feels kind of insecure because app never disclose the detail of asset they invested

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Feb 21 2022, 12:08 PM Feb 21 2022, 12:08 PM

Return to original view | Post

#1

|

Junior Member

998 posts Joined: May 2014 |

feels kind of insecure because app never disclose the detail of asset they invested

|

|

|

|

|

|

Feb 21 2022, 06:14 PM Feb 21 2022, 06:14 PM

Return to original view | Post

#2

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(tehoice @ Feb 21 2022, 12:28 PM) no idea, hopefully they can clarify it through their updated FAQ next time. transparency is needed regardless of the company background and past achievements. For example, StashAway invested significant amount in Kweb but price kept dropping, if investors disagree with it then they can pull their money out ASAP.We won't know until they share or someone gotten their statement and share. Meanwhile, I have more confidence in them because they are a listed company, not some small start ups, they are regulated by the SC, your money goes to the trustee and not them directly. However, do exercise your own diligence whether you would want to invest with them. P/S: and my ex-com as well This post has been edited by bcombat: Feb 21 2022, 06:16 PM |

|

|

Feb 23 2022, 09:44 AM Feb 23 2022, 09:44 AM

Return to original view | IPv6 | Post

#3

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Mar 1 2022, 01:34 PM Mar 1 2022, 01:34 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Mar 1 2022, 03:35 PM Mar 1 2022, 03:35 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Mar 2 2022, 10:28 PM Mar 2 2022, 10:28 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(DragonReine @ Mar 2 2022, 05:22 PM) After looking through KDI invest i think I'll pass, as some mentioned the lack of transparency on backtesting is a bit of a red flag for me. they still new. likely will improve graduallyThat said, the 0 fees for under RM3k makes this nice for very small fry investor beginners. KDI Save will be good for short term cash parking with current rates. |

|

|

|

|

|

Mar 8 2022, 09:36 AM Mar 8 2022, 09:36 AM

Return to original view | Post

#7

|

Junior Member

998 posts Joined: May 2014 |

just do a testing to withdrawal….

withdraw same sum from both KDI save and KDI invest on 2/3 Already received fund 3/3 in my bank acc next day for KDI save But I only get refund on 7/3 for money parked under KDI invest and it is not exact amount I requested earlier …. slightly less than my I requested |

|

|

Mar 29 2022, 09:58 AM Mar 29 2022, 09:58 AM

Return to original view | IPv6 | Post

#8

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(Afterburner1.0 @ Mar 28 2022, 02:40 PM) no no don't get me wrong, just for my knowledge only... looking for short simple answers only.... so its confirmed compounding interest if i read all the long ass answers/ debate in the previous post rite? best is ask their CSppl here sometimes give u answer that is not what u need. Can’t get satisfactory answer from CS then only come here |

|

|

Apr 30 2022, 07:07 PM Apr 30 2022, 07:07 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(c64 @ Apr 30 2022, 10:44 AM) they intend to reduce US equity exposure and place more fund in gold investment, ie SPDR gold trust. In btw, those who invested in KDI should watch their webinar to get latest update on the investment….can post questions during live session. |

|

|

Apr 30 2022, 11:34 PM Apr 30 2022, 11:34 PM

Return to original view | Post

#10

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(sgh @ Apr 30 2022, 10:22 PM) That is normal always market correction ppl flock to gold investment. SPDR gold is backed by physical gold. I think Bursa and SGX also listed. This is the conservative portfolio as per the March statement:I wonder in their diversification basket of ETF do they also invest a bit on country specific ETF? I invest with Syfe and my Indonesia, Australia a little green color SHV FLOT IEF QQQ UUP HYG SPY VT BDNX Other portfolio such as aggressive, growth, balanced etc, individual assets component are different from above. |

|

|

May 2 2022, 12:21 AM May 2 2022, 12:21 AM

Return to original view | IPv6 | Post

#11

|

Junior Member

998 posts Joined: May 2014 |

Changes of assets allocation March 22 vs April 22 (for conservative portfolio only):

SHV 7.02% --> 4% FLOT 7.02% --> 4% IEF 2.21% --> 3% CASH 16.81% ---> 8% QQQ 11.19% ---> 0% UUP 4.37% ---> 17% HYG 3.61% ---> 3% SPY 13.58% ---> 7% VT 22.49% ---> 0% BDNX 11.7% ----> 0% VNQ 0 %----> 5% LQD 0 % ----->8% BWX 0 % ----> 8% EWZ 0 % -----> 15% GLD 0 %------> 17% |

|

|

May 2 2022, 12:39 PM May 2 2022, 12:39 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

May 26 2022, 09:49 PM May 26 2022, 09:49 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

|

|

|

Jun 2 2022, 10:34 PM Jun 2 2022, 10:34 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 9 2022, 11:58 AM Jun 9 2022, 11:58 AM

Return to original view | IPv6 | Post

#15

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 9 2022, 01:17 PM Jun 9 2022, 01:17 PM

Return to original view | IPv6 | Post

#16

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 9 2022, 09:59 PM Jun 9 2022, 09:59 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

998 posts Joined: May 2014 |

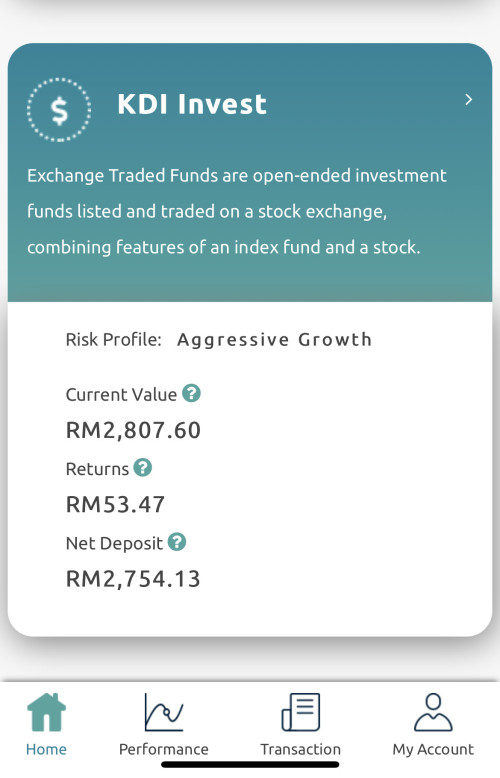

QUOTE(Davidtcf @ Jun 9 2022, 06:58 PM) Just checked again today after getting email risk change completed. Shocked to see returns so fast. I also thought will have some losses changing portfolio: — Total I have in invest is 2.8k When I left Balanced was 2754 Need to see statement to understand what happened 🤪 Not complaining though.. Maybe I came in at right time 😆 This post has been edited by bcombat: Jun 9 2022, 09:59 PM |

|

|

Jun 13 2022, 09:44 PM Jun 13 2022, 09:44 PM

Return to original view | IPv6 | Post

#18

|

Junior Member

998 posts Joined: May 2014 |

gold lau sai

|

|

|

Jun 13 2022, 10:39 PM Jun 13 2022, 10:39 PM

Return to original view | IPv6 | Post

#19

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 15 2022, 12:01 AM Jun 15 2022, 12:01 AM

Return to original view | IPv6 | Post

#20

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(PoisonSoul @ Jun 14 2022, 11:03 PM) Just keeping a record here for those curious. KDI invest withdrawal will take much longer time. Extra few days.KDI Save Requested withdrawal @ 9/6/22 (Thursday) 4:31pm Received email saying successful @ 10/6/22 (Friday) 4:30pm Received funds into bank (CIMB) account @ 10/6/22 (Friday) around 8-9pm. |

| Change to: |  0.0319sec 0.0319sec

0.37 0.37

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 09:11 PM |