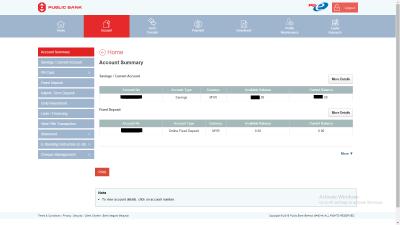

QUOTE(Ramjade @ Mar 2 2016, 09:34 AM)

Thanks for the screenshot. Btw, isn't it better to put under maybank GIA-i for eFD seeing that they will give 4% instead of PB eFD which give only 3.45%?

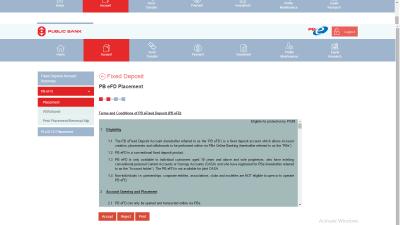

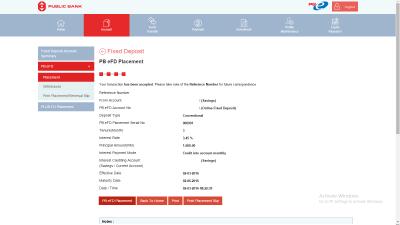

I was just trying the features of different banks, its fun. 1k at pbbank wont lose much

QUOTE(pearl_white @ Mar 2 2016, 10:57 AM)

Let me give you an answer (with the intention to solve your curiousity that will eventually kill you, if I did not intervene).

Why would some people rather earn less interest when you can earn higher elsewhere ? The answer can be found in genxgenygenz postings. To be precise, the words "chiak beh liao" would explain it all.

At 3.45% p.a., some people's FD would be earning more interest (in absolute terms) in a month than what you would earn in 1 year @ 4% .

For example,

MR. LIM puts in a RM10million FD at 3.9% p.a. He earns rm390k per annum, and the bank credits his SA rm32,500.00 every month.

MR. RANJIT SINGH put in a RM100k FD at 4.0% p.a. He earns rm4k per annum, and the bank credits his SA with rm333.33 everymonth.

For MR. LIM, he may be in a situation of "chiak beh liao" whereas MR. RANJIT SINGH is merely surviving day to day. Hence, psychologically, MR. RANJIT would be very sensitive to interest rate difference where as MR. LIM would not. Hence, also why, MR. RANJIT SINGH cannot pathom why MR. LIM do not go for the highest interest rates.

The law of absolutes and reaching the level of "chiak beh liao".

Chiak beh liao belum sampai lar, for major chunks, i happy to put in 4%+ than 3.45% too

QUOTE(Gen-X @ Mar 2 2016, 11:00 AM)

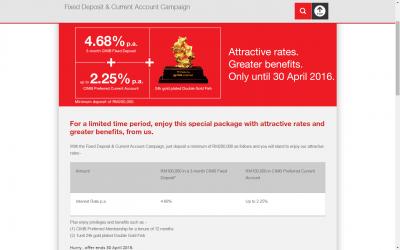

if one got USD1M deosited into FD, he can be eligible for Private Banking, no need Fresh Fund also the bank will give promo rates, and therefore in the above case, Mr. Lim will perpetually get more from interest paid, haha. Actually if you are a Maybank Premier Wealth, your RM also can give you their Promo rates when renewing matured FD.

Still far away from Private

Was considering HSBC Premier, now i am interested with Maybank Premier

QUOTE(McFD2R @ Mar 2 2016, 12:11 PM)

For him, why would Mr. Lim put in @ 3.9% when he can get RM400k if he can place @ 4%. Is RM10,000 / 12 months = RM833 extra per month not worth it? Well, I can answer him on your behalf. It is because for Mr. Lim who has RM10 mil, RM833 p/m is not critical to his survival nor will it make him much richer.

Unfortunately, this is something that he will never comprehend. Because he isn't where Mr. Lim is yet.

It's the same why some won't understand why I would buy a car for cash instead of taking loan. They think the cash can be used to get >4% FD and pay off hire purchase interest at 2.x-3.x% and pocket the difference. They do not understand the feeling of being debt free from housing or car or any loan. It's like having wings every month without any commitments tying me down. The freedom and reduced stress for me is absolute, as you so put it. But all he would see is, the little gains he could get by trying to make the most of the money available.

Similiar to reply above, I am happy with higher rate, but tak dapat pun tak apa. I do agree that FD cant beats most loans due to EIR. the only loan FD can beat, i think is Ptptn, do correct me if wong

QUOTE(Ramjade @ Mar 2 2016, 02:02 PM)

Guess I am in Mr Ranjit position. Btw, when I reach Mr lim position, I will still be Mr Ranjit. No point giving up free money.

You are passionate, thats the spirit. Dont be like me, malas.

QUOTE(cherroy @ Mar 2 2016, 02:09 PM)

Another factor is trust.

We tend to trust a bank more than another due to convenience, and service quality we experienced as well as how well it is being run.

Also, Mr Lim may not want to deposit in Bank A, even the bank gives him 4.5% if bank A had history run into losses during economy difficult time.

Rate alone is not absolute factor.

There are other consideration and individual preference as well.

Btw, 2.x% car loan, its EIR is more than 4%.

You never can win against Bank by loaning vs FD.

Yeah, i still remember what i saw at MBF Kepong in mid 90s, bank runs ain't no fun.

Feb 23 2016, 01:00 PM

Feb 23 2016, 01:00 PM

Quote

Quote

0.0592sec

0.0592sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled