opening this thread for the discussion on Kenanga Digital Investing (KDI) so not to hijack SA (Stashaway) thread

Reminder: peep pls do not share your referral outright in the forum, you will get reported by anonymous (not me), it is unspoken rule in FBI session

I already saw several reports on forumer who asking for referral code or replying to such.

KDI Official Website:

https://digitalinvesting.com.my/

- Login

- Account Opening

KDI Web Account Login:

https://app.digitalinvesting.com.my/user-login

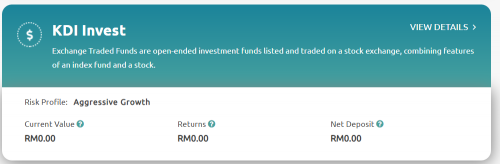

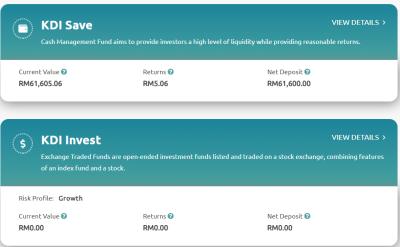

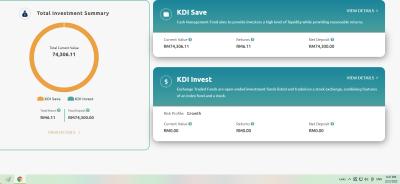

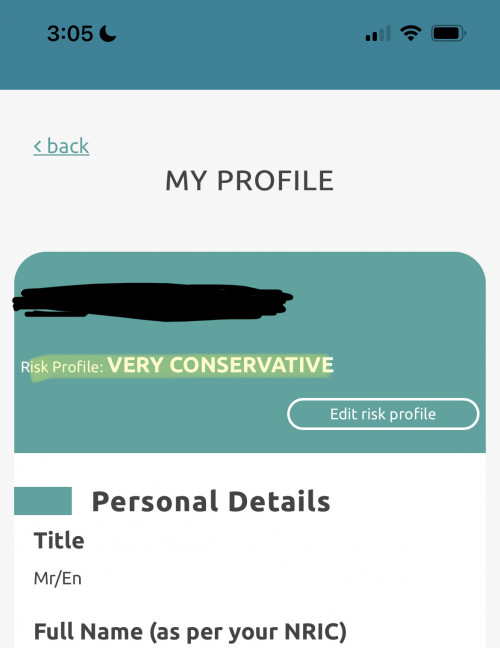

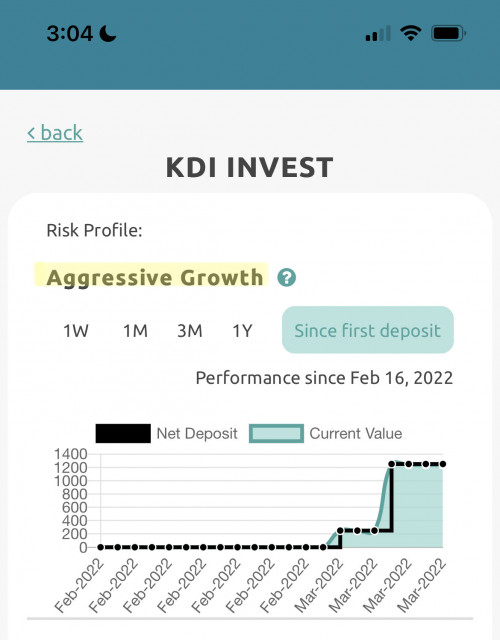

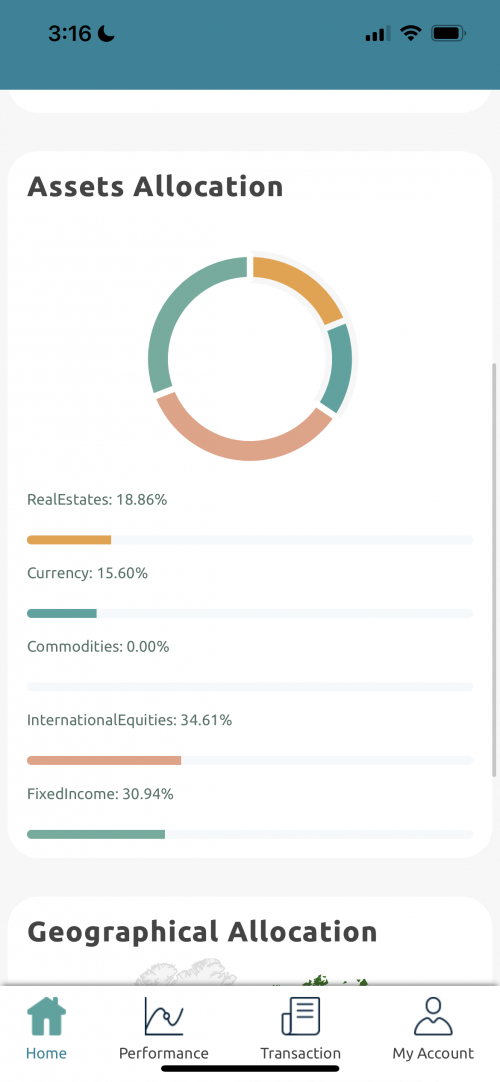

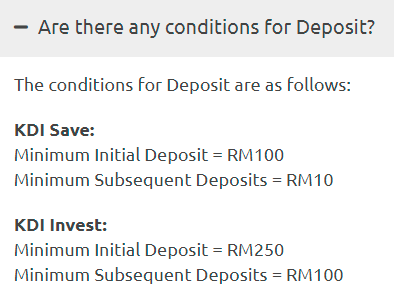

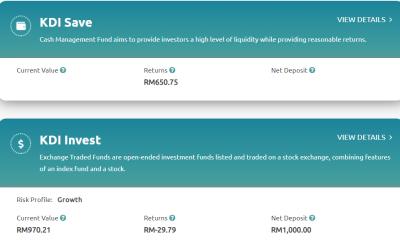

Kenanga Digital Investing (KDI) consists of two investment tools:

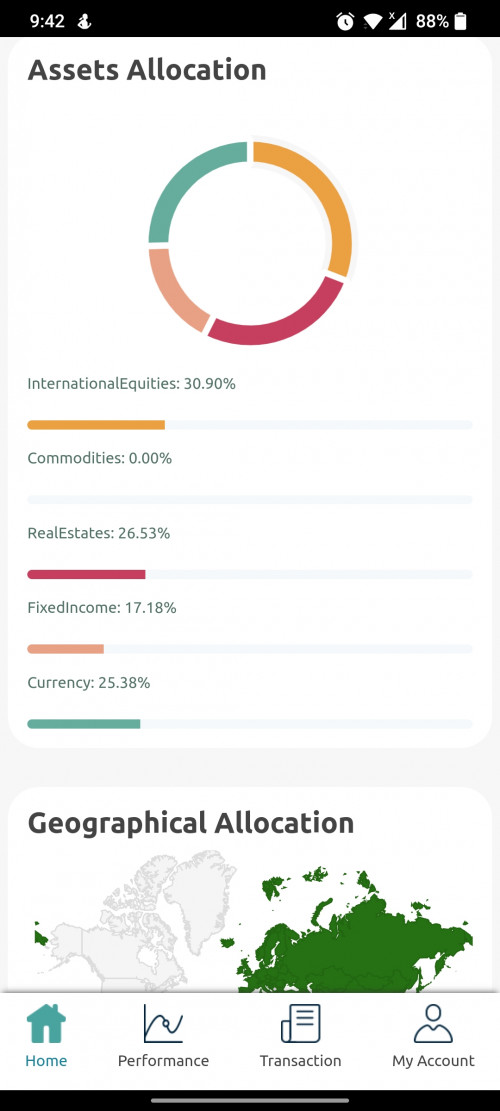

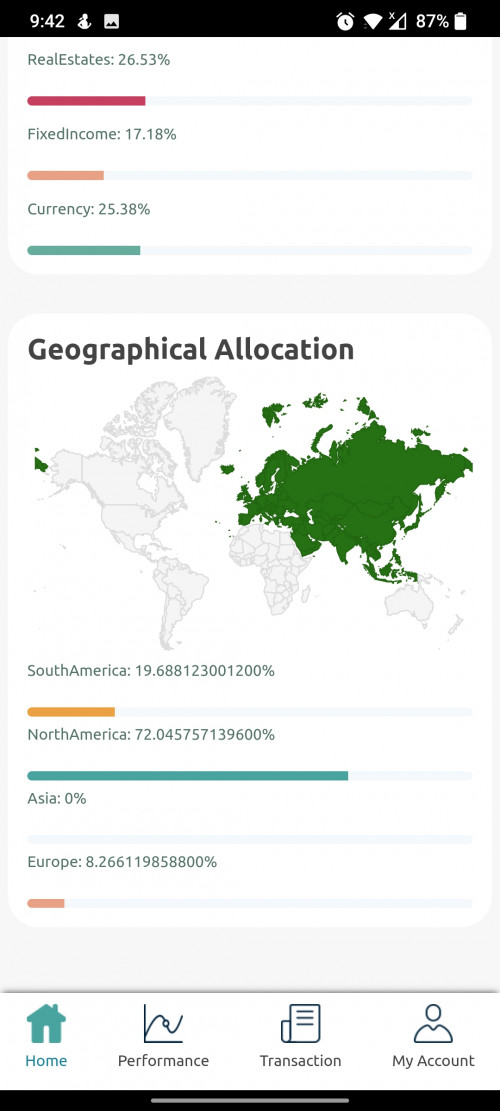

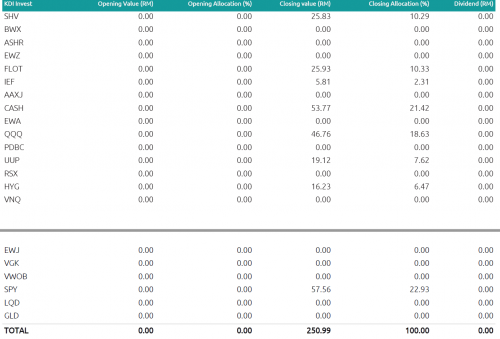

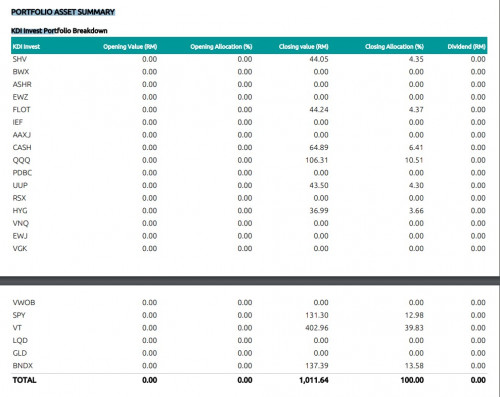

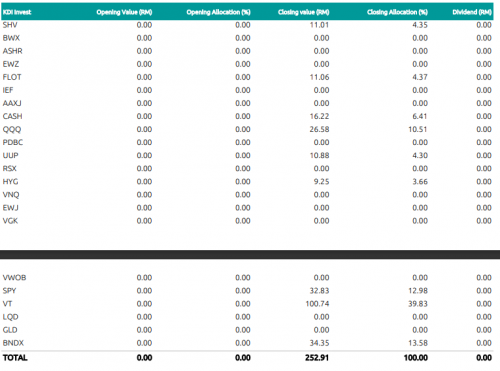

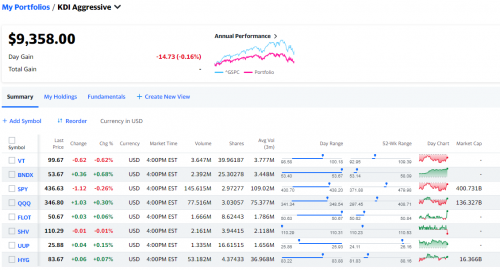

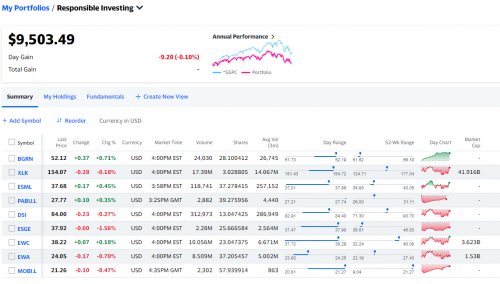

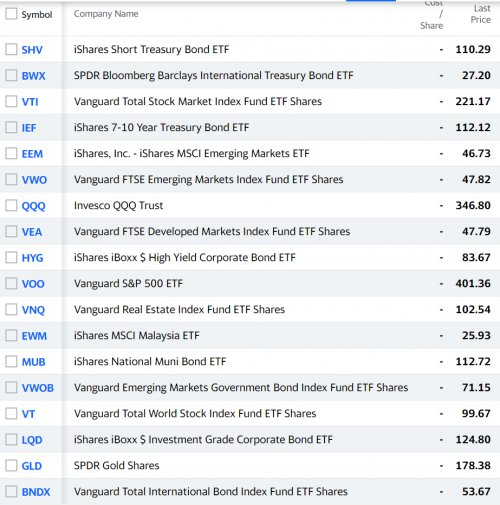

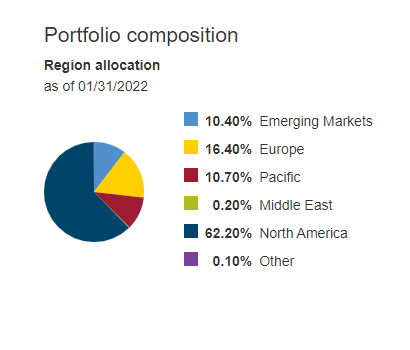

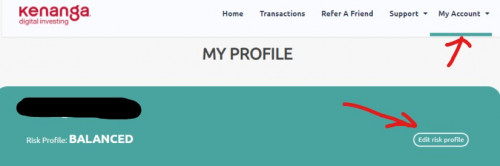

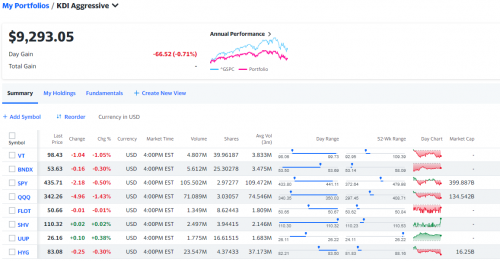

1. KDI Invest (Stashaway ETF portfolio alike) - click for more info

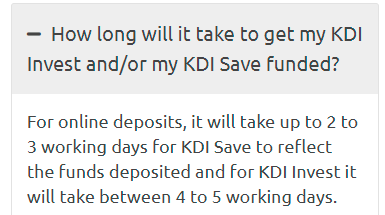

Your withdrawal from KDI Invest will take approximately 5 working days to reflect in your bank account

QUOTE

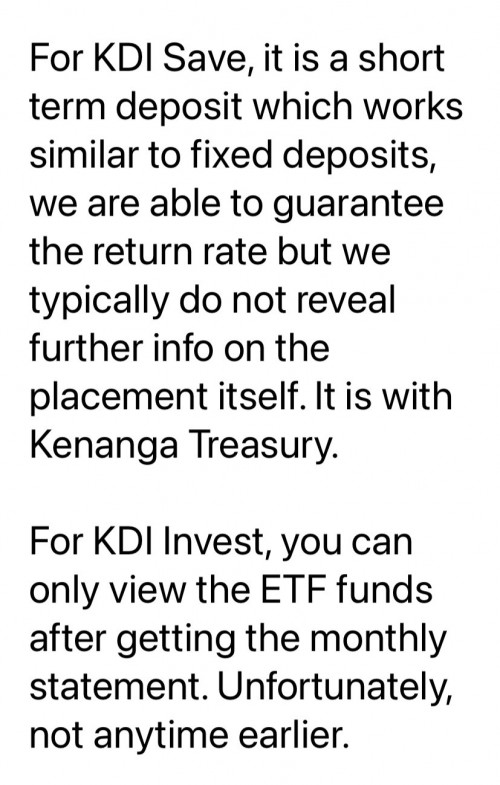

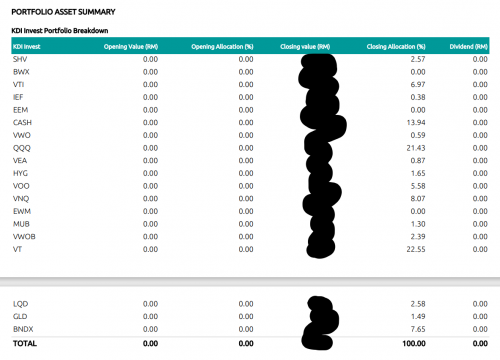

According to KDI CS, you can view the portfolio's underlying ETF placement after getting the monthly statement.

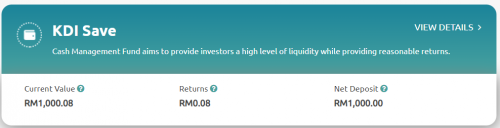

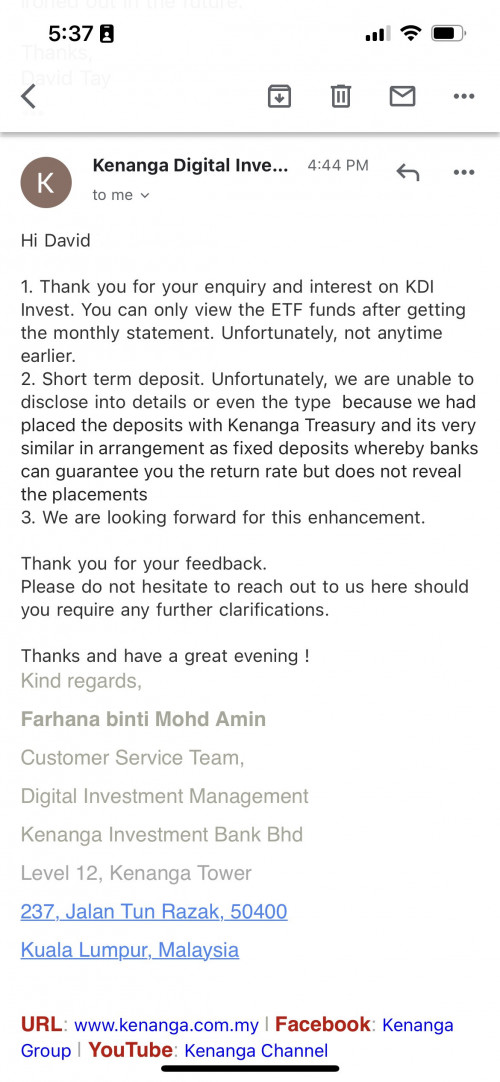

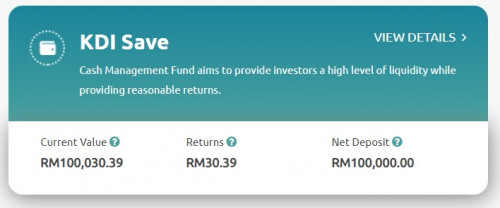

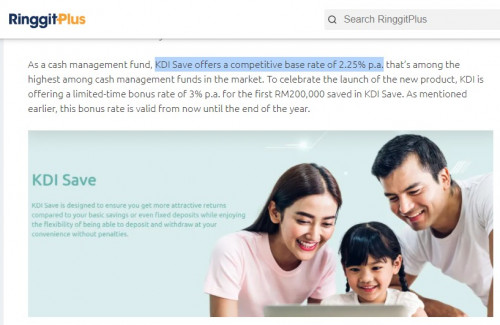

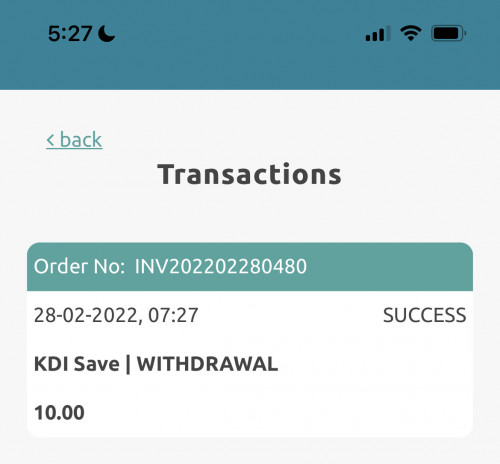

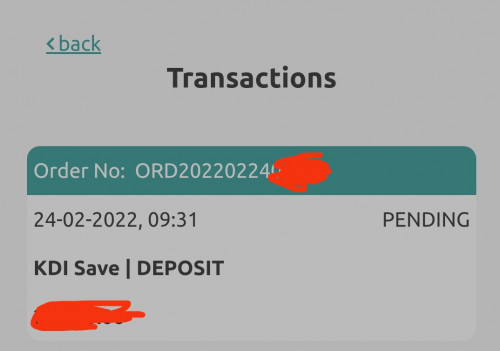

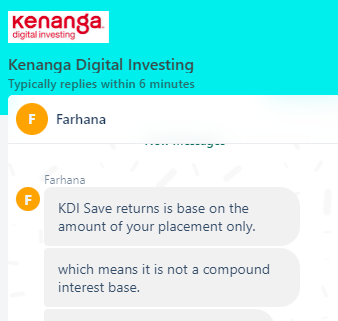

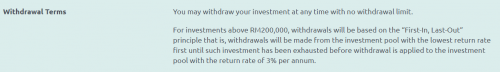

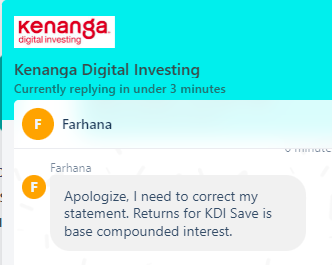

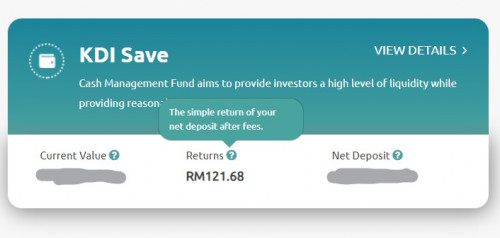

2. KDI Save (seems to be akin to Money Market Funds portfolio like Stashaway Simple/Versa) - click for more info

QUOTE

According to KDI CS, it is a short-term deposit that works similar to FD, they are able to guarantee the return rate but they typically do not reveal further info on the placement itself. It is with Kenanga Treasury.

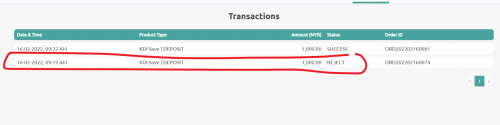

Your withdrawal from KDI Save will reflect in your bank account:

Latest 1 day after the withdrawal day (T+1), if withdrawal made before cut-off time of 11am; or

Latest 2 days after the withdrawal day (T+2), if withdrawal made after cut-off time of 11am.

T should be working day, If you make deposit or withdrawal on weekend or holiday, then it will follow upcoming working day

Cut-off / Turn-around

(according to forummer's sharing here)

QUOTE(lovelyuser @ Mar 1 2022, 01:33 PM)

Deposit or withdrawal cut off is working day 11am, you will see update of same day interest or your withdrawal proceed(process by KDI) by 430pm same day

If you make deposit or withdrawal on weekend or holiday, then it will follow upcoming working day

If you make deposit or withdrawal on weekend or holiday, then it will follow upcoming working day

QUOTE(rocketm @ Mar 11 2022, 11:48 AM)

I have asked Kenangan this:

Cutoff Deposit

KDI Save - 11am

KDI Invest - 8am

Cutoff withdraw

1-2 working days

Transfer from KDI Save to KDI Invest

4-5 working days

My experience is

Deposit @21.02.2022, 3:14PM and account update @23.02.2022, 12:47AM. (2days)

Transfer from KDI Save to KDI Invest @24.02.2022, 3:57AM, account updated @25.02.2022, 4:42PM (1day)

FAQ ShortcutCutoff Deposit

KDI Save - 11am

KDI Invest - 8am

Cutoff withdraw

1-2 working days

Transfer from KDI Save to KDI Invest

4-5 working days

My experience is

Deposit @21.02.2022, 3:14PM and account update @23.02.2022, 12:47AM. (2days)

Transfer from KDI Save to KDI Invest @24.02.2022, 3:57AM, account updated @25.02.2022, 4:42PM (1day)

https://digitalinvesting.com.my/faq/

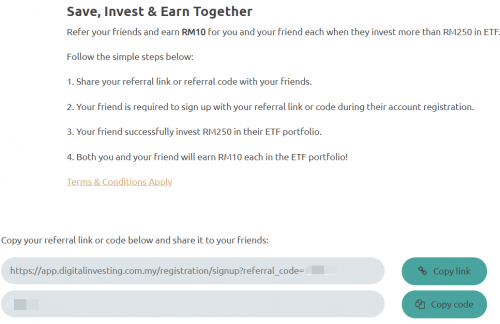

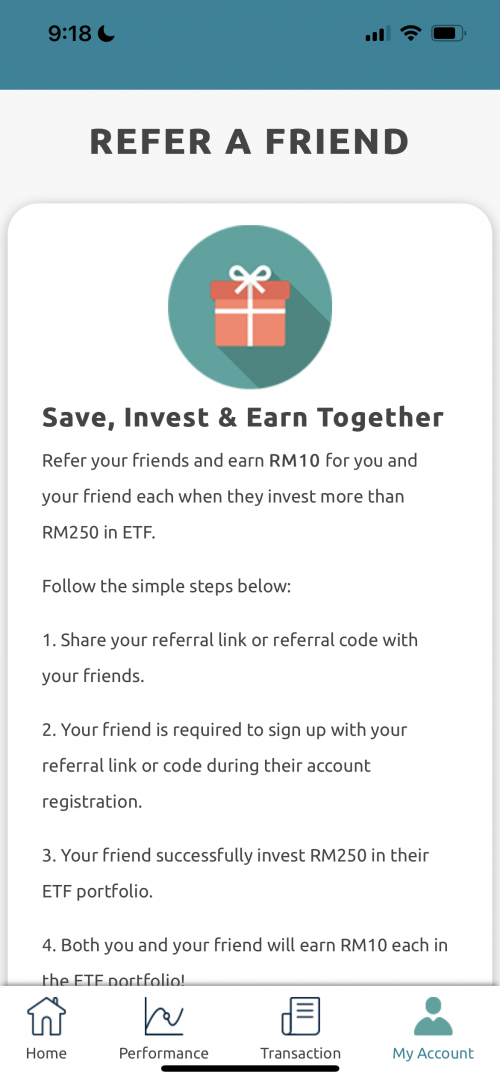

KDI Referral Program

- not sharing my code to abide forum rule, do PM me or other investor

QUOTE

According to KDI CS, after your referee successfully deposited RM250 in their ETF account, KDI will reward RM 10 to both referrer and referee in 30 days.

Experience Sharing:

Pros

1. Quick account opening, got it open in one hour (Though there are forumer reported a day or more than that)

2. Quick investment deposit processing for KDI Save, deposit through FPX in the morning, got the units, and return in the afternoon

3. Promotional rate of KDI save 3%

Cons

1. BY FAR no details of underlying assets for KDI Invest, this info will only be available in your next month's statement

2. Login engine doesn't have 2FA

3. Mobile app doesn't have fingerprint/face ID login

Fee

https://digitalinvesting.com.my/invest/

This post has been edited by tadashi987: Apr 7 2022, 11:02 PM

Feb 17 2022, 12:11 PM, updated 4y ago

Feb 17 2022, 12:11 PM, updated 4y ago

Quote

Quote

0.2165sec

0.2165sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled