Hi guys. Ok i've asked this last March, now i wanna ask again. its about my 5-year FD with EON Bank (now Hong Leong lah) in 2011. Ok, according to the maturity date, its already matured on last april 27th and I can withdraw it with appropriate documentations.

I went to the bank to withdraw it on april 29th, and then i found out the maturity date is forwarded to 27th April 2017. well, it's normal, said a staff there because it is automatically renewed its maturity date once the previous one is lapsed. And the guy said I need to bring my housing loan offer letter in order to withdraw the FD, because the offer letter act like the FD's certificate. Ok no problem. And I double-checked with the staff whether my FD is matured or not despite of the new maturity date and he assured to me that is matured once the original period is passed.

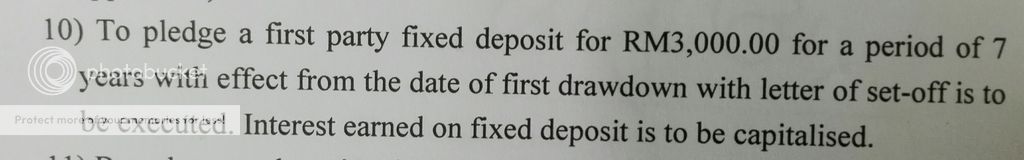

So I went home and take out the offer letter. And suddenly it stated there:

» Click to show Spoiler - click again to hide... «

7 years???

Well, my questions:

1) Can I still withdraw the FD?

2) Do my FD really matured and can be withdraw-ed?

3) The staff there assured to me that it is indeed matured and can withdraw, but if he sees the offer letter, is he gonna take back what he said and instead follow what stated in the agreements, thus making me wait for another 2 years?

Thanks in advance guys

Mar 10 2016, 02:49 PM

Mar 10 2016, 02:49 PM

Quote

Quote

0.0482sec

0.0482sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled