Maybank Balance Transfer 0% p.a 12 monthsMaybank

Maybank Balance Transfer 0% p.a 12 monthsMaybank |

Terms and Conditions |

FAQs |

Campaign Promo |

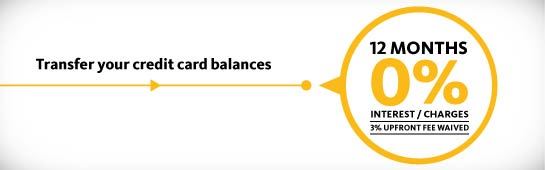

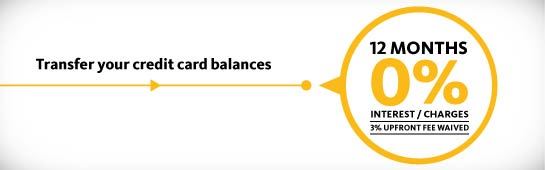

Application FormCampaign Period: 15 September 2016 - 15 March 2017Enjoy 0% interest for 12 months and

3% upfront fee waived when you transfer your balances from other credit cards to Maybank Credit Card today.

Terms and Conditions:Applicable to Maybank MasterCard, Visa or American Express Credit Cards Cardmembers.

Applicable to approved Balance Transfer during the campaign period.

Minimum transfer amount RM1,000 and maximum transfer amount RM50,000

Upfront fee of 3% for Balance Transfer 0% 12 months is WAIVED during the Campaign periodCampaign Mechanics:-i. 12 months Instalment Plan - Interest Rate at 0% per month.

ii. The minimum transfer amount is RM1,000 and the maximum amount is capped at RM50,000 per transaction.

iii. One time up-front fee at 3% which will be charge from the approved amount for each approved application will be WAIVED during the campaign period

iv. The 3% waiver of upfront fee will be credited to credit card account within 30 working days from the approval date.

v. Any Balance Transfer plan approved prior to this campaign period is not allowed to be change to this Balance Transfer Plan

vi.

The fee allocated for the waiver is only up to RM3.6M for 6 months campaign duration. The campaign will be automatically stop upon fund has fully depleted.

vi. The fee allocated for the waiver is only up to RM3.6M for 6 months campaign duration. The campaign will be automatically stop upon fund has fully depleted.

I can't find in T&C and FAQ. Are you working in Maybank?

Sep 8 2016, 08:28 PM

Sep 8 2016, 08:28 PM

Quote

Quote

0.0333sec

0.0333sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled