Campaign Period: 3 June 2016 - 30 September 2016

This post has been edited by cybpsych: Jun 6 2016, 01:31 PM

Credit Cards Balance Transfer (BT) Plans V4 - Banks Offer List, Credit card debt consolidation

|

|

Jun 6 2016, 01:22 PM Jun 6 2016, 01:22 PM

Return to original view | Post

#1

|

All Stars

65,281 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jun 30 2016, 07:57 AM Jun 30 2016, 07:57 AM

Return to original view | Post

#2

|

All Stars

65,281 posts Joined: Jan 2003 |

|

|

|

Aug 22 2016, 12:45 PM Aug 22 2016, 12:45 PM

Return to original view | Post

#3

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(iamsolucky @ Aug 20 2016, 11:17 AM) Hi, Mbb balance transfer promotion 1% can apply by today via M2U right ? read the T&Cs ?But i still see the charges is 3%.from the selection of 12 months. QUOTE Maybank will charge the one time upfront fee of 3% from the approved amount for each approved application. The 2% will be WAIVED for application approved during the Campaign Period. The 2% up-front fee waiver will be reversed from the credit card account within 30 working days from the approval date. |

|

|

Aug 25 2016, 08:55 PM Aug 25 2016, 08:55 PM

Return to original view | Post

#4

|

All Stars

65,281 posts Joined: Jan 2003 |

question about mbb bt promo.

1) if my mbb credit limit is RM10k, how much can i bt from other banks? 80% of RM10k = RM8k max? 2) i have an upcoming renovation and appliances purchase. total would be rm14k. can i temporary increase credit limit, and then request BT? thanks. |

|

|

Aug 29 2016, 04:14 PM Aug 29 2016, 04:14 PM

Return to original view | Post

#5

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(MeToo @ Aug 29 2016, 03:54 PM) I currently have 50k with HLB... I wishes to clear this up so I can charge another 50k on it.... errrr, post #1?SO either I BT it to a ZERO cost card.. or I just pay it off. Ofcourse I prefer to BT it cause it will save me a little here and there compared to paying lump sum. WOuld appreciate if anyone knows any real ZERO cost BT available from the following cards... CIMB - World AmBank - Infinite Maybank - Master + Amex PBB - Sig Thanks! |

|

|

Aug 29 2016, 04:24 PM Aug 29 2016, 04:24 PM

Return to original view | Post

#6

|

All Stars

65,281 posts Joined: Jan 2003 |

|

|

|

|

|

|

Aug 29 2016, 04:42 PM Aug 29 2016, 04:42 PM

Return to original view | Post

#7

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(MeToo @ Aug 29 2016, 04:38 PM) Thanks! bt doesnt work that way.The Flexipay I cannot use cause I'm charging the sum to HLB's Fortune card to get the $1800 cash back... So left the BT. If I read your link correctly.. the BT 6 months for 6K and above is zero fee... no hidden cost/processing fee etc? This means I have 6 months to clear the 50k? Meaning I can wait until the last month then only dump total sum in? 50k bt = 6 equal split/portion charged to PBB statement for 6 months (i.e. 6 months x RM8,333) |

|

|

Aug 29 2016, 05:04 PM Aug 29 2016, 05:04 PM

Return to original view | Post

#8

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(MeToo @ Aug 29 2016, 04:58 PM) Oh okok.. sorry first time do BT u can bt all you want, but of course subject to fee (if any) or credit limit (about 80% of available limit) or approval.then its also doable.. still better then me paying it off immediately and gaining nothing. No other hidden admin/paperwork/gst cost? Now if there is another bank with BT then I can BT my 2nd 50k as well... feelign like a cheapskate for a 50k bt, your available CL should be at least 63k (without any outstanding). pbb's so far 6months without any fee, and without the need for statement too. |

|

|

Aug 29 2016, 05:46 PM Aug 29 2016, 05:46 PM

Return to original view | Post

#9

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(MeToo @ Aug 29 2016, 05:13 PM) Thanks for your input! check the BT form (page 1 footnote). i think email also can.My PBB cannot tahan 2 50k BT.... mana ada cukup limit Oh 1 last question... would it be faster to fax in the form or just drop by their branch? Usually what's the lead time with regards to BT? usually few days to get approved and transfer money. This post has been edited by cybpsych: Aug 29 2016, 05:48 PM |

|

|

Aug 30 2016, 07:24 AM Aug 30 2016, 07:24 AM

Return to original view | Post

#10

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(MGM @ Aug 30 2016, 07:08 AM) I would like to BT 4x RM6000 to PBB from 3 other CC accounts, where the balances can be easily cash out. Any good suggestion? mbb not accept request to transfer to SA?I know it is no longer possible with MBB. Would like to loan rm24000 from PBB with 0% interest for 6 months. that's exactly what i wanted to do |

|

|

Sep 15 2016, 07:19 AM Sep 15 2016, 07:19 AM

Return to original view | Post

#11

|

All Stars

65,281 posts Joined: Jan 2003 |

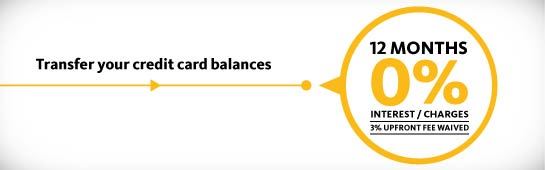

Maybank Balance Transfer 0% p.a 12 months Maybank | Terms and Conditions | FAQs | Campaign Promo | Application Form Campaign Period: 15 September 2016 - 15 March 2017 Enjoy 0% interest for 12 months and 3% upfront fee waived when you transfer your balances from other credit cards to Maybank Credit Card today. Terms and Conditions: Applicable to Maybank MasterCard, Visa or American Express Credit Cards Cardmembers. Applicable to approved Balance Transfer during the campaign period. Minimum transfer amount RM1,000 and maximum transfer amount RM50,000 Upfront fee of 3% for Balance Transfer 0% 12 months is WAIVED during the Campaign period Campaign Mechanics:- i. 12 months Instalment Plan - Interest Rate at 0% per month. ii. The minimum transfer amount is RM1,000 and the maximum amount is capped at RM50,000 per transaction. iii. One time up-front fee at 3% which will be charge from the approved amount for each approved application will be WAIVED during the campaign period iv. The 3% waiver of upfront fee will be credited to credit card account within 30 working days from the approval date. v. Any Balance Transfer plan approved prior to this campaign period is not allowed to be change to this Balance Transfer Plan vi. The fee allocated for the waiver is only up to RM3.6M for 6 months campaign duration. The campaign will be automatically stop upon fund has fully depleted.  This post has been edited by cybpsych: Sep 15 2016, 08:22 AM |

|

|

Sep 15 2016, 07:58 AM Sep 15 2016, 07:58 AM

Return to original view | Post

#12

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(mamamia @ Sep 15 2016, 07:33 AM) Wow, finally got pure 0% BT from Maybank.. Somemore is 12 months, aiya, I shouldn't do BT to PBB ytd.. i also banging myself to the wall i recently did PBB's 9-mth flexipay for 3 large transactions ... other way to look at it, once next pbb statement is out, amount already >RM1k (total flexipay installment amount), then apply Maybank BT instead. |

|

|

Sep 15 2016, 08:21 AM Sep 15 2016, 08:21 AM

Return to original view | Post

#13

|

All Stars

65,281 posts Joined: Jan 2003 |

|

|

|

|

|

|

Sep 15 2016, 09:29 AM Sep 15 2016, 09:29 AM

Return to original view | Post

#14

|

All Stars

65,281 posts Joined: Jan 2003 |

|

|

|

Sep 15 2016, 09:42 AM Sep 15 2016, 09:42 AM

Return to original view | Post

#15

|

All Stars

65,281 posts Joined: Jan 2003 |

|

|

|

Sep 15 2016, 10:01 AM Sep 15 2016, 10:01 AM

Return to original view | Post

#16

|

All Stars

65,281 posts Joined: Jan 2003 |

|

|

|

Sep 15 2016, 10:31 AM Sep 15 2016, 10:31 AM

Return to original view | Post

#17

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(lilsunflower @ Sep 15 2016, 10:23 AM) I'm so happy about this promo i'm having same dilemma now as yesterday i submitted 6-month 0% BT to PBB. now trying to cancel this, and apply MBB's 12-month 0% BT instead.Was already prepared to pay the 1% (for the last round of the previous MBB campaign), so your early announcement managed to save me RM330 - thank you. Better still, I was waiting until 20 Sep, because that's the previous campaign's application period. Under this new campaign, I can submit today, and I'm hoping that the BT will be made before my due date of 22 Sep *fingers crossed*. I'll make the minimum payment today just in case. Will update here on progress. almost same as yours, my other card's due date falls on 23 Sep |

|

|

Sep 15 2016, 10:41 AM Sep 15 2016, 10:41 AM

Return to original view | Post

#18

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(lilsunflower @ Sep 15 2016, 10:39 AM) If can't cancel PBB, perhaps you can wait until PBB charges the first BT instalment to your card, and then apply for MBB BT? So you're effectively using MBB BT to pay (part of) PBB's BT. PBB BT application canceled. now proceed to apply MBB's BT OR Proceed with BOTH the MBB and PBB BTs. This should result in excess credit in your other CCs. Then you can request for the excess credit to be transferred into your current / savings accounts. Which is essentially FREE CASH payable in instalments. I personally like the second method and have done this before. i prefer 2nd method too, but i'm BT-ing from UOB VOX --> |

|

|

Sep 15 2016, 11:30 AM Sep 15 2016, 11:30 AM

Return to original view | Post

#19

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(lilsunflower @ Sep 15 2016, 11:06 AM) This is a very useful calculation and I'm glad you brought it up for the benefit of everyone. Even 5k is a conservative assumption. If we assume 10k, the number of eligible applicants is half (only 300+) which can be filled up super quickly. For example, this morning 2 forummers have already submitted their applications. With the long weekend coming up, perhaps more applications will be flooding in. QUOTE(MeToo @ Sep 15 2016, 11:17 AM) WHOA. that's why gotta submit asap lor.I have about 20k i swiped on a card which I was thinking of paying off immediately... if got 0% BT to MBB would be great... but I'm abit worried about the 3% fee waiver not being known until after the transfer is confirmed MeToo, max transfer is RM50k, you can take advantage of it. |

|

|

Sep 15 2016, 11:38 AM Sep 15 2016, 11:38 AM

Return to original view | Post

#20

|

All Stars

65,281 posts Joined: Jan 2003 |

QUOTE(lamode @ Sep 15 2016, 11:35 AM) no la... 3% of 120 mil is 3.6 mil. so i think 120 mil is in the pool, and assume each apply 10k, they can accommodate 12,000,000 applications. QUOTE The fee allocated for the waiver is only up to RM3.6M for 6 months campaign duration. The campaign will be automatically stop upon fund has fully depleted. meaning mbb has allocated rm3.6mil of fees to be waived. since the 3% is based on BT amount, it varies. |

| Change to: |  0.2505sec 0.2505sec

0.17 0.17

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 06:51 AM |