Reserved

Credit Cards Balance Transfer (BT) Plans V4 - Banks Offer List, Credit card debt consolidation

Credit Cards Balance Transfer (BT) Plans V4 - Banks Offer List, Credit card debt consolidation

|

|

Apr 9 2016, 06:25 PM, updated 8y ago Apr 9 2016, 06:25 PM, updated 8y ago

Show posts by this member only | Post

#1

|

Senior Member

2,392 posts Joined: Dec 2009 |

Click Here For V2 Click Here For V3 FAQ On BT Topics (Read This Before You Ask Any Questions. If Your Questions Are Not Covered By The FAQ, Pls Ask In Forum) In the spoiler are some of the most commonly asked questions in the thread. I have compiled them here for easier reference as not to repeat the same question all over » Click to show Spoiler - click again to hide... « ######### Listed below are banks current offering of Balance Transfer (BT) program As I do this on a non regular basis, so if there is any update on the balance transfer offering or mistake in my post, pls let me know by PM so that I can update / correct it Disclaimer : I am not responsible for any financial issues arise from using the information provided. As I cannot list down all the T & C impose by banks, pls make sure you double check with the banks on the BT topics before you make any of your decision Thanks ######### Banks Currently Offering 0% Balance Transfer » Click to show Spoiler - click again to hide... « Banks Currently Offering <= 3%/yr Balance Transfer » Click to show Spoiler - click again to hide... « General Balance Transfer Offering Bank Name : Public Bank » Click to show Spoiler - click again to hide... « Bank Name : Maybank » Click to show Spoiler - click again to hide... « Bank Name : RHB » Click to show Spoiler - click again to hide... « Bank Name : RHB Islamic » Click to show Spoiler - click again to hide... « Bank Name : Aeon Credit Service » Click to show Spoiler - click again to hide... « Bank Name : AmBank » Click to show Spoiler - click again to hide... « Bank Name : Al Rajhi Bank » Click to show Spoiler - click again to hide... « Bank Name : BSN » Click to show Spoiler - click again to hide... « Bank Name : CIMB » Click to show Spoiler - click again to hide... « Bank Name : OCBC » Click to show Spoiler - click again to hide... « Bank Name : Standard Charted » Click to show Spoiler - click again to hide... « Bank Name : MBF » Click to show Spoiler - click again to hide... « Bank Name : Citibank » Click to show Spoiler - click again to hide... « Bank Name : UOB » Click to show Spoiler - click again to hide... « Bank Name : Hong Leong » Click to show Spoiler - click again to hide... « Bank Name : Affin » Click to show Spoiler - click again to hide... « Bank Name : Alliance Bank » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Apr 9 2016, 06:25 PM Apr 9 2016, 06:25 PM

Show posts by this member only | Post

#2

|

Senior Member

2,392 posts Joined: Dec 2009 |

Reserved

|

|

|

Apr 10 2016, 10:43 AM Apr 10 2016, 10:43 AM

Show posts by this member only | Post

#3

|

Senior Member

1,465 posts Joined: Feb 2009 |

|

|

|

Apr 10 2016, 11:15 AM Apr 10 2016, 11:15 AM

Show posts by this member only | Post

#4

|

All Stars

11,741 posts Joined: Oct 2013 From: Her Heart |

|

|

|

Apr 10 2016, 11:17 AM Apr 10 2016, 11:17 AM

Show posts by this member only | Post

#5

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Apr 10 2016, 11:35 AM Apr 10 2016, 11:35 AM

Show posts by this member only | Post

#6

|

Senior Member

1,465 posts Joined: Feb 2009 |

|

|

|

|

|

|

Apr 10 2016, 11:40 AM Apr 10 2016, 11:40 AM

Show posts by this member only | Post

#7

|

All Stars

11,741 posts Joined: Oct 2013 From: Her Heart |

|

|

|

Apr 10 2016, 01:44 PM Apr 10 2016, 01:44 PM

Show posts by this member only | Post

#8

|

Junior Member

82 posts Joined: Aug 2006 From: Petaling Jaya |

we can only apply for BT when we receive the cc statement for other cc right? the interest free period is 20 days, usually receive the e-statement few days after the statement date, and the BT will be completed within 15 business days. won't it be late? sorry, new to BT

|

|

|

Apr 10 2016, 01:58 PM Apr 10 2016, 01:58 PM

Show posts by this member only | Post

#9

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(crazyito @ Apr 10 2016, 01:44 PM) we can only apply for BT when we receive the cc statement for other cc right? the interest free period is 20 days, usually receive the e-statement few days after the statement date, and the BT will be completed within 15 business days. won't it be late? sorry, new to BT Most cases yesFor pbb, don't need statement though |

|

|

Apr 10 2016, 02:35 PM Apr 10 2016, 02:35 PM

Show posts by this member only | IPv6 | Post

#10

|

Senior Member

6,484 posts Joined: Apr 2012 |

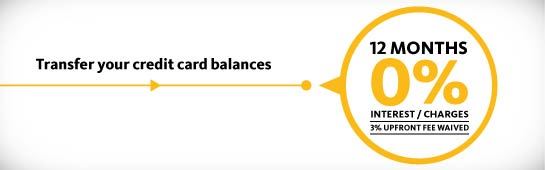

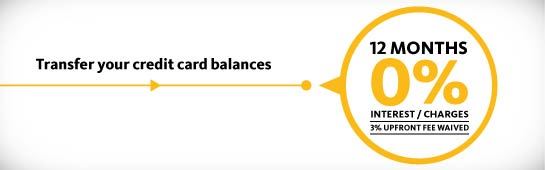

QUOTE(busyman @ Apr 10 2016, 11:35 AM) Have asked about BT from MBB (MBB Card & MBB Islamic Ikhwan Card)Ya, 0% for 12 months come with one time fee 3% but for Islamic Ikhwan Card there is no 3% charge in their website. However, the Card Center Staff told me it should be 3% too, not sure whether which one is correct Maybank Credit Card Balance Transfer rate Maybank Islamic Ikhwan Card Balance Transfer rate |

|

|

Apr 10 2016, 02:47 PM Apr 10 2016, 02:47 PM

|

Senior Member

2,677 posts Joined: Dec 2010 |

QUOTE(sj0217 @ Apr 10 2016, 02:35 PM) Have asked about BT from MBB (MBB Card & MBB Islamic Ikhwan Card) Look interesting for the Ikhwan if there's no 3% Ya, 0% for 12 months come with one time fee 3% but for Islamic Ikhwan Card there is no 3% charge in their website. However, the Card Center Staff told me it should be 3% too, not sure whether which one is correct Maybank Credit Card Balance Transfer rate Maybank Islamic Ikhwan Card Balance Transfer rate |

|

|

Apr 10 2016, 03:02 PM Apr 10 2016, 03:02 PM

|

Senior Member

2,114 posts Joined: Jul 2013 |

QUOTE(sj0217 @ Apr 10 2016, 02:35 PM) Have asked about BT from MBB (MBB Card & MBB Islamic Ikhwan Card) Apply for the Ikhwan BT, and update us here then..Ya, 0% for 12 months come with one time fee 3% but for Islamic Ikhwan Card there is no 3% charge in their website. However, the Card Center Staff told me it should be 3% too, not sure whether which one is correct Maybank Credit Card Balance Transfer rate Maybank Islamic Ikhwan Card Balance Transfer rate |

|

|

Apr 10 2016, 03:51 PM Apr 10 2016, 03:51 PM

|

Senior Member

1,465 posts Joined: Feb 2009 |

QUOTE(sj0217 @ Apr 10 2016, 02:35 PM) Have asked about BT from MBB (MBB Card & MBB Islamic Ikhwan Card) interested with may bank BT, how much can we BT? 80% of CL? anyone experience more than 80% of CL ?Ya, 0% for 12 months come with one time fee 3% but for Islamic Ikhwan Card there is no 3% charge in their website. However, the Card Center Staff told me it should be 3% too, not sure whether which one is correct Maybank Credit Card Balance Transfer rate Maybank Islamic Ikhwan Card Balance Transfer rate Question Let say my Mbb CC statement date is 6th every month. So suppose my statement will be 6 may 2016, right now let say I have already spend RM100. I apple for BT from HL to MBB said next week(17/4/2016), and got approve. So where's the RM100 CC expenses go to ? will I still enjoy interest free period of 20 days after I got the 6 may 2016 statement? As I read somewhere that any expenses after the BT approve will be part of the loan. |

|

|

|

|

|

Apr 10 2016, 03:53 PM Apr 10 2016, 03:53 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(busyman @ Apr 10 2016, 03:51 PM) interested with may bank BT, how much can we BT? 80% of CL? anyone experience more than 80% of CL ? you are trying to BT from HL to MBB or MBB to HL? although you did state it, your detail description still confused meQuestion Let say my Mbb CC statement date is 6th every month. So suppose my statement will be 6 may 2016, right now let say I have already spend RM100. I apple for BT from HL to MBB said next week(17/4/2016), and got approve. So where's the RM100 CC expenses go to ? will I still enjoy interest free period of 20 days after I got the 6 may 2016 statement? As I read somewhere that any expenses after the BT approve will be part of the loan. BT from HL to MBB means you ask MBB to pay HL cc statement This post has been edited by brotan: Apr 10 2016, 03:55 PM |

|

|

Apr 10 2016, 03:58 PM Apr 10 2016, 03:58 PM

Show posts by this member only | IPv6 | Post

#15

|

Senior Member

6,484 posts Joined: Apr 2012 |

QUOTE(CP88 @ Apr 10 2016, 02:47 PM) Somehow MBB staff told me, there will be 3% one time fee regardless Islamic and normal CardQUOTE(leo_kiatez @ Apr 10 2016, 03:02 PM) Too bad as my credit limit for Islamic Card only RM1,000, so unable to process for BT |

|

|

Apr 10 2016, 03:59 PM Apr 10 2016, 03:59 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(sj0217 @ Apr 10 2016, 03:58 PM) Somehow MBB staff told me, there will be 3% one time fee regardless Islamic and normal Card what the cs said make more sense because normally BT T&C are not tied to a type of ccToo bad as my credit limit for Islamic Card only RM1,000, so unable to process for BT but i can be wrong |

|

|

Apr 10 2016, 04:07 PM Apr 10 2016, 04:07 PM

|

Senior Member

1,465 posts Joined: Feb 2009 |

|

|

|

Apr 10 2016, 04:15 PM Apr 10 2016, 04:15 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Apr 10 2016, 04:29 PM Apr 10 2016, 04:29 PM

|

Senior Member

2,493 posts Joined: Mar 2014 |

May I ask, if I already have 1 BT account under Aeon Watami, can I do another BT using another Aeon Gold?

|

|

|

Apr 10 2016, 04:31 PM Apr 10 2016, 04:31 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Apr 10 2016, 04:34 PM Apr 10 2016, 04:34 PM

|

Senior Member

2,493 posts Joined: Mar 2014 |

|

|

|

Apr 10 2016, 06:16 PM Apr 10 2016, 06:16 PM

|

Junior Member

82 posts Joined: Aug 2006 From: Petaling Jaya |

|

|

|

Apr 10 2016, 08:05 PM Apr 10 2016, 08:05 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(crazyito @ Apr 10 2016, 06:16 PM) when you apply for BT, do you still pay your cc outstanding balance first? or you will just wait for the bank to transfer? have you experienced situation where the bank transfers AFTER the due date? Depends when u applyTo play safe, make sure u have the cash to pay in case the bt money late. Most cases if u apply early, no issue |

|

|

Apr 10 2016, 08:55 PM Apr 10 2016, 08:55 PM

|

Junior Member

215 posts Joined: May 2013 |

Dude, i have RM10k debts in maybank cc. I can write off it but for some reasons i wish to defer the payment for a year. Anyone who can recommend me what are the best bank to offer BT right now?

|

|

|

Apr 10 2016, 08:56 PM Apr 10 2016, 08:56 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(JustForCheonging @ Apr 10 2016, 08:55 PM) Dude, i have RM10k debts in maybank cc. I can write off it but for some reasons i wish to defer the payment for a year. Anyone who can recommend me what are the best bank to offer BT right now? aeon credit6 months what do u mean u can "write it off" ? This post has been edited by brotan: Apr 10 2016, 08:57 PM |

|

|

Apr 10 2016, 08:59 PM Apr 10 2016, 08:59 PM

|

Junior Member

215 posts Joined: May 2013 |

|

|

|

Apr 10 2016, 09:00 PM Apr 10 2016, 09:00 PM

|

Junior Member

82 posts Joined: Aug 2006 From: Petaling Jaya |

|

|

|

Apr 10 2016, 09:02 PM Apr 10 2016, 09:02 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(JustForCheonging @ Apr 10 2016, 08:59 PM) Sorry for the confusion. I can pay it off. Ok i will look into it. Just now i called to Maybank call centre that call attendant asked me to consult AKPK instead... Was looking for soft loan.... lol write it off and pay it off are totally different thingakpk is your really last choice. if possible don't go to them unless no other way |

|

|

Apr 10 2016, 09:02 PM Apr 10 2016, 09:02 PM

|

Senior Member

2,383 posts Joined: Feb 2015 From: IT wonderland |

QUOTE(JustForCheonging @ Apr 10 2016, 08:59 PM) Sorry for the confusion. I can pay it off. Ok i will look into it. Just now i called to Maybank call centre that call attendant asked me to consult AKPK instead... Was looking for soft loan.... if you can pay it off , why dont pay it? instead get another loan to cover which may lead to dig another hole |

|

|

Apr 10 2016, 09:13 PM Apr 10 2016, 09:13 PM

|

Junior Member

215 posts Joined: May 2013 |

|

|

|

Apr 10 2016, 09:26 PM Apr 10 2016, 09:26 PM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(brotan @ Apr 10 2016, 09:02 PM) lol write it off and pay it off are totally different thing yeah i know, sorry for the confusion of "write off vs pay off". Do you think this is the best solution for my case? BT transfer from Maybank to Aeon Credit? How high would be the successful rate?akpk is your really last choice. if possible don't go to them unless no other way |

|

|

Apr 10 2016, 10:48 PM Apr 10 2016, 10:48 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(JustForCheonging @ Apr 10 2016, 09:26 PM) yeah i know, sorry for the confusion of "write off vs pay off". Do you think this is the best solution for my case? BT transfer from Maybank to Aeon Credit? How high would be the successful rate? first off, u need to get your aeon cc approved. i don't know if your credit situation will cause issues or notif u can get the aeon card, then just bt. no brainer if u can't get it , i don't know then |

|

|

Apr 10 2016, 11:18 PM Apr 10 2016, 11:18 PM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(brotan @ Apr 10 2016, 10:48 PM) first off, u need to get your aeon cc approved. i don't know if your credit situation will cause issues or not noted, will try and see whether is it feasible. if cannot then have to just pay off dy.if u can get the aeon card, then just bt. no brainer if u can't get it , i don't know then This post has been edited by JustForCheonging: Apr 10 2016, 11:33 PM |

|

|

Apr 10 2016, 11:20 PM Apr 10 2016, 11:20 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Apr 11 2016, 03:43 PM Apr 11 2016, 03:43 PM

|

Junior Member

565 posts Joined: Mar 2014 |

One of the TnC for Aeon balance transfer:-

For each Cardholder account, this Balance Transfer programme is available to Cardholders once every 6 months effective from the posting date of the Balance Transfer amount. Further Balance Transfer application will not be considered until expiry of 6 months after the last approved Balance Transfer amount is posted to Cardholder account. Has anyone paid off their BT earlier (less than 6 mths) and apply for another BT before the expiry of 6 months and still get the BT approved? |

|

|

Apr 11 2016, 08:35 PM Apr 11 2016, 08:35 PM

Show posts by this member only | IPv6 | Post

#36

|

Junior Member

663 posts Joined: Feb 2009 |

QUOTE(ytan053 @ Apr 11 2016, 03:43 PM) One of the TnC for Aeon balance transfer:- I got another of my BT approved during my 4th repayment of the earlier BT. For each Cardholder account, this Balance Transfer programme is available to Cardholders once every 6 months effective from the posting date of the Balance Transfer amount. Further Balance Transfer application will not be considered until expiry of 6 months after the last approved Balance Transfer amount is posted to Cardholder account. Has anyone paid off their BT earlier (less than 6 mths) and apply for another BT before the expiry of 6 months and still get the BT approved? You may try your luck 😊 |

|

|

Apr 12 2016, 01:40 PM Apr 12 2016, 01:40 PM

|

Junior Member

26 posts Joined: Sep 2006 |

i dont understand how you guys evaluate which one is the best BT. Help please.

|

|

|

Apr 12 2016, 03:27 PM Apr 12 2016, 03:27 PM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

is the info updated?

|

|

|

Apr 12 2016, 03:27 PM Apr 12 2016, 03:27 PM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

or shall i say is this thread updated?

|

|

|

Apr 12 2016, 03:28 PM Apr 12 2016, 03:28 PM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

|

|

|

Apr 13 2016, 03:54 AM Apr 13 2016, 03:54 AM

|

Junior Member

26 posts Joined: Sep 2006 |

ok...i plan to BT around 10K for the period of 6 to 12 months. which is the best? AEON? BSN? others?

|

|

|

Apr 13 2016, 12:20 PM Apr 13 2016, 12:20 PM

|

Senior Member

1,465 posts Joined: Feb 2009 |

Hpw you guys normally apply for BT ?

Fax or manually mail through pos office ? |

|

|

Apr 13 2016, 12:50 PM Apr 13 2016, 12:50 PM

|

Senior Member

4,232 posts Joined: Apr 2011 |

QUOTE(jmZ @ Apr 13 2016, 03:54 AM) ok...i plan to BT around 10K for the period of 6 to 12 months. which is the best? AEON? BSN? others? that depends on which bank card you have right?Personally, BT to PBB and AM is quite easy. PBB - fill up a form, no statement , email and done. AMBank - one phone call away. |

|

|

Apr 13 2016, 12:51 PM Apr 13 2016, 12:51 PM

|

Senior Member

4,232 posts Joined: Apr 2011 |

|

|

|

Apr 13 2016, 01:43 PM Apr 13 2016, 01:43 PM

|

Senior Member

1,465 posts Joined: Feb 2009 |

After a quick read about the Maybank BT T&C, have some question about it.

I'm interested with either the 6 months plan with 0.5%pm or 12 months plan with 0% interest(but 3% one time fee) My questions are as below: - for 6 months plan, new account will be open, does it mean that if we swipe the card within the 6 months, no interest will be impose(mean we will have the same 20 days interest free cycle like normally?) - reducing balance BT? Said we do a 5K BT, so if we pay 0.5% interest monthly(reducing balance method), the interest will be less than the one time 3% fee on 12 months plan. right? - according to the T&C, we need to pay min 5% monthly. so can we like pay 5% for the 1st 5 months, then settle the rest on the last month? or need to pay equally every month? Anyone tried Maybank BT before please shed some light Tq |

|

|

Apr 13 2016, 01:49 PM Apr 13 2016, 01:49 PM

|

Senior Member

4,232 posts Joined: Apr 2011 |

QUOTE(busyman @ Apr 13 2016, 01:43 PM) After a quick read about the Maybank BT T&C, have some question about it. I did one before and it was an evenly distributed amount to pay monthly.I'm interested with either the 6 months plan with 0.5%pm or 12 months plan with 0% interest(but 3% one time fee) My questions are as below: - for 6 months plan, new account will be open, does it mean that if we swipe the card within the 6 months, no interest will be impose(mean we will have the same 20 days interest free cycle like normally?) - reducing balance BT? Said we do a 5K BT, so if we pay 0.5% interest monthly(reducing balance method), the interest will be less than the one time 3% fee on 12 months plan. right? - according to the T&C, we need to pay min 5% monthly. so can we like pay 5% for the 1st 5 months, then settle the rest on the last month? or need to pay equally every month? Anyone tried Maybank BT before please shed some light Tq but there are new promotions from time to time that may have different terms and conditions. |

|

|

Apr 13 2016, 03:26 PM Apr 13 2016, 03:26 PM

|

Junior Member

215 posts Joined: May 2013 |

Applied AEON Credit Card dy, now proceed my application. Hopefully manage to get BT before next month.

|

|

|

Apr 13 2016, 07:45 PM Apr 13 2016, 07:45 PM

|

Junior Member

26 posts Joined: Sep 2006 |

QUOTE(laymank @ Apr 13 2016, 01:50 PM) that depends on which bank card you have right? Actually dont have any cards from those banks. I have standard chartered but it i think its high interest. So either way i need to apply the card first right? i am looking for just a BT card.Personally, BT to PBB and AM is quite easy. PBB - fill up a form, no statement , email and done. AMBank - one phone call away. |

|

|

Apr 13 2016, 09:26 PM Apr 13 2016, 09:26 PM

|

Junior Member

215 posts Joined: May 2013 |

Hi I have another question for BT (i have no experience whatsoever), only 1 CC debts can do BT or i can do multiple BT with other cards (into single account)?

|

|

|

Apr 13 2016, 09:36 PM Apr 13 2016, 09:36 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Apr 13 2016, 09:37 PM Apr 13 2016, 09:37 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Apr 13 2016, 10:12 PM Apr 13 2016, 10:12 PM

|

Junior Member

215 posts Joined: May 2013 |

|

|

|

Apr 13 2016, 10:13 PM Apr 13 2016, 10:13 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(JustForCheonging @ Apr 13 2016, 10:12 PM) Is it the maximum BT value subject to credit limit of the card? Normally 80% of available limitFor instance, I have RM10k MBB and RM10k PBB debts, I wish to use BSN for BT transfer (only 15k credit limit), so i can only get RM10k MBB & RM5k PBB of BT? Sorry really newbie on this. |

|

|

Apr 13 2016, 10:16 PM Apr 13 2016, 10:16 PM

|

Junior Member

215 posts Joined: May 2013 |

|

|

|

Apr 14 2016, 01:00 PM Apr 14 2016, 01:00 PM

|

Senior Member

4,232 posts Joined: Apr 2011 |

QUOTE(jmZ @ Apr 13 2016, 07:45 PM) Actually dont have any cards from those banks. I have standard chartered but it i think its high interest. So either way i need to apply the card first right? i am looking for just a BT card. You might want to consider cards that offer you more than just BT.Aeon Gold cards offers you free plaza premium lounge access + 6 months interest free BT. Likewise a few other cards. |

|

|

Apr 14 2016, 03:04 PM Apr 14 2016, 03:04 PM

|

Junior Member

50 posts Joined: Nov 2011 |

if outstanding v maybank is 10k but my pbb credit limit is 30k , how many bt i can do?

|

|

|

Apr 15 2016, 12:19 PM Apr 15 2016, 12:19 PM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

» Click to show Spoiler - click again to hide... « hi guys need to know whether these are worthy deals it says 8.99% per annum or 16.41% or 16.23% effective interest means, if BT 10k, just multiply with 16.41 or 16.23% will get the total cost is this correct? |

|

|

Apr 15 2016, 12:55 PM Apr 15 2016, 12:55 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Apr 15 2016, 01:54 PM Apr 15 2016, 01:54 PM

|

Junior Member

31 posts Joined: Sep 2011 |

QUOTE(laymank @ Apr 14 2016, 01:00 PM) You might want to consider cards that offer you more than just BT. maybe can try uob as well if u looking for bt . 0 percent for half a year, 1 percent for one year. pm if u need for assistAeon Gold cards offers you free plaza premium lounge access + 6 months interest free BT. Likewise a few other cards. |

|

|

Apr 15 2016, 01:56 PM Apr 15 2016, 01:56 PM

|

Junior Member

31 posts Joined: Sep 2011 |

|

|

|

Apr 15 2016, 01:58 PM Apr 15 2016, 01:58 PM

|

Junior Member

31 posts Joined: Sep 2011 |

|

|

|

Apr 15 2016, 03:21 PM Apr 15 2016, 03:21 PM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

|

|

|

Apr 15 2016, 03:24 PM Apr 15 2016, 03:24 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Apr 15 2016, 11:46 PM Apr 15 2016, 11:46 PM

|

Junior Member

565 posts Joined: Mar 2014 |

I understand that we cant BT to supplementary card (experience from Public Bank, Alliance Bank) but can we BT from Mr.A's supplementary card to Mr.A's principal card?

Regarding HSBC's BT program, let say I have RM3,000 (1st BT) with HSBC at 0% for 3mths . If I do another BT of RM5,000 without clearing my 1st BT (outstanding still have RM2,000), will I get interest charge? This is because I understand that there is no more 20 days interest free after having 1st BT and everyone would suggest to keep the card in drawer. I will call CS to confirm, but at the mean time, appreciate any advice or experience HSBC BT user. Thank you in advance! |

|

|

Apr 16 2016, 12:02 AM Apr 16 2016, 12:02 AM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(ytan053 @ Apr 15 2016, 11:46 PM) I understand that we cant BT to supplementary card (experience from Public Bank, Alliance Bank) but can we BT from Mr.A's supplementary card to Mr.A's principal card? check faq post #1Regarding HSBC's BT program, let say I have RM3,000 (1st BT) with HSBC at 0% for 3mths . If I do another BT of RM5,000 without clearing my 1st BT (outstanding still have RM2,000), will I get interest charge? This is because I understand that there is no more 20 days interest free after having 1st BT and everyone would suggest to keep the card in drawer. I will call CS to confirm, but at the mean time, appreciate any advice or experience HSBC BT user. Thank you in advance! |

|

|

Apr 16 2016, 12:06 AM Apr 16 2016, 12:06 AM

|

Junior Member

565 posts Joined: Mar 2014 |

QUOTE(brotan @ Apr 16 2016, 12:02 AM) I have checked the faq before posting it and it doesnt address my concern. I know I cant BT Mr.A Bank A principal card to Mr.A's Bank B supplementary card, but can I do it other way round (BT Mr.A's Bank B supplementary card to Mr.A's Bank A principal card)?It is still the same owner and name but different bank. The difference here is where it involves principal card and supplementary card of different banks (I know cant BT from same bank between principal and supplementary). |

|

|

Apr 16 2016, 12:15 AM Apr 16 2016, 12:15 AM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(ytan053 @ Apr 16 2016, 12:06 AM) I have checked the faq before posting it and it doesnt address my concern. I know I cant BT Mr.A Bank A principal card to Mr.A's Bank B supplementary card, but can I do it other way round (BT Mr.A's Bank B supplementary card to Mr.A's Bank A principal card)? if not mistaken, supplementary card acc is tied to principalIt is still the same owner and name but different bank. The difference here is where it involves principal card and supplementary card of different banks (I know cant BT from same bank between principal and supplementary). since principal for both card is different, cannot do but you can always try and see if it works or u can call cs to ask and feedback here |

|

|

Apr 16 2016, 12:30 AM Apr 16 2016, 12:30 AM

|

Junior Member

565 posts Joined: Mar 2014 |

QUOTE(brotan @ Apr 16 2016, 12:15 AM) if not mistaken, supplementary card acc is tied to principal Thanks. I will call the CS although I feel that likely it is not gonna get thru.since principal for both card is different, cannot do but you can always try and see if it works or u can call cs to ask and feedback here |

|

|

Apr 17 2016, 01:52 PM Apr 17 2016, 01:52 PM

|

Junior Member

215 posts Joined: May 2013 |

Hi,

I have taken BT to the whole new level. Right now i have applied 1) Aeon CC 2) Public Bank CC 3) BSN CC And soon i may wanna apply Affin (quite interest their 7% one time for 36mths repayment plan, that would translate into 2.4% below per annual which is very ideal for me.) Any other CC that highly recommended? Just notice Alliance Bank has 4% 24mths, oh my that might be another to get list lol. This post has been edited by JustForCheonging: Apr 17 2016, 01:56 PM |

|

|

Apr 17 2016, 02:54 PM Apr 17 2016, 02:54 PM

|

Trade Dispute

2,644 posts Joined: Sep 2013 |

QUOTE(JustForCheonging @ Apr 17 2016, 01:52 PM) Hi, did you applied all at one shot? lol...I have taken BT to the whole new level. Right now i have applied 1) Aeon CC 2) Public Bank CC 3) BSN CC And soon i may wanna apply Affin (quite interest their 7% one time for 36mths repayment plan, that would translate into 2.4% below per annual which is very ideal for me.) Any other CC that highly recommended? Just notice Alliance Bank has 4% 24mths, oh my that might be another to get list lol. |

|

|

Apr 17 2016, 04:16 PM Apr 17 2016, 04:16 PM

|

Junior Member

215 posts Joined: May 2013 |

|

|

|

Apr 17 2016, 04:25 PM Apr 17 2016, 04:25 PM

|

Trade Dispute

2,644 posts Joined: Sep 2013 |

QUOTE(JustForCheonging @ Apr 17 2016, 04:16 PM) yes, 4 more sets of doc to submit tomorrow, 2 is for increase of credit limits, 2 more is for affin bank and alliance bank. I all in. lol. let us know if ur all cc / credit limit increase got approved at one shot.. I need 1 more credit card to swipe, prolly getting CIMB soon. This post has been edited by aromachong: Apr 17 2016, 04:25 PM |

|

|

Apr 17 2016, 06:35 PM Apr 17 2016, 06:35 PM

|

Junior Member

215 posts Joined: May 2013 |

|

|

|

Apr 17 2016, 08:30 PM Apr 17 2016, 08:30 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

QUOTE(JustForCheonging @ Apr 17 2016, 01:52 PM) Hi, Mind sharing link of Alliance 4%? Their website only can see (1) 6 months 0% for new to bank and (2) 8% p.a. for 24 monthsI have taken BT to the whole new level. Right now i have applied 1) Aeon CC 2) Public Bank CC 3) BSN CC And soon i may wanna apply Affin (quite interest their 7% one time for 36mths repayment plan, that would translate into 2.4% below per annual which is very ideal for me.) Any other CC that highly recommended? Just notice Alliance Bank has 4% 24mths, oh my that might be another to get list lol. QUOTE(ytan053 @ Apr 15 2016, 11:46 PM) I understand that we cant BT to supplementary card (experience from Public Bank, Alliance Bank) but can we BT from Mr.A's supplementary card to Mr.A's principal card? My maybank statement always lump both principal and supp due amount and list it under principal. So far i can BT the total with no question asked.Regarding HSBC's BT program, let say I have RM3,000 (1st BT) with HSBC at 0% for 3mths . If I do another BT of RM5,000 without clearing my 1st BT (outstanding still have RM2,000), will I get interest charge? This is because I understand that there is no more 20 days interest free after having 1st BT and everyone would suggest to keep the card in drawer. I will call CS to confirm, but at the mean time, appreciate any advice or experience HSBC BT user. Thank you in advance! Bank like RHB always split both principal & supp which i believe you then can't do what you intend to do. So depends on how they treat your account and statement i guess. |

|

|

Apr 17 2016, 09:28 PM Apr 17 2016, 09:28 PM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(bearbear @ Apr 17 2016, 08:30 PM) Mind sharing link of Alliance 4%? Their website only can see (1) 6 months 0% for new to bank and (2) 8% p.a. for 24 months ops, I was referring front page and didnt see clearly that it is no longer available. thanks for pointing it out My maybank statement always lump both principal and supp due amount and list it under principal. So far i can BT the total with no question asked. Bank like RHB always split both principal & supp which i believe you then can't do what you intend to do. So depends on how they treat your account and statement i guess. I just did some searching, i cant find any BT plan for Affin (unable to access their official website) and im not sure whether Ringgit Plus or Imoney is correct. This post has been edited by JustForCheonging: Apr 17 2016, 09:53 PM |

|

|

Apr 17 2016, 10:10 PM Apr 17 2016, 10:10 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

QUOTE(JustForCheonging @ Apr 17 2016, 09:28 PM) ops, I was referring front page and didnt see clearly that it is no longer available. thanks for pointing it out Works fine for me, silly rates.I just did some searching, i cant find any BT plan for Affin (unable to access their official website) and im not sure whether Ringgit Plus or Imoney is correct. https://www.affinbank.com.my/getattachment/...P-Form.pdf.aspx |

|

|

Apr 17 2016, 10:19 PM Apr 17 2016, 10:19 PM

|

Trade Dispute

2,644 posts Joined: Sep 2013 |

|

|

|

Apr 17 2016, 10:20 PM Apr 17 2016, 10:20 PM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(bearbear @ Apr 17 2016, 10:10 PM) thanks for the link.Its not silly at all, for 36mths u only pay for 7%, thats effective rate of 2.33% per annual. I will prolly max up affin balance transfer 1st, and slowly pay it for 3 years. BSN comes second (24mth @ 4.5%) and 3rd would be PBB (24mth @ 5%). AEON will be last for short term cash rolling. |

|

|

Apr 18 2016, 02:45 AM Apr 18 2016, 02:45 AM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

QUOTE(JustForCheonging @ Apr 17 2016, 10:20 PM) thanks for the link. it is not 7% effectively as you have to pay back in equal for 36 months. Its not silly at all, for 36mths u only pay for 7%, thats effective rate of 2.33% per annual. I will prolly max up affin balance transfer 1st, and slowly pay it for 3 years. BSN comes second (24mth @ 4.5%) and 3rd would be PBB (24mth @ 5%). AEON will be last for short term cash rolling. I believe you are catching the wrong concept, I hope you are not diggin bigger hole than you can fill. |

|

|

Apr 18 2016, 07:23 AM Apr 18 2016, 07:23 AM

|

Junior Member

215 posts Joined: May 2013 |

|

|

|

Apr 18 2016, 08:39 AM Apr 18 2016, 08:39 AM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Apr 18 2016, 09:03 AM Apr 18 2016, 09:03 AM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

|

|

|

Apr 18 2016, 09:11 AM Apr 18 2016, 09:11 AM

|

Senior Member

4,728 posts Joined: Jul 2013 |

QUOTE(JustForCheonging @ Apr 17 2016, 10:20 PM) thanks for the link. it gets more scary when you said you want to take BT to whole new level.Its not silly at all, for 36mths u only pay for 7%, thats effective rate of 2.33% per annual. I will prolly max up affin balance transfer 1st, and slowly pay it for 3 years. BSN comes second (24mth @ 4.5%) and 3rd would be PBB (24mth @ 5%). AEON will be last for short term cash rolling. Bear in mind, bank is in the market to make money out of you. you need to read up. The affin bank 7% over 36months, should be at about 4-5% per year effective interest rate (EIR). BSN and PBB the EIR is about 8% - 9+% per year. if you don't need the BT, then these are not for you. if you do need it, it is better than paying 18% p.a. to the bank on the outstanding balance of your credit card. https://loanstreet.com.my/learning-centre/i...e-flat-interest https://loanstreet.com.my/calculator/flat-t...rest-calculator This post has been edited by adele123: Apr 18 2016, 09:12 AM |

|

|

Apr 18 2016, 09:18 AM Apr 18 2016, 09:18 AM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(brotan @ Apr 18 2016, 08:39 AM) Meaning u r getting deeper into depth and finally you realize it is too deep and too late Cuz u can't pay the monthly instalment Thanks for ur advise. I have RM100k cash to standby for any unforeseen circumstances. Just i prefer venturing small business with abit aids from banks. |

|

|

Apr 18 2016, 09:29 AM Apr 18 2016, 09:29 AM

|

Senior Member

1,188 posts Joined: Sep 2008 |

Hi all. Want to ask anyone tried Alliance Bank BT? Do they still give 20day free credit period for other swipes when we are on BT?

Want to apply their younique cc and surprise to know they give one time 0% interest BT for 12months. |

|

|

Apr 18 2016, 09:47 AM Apr 18 2016, 09:47 AM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(adele123 @ Apr 18 2016, 09:11 AM) it gets more scary when you said you want to take BT to whole new level. Now u caught my attention. How do they calculate the interest rate?Bear in mind, bank is in the market to make money out of you. you need to read up. The affin bank 7% over 36months, should be at about 4-5% per year effective interest rate (EIR). BSN and PBB the EIR is about 8% - 9+% per year. if you don't need the BT, then these are not for you. if you do need it, it is better than paying 18% p.a. to the bank on the outstanding balance of your credit card. https://loanstreet.com.my/learning-centre/i...e-flat-interest https://loanstreet.com.my/calculator/flat-t...rest-calculator |

|

|

Apr 18 2016, 09:51 AM Apr 18 2016, 09:51 AM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

QUOTE(JustForCheonging @ Apr 18 2016, 09:47 AM) you are already been spoon-feeded with the calculator link, at the very least click in and find out As i told you, you pay 7% for full lump sum but you are paying back monthly installment equally for 36 months. Does it not make sense to you that the interest will be more than what they try to con you into? tease you somemore, effective interest rate is >10% p.a. This post has been edited by bearbear: Apr 18 2016, 09:52 AM |

|

|

Apr 18 2016, 10:31 AM Apr 18 2016, 10:31 AM

|

Trade Dispute

2,644 posts Joined: Sep 2013 |

QUOTE(JustForCheonging @ Apr 18 2016, 09:18 AM) Thanks for ur advise. I have RM100k cash to standby for any unforeseen circumstances. Just i prefer venturing small business with abit aids from banks. i don't see anything wrong here if your business could roll yield you more than >20% profit per year.. or more than that. |

|

|

Apr 18 2016, 11:46 AM Apr 18 2016, 11:46 AM

|

Senior Member

558 posts Joined: Jan 2003 From: HELL |

QUOTE(bearbear @ Apr 18 2016, 09:51 AM) you are already been spoon-feeded with the calculator link, at the very least click in and find out Don't jump the gun. 7% is the up-front fee for 36 months, which equivalent to flat rate of 2.33% pa or effective rate of about 4.7% pa, which isn't bad compare to credit card debt at 18% or ahlong.As i told you, you pay 7% for full lump sum but you are paying back monthly installment equally for 36 months. Does it not make sense to you that the interest will be more than what they try to con you into? tease you somemore, effective interest rate is >10% p.a. It is |

|

|

Apr 18 2016, 12:10 PM Apr 18 2016, 12:10 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

QUOTE(roy918 @ Apr 18 2016, 11:46 AM) Don't jump the gun. 7% is the up-front fee for 36 months, which equivalent to flat rate of 2.33% pa or effective rate of about 4.7% pa, which isn't bad compare to credit card debt at 18% or ahlong. Please read and re-read It is I am not jumping the gun, i present you with facts. The calculator is there. |

|

|

Apr 18 2016, 12:10 PM Apr 18 2016, 12:10 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

Sorry double post

This post has been edited by bearbear: Apr 18 2016, 12:10 PM |

|

|

Apr 18 2016, 12:37 PM Apr 18 2016, 12:37 PM

|

Trade Dispute

2,644 posts Joined: Sep 2013 |

QUOTE(roy918 @ Apr 18 2016, 11:46 AM) Don't jump the gun. 7% is the up-front fee for 36 months, which equivalent to flat rate of 2.33% pa or effective rate of about 4.7% pa, which isn't bad compare to credit card debt at 18% or ahlong. if his business can generate profit of >10-20% p.a then there should be nothing to worry aboutIt is maybe thats what he mean bring balance transfer to whole new level lol This post has been edited by aromachong: Apr 18 2016, 12:37 PM |

|

|

Apr 18 2016, 01:11 PM Apr 18 2016, 01:11 PM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(roy918 @ Apr 18 2016, 11:46 AM) Don't jump the gun. 7% is the up-front fee for 36 months, which equivalent to flat rate of 2.33% pa or effective rate of about 4.7% pa, which isn't bad compare to credit card debt at 18% or ahlong. Aiya i am not professional in financial. Learning together mar. As i said if the average less than 3% per annual i will not hesitate to get it. I still do not understand how he cals the rate.It is |

|

|

Apr 18 2016, 01:39 PM Apr 18 2016, 01:39 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

QUOTE(JustForCheonging @ Apr 18 2016, 01:11 PM) Aiya i am not professional in financial. Learning together mar. As i said if the average less than 3% per annual i will not hesitate to get it. I still do not understand how he cals the rate. very simple illustrationi loan you 1000 for 2 months, fee is 2%. you pay back equally 1010 per month. After month 1, your make your payment thus your loan principal is 1000 (assuming you pay your fee upfront, as with BT usually). Problem is i still charge you 2% based on your initial loan principal of 2000. Thus it is not 2% Your case It is 7% / 3 years IF you only pay back your loan principal (10k or 100k) at end of loan tenure. But you are paying monthly equally yet they charge the % based on your initial loan principal. See the difference now? Well if you don't then i have to say just go ahead and make the bank richer. This post has been edited by bearbear: Apr 18 2016, 01:41 PM |

|

|

Apr 18 2016, 02:35 PM Apr 18 2016, 02:35 PM

|

Trade Dispute

2,644 posts Joined: Sep 2013 |

QUOTE(JustForCheonging @ Apr 18 2016, 01:11 PM) Aiya i am not professional in financial. Learning together mar. As i said if the average less than 3% per annual i will not hesitate to get it. I still do not understand how he cals the rate. 100,000 credit limit. u can withdraw 80% credit limit example , rm80k u are about to get cashso u need a second credit card with 100k limit too. u can get from Aeon, or PB , BSN.. aeon offer 0% so u can make a BT and RM80k /6 months , or RM80k /12 months with a little interest to add on another way is when banks hav promotion u can cash out from your available limit. i will take above example again .. 100k .. some foreign banks allow u to take out all cash from ur cc.. interest as low as 3.99% .. so 100k / 12 months / 24 months / 36 months i still see it is a very low interest for businessman no? correct me if im wrong |

|

|

Apr 18 2016, 05:09 PM Apr 18 2016, 05:09 PM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(bearbear @ Apr 18 2016, 01:39 PM) very simple illustration Dude just spoken to Affin Bank staff, he said that up front is only once so 7% (36mths tenure) for ur total BT value.i loan you 1000 for 2 months, fee is 2%. you pay back equally 1010 per month. After month 1, your make your payment thus your loan principal is 1000 (assuming you pay your fee upfront, as with BT usually). Problem is i still charge you 2% based on your initial loan principal of 2000. Thus it is not 2% Your case It is 7% / 3 years IF you only pay back your loan principal (10k or 100k) at end of loan tenure. But you are paying monthly equally yet they charge the % based on your initial loan principal. See the difference now? Well if you don't then i have to say just go ahead and make the bank richer. Lets say u BT RM10 k Up front payment is RM700 Ur principle will be split into 36mths which is average RM277.78 per mth. For others i am not sure yet. Anyway thanks for pointing it out. |

|

|

Apr 18 2016, 05:31 PM Apr 18 2016, 05:31 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

QUOTE(JustForCheonging @ Apr 18 2016, 05:09 PM) Dude just spoken to Affin Bank staff, he said that up front is only once so 7% (36mths tenure) for ur total BT value. i said what i had to, so judge yourself Lets say u BT RM10 k Up front payment is RM700 Ur principle will be split into 36mths which is average RM277.78 per mth. For others i am not sure yet. Anyway thanks for pointing it out. |

|

|

Apr 18 2016, 07:19 PM Apr 18 2016, 07:19 PM

|

Senior Member

1,188 posts Joined: Sep 2008 |

QUOTE(tbheng @ Apr 18 2016, 09:29 AM) Hi all. Want to ask anyone tried Alliance Bank BT? Do they still give 20day free credit period for other swipes when we are on BT? Found out myself from card application dept. Sharing here…They will create diff acct. Each month just pay min 5%. Card swipes still get 20 days free credit period. Good then!Want to apply their younique cc and surprise to know they give one time 0% interest BT for 12months. |

|

|

Apr 18 2016, 07:56 PM Apr 18 2016, 07:56 PM

|

Senior Member

4,728 posts Joined: Jul 2013 |

QUOTE(JustForCheonging @ Apr 18 2016, 05:09 PM) Dude just spoken to Affin Bank staff, he said that up front is only once so 7% (36mths tenure) for ur total BT value. bearbear already knows how to calculate... it's you who do not understand.Lets say u BT RM10 k Up front payment is RM700 Ur principle will be split into 36mths which is average RM277.78 per mth. For others i am not sure yet. Anyway thanks for pointing it out. read the links i posted earlier... if you have read, you would have known how the banks calculate.. all the banks calculate the same way... |

|

|

Apr 18 2016, 08:17 PM Apr 18 2016, 08:17 PM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(adele123 @ Apr 18 2016, 07:56 PM) bearbear already knows how to calculate... it's you who do not understand. Flat rate methodread the links i posted earlier... if you have read, you would have known how the banks calculate.. all the banks calculate the same way... Ok noted. Thanks for telling. I will study it before committing my BT. |

|

|

Apr 19 2016, 10:27 PM Apr 19 2016, 10:27 PM

|

Senior Member

4,929 posts Joined: Feb 2008 From: /K/opitiam Pak Hang Status: Permaban |

https://ringgitplus.com/en/balance-transfer...-Programme.html

sifu.. if i opted from above link for example..10k, with 24 months 0% p.a. and no one-time upfront handling fee, means that 10k/24 only right? means 417 monthly.. correct or not? |

|

|

Apr 19 2016, 10:32 PM Apr 19 2016, 10:32 PM

|

Senior Member

616 posts Joined: Jan 2003 From: Penang |

QUOTE(gastacopz @ Apr 19 2016, 10:27 PM) https://ringgitplus.com/en/balance-transfer...-Programme.html Isn't the monthly payment = 5% of outstanding amount?sifu.. if i opted from above link for example..10k, with 24 months 0% p.a. and no one-time upfront handling fee, means that 10k/24 only right? means 417 monthly.. correct or not? |

|

|

Apr 19 2016, 10:36 PM Apr 19 2016, 10:36 PM

|

Senior Member

4,929 posts Joined: Feb 2008 From: /K/opitiam Pak Hang Status: Permaban |

|

|

|

Apr 20 2016, 04:31 PM Apr 20 2016, 04:31 PM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

hello sifus

need some info and guidance/professional advice current i got some CC debt that i would like to do a BT with is there any Bt plan that is 0 upfront fee/interest and can settle early without penalty? of course with low monthly interest... i read up and got a few like aeon, bsn... hsbc? thanks for advice |

|

|

Apr 20 2016, 09:04 PM Apr 20 2016, 09:04 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(Petre @ Apr 20 2016, 04:31 PM) hello sifus check post #1need some info and guidance/professional advice current i got some CC debt that i would like to do a BT with is there any Bt plan that is 0 upfront fee/interest and can settle early without penalty? of course with low monthly interest... i read up and got a few like aeon, bsn... hsbc? thanks for advice |

|

|

Apr 22 2016, 10:53 AM Apr 22 2016, 10:53 AM

|

Senior Member

4,334 posts Joined: Nov 2004 From: Shadow Striker |

|

|

|

Apr 22 2016, 02:54 PM Apr 22 2016, 02:54 PM

|

Senior Member

4,929 posts Joined: Feb 2008 From: /K/opitiam Pak Hang Status: Permaban |

|

|

|

Apr 22 2016, 03:11 PM Apr 22 2016, 03:11 PM

|

Senior Member

2,493 posts Joined: Mar 2014 |

QUOTE(Petre @ Apr 22 2016, 10:53 AM) thanks for the info to those applied recently, any difference applying aeon card in the mall and thru online? gifts... offers... QUOTE(gastacopz @ Apr 22 2016, 02:54 PM) got gifts meh? Apply in the mall or Aeon Credit will get RM10 Aeon Voucher. Not sure about applying online though.tot wanna apply aeon bt too... via online..just submit the latest statement and the form.. |

|

|

Apr 22 2016, 03:16 PM Apr 22 2016, 03:16 PM

|

Senior Member

4,929 posts Joined: Feb 2008 From: /K/opitiam Pak Hang Status: Permaban |

|

|

|

Apr 22 2016, 03:32 PM Apr 22 2016, 03:32 PM

|

Senior Member

2,493 posts Joined: Mar 2014 |

|

|

|

Apr 22 2016, 03:36 PM Apr 22 2016, 03:36 PM

|

Senior Member

4,929 posts Joined: Feb 2008 From: /K/opitiam Pak Hang Status: Permaban |

|

|

|

Apr 23 2016, 08:41 PM Apr 23 2016, 08:41 PM

|

Junior Member

215 posts Joined: May 2013 |

Looks like i failed to secure CC this time. My application was rejected for affin and AEON. (Alliance and PBB still pending)

However i have applied UOB loan 3.99% per annual @ 12mths tenure and HLB loan 5.60% per annual @ 24mths tenure for RM39.4k combined. Should be sufficient for my business expension and share allocation. This post has been edited by JustForCheonging: Apr 23 2016, 08:42 PM |

|

|

Apr 24 2016, 10:42 AM Apr 24 2016, 10:42 AM

|

Trade Dispute

2,644 posts Joined: Sep 2013 |

QUOTE(JustForCheonging @ Apr 23 2016, 08:41 PM) Looks like i failed to secure CC this time. My application was rejected for affin and AEON. (Alliance and PBB still pending) that is why i congratulates you in first place for putting all unsecured loans together in first placeHowever i have applied UOB loan 3.99% per annual @ 12mths tenure and HLB loan 5.60% per annual @ 24mths tenure for RM39.4k combined. Should be sufficient for my business expension and share allocation. pbb will follow.. alliance 70% follow too uob i duno maybe uob will take the risk .. if uob took more than 14 days pending prepare to see all reject |

|

|

Apr 24 2016, 01:24 PM Apr 24 2016, 01:24 PM

|

Junior Member

215 posts Joined: May 2013 |

QUOTE(aromachong @ Apr 24 2016, 10:42 AM) that is why i congratulates you in first place for putting all unsecured loans together in first place Already had UOB cc with me previously. Luckily a kind lady called me and informed me about the promo. I have abandoned the thought of getting BT this time, thanks for all your advises pbb will follow.. alliance 70% follow too uob i duno maybe uob will take the risk .. if uob took more than 14 days pending prepare to see all reject |

|

|

Apr 25 2016, 12:14 AM Apr 25 2016, 12:14 AM

|

Junior Member

24 posts Joined: Oct 2004 |

AEON offer 0%, no upfront fee and no early termination penalty, seems like too good too be true. any hidden charges?

I was thinking of paying my bills with CC X for utilities rebate, then bt to AEON, then clear with CC Y for online rebate via POSOnline you guys think it's worth the hassle? |

|

|

Apr 25 2016, 08:16 AM Apr 25 2016, 08:16 AM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(kerrigan_id @ Apr 25 2016, 12:14 AM) AEON offer 0%, no upfront fee and no early termination penalty, seems like too good too be true. any hidden charges? Drawback. Only allow bt every 6 monthsI was thinking of paying my bills with CC X for utilities rebate, then bt to AEON, then clear with CC Y for online rebate via POSOnline you guys think it's worth the hassle? |

|

|

Apr 25 2016, 02:54 PM Apr 25 2016, 02:54 PM

|

Senior Member

3,283 posts Joined: Dec 2013 |

|

|

|

Apr 26 2016, 11:30 PM Apr 26 2016, 11:30 PM

|

Junior Member

332 posts Joined: Mar 2010 From: 1Malaysia |

Hello sifus, credit card and balance transfer is new to me, just wondering how does this work?

So, I have two credit cards from two different banks, can I transfer both debts to one bank only and enjoy lowered interest rates? 6 months is a bit hefty IMO albeit the 0% interest, 1 year should be good. Any suggestions for the best solution will be very much appreciated! |

|

|

Apr 26 2016, 11:55 PM Apr 26 2016, 11:55 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(megabyte @ Apr 26 2016, 11:30 PM) Hello sifus, credit card and balance transfer is new to me, just wondering how does this work? u can transfer both card debt to 1 bank provided that bank is not the issuer of both cardsSo, I have two credit cards from two different banks, can I transfer both debts to one bank only and enjoy lowered interest rates? 6 months is a bit hefty IMO albeit the 0% interest, 1 year should be good. Any suggestions for the best solution will be very much appreciated! |

|

|

Apr 27 2016, 08:57 AM Apr 27 2016, 08:57 AM

|

Senior Member

4,232 posts Joined: Apr 2011 |

QUOTE(megabyte @ Apr 26 2016, 11:30 PM) Hello sifus, credit card and balance transfer is new to me, just wondering how does this work? If you think 6 months 0% interest is hefty, you should not have spent so much in the first place. Imagine you have to pay ALL in 20 days if there is no BT.So, I have two credit cards from two different banks, can I transfer both debts to one bank only and enjoy lowered interest rates? 6 months is a bit hefty IMO albeit the 0% interest, 1 year should be good. Any suggestions for the best solution will be very much appreciated! |

|

|

Apr 27 2016, 02:41 PM Apr 27 2016, 02:41 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(laymank @ Apr 27 2016, 08:57 AM) If you think 6 months 0% interest is hefty, you should not have spent so much in the first place. Imagine you have to pay ALL in 20 days if there is no BT. i guess he already realize the trouble he is getting himself into because he can't pay his cc on time that's why looking at BT option |

|

|

Apr 27 2016, 02:44 PM Apr 27 2016, 02:44 PM

|

Junior Member

332 posts Joined: Mar 2010 From: 1Malaysia |

QUOTE(brotan @ Apr 26 2016, 11:55 PM) Subjective to approval rite? What exactly documents are required to apply? QUOTE(laymank @ Apr 27 2016, 08:57 AM) If you think 6 months 0% interest is hefty, you should not have spent so much in the first place. Imagine you have to pay ALL in 20 days if there is no BT. I needed some furniture for my new house, what to do right with this current economy situation? I'm wondering if I can just request to turn these credit card loans into term loans for lower interest rates or consider getting a BT |

|

|

Apr 27 2016, 03:15 PM Apr 27 2016, 03:15 PM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(megabyte @ Apr 27 2016, 02:44 PM) Subjective to approval rite? What exactly documents are required to apply? new credit card application of course subject for approvalI needed some furniture for my new house, what to do right with this current economy situation? I'm wondering if I can just request to turn these credit card loans into term loans for lower interest rates or consider getting a BT for balance transfer officially need approval but normally very simple. mainly need the cc statement you want to transfer from + the bt application form. some banks is ok without the cc statement or bt form or both |

|

|

Apr 28 2016, 03:13 PM Apr 28 2016, 03:13 PM

|

Junior Member

183 posts Joined: Jan 2003 |

Hi guys,

Just wondering whether it is ok to send the Aeon balance transfer form to their email instead of faxing it. Thanks. |

|

|

Apr 28 2016, 04:39 PM Apr 28 2016, 04:39 PM

|

Junior Member

546 posts Joined: Sep 2008 |

I'm just completed BT from CIMB to MBB... 12 months 0%

RM2700 (BT amount) + up front 3% (RM81) + GST (RM4.86) |

|

|

Apr 29 2016, 12:38 AM Apr 29 2016, 12:38 AM

|

Junior Member

334 posts Joined: Dec 2008 |

|

|

|

Apr 29 2016, 08:13 AM Apr 29 2016, 08:13 AM

|

Junior Member

183 posts Joined: Jan 2003 |

|

|

|

May 2 2016, 09:14 AM May 2 2016, 09:14 AM

|

Senior Member

1,168 posts Joined: Jun 2006 |

Do Aeon BT need to submit other credit cards statement together?

|

|

|

May 2 2016, 09:17 AM May 2 2016, 09:17 AM

|

Senior Member

6,484 posts Joined: Apr 2012 |

|

|

|

May 3 2016, 03:00 AM May 3 2016, 03:00 AM

|

Junior Member

334 posts Joined: Dec 2008 |

|

|

|

May 3 2016, 10:14 AM May 3 2016, 10:14 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

Hi Sifus,

Let's say BT for 6 months 1.88% I BT RM2400 Interest RM45.12 The bank disclosure sheet shows: http://www.ocbc.com.my/assets/pdf/cardspro.../BT_TnC_Eng.pdf 3.42% ANNUALISED EFFECTIVE RATE, but my own calculation shows that it's not so. RM2400 BT amount Month 1 pay RM445.12 Month 2 to 6 pay RM400 My calculation shows 6.5% Can I sue the bank for misrepresentation??? |

|

|

May 10 2016, 10:40 AM May 10 2016, 10:40 AM

|

Senior Member

1,168 posts Joined: Jun 2006 |

For Aeon BT 6 months 0%, let's say we BT total of 10k, so the first 5 months we can pay only 5% of 10k each month and the 6th month statement before payment due date we settle full amount. In this way, we won't charge interest? Or we need to actually 10k divided into 6 installment?

Another question, for Aeon can we BT more than statement amount? example 8k outstanding and we transfer 10k |

|

|

May 10 2016, 11:01 AM May 10 2016, 11:01 AM

|

Senior Member

3,904 posts Joined: Jul 2007 |

QUOTE(shiroikun @ May 10 2016, 10:40 AM) For Aeon BT 6 months 0%, let's say we BT total of 10k, so the first 5 months we can pay only 5% of 10k each month and the 6th month statement before payment due date we settle full amount. In this way, we won't charge interest? Or we need to actually 10k divided into 6 installment? 10k into 6 installments, each installment will be billed into your monthly statement. Another question, for Aeon can we BT more than statement amount? example 8k outstanding and we transfer 10k For AEON, only the statement amount, round up to the nearest ringgit. |

|

|

May 10 2016, 11:07 AM May 10 2016, 11:07 AM

|

Senior Member

1,168 posts Joined: Jun 2006 |

QUOTE(lamode @ May 10 2016, 11:01 AM) 10k into 6 installments, each installment will be billed into your monthly statement. Thanks, it will be nice if statement is not needed. If transferring big sum of amount, it's quite hard to settle in 6 months only. For AEON, only the statement amount, round up to the nearest ringgit. |

|

|

May 10 2016, 01:01 PM May 10 2016, 01:01 PM

|

Senior Member

2,493 posts Joined: Mar 2014 |

|

|

|

May 10 2016, 01:35 PM May 10 2016, 01:35 PM

|

Senior Member

2,677 posts Joined: Dec 2010 |

QUOTE(Pink Spider @ May 3 2016, 10:14 AM) Hi Sifus, Finding alternative income instead from Bursa? Let's say BT for 6 months 1.88% I BT RM2400 Interest RM45.12 The bank disclosure sheet shows: http://www.ocbc.com.my/assets/pdf/cardspro.../BT_TnC_Eng.pdf 3.42% ANNUALISED EFFECTIVE RATE, but my own calculation shows that it's not so. RM2400 BT amount Month 1 pay RM445.12 Month 2 to 6 pay RM400 My calculation shows 6.5% Can I sue the bank for misrepresentation??? |

|

|

May 12 2016, 09:44 PM May 12 2016, 09:44 PM

|

Junior Member

29 posts Joined: Aug 2010 |

hi sifu

i able to save around 3000/month but if i just put it straight into bank , i only manage to get min dividend from it so , i plan to use cashlite service from cimb to borrow rm18000 with 5.99 interest p.a for 12 month and no advance fee then i BT STRAIGHT AWAY to Aeon card for 6 month to avoid interest from cimb The money ( 18000) i will put into f.d which give me dividend IT is possible and good idea? Can i BT straight away from CIMb to Aeon ? or i still need to pa the interest |

|

|

May 13 2016, 07:46 PM May 13 2016, 07:46 PM

|

Senior Member

3,283 posts Joined: Dec 2013 |

QUOTE(razor21 @ May 12 2016, 09:44 PM) hi sifu What u talking about? U already unfront pay 5.99% interest to CIMB..it is much more than the FD interest. No point to do balance transfer to AEON credit card. i able to save around 3000/month but if i just put it straight into bank , i only manage to get min dividend from it so , i plan to use cashlite service from cimb to borrow rm18000 with 5.99 interest p.a for 12 month and no advance fee then i BT STRAIGHT AWAY to Aeon card for 6 month to avoid interest from cimb The money ( 18000) i will put into f.d which give me dividend IT is possible and good idea? Can i BT straight away from CIMb to Aeon ? or i still need to pa the interest Unless you telling me that 5.99% no need to pay to CIMB when u do a full amount of balance transfer immediate you apply the cimb lite. U need to check any penanlthy on earlier settlement on CIMB. |

|

|

May 14 2016, 11:53 AM May 14 2016, 11:53 AM

|

Junior Member

29 posts Joined: Aug 2010 |

QUOTE(sms2u @ May 13 2016, 07:46 PM) What u talking about? U already unfront pay 5.99% interest to CIMB..it is much more than the FD interest. No point to do balance transfer to AEON credit card. Unless you telling me that 5.99% no need to pay to CIMB when u do a full amount of balance transfer immediate you apply the cimb lite. U need to check any penanlthy on earlier settlement on CIMB. i thought the interest will be charge once we pay the installment for the cimb cashlite i plan to BT even before first installment yea it true .... it not worth if the bank straight away charge you rm 1062 for rm18000 loan even before 1st installment one more thing... i think there is no early settlement charge last time i check in th internet |

|

|

May 14 2016, 12:14 PM May 14 2016, 12:14 PM

|

Senior Member

3,283 posts Joined: Dec 2013 |

QUOTE(razor21 @ May 14 2016, 11:53 AM) i thought the interest will be charge once we pay the installment for the cimb cashlite U can refer to section below in the url belowi plan to BT even before first installment yea it true .... it not worth if the bank straight away charge you rm 1062 for rm18000 loan even before 1st installment one more thing... i think there is no early settlement charge last time i check in th internet Section What if I fully settle the CashLite facility before its maturity? URL http://www.cimbbank.com.my/content/dam/cim...ant-mar2016.pdf Also T&C http://www.cimbbank.com.my/content/dam/cim...ant-mar2016.pdf U need at least to inform CIMB prior to terminate the cash lite in 30 days. In that case, u already need to pay for the interest for first 30 days. May be u can still earn a bit from FD interest rate if you immediate choose to terminate the Cash List onc eCIMB approved it and release to you. But, too many work to do and also depend the amount applied and aprroved. Not worth to do that. U need to consider also whether it will give any impact to your record in CIMB or crisss. |

|

|

May 14 2016, 12:52 PM May 14 2016, 12:52 PM

|

Junior Member

29 posts Joined: Aug 2010 |

QUOTE(sms2u @ May 14 2016, 12:14 PM) U can refer to section below in the url below thank you very much...Section What if I fully settle the CashLite facility before its maturity? URL http://www.cimbbank.com.my/content/dam/cim...ant-mar2016.pdf Also T&C http://www.cimbbank.com.my/content/dam/cim...ant-mar2016.pdf U need at least to inform CIMB prior to terminate the cash lite in 30 days. In that case, u already need to pay for the interest for first 30 days. May be u can still earn a bit from FD interest rate if you immediate choose to terminate the Cash List onc eCIMB approved it and release to you. But, too many work to do and also depend the amount applied and aprroved. Not worth to do that. U need to consider also whether it will give any impact to your record in CIMB or crisss. |

|

|

May 15 2016, 08:40 AM May 15 2016, 08:40 AM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(shiroikun @ May 10 2016, 10:40 AM) For Aeon BT 6 months 0%, let's say we BT total of 10k, so the first 5 months we can pay only 5% of 10k each month and the 6th month statement before payment due date we settle full amount. In this way, we won't charge interest? Or we need to actually 10k divided into 6 installment? 1. The bt amount is divided equally 6 months charged to your cc every month and u r expected to pay them every time on time every month, just like your normal cc spending. Just like normal spending, if u missed payment, you will be charged standard cc interest (12% to 18%) Another question, for Aeon can we BT more than statement amount? example 8k outstanding and we transfer 10k 2. Not for aeon |

|

|

May 15 2016, 08:45 AM May 15 2016, 08:45 AM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(shiroikun @ May 10 2016, 11:07 AM) Thanks, it will be nice if statement is not needed. If transferring big sum of amount, it's quite hard to settle in 6 months only. Firstly, why even owe/spend that amount in the 1st place if you can't afford to pay within 6 months?Secondly, if you really need to spend that amount due to emergency cases (medical, etc) which is out of your control and 6 months is too much for you, can consider BSN. They have 36 months installment with interest but not high Check out all available options in post #1 This post has been edited by brotan: May 15 2016, 08:45 AM |

|

|

May 16 2016, 11:52 AM May 16 2016, 11:52 AM

|

Senior Member

5,469 posts Joined: Jun 2008 |

hello mates, i saw that the cheapest BT is aeon cc? is there any annual fees or bank charges? i do not have any aeon CC now. any other cc that have 0% interest and maybe 0% fees and no bank charges at all ? be it annual fees or watever fees?

|

|

|

May 16 2016, 01:57 PM May 16 2016, 01:57 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

QUOTE(klthor @ May 16 2016, 11:52 AM) hello mates, i saw that the cheapest BT is aeon cc? is there any annual fees or bank charges? i do not have any aeon CC now. any other cc that have 0% interest and maybe 0% fees and no bank charges at all ? be it annual fees or watever fees? it is free for AEON but they have a rule of only one BT every 6 months.Aeon CC annual fee are waived upon making 12 transactions a year. |

|

|

May 16 2016, 02:35 PM May 16 2016, 02:35 PM

|

Senior Member

5,469 posts Joined: Jun 2008 |

|

|

|

May 18 2016, 10:50 PM May 18 2016, 10:50 PM

|

Senior Member

2,493 posts Joined: Mar 2014 |

Wanted to BT from UOB to Aeon, who knows the cash rebate offset the RM1k spending, now my statement is only RM996++. Aeon won't round it up to RM1k right?

|

|

|

May 19 2016, 01:24 AM May 19 2016, 01:24 AM

|

Senior Member

3,283 posts Joined: Dec 2013 |

|

|

|

May 19 2016, 10:11 AM May 19 2016, 10:11 AM

|

Senior Member

2,493 posts Joined: Mar 2014 |

|

|

|

May 19 2016, 12:30 PM May 19 2016, 12:30 PM

|

Junior Member

354 posts Joined: Aug 2012 |

QUOTE(kelvinlzy @ May 19 2016, 10:11 AM) I managed to do BT from UOB to Aeon recently. For my case, Aeon approved BT RM3K and statement balance I showed to them is RM2994.20.So, sometime they might allow for round up. I think it is based on case by case basis. |

|

|

May 19 2016, 01:40 PM May 19 2016, 01:40 PM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

I just noticed my PBB BT installment plans has been posted earlier than normal.

Usually it's posted on Statement Date. Now it's posted right after passed the previous Statement Date |

|

|

May 19 2016, 02:01 PM May 19 2016, 02:01 PM

|

Senior Member

4,232 posts Joined: Apr 2011 |

|

|

|

May 19 2016, 06:31 PM May 19 2016, 06:31 PM

|

Senior Member

6,432 posts Joined: Jun 2005 |

QUOTE(ronnie @ May 19 2016, 01:40 PM) I just noticed my PBB BT installment plans has been posted earlier than normal. Yes, i saw that.. But, no difference whether is on statement date or after statement date, as long as we still got 20 days interest free from statement date. Usually it's posted on Statement Date. Now it's posted right after passed the previous Statement Date We didn't loss anything on this.. |

|

|

May 19 2016, 07:16 PM May 19 2016, 07:16 PM

Show posts by this member only | IPv6 | Post

#154

|

Junior Member

174 posts Joined: Jul 2011 |

QUOTE(ronnie @ May 19 2016, 01:40 PM) I just noticed my PBB BT installment plans has been posted earlier than normal. I realize that too. Maybe they purposely put in earlier to remind u that u have more outstanding balance to clear nx month. :-PUsually it's posted on Statement Date. Now it's posted right after passed the previous Statement Date This post has been edited by kelvintt: May 19 2016, 07:16 PM |

|

|

May 20 2016, 09:41 AM May 20 2016, 09:41 AM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

May 20 2016, 10:31 AM May 20 2016, 10:31 AM

|

All Stars

18,495 posts Joined: Oct 2010 |

QUOTE(ronnie @ May 20 2016, 09:41 AM) If they are posted at end of statement (say 20th) and if u request to change the next statement to a earlier date (say 16th), u effectively delay the BT by ~ 1 month, cos the BT transactions will still be dated on 20th n will appear on the next statement. I hope u all understand my explanation. |

|

|

May 20 2016, 11:11 AM May 20 2016, 11:11 AM

|

Senior Member

4,232 posts Joined: Apr 2011 |

QUOTE(MGM @ May 20 2016, 10:31 AM) If they are posted at end of statement (say 20th) and if u request to change the next statement to a earlier date (say 16th), u effectively delay the BT by ~ 1 month, cos the BT transactions will still be dated on 20th n will appear on the next statement. I hope u all understand my explanation. Different bank has different 'flexibility' in changing the statement date. Most of them will say it will take effect in the Next cycle, which is not immediately. |

|

|

May 20 2016, 11:18 AM May 20 2016, 11:18 AM

|

All Stars

18,495 posts Joined: Oct 2010 |

|

|

|

May 21 2016, 03:51 PM May 21 2016, 03:51 PM

|

All Stars

14,039 posts Joined: Jan 2003 |

Any HSBC balance transfer, they don't split the monthly by month? Thanks

|

|

|

May 23 2016, 08:27 AM May 23 2016, 08:27 AM

|

Senior Member

1,188 posts Joined: Sep 2008 |

QUOTE(ronnie @ May 20 2016, 09:41 AM) QUOTE(MGM @ May 20 2016, 10:31 AM) If they are posted at end of statement (say 20th) and if u request to change the next statement to a earlier date (say 16th), u effectively delay the BT by ~ 1 month, cos the BT transactions will still be dated on 20th n will appear on the next statement. I hope u all understand my explanation. Yes, MGM spots on. I enjoyed that 1 month delay previously after bring earlier my stmt date. PBB screwed up my bt 2 years back, end up 2 repayments in one stmt. Complained to bnm. So this time alerted them as soon as I see the anomaly. to avoid they post again on stmt date,. They replied they hv changed their system. It is posted one day after stmt date and no more on stmt date. This post has been edited by tbheng: May 23 2016, 08:32 AM |

|

|

May 23 2016, 10:57 AM May 23 2016, 10:57 AM

|

Junior Member

47 posts Joined: Feb 2008 |

Hi all, i have a little confusion here, and did not manage to look for the answer in previous thread.

I just recently applied for HSBC Platinum, and it comes with a 0% 6 months balance transfer offer, so I BT my Aeon 10k outstanding to HSBC, and i just got my first statement from HSBC, it shows the full 10k amount in the statement, current finance charges stated 0%, minimum payment is RM 500. My question is, do I pay only the minimum amount stated in the statement, then make sure I clear all balance before the 6th month? So that no interest will incurred? Or, I need to pay 10k divide by 6 by myself? Previously during Maybank 0% BT time, the amount to pay will be charged to CC every month, first time saw full amount straight charge to CC, can anyone experience this before explain to me? Thanks so much. This post has been edited by only_lonely1220: May 23 2016, 10:58 AM |

|

|

May 23 2016, 11:31 AM May 23 2016, 11:31 AM

|

Senior Member

3,904 posts Joined: Jul 2007 |

QUOTE(only_lonely1220 @ May 23 2016, 10:57 AM) Hi all, i have a little confusion here, and did not manage to look for the answer in previous thread. you can just pay the min amount, the rest of the balance (RM9.5k) will be interest free until the end of the 0% BT tenure.I just recently applied for HSBC Platinum, and it comes with a 0% 6 months balance transfer offer, so I BT my Aeon 10k outstanding to HSBC, and i just got my first statement from HSBC, it shows the full 10k amount in the statement, current finance charges stated 0%, minimum payment is RM 500. My question is, do I pay only the minimum amount stated in the statement, then make sure I clear all balance before the 6th month? So that no interest will incurred? Or, I need to pay 10k divide by 6 by myself? Previously during Maybank 0% BT time, the amount to pay will be charged to CC every month, first time saw full amount straight charge to CC, can anyone experience this before explain to me? Thanks so much. but remember not to use this card, those retail transactions will kena interest. This post has been edited by lamode: May 23 2016, 11:31 AM |

|

|

May 23 2016, 11:40 AM May 23 2016, 11:40 AM

|

Junior Member

47 posts Joined: Feb 2008 |

|

|

|

May 24 2016, 02:42 PM May 24 2016, 02:42 PM

|

Junior Member

68 posts Joined: May 2007 |

How easy to transfer out the excess amount if i BT more than what i owed?

|

|

|

May 24 2016, 10:51 PM May 24 2016, 10:51 PM

|

Senior Member

5,379 posts Joined: Jul 2009 |

rhb bank used to have good BT plan, but now no more.

citibank and cimb bank's BT are expensive. |

|

|

May 25 2016, 01:17 PM May 25 2016, 01:17 PM

|

Senior Member

4,232 posts Joined: Apr 2011 |

|

|

|

May 25 2016, 03:25 PM May 25 2016, 03:25 PM

|

Junior Member

315 posts Joined: Aug 2012 |

Can a balance transfer to Debit Card (Visa or Master) account?

|

|

|

May 25 2016, 03:26 PM May 25 2016, 03:26 PM

|

Junior Member

315 posts Joined: Aug 2012 |

Any bank can have balance transfer (one lump sum) without any instalment plan?

|

|

|

May 29 2016, 06:22 PM May 29 2016, 06:22 PM

|

Senior Member

1,269 posts Joined: May 2005 |

currently have maybank 2 card and cimb cash rebate

which is the best bank to do BT? |

|

|

May 29 2016, 09:43 PM May 29 2016, 09:43 PM

|

All Stars

10,061 posts Joined: Dec 2004 From: Sheffield |

|

|

|

May 30 2016, 01:56 PM May 30 2016, 01:56 PM

|

Junior Member

315 posts Joined: Aug 2012 |

|

|

|

May 30 2016, 05:32 PM May 30 2016, 05:32 PM

|

Senior Member

6,432 posts Joined: Jun 2005 |

For AEON balance transfer, we can only send to them via fax? Can we email? I read post 1 stated the cs email, but I check the form instruction only fax

This post has been edited by mamamia: May 30 2016, 05:33 PM |

|

|

May 30 2016, 05:45 PM May 30 2016, 05:45 PM

|

Senior Member

3,904 posts Joined: Jul 2007 |

|

|

|

May 30 2016, 07:00 PM May 30 2016, 07:00 PM

|

Senior Member