th Dec 2014

(1) 4.00% for 6 months

(2) 4.20% for 12 months

Min placement RM 50K

Mach Bank - New added by byshierly on 5 December 2014Online placement 12mths now is 4%

HSBC Amanah, valid from 3 Dec until 28 Feb 2015 -

New added by dEviLs on 4 December 20144.00% for 6 Months

- for new/existing premier customer

- min 50k

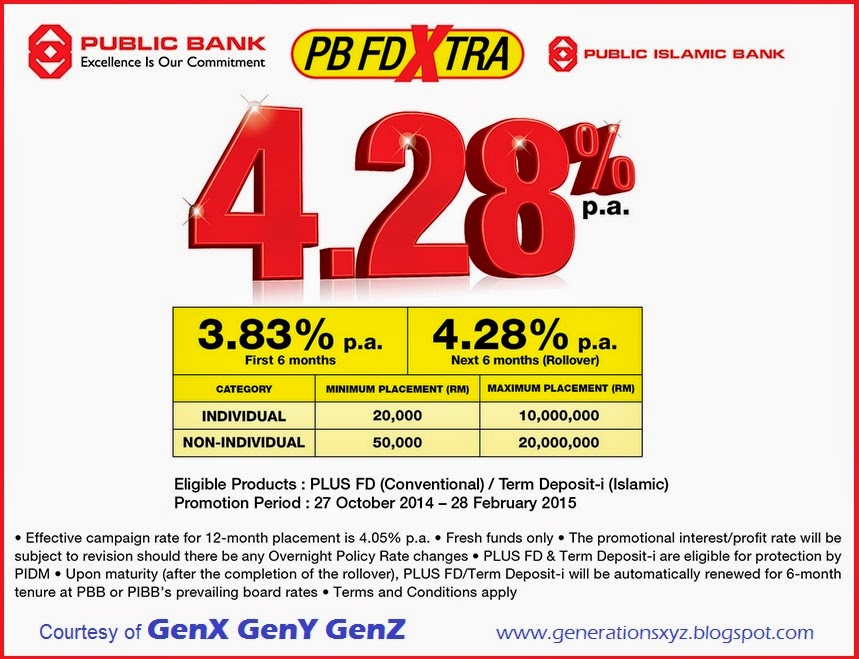

Public Bank

Public Bank, valid from 1 Nov until 28 Feb 2015 -

New added by magika on 24 NovemberPublic Bank Step Up FD 3 months 3.70% + 3 months 3.80% + 3 months 3.90%.

-

Updated by okuribito on 24 November Public Bank FD Link - Updated by cybpsych on 24 NovemberStandard Chartered Bank

Public Bank FD Link - Updated by cybpsych on 24 NovemberStandard Chartered Bank From 3 Nov to 31 Dec 2014 -

New added by dEviLs on 21 November3 Months at 4.5%

Drawback: Need to sign-up Priority Banking account which requires min RM 250K

Hong Leong Bank with Monthly Interest, valid until March 2015 -

New added by magika on 21 November8 Mths FD Step-up up to 4.28 %

First 4 Months - 3.68%

Next 4 Months - 4.28%

Effective rate 3.98%

Min RM 10K. A saving account is required.

Bank Rakyat introduces Xclusive membership card -

New added by okuribito on 20 November AM Bank

AM Bank -

New added by michaelho on 18 NovemberLATEST FROM AMBANK- Promo effective 17 NOV - 31 JAN 2015

AMSIGNATURE CUSTOMERS - additional 0.05%

No leaflet yet, so staff just wrote on piece of paper smile.gif - Ambank OUG

6 mths - 4% (4.05% for AmSignature)

12 mths - 4.1% (4.15% for AmSignature)

*AmSignature is priority banking customer with deposit RM200K and above

*50 years old and above can get monthly interest

-

Updated by cybpsych on 21 NovemberRHB -

New added by Gen-X on 14 NovemberEnjoy Interest Rate up to 3.95% p.a. for 3-month FD, T& C apply

Bank Rakyat Offers Up-front interest effective 30 Sept 2014 -

New added by leo_kiatez on 12 November

Minimum FD placement RM 5K

The upfront interest promo is for FD of 6 mths only -

Updated by okuribito & bbgoat on 12/13 November CIMB

CIMB, valid from 20 Oct 2014 to 31 Jan 2015 -

New added by cklimm on 11 Novemberoption1: 2 months 3.48% pa, min 20k, 5% in casa;

option2: step up FD, 12 months effective rate 3.69%pa

RHB P.A.Y.S. FD

RHB P.A.Y.S. FD -

New added by giko on 10 November1. minimum term of three months

2. pays interest every month

3. can use your FD account as collateral for an overdraft facility of up to 100% margin

4. if buy shares on the BURSA through RHB, your first five orders are commission free

5. can withdraw some of your cash from this fixed deposit without losing interest earned on the remaining balance

