QUOTE(annoymous1234 @ Feb 17 2022, 03:51 PM)

It is daily compounded so even Better than pro rated Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Feb 18 2022, 05:30 AM Feb 18 2022, 05:30 AM

Return to original view | Post

#1

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

|

|

|

Feb 18 2022, 05:30 AM Feb 18 2022, 05:30 AM

Return to original view | Post

#2

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Feb 18 2022, 05:32 AM Feb 18 2022, 05:32 AM

Return to original view | Post

#3

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Feb 18 2022, 04:16 PM Feb 18 2022, 04:16 PM

Return to original view | Post

#4

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Yjgpig @ Feb 18 2022, 04:00 PM) Well, this was what they replied upon my e-mail inquiry on the same question today: Kenanga Treasury is most likely done a deal with one of the banks as to why they able to offer that rate up to 200k"It is a short term deposit. Similar to fixed deposits, we are able to guarantee the return rate but we typically do not reveal further info on the placement itself. It is with Kenanga Treasury." Still digging which bank as it is seems familiar with 2.25% rate but my guts suspect it is most likely with UOB QUOTE(akhito @ Feb 18 2022, 04:11 PM) actually non transparent will cause more problem in the long run. Let ppl then they choose to invest or not. Portfolio and sell-buy execution is clear then only can gain trust for large investment. Even MyTheo doesn’t disclose the allocation but they disclose the entire list of ETF under which portfolio The problem is KDI couldn’t pinpoint and fixed a proper allocation unlike others which have fixed portfolio list to allocate around Yjgpig liked this post

|

|

|

Feb 18 2022, 04:18 PM Feb 18 2022, 04:18 PM

Return to original view | Post

#5

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(akhito @ Feb 18 2022, 04:11 PM) actually non transparent will cause more problem in the long run. Let ppl then they choose to invest or not. Portfolio and sell-buy execution is clear then only can gain trust for large investment. No allocation for ETF unless successful depositbis made then only can tell from monthly statements onlyedit : what I understand from this thread is based ur risk preference they will generate portfolio for u at least they need to tell u ehat the ai bought for u right? How unique the portfolio is if we can gather enough info should be able to figure out how they allocate So TS got ald ur porfolio with the etf lit> |

|

|

Feb 18 2022, 06:56 PM Feb 18 2022, 06:56 PM

Return to original view | Post

#6

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

|

|

|

Feb 20 2022, 01:50 AM Feb 20 2022, 01:50 AM

Return to original view | Post

#7

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

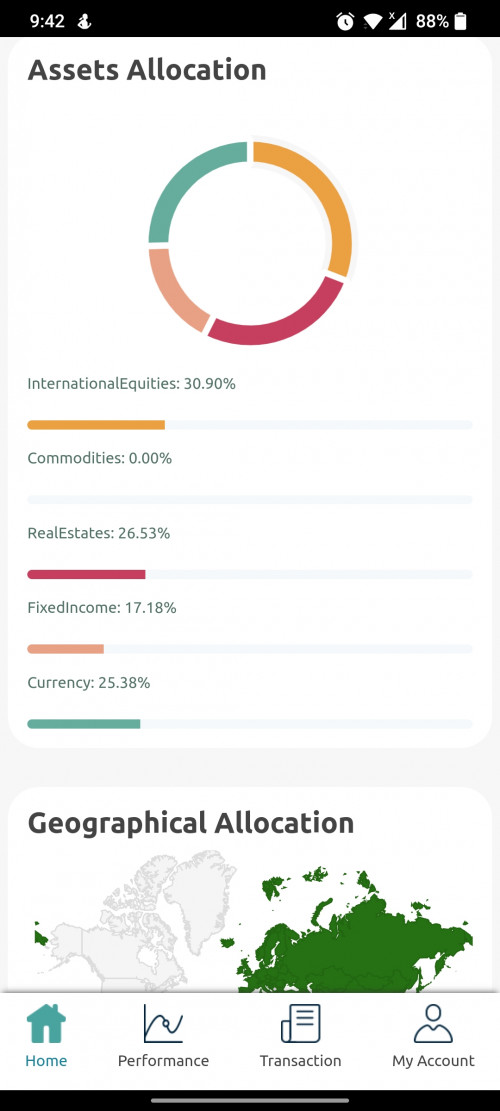

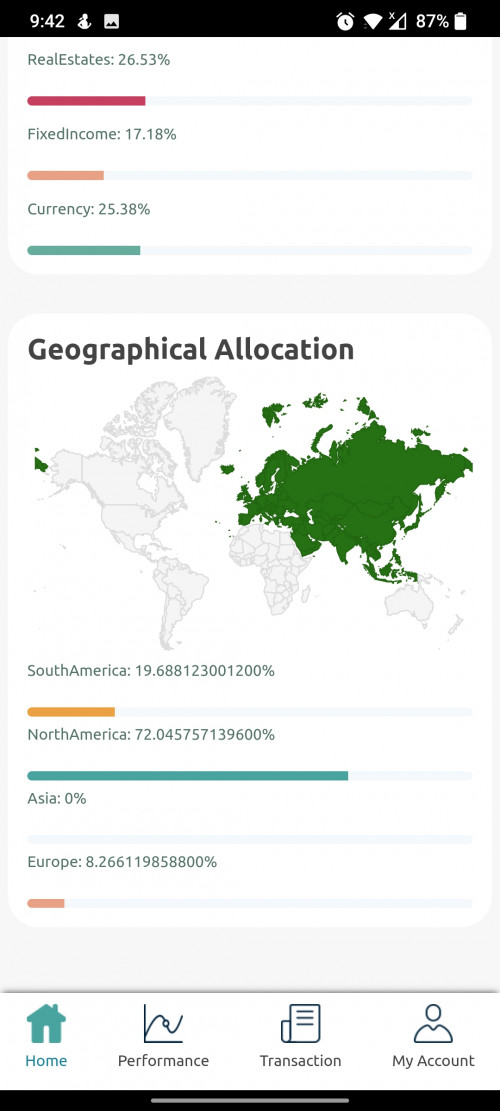

QUOTE(melondance @ Feb 19 2022, 12:31 PM) I wonder is there any good alternatives to IBKR that is licensed locally? I don't mind taking some compromises. Rakuten's fee are not that expensive but the stocks and ETFs are currently limited.. MIDF the fee is expensive at 8USD for <1K USD. However, I am looking to hold for a very long time.. Looking for solutions with simple deposit and withdrawal You can try FSMone but beware of the chargesSo far so good on them especially withdrawal QUOTE(jutamind @ Feb 19 2022, 09:45 PM) Here's the asset allocation for Aggressive Growth profile/risk. High allocations to real estate Most likely skewed towards IYR or VNQ or VNQI while commodities should have GLD as well Seems like the highlighted region in the map and the geography invested doesn't tally. Could be a bug.  Need to wait for next statement to see the actual ETF purchased Davidtcf liked this post

|

|

|

Feb 20 2022, 10:15 AM Feb 20 2022, 10:15 AM

Return to original view | Post

#8

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Medufsaid @ Feb 20 2022, 09:36 AM) bagus, i want to live in north america one. today i know i'm actually here 🤣🤣 For fractional it will be rounded up to the nearest 4 decimalsactually computers calculate until that many decimals one. just that if UI is polished, will round up to 2 or 3 decimals. this looks like an app created in a 3 hour hackathon The UI design is fine it is just the data Fromm their database is not matching the site hence got to do with the linkage instead |

|

|

Feb 20 2022, 11:21 PM Feb 20 2022, 11:21 PM

Return to original view | Post

#9

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Davidtcf @ Feb 20 2022, 03:24 PM) If gov become like Singapore then that could happen. Else slowly dream. Malaysia gov very conservative about their currency and what also wanna tax when come to foreign investments. Local bursa also a bad place to invest unless experienced and pour in a lot of time to monitor. Which is why FSMone or Rakuten still have stamp duty being charged on US shares or ETFs as they see it as new source of revenue for them |

|

|

Feb 22 2022, 12:43 PM Feb 22 2022, 12:43 PM

Return to original view | Post

#10

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(shawnme @ Feb 22 2022, 11:41 AM) Apparently so, as stated on their site. Somehow, I deposited RM 250 on the 18th Feb into Invest, but still "Pending". Markets in US is in holiday which is why " Refer your friends and earn RM10 for you and your friend each when they invest more than RM250 in ETF. Follow the simple steps below: 1. Share your referral link or referral code with your friends. 2. Your friend is required to sign up with your referral link or code during their account registration. 3. Your friend successfully invest RM250 in their ETF portfolio. 4. Both you and your friend will earn RM10 each in the ETF portfolio! " Check back tomorrow then shawnme liked this post

|

|

|

Feb 22 2022, 03:45 PM Feb 22 2022, 03:45 PM

Return to original view | Post

#11

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(CoolCatToM @ Feb 22 2022, 03:37 PM) https://www.thestar.com.my/business/busines...manager-licenceIt is under curren5 IB with digital ib license This post has been edited by xander83: Feb 22 2022, 03:48 PM |

|

|

Feb 23 2022, 07:04 PM Feb 23 2022, 07:04 PM

Return to original view | Post

#12

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Feb 24 2022, 08:38 AM Feb 24 2022, 08:38 AM

Return to original view | Post

#13

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

|

|

|

Feb 24 2022, 06:09 PM Feb 24 2022, 06:09 PM

Return to original view | Post

#14

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Hoshiyuu @ Feb 24 2022, 01:21 PM) Wed, Feb 23, 5:20 AM Requested via website. Advantage of having internal treasury seems like before cut off will received on the same day so technically within 6 hours the fastest Wed, Feb 23, 4:29 PM Received processing done email. Wednesday late evening received money in bank account. QUOTE(Davidtcf @ Feb 24 2022, 04:34 PM) if long term invest they will come back up.. any losses are just paper loss until they are sold. In fact next week onwards for the coming 2 weeks will be buy8ng opportunity my IBKR now also much red, CSPX loss 180 USD, AAPL 40 USD, PFE 28 USD, SMH 45 USD, VWRA 42 USD. All are my losses for them. Even BNKS - bank ETFs also loss at 24 USD. Fall happened after Fed announced raising interest rates. mostly bought end of last year.. this year added a few. That also I small investor.. imagine what some big whales here would have loss. just continue DCA when you're comfortable and keep it long term. 5-10 years minimum sure will go back up. can wait for Russia war to over first before putting in money.. but as usual when things start showing positive, stocks also will be more expensive to buy. Better to buy when they are down. Davidtcf liked this post

|

|

|

Feb 24 2022, 07:30 PM Feb 24 2022, 07:30 PM

Return to original view | Post

#15

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(ky33li @ Feb 24 2022, 07:17 PM) Strongly against investment in KDI Invest. My risk profile is “conservative” but it ended invested in “Agressive” porfolio for me. Send email to customer service but after two days still cannot find out what is the problem. in the mean time i have to bear the losses. Get the statement and make noise on it Seems like another bigger Akru in the making |

|

|

Feb 26 2022, 03:25 AM Feb 26 2022, 03:25 AM

Return to original view | Post

#16

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(ky33li @ Feb 25 2022, 11:15 PM) I disagree SSPN is much safer. SSPN savings pretty much lend to students for PTPTN loans. If you look at number on collections which very much fall short and against SSPN contribution. It is like musical chair. If all depositors pull out all funds at once I dont think PTPTN cannot pay you 100%. Bear in mind total PTPTN outstanding is around RM40billion. For 3% dividend really not worth the risk at all. Don’t forget that SSPN are actually backed by govt because it is mostly goes to MGS bonds It is only safe for principal value but however if there any changes on coupon rates there goes your troubles instead of worrying about the loans repayment |

|

|

Feb 26 2022, 05:14 PM Feb 26 2022, 05:14 PM

Return to original view | Post

#17

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(CoolStoryWriter @ Feb 26 2022, 12:19 PM) Would you recommend to put in KDI invest or Stashaway? I currently have 5 digits in Stashaway but the 36% risk index is disappointing, mostly due to KWEB. Stop putting into SA and only put max of 3000 to avoid and save feesIm planning to stop putting into STASHAWAY and diversity into KDI. Anything extra DIY yourself buying whatever you feel c9mfortable to grow with plain and simple |

|

|

Feb 26 2022, 05:34 PM Feb 26 2022, 05:34 PM

Return to original view | Post

#18

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Feb 26 2022, 11:38 PM Feb 26 2022, 11:38 PM

Return to original view | Post

#19

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Mar 1 2022, 08:56 AM Mar 1 2022, 08:56 AM

Return to original view | Post

#20

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

| Change to: |  0.0265sec 0.0265sec

0.23 0.23

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 12:22 AM |