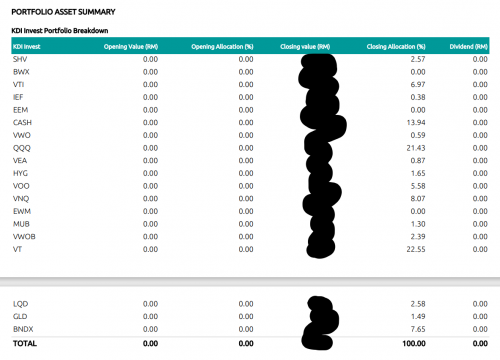

Started out with 'Conservative', then changed to 'Balanced' as I was playing around with the website.

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Mar 3 2022, 11:11 AM Mar 3 2022, 11:11 AM

Return to original view | Post

#1

|

Junior Member

743 posts Joined: Feb 2011 |

|

|

|

|

|

|

Mar 3 2022, 03:51 PM Mar 3 2022, 03:51 PM

Return to original view | Post

#2

|

Junior Member

743 posts Joined: Feb 2011 |

QUOTE(x3Kai @ Mar 3 2022, 03:49 PM) any referrals? pm thanks Sent looking to enjoy that 3% since even my trusty SC PSA doesn't give that much interest anymore lol. so far what are the thoughts on their offerings? i saw many here complained about transparency, but i'm still thinking of taking advantage of the first RM3k managed for free if the portfolios offered looks reasonable and such. |

|

|

Mar 3 2022, 04:55 PM Mar 3 2022, 04:55 PM

Return to original view | Post

#3

|

Junior Member

743 posts Joined: Feb 2011 |

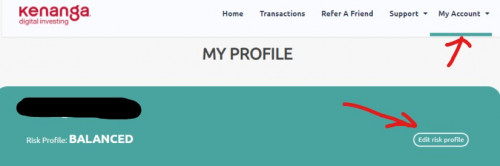

QUOTE(tehoice @ Mar 3 2022, 04:49 PM) I did it via website.Go to : My Accounts > My Profile > Edit Risk Profile Accidentally stumbled onto it. I did it without selling anything, and despite after the deposit succeeded as I was just playing around without matter the consequences. If i remember correctly, it took a few days before it actually changed.  *Disclaimer : I searched high and low, but couldn't find any correspondence to prove my claim. I just remember the steps, but what happens during/after change or cost incurred, I am not sure. I didn't notice any losses though. This post has been edited by shawnme: Mar 3 2022, 05:09 PM tehoice liked this post

|

|

|

Mar 4 2022, 09:11 AM Mar 4 2022, 09:11 AM

Return to original view | Post

#4

|

Junior Member

743 posts Joined: Feb 2011 |

|

|

|

Mar 8 2022, 10:25 PM Mar 8 2022, 10:25 PM

Return to original view | Post

#5

|

Junior Member

743 posts Joined: Feb 2011 |

QUOTE(Medufsaid @ Mar 8 2022, 03:14 PM) Well, it did work for me. I started off conservative, now its balanced. I saw this in the FAQ if you're interested. Again, just my experience." Can I switch my risk profile for KDI Invest and how to make the switch? Yes, you are able to change your risk profile for your KDI Invest account. If you do not have any existing investment or have no balance inside your KDI Invest account, then you will be able to immediately make the change. Please follow the steps below to make the change: Login to KDI > Click on “My Account” > Click on “My Profile” > Click on “Edit Risk Profile” > Select your new risk profile > Click on “Confirm” button. Once you have clicked on the confirm button, your updated risk profile will be displayed on the “My Profile” page and a notification email would be sent to your registered email address. You will also be able to immediately see a pop-up message confirming the risk profile change. However, if you have an existing investment amount in your KDI Invest account, you may follow the steps below: Login to KDI > Click on “My Account” > Click on “My Profile” > Click on “Edit Risk Profile” > Select your new risk profile > Click on “Confirm” button. Once you have clicked on the “Confirm” button, there will be a pop message to “Confirm” or “Cancel” the newly selected risk profile as well as a note to inform you that the existing amount will be fully withdrawn so that it can be invested into your new portfolio with the newly chosen risk profile. This process will take up to 7 working days to be completed. Upon completion, the new risk profile will be reflected on the “My Profile” page and a notification email confirming the change will be sent to your registered email address. You will also be able to see a pop-up message confirming the risk profile change upon your next login after the completion is done. " lovelyuser liked this post

|

|

|

Mar 11 2022, 08:20 AM Mar 11 2022, 08:20 AM

Return to original view | Post

#6

|

Junior Member

743 posts Joined: Feb 2011 |

My experience, opened account 4 days before, did everything proper, still pending. Then on the 4th day, sent them an email for the status. No reply, but received approval 1 hour later. sweetpea123 liked this post

|

|

|

|

|

|

Mar 11 2022, 08:53 AM Mar 11 2022, 08:53 AM

Return to original view | Post

#7

|

Junior Member

743 posts Joined: Feb 2011 |

QUOTE(Sheng890624 @ Mar 11 2022, 08:27 AM) '4 days'I meant that even after 4 days, it was still pending, hence I emailed them and it got approved within the hour. Also meant that, in my experience, if one is still waiting 'after 48 hours', maybe you would want to email them and it might just hasten the process. This post has been edited by shawnme: Mar 11 2022, 08:57 AM |

|

|

Mar 11 2022, 10:05 AM Mar 11 2022, 10:05 AM

Return to original view | Post

#8

|

Junior Member

743 posts Joined: Feb 2011 |

|

|

|

Mar 14 2022, 05:03 PM Mar 14 2022, 05:03 PM

Return to original view | Post

#9

|

Junior Member

743 posts Joined: Feb 2011 |

Made a deposit today, and it showed "Failed", now awaiting reply from CS. Meanwhile I am curious what happened in between when it was just another deposit just like before, and it's my first failed deposit.

If anyone has the same experience, please do share. *Disclaimer, the transaction went by the book..meaning not credit card, same account IC name, etc. |

|

|

Mar 15 2022, 08:39 AM Mar 15 2022, 08:39 AM

Return to original view | Post

#10

|

Junior Member

743 posts Joined: Feb 2011 |

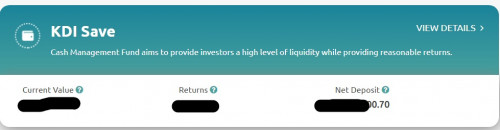

QUOTE(guy3288 @ Mar 14 2022, 08:51 PM) I monitored the daily increase in accumulated interest for 3 days and I've made a withdrawal of RM 1k, and I noticed my "Net Deposit" amount increased by RM 0.70. Could it be where it went to?found my calculated daily interest (200k x 3%/365)+ (>2000k x 2.25%/365) is same as KDI daily increase in accumulated interest. After withdrawal noticed reduced interest is more than expected WD RM10k, today daily interest reduced by RM3.54 WD RM1k , today daily interest reduced by RM0.40 i WD RM10 000 8.30am today , received money in CIMB 7.30pm just now RM10k out I expect today's daily interest reduced by RM0.62 (RM10k @2.25% pa) RM2.92 as fee? another acc i WD RM1000 @9.00am, received money in MBB 7.00pm RM1000 out should reduce interest by RM 0.06, 34 sen ? fees Anybody noticed that? PS: Just redeposited back the 10k and 1k , tomorrow 5pm would know daily interest is back to pre-withdrawal amount or not.  By the way, I'm not sure as I did not track the daily returns, just a wild guess. Also, anyone have gotten their referral rewards? This post has been edited by shawnme: Mar 15 2022, 08:41 AM |

|

|

Apr 29 2022, 01:01 PM Apr 29 2022, 01:01 PM

Return to original view | Post

#11

|

Junior Member

743 posts Joined: Feb 2011 |

QUOTE(cynachen @ Apr 29 2022, 12:42 PM) Hi All, I just did a withdrawal request and received the email notification stating the withdrawal is successful, how long do I need to wait approximately to get the fund after the email notification? Thanks. Assuming you did the withdrawal after 11am. (KDI Save) My guess, probably you'll only get the funds next Thursday (5th May) after 5pm. Otherwise, by tonight, very likely you'll get the funds. Edit: Ahh, my mistake for assuming KDI Save, enlightened by the post below. This post has been edited by shawnme: Apr 29 2022, 02:14 PM cynachen liked this post

|

|

|

May 1 2022, 12:08 PM May 1 2022, 12:08 PM

Return to original view | Post

#12

|

Junior Member

743 posts Joined: Feb 2011 |

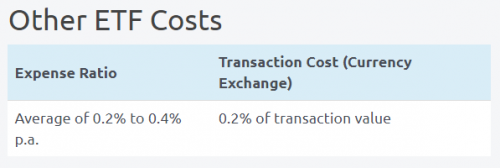

QUOTE(Alocasia @ May 1 2022, 11:44 AM) May I know why the final amount is not RM250.30? I think there's no fee charging for funds below RM3k for KDI Invest? Probably this. This post has been edited by shawnme: May 1 2022, 12:14 PM Medufsaid liked this post

|

|

|

Oct 3 2022, 09:13 AM Oct 3 2022, 09:13 AM

Return to original view | Post

#13

|

Junior Member

743 posts Joined: Feb 2011 |

*removed

This post has been edited by shawnme: Oct 3 2022, 09:33 AM |

|

|

|

|

|

Oct 3 2022, 03:18 PM Oct 3 2022, 03:18 PM

Return to original view | Post

#14

|

Junior Member

743 posts Joined: Feb 2011 |

QUOTE(bcombat @ Oct 3 2022, 02:19 PM) something don't seem right with the first example. RM 9 per day for 10k deposit ...to 100k balance after first day shocking as coming from a financial firm where decimals are part of daily routine. This post has been edited by shawnme: Oct 3 2022, 03:23 PM |

|

|

Oct 3 2022, 04:34 PM Oct 3 2022, 04:34 PM

Return to original view | Post

#15

|

Junior Member

743 posts Joined: Feb 2011 |

In my case, it wasn't affected by new deposits as I have not made a deposit in awhile.

Meanwhile, by calculation of today's interest accrued, it seems right with 50k @ 3.5% ..... following the calculations provided in the example above. This post has been edited by shawnme: Oct 3 2022, 04:36 PM |

|

|

Oct 3 2022, 06:24 PM Oct 3 2022, 06:24 PM

Return to original view | Post

#16

|

Junior Member

743 posts Joined: Feb 2011 |

QUOTE(guy3288 @ Oct 3 2022, 06:13 PM) good the higher the better but Hmm...I may be wrong, I did a quickie on excel and it came out right for all my accounts.that 3.5% was abit of an exaggeration. Yes marketing gimmick. are you sure is 3.5%? i checked min only 3.44% , 1day interest RM4.26 If really 3.5%, it should be RM4.33 i checked other 4 accs all same 3.44% no such thing as 3.5% This is the formula I used. It came out exactly the interest accrued for today : =ROUND((((50000)*(1+3.5%)^(1/365))-(50000))+(((current value-50000)*(1+3%)^(1/365))-(current value-50000)),2) *side note, don't forget to calculate the "compounding" factor. Put it in another way, that interest amount will only compound to a total of 3.5% after 365 days. The interest accrued is not linear, starts less and increasing ever so slightly.. So daily percentage is not equal.. Its increasing by the day. In other words, it's not 3.5% p.a. unless left there for 365 days. P. A. is 3.5%...but how it gets there is stated individually. Example, FD 12 months, they give it to you by then, but for KDI Save, they did say 3% compounded daily. So they are giving it to you, just not in linear form where its divided into 365 interest payments. If its still confusing, try putting it as simple as possible into excel, drag it down to 365 days, look at each row, and see the effect of compounding. (unsure, stand to be corrected).. I certainly hope I'm right, otherwise I'm cheated as well.. Haha..oh well.. Anyway, to each their own.. have fun.. This post has been edited by shawnme: Oct 3 2022, 07:14 PM engyr liked this post

|

|

|

Apr 20 2024, 03:23 PM Apr 20 2024, 03:23 PM

Return to original view | Post

#17

|

Junior Member

743 posts Joined: Feb 2011 |

|

|

|

May 26 2024, 12:14 PM May 26 2024, 12:14 PM

Return to original view | Post

#18

|

Junior Member

743 posts Joined: Feb 2011 |

QUOTE(Batusai @ May 26 2024, 12:00 PM) I understand. My question is if the interest counted from total net deposit or total cumulative? My last try was based on 50k net deposit @ 4%.As I'd like to max out 50k and try to withdraw the interest once in a while instead of parking the interest there. Anyway, when you click on deposit, entered an amount, and prior to FPX, you'll be shown the amount allocated to both 4% and 3.5% (when applicable). Example, I key in a ridiculous amount for KDI Save, it'll show the allocation for both. Just do a few calculations and you'll find your answer there. This post has been edited by shawnme: May 26 2024, 12:15 PM |

| Change to: |  0.0368sec 0.0368sec

0.47 0.47

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 11:27 PM |