6. minimum RM10000 to open an account

7. protected by PIDM

8. 3.2% interest

*RHB Conventional Page 1 & Page 2 -

Updated by dEviLs on 20 November"noted they have same promo for islamic too, the difference is in case you need to withdraw it pre-mature then you get more back (75%) from islamic as compared to conventional (50%)"

*RHB Islamic

May Bank

May Bank (1) 2 months 3.6% min 25k -

Updated by bbgoat on 4 November(2) 6+9 mths with 3.85%+4% interest -

Updated by bbgoat on 29 Oct & cklimm on 3 NovEffective 3.94 % for 15 months -

Updated by gsc on 3 NovemberM2URHB - A Deposit that Rewards in Gold Valid from 28 Oct to 28 Feb 2015 -

New added by robert82 on 29 October(1) Every RM 50K deposited in CASA, then RM 50K to RM 299,999.00 FD can earn 3.78% for 3 months*

(2) Every RM 300K deposited in CASA, then RM 300K & above FD can earn 3.88% for 3 months*

* Note: FD amount must not more than CASA amount

HSBC

HSBC advance FD promo for 3m FD for new customer joining advance (eligibility is 30k only) -

New added by dEviLs on 31 October- Preferential rate of 5% p.a. on a 3-month Time Deposit (Standard Scheme) placement.

- Minimum placement of RM5,000 and up to a maximum RM30,000 for each HSBC Advance relationship maintained.

- One-time preferential rate for first Time Deposit placement.

Public Bank

Public Bank, valid from 27 Oct 2014 to 28 Feb 2015 -

New added by cklimm on 27 OctoberMIn RM 20K -

Updated by Lineage on 27 October

-

Updated by FDInvestor on 27 OctoberKFH, valid from 9 October to 31 December -

(New added by pinpinmiao on 11 October)

effective rates:-

(updated by giko on 11 October)(1) 13 mths = 3.760% or 3.779% if compounded. Minimum deposit fund RM10k

(2) 26 mths = 4.098% or 4.149% if compounded. Minimum deposit fund RM25k

Affin OMG is still available until 31 Dec 2014:

http://www.affinbank.com.my/General/Whats-...--Campaign.aspx(2) Hong Leong Bank - Priority Banking's Deposit Savvy - From 4 July to 31 Dec4% for 3 months, 75% in FD and 25% in Premium saving account.

Effective rate is approximately 3.56% (average with saving a/c rate 2.25% for 90 days).

Link:

https://www.hlb.com.my/main/promotion/20140...2-deposit-savvyHong Leong Bank's Member-Get-Member Programme

Received sms...bring a family or friend to open Hong Leong Saving account with RM5k deposit, both get gifts. Valid until 30 June 2015- by gsc & HJebat

FD Market NewsBank Negara likely to cut OPR in 2015

- New added by spikeman on 19 December 2014http://www.thestar.com.my/Business/Busines...-UBS/?style=bizBanks that pay interest for non-working days - Updated on 13 Dec 2014OCBC

Bank Rakyat

UOB

May Bank (Need to remind May bank staff to add interest)

Affin Bank - updated by cybpscyh on 12 Dec 2014

Banks that do not pay interest for non-working daysAm Bank

RHB

Standard & Chartered Bank

Bank that non-voluntary credit interest unless appealPublic Bank (Need to complain to BNM then only pay interest)

New IBG Transfer Timing

- Updated by gchowyh on 16 December 2014

Old New IBG Transfer Timing

Thanks so much to below Contributors:

Thanks so much to below Contributors:

cherroy

Gen-X

munkeyflo

McFD2R - 2 contributions

pinpinmiao - 2 contributions

gsc - 7 contributions

cybpscyh - 10 contributions

kingofong

FDInvestor - 2 contributions

michaelho - 3 contributions

wil-i-am - 2 contributions

X_hunter

HJebat

guy3288

bbgoat - 10 contributions

giko - 4 contributions

nsx88

raptar_eric - 2 contributions

sylille

harmonics3 - 2 contributions

xcxa23

RO Player - 2 contributions

Styrroyds

yklooi - 2 contributions

haur

netbuzzchin

nomen

Human Nature

MGM

kinabalu

kwokwah

bearbear

gchowyh - 2 contributions

AVFAN

wr6969

kimmo88

cklimm - 4 contributions

Lineage

dEviLs - 6 contributions

Mansamune - 4 contributions

robert82

dagdag1

Ramjade

leo_kiatez

okuribito - 3 contributions

magika - 2 contributions

byshierly

BartS

hcolin

almeizer

munnie

kyenli

This post has been edited by BoomChaCha: Dec 30 2014, 11:46 PM

Sep 6 2014, 01:10 AM, updated 11y ago

Sep 6 2014, 01:10 AM, updated 11y ago

Quote

Quote

0.0425sec

0.0425sec

1.17

1.17

6 queries

6 queries

GZIP Disabled

GZIP Disabled