Original FD Thread

Fixed Deposit Rates in Malaysia v2

Fixed Deposit Rates in Malaysia v3

Fixed Deposit Rates in Malaysia v4

Fixed Deposit Rates in Malaysia v5

Fixed Deposit Rates in Malaysia v6.1

Fixed Deposit Rates in Malaysia v7

Fixed Deposit Rates in Malaysia v8

Fixed Deposit Rates in Malaysia v9

Fixed Deposit Rates in Malaysia v10

Fixed Deposit Rates in Malaysia v11

Fixed Deposit Rates in Malaysia v12

Fixed Deposit Rates in Malaysia v13

Notice / Disclaimer:-

Call & Visit the respective banks for confirmation & latest promotion.

We are not liable to any misinformation which might cause any financial or opportunity loss (which include FD rates & any others information).

Malaysia Major Commercial Banks and Foreign Banks Fixed Deposit / Time Deposit Rates as at 6 August 2016.

| Bank | 1 month | 3 months | 6 months | 12 months | Remarks |

| Affin Bank | 3.00% | 3.05% | 3.15% | 3.45% | |

| Alliance Bank | 3.05% | 3.05% | 3.10% | 3.15% | FD Gold 12 months 3.25% (Interest paid monthly) |

| AmBank | 2.95% | 3.00% | 3.05% | 3.15% | |

| Citibank | 2.70% | 2.75% | 2.75% | 2.85% | |

| CIMB Bank | 2.95% | 3.00% | 3.05% | 3.10% | |

| Hong Leong Bank | 2.80% | 2.85% | 2.90% | 2.90% | |

| HSBC Bank | 2.75% | 2.85% | 2.85% | 2.90% | |

| Maybank | 2.95% | 3.00% | 3.05% | 3.10% | |

| OCBC Bank | 2.65% | 2.75% | 2.85% | 3.00% | |

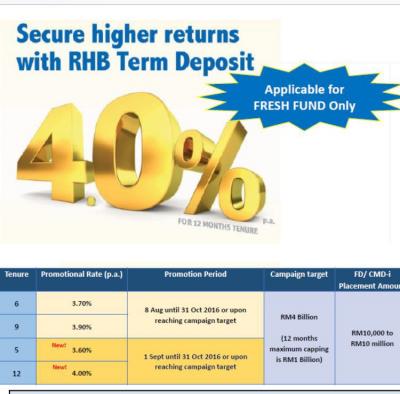

| RHB Bank | 3.00% | 3.05% | 3.10% | 3.05% | |

| Public Bank | 2.95% | 3.00% | 3.05% | 3.10% | PB Golden 50 Plus 12 months 3.20% |

| Standard Chartered Bank | 2.70% | 2.85% | 2.90% | 3.00% | |

| UOB Bank | 2.70% | 2.80% | 2.90% | 3.00% |

Fixed / Time Deposit and Savings Account Promotions 2016.

Please call the nearest bank to reconfirm the rates (go to the bank website for bank contact number where you can also get the contact number of the branch nearest to you) before going to the bank to check if promotions are still valid.

*

Affin Bank. Minimum Fresh Fund RM10K. Valid until 28 February 2016

Terms & Conditions

*

Bangkok Bank. Minimum Fresh Fund RM10K. Valid until 28 February 2017

3 months - 3.70%p.a.

5 months - 3.90%p.a.

This post has been edited by Ah SiAnG: Dec 21 2016, 09:16 PM

Aug 20 2016, 07:51 PM, updated 9y ago

Aug 20 2016, 07:51 PM, updated 9y ago

Quote

Quote

0.1912sec

0.1912sec

0.75

0.75

6 queries

6 queries

GZIP Disabled

GZIP Disabled