Proceeded from http://forum.lowyat.net/topic/368156/+2500

Personal financial management, V2

Personal financial management, V2

|

|

Sep 27 2010, 05:18 PM, updated 14y ago Sep 27 2010, 05:18 PM, updated 14y ago

Show posts by this member only | Post

#1

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

Proceeded from http://forum.lowyat.net/topic/368156/+2500

|

|

|

|

|

|

Sep 27 2010, 06:29 PM Sep 27 2010, 06:29 PM

Show posts by this member only | Post

#2

|

Junior Member

13 posts Joined: May 2006 |

I am a degree graduate and am earning only 1700 per monthbeing an executive in retail industry, but im happy with my job and my current lifestyle. Having work for 3 years, i have limited savings due to the low salary and high living expenses. But this doesnt deter me from saving and start investing. Got no car, no house, no property whatsoever. Bad Bad

Due to peer pressure, i think its better off to bump up my self confidence and look for better opportunities, when most of my friends are earning more than 5k per month, im earning 1.7k. This is what we choose, what i have choosen 3 years ago. But this thinking had been in my mind the first day i started my current job, and time flies, 3 years later, im still here, complaining that i earn peanuts, but did i do anything? =/ Well, obviously i dint do enough. We must believe that there is a better and brighter sky out there. For those who earn high income but complain that standard of living is too high, got not enough money to use, think of those like me who earn so little yet managed to save and invest. People earning 1k plus can start a family, by living within their means. You can do it, the key is actually PERSONAL FINANCIAL MANAGEMENT. Take it personal, there is no plan that is for everyone. Manage it perrsonaly, do not just whine and complain like me =/ Now for those who are like me, always complain that pay is low, do you have capabilities that proved that you are indeed underpaid, if yes, anything been done? Ever look for better opportunities, i believe a lot of you would say No. Because im in the exact same situation so i understand =/ Again, it PERSONAL FINANCIAL MANAGEMENT. Its your life, its personal, its how you managed it. I have been giving it a lot of thought lately, im getting older, i already have a slow start up, now my resolution for 2011 is to get a new job. Albeit slower than those who earn more and save more, we can also achieve it, thru various ways. Take charged. Make it personal. |

|

|

Sep 27 2010, 10:57 PM Sep 27 2010, 10:57 PM

Show posts by this member only | Post

#3

|

Junior Member

53 posts Joined: Oct 2007 From: Malaysia |

QUOTE(icycool @ Sep 27 2010, 06:29 PM) I am a degree graduate and am earning only 1700 per monthbeing an executive in retail industry, but im happy with my job and my current lifestyle. Having work for 3 years, i have limited savings due to the low salary and high living expenses. But this doesnt deter me from saving and start investing. Got no car, no house, no property whatsoever. Bad Bad Hard to believe you are a graduate with 3 yrs working experience earning just RM1.7K. You seem to be mature in thinking and come across as a well adjusted individual. Maybe you just need to be a little more ambitious. Best of luck in your future endeavor!Due to peer pressure, i think its better off to bump up my self confidence and look for better opportunities, when most of my friends are earning more than 5k per month, im earning 1.7k. This is what we choose, what i have choosen 3 years ago. But this thinking had been in my mind the first day i started my current job, and time flies, 3 years later, im still here, complaining that i earn peanuts, but did i do anything? =/ Well, obviously i dint do enough. We must believe that there is a better and brighter sky out there. For those who earn high income but complain that standard of living is too high, got not enough money to use, think of those like me who earn so little yet managed to save and invest. People earning 1k plus can start a family, by living within their means. You can do it, the key is actually PERSONAL FINANCIAL MANAGEMENT. Take it personal, there is no plan that is for everyone. Manage it perrsonaly, do not just whine and complain like me =/ Now for those who are like me, always complain that pay is low, do you have capabilities that proved that you are indeed underpaid, if yes, anything been done? Ever look for better opportunities, i believe a lot of you would say No. Because im in the exact same situation so i understand =/ Again, it PERSONAL FINANCIAL MANAGEMENT. Its your life, its personal, its how you managed it. I have been giving it a lot of thought lately, im getting older, i already have a slow start up, now my resolution for 2011 is to get a new job. Albeit slower than those who earn more and save more, we can also achieve it, thru various ways. Take charged. Make it personal. |

|

|

Sep 27 2010, 11:13 PM Sep 27 2010, 11:13 PM

Show posts by this member only | Post

#4

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

for 3 minutes, just ignore the blue tag

i'm currently nearing my thirties. what i do and how much i earn shouldn't be important, rigth? currently, 1. i maxed out my ASB investment 2. HP repayment about RM 800, another 2 yrs left <-- my only liability, currently 3. property loan repayment = RM 2k per month, 9.5 yrs left i've been saving almost 60% of my salary. my ASB goes from zero to max within 5 years. i don;t desire many things but i still do spend normally - a new phone every year, this and that, fine watches, bicycles, gadgets, etc etc now my big problem: i just don't have any idea what else to do with the money. pls help. atm, i just dump my extra money into ASM or ASW which earns me about 6% return annually. and to quote from a popular pop song "i wanna be a billionaire, so freaking bad... bla bla bal bala bal" and oh yeah. i'm single. w/o insurance (never believe in insurance) This post has been edited by lucifah: Sep 27 2010, 11:28 PM |

|

|

Sep 27 2010, 11:45 PM Sep 27 2010, 11:45 PM

Show posts by this member only | Post

#5

|

Junior Member

54 posts Joined: Sep 2008 From: Sir-rum-bun / Pee-Jay |

Hi all, I am a fresh graduate starting work in pj. I am determined to save up and invest rather than spending it away.

So here is what I got. -I have a 2.7k salary, with around RM400 allowance, which most of the time will be used up for transportation, since I travel alot. -I got a car, and won't be changing it, just maintain it. The question is, how and what should I invest in? Coz I dun believe in putting money in bank, coz the interest rate is way too low. I believe money can generate more money itself. Hope some sifu will gimme some advise! |

|

|

Sep 28 2010, 09:42 AM Sep 28 2010, 09:42 AM

Show posts by this member only | Post

#6

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(lucifah @ Sep 27 2010, 11:13 PM) 1. i maxed out my ASB investment Well, ASB is the best risk adjusted investment out there. If you have max out, then you will need other options. Well below is several investment option, no recommendations since I don't know how risk adverse are you. Look through the list and see if anything particular interests you.2. HP repayment about RM 800, another 2 yrs left <-- my only liability, currently 3. property loan repayment = RM 2k per month, 9.5 yrs left i've been saving almost 60% of my salary. my ASB goes from zero to max within 5 years. now my big problem: i just don't have any idea what else to do with the money. pls help. atm, i just dump my extra money into ASM or ASW which earns me about 6% return annually. 1. Fixed Deposit - Well everyone knows this, risk free but you only get about 2.8% to 3.3% per year, barely keeping up with inflation. You can get 4%-5% with foreign fixed deposit, but these have currency conversion risk and charges. 2. Share market - This option will need a lot of study and stock selection, if you have time to learn all about it, it could be rewarding, as the gains are not limited. However it is quite risky as share prices can drop significantly. Many a fortune was made and lost in the share market. If you want stable income you can consider REITs which is paying 7%-8+% in dividends a year and is actually quite stable. If you ignore the market prices (prices can come down!) and just collect dividends then it could be a good income generator for a long time. 3. Unit Trust - If you want others to do your investing works for you, then you can consider unit trusts. There are loads out there, but not everyone is good, there are some real bad ones as well. If you want to select good funds choose those which fits your risk, chose from the 10% in at least 5 years of history. Unit trust funds are capable of 20%-30% profit a year but is ALSO capable of losing up to 50% in bad economic times. Alternatively you can consider guaranteed fund, but these usually perform on par with bond funds. However there is very little risk, at worst you get your money back, with no earnings. 4. Bond Funds - Commercial and government debts. If you want another source of stable income, bond funds are less volatile than other share funds. expect to get about 5%-6% for good quality bond funds, and 7%-9% for emerging market funds but at considerably more risk. However bond funds rarely drops more than 10% in bad times. 5. Property - Property with good location can be a a good income generator provided you get at least 6-7% yield. If you did not pay for an overpriced property, with the yield above, your property loan can be fully serviced by your tenant. At the end of your loan period, you get the property for free, and bonus for capital appreciation. However there are risk of your property not rented out and if you choose to buy in a poor area. 6. Well the final option is to dump more money with ASNB with the 6% return annually. But that is boring. Added on September 28, 2010, 9:43 am QUOTE(kevinwcm @ Sep 27 2010, 11:45 PM) The question is, how and what should I invest in? Coz I dun believe in putting money in bank, coz the interest rate is way too low. I believe money can generate more money itself. Hope some sifu will gimme some advise! look at the reply above, see if anything interest you and you would like to know better. This post has been edited by gark: Sep 28 2010, 09:54 AM |

|

|

|

|

|

Sep 29 2010, 12:26 AM Sep 29 2010, 12:26 AM

Show posts by this member only | Post

#7

|

Junior Member

24 posts Joined: Jun 2010 |

Hi, Im 20 this year and im doing my 2nd year diploma. im doing some part-time and able to earn up 800 per month. Till now im able to save up 5k in my saving account. Recently one of my friend introduce me a investment company that invest in forex. http://www.owgfx.com/ im not sure whether i should put in some money inside to invest cause i like to see my money keep growing or continue to earn 800 per month? please give me some advise what should i do now and any ideas that can help me to keep my money grow. thanks people.

|

|

|

Sep 29 2010, 04:51 AM Sep 29 2010, 04:51 AM

Show posts by this member only | Post

#8

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Eelinkim @ Sep 29 2010, 12:26 AM) Hi, Im 20 this year and im doing my 2nd year diploma. im doing some part-time and able to earn up 800 per month. Till now im able to save up 5k in my saving account. Recently one of my friend introduce me a investment company that invest in forex. http://www.owgfx.com/ im not sure whether i should put in some money inside to invest cause i like to see my money keep growing or continue to earn 800 per month? please give me some advise what should i do now and any ideas that can help me to keep my money grow. thanks people. It is impossible to have any investment that can earn you Rm800 per month consistently with a 5K capital.For forex issue, please read this. http://www.bnm.gov.my/index.php?ch=8&pg=14&ac=1976 |

|

|

Sep 29 2010, 11:07 AM Sep 29 2010, 11:07 AM

Show posts by this member only | Post

#9

|

Junior Member

24 posts Joined: Jun 2010 |

QUOTE(cherroy @ Sep 29 2010, 04:51 AM) It is impossible to have any investment that can earn you Rm800 per month consistently with a 5K capital. I never expect to earn RM800 per month with 5k investment. As long got return in the investment is already okay for me.For forex issue, please read this. http://www.bnm.gov.my/index.php?ch=8&pg=14&ac=1976 |

|

|

Sep 29 2010, 09:59 PM Sep 29 2010, 09:59 PM

|

Senior Member

1,262 posts Joined: Aug 2005 From: Mars |

QUOTE(Eelinkim @ Sep 29 2010, 12:26 AM) Hi, Im 20 this year and im doing my 2nd year diploma. im doing some part-time and able to earn up 800 per month. Till now im able to save up 5k in my saving account. Recently one of my friend introduce me a investment company that invest in forex. http://www.owgfx.com/ im not sure whether i should put in some money inside to invest cause i like to see my money keep growing or continue to earn 800 per month? please give me some advise what should i do now and any ideas that can help me to keep my money grow. thanks people. QUOTE(Eelinkim @ Sep 29 2010, 11:07 AM) I never expect to earn RM800 per month with 5k investment. As long got return in the investment is already okay for me. Hello Eelinkim, Some questions, your "friend" said forex is good. so how many years he traded in the forex market ? how many % can he profit from it? Don't jump into the forex market based on other ppl's opinion. Forex is a very very volatile market... Trust me, it is not for everyone. I have seen some of my friends lost all their hard earned money in one night... All the above statement i made sounds quite "risky" & "danger". However, I myself is a part time forex trader. In my opinion the risk is manageable. Remember, DO NOT INVEST in anything YOU NOT FAMILIAR WITH ! STAY OUT of you don't know ! Cheers This post has been edited by cscheat: Sep 29 2010, 09:59 PM |

|

|

Sep 30 2010, 09:16 AM Sep 30 2010, 09:16 AM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

QUOTE(jeff_ckf @ Sep 25 2010, 07:55 AM) No, your portion of the EPF deduction is 11% while the normal rate for employers (a.k.a. your company) is 12%. So if you earn RM 2000 gross, your EPF deduction would be RM 220 while your company would be RM 240. In total, RM 460 would be channeled into your EPF account. A while back, the government did allow the employees' portion of 11% to be reduced to 8% (during the economy crisis as a tool to encourage the people to spend) but I think that it is now back to 11%. Hi jeff_ckf,As for the banks' 16%, it would mean your boss is paying more for your EPF but your portion of deduction remains the same. Taking the RM 2000 example, if it was 16%, the bank would contribute RM 320 into your EPF and you would continue to contribute RM 220 making the total RM 540. Thanks for you explaination. I just received the offer letter from the new company. I was also informed by the HR of the company that the EPF portion contributed by me is 11% of my salary. However I can chose to pay 8%. Whereby the company will pay another 12% for EPF. As the EPF's return is not that attractive, I prefer to contribute 8%, not 11%. As a whole the total contribution to EPF is 20% then. |

|

|

Sep 30 2010, 09:20 AM Sep 30 2010, 09:20 AM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

QUOTE(Eelinkim @ Sep 29 2010, 11:07 AM) I never expect to earn RM800 per month with 5k investment. As long got return in the investment is already okay for me. Hi EelinkimIf something sounds too good to be true, you have to think more about it. Anyway, who knows there might have such too good stuff for us to explore and dig out? So it's your own responsibilities to make sure you know more your investment. |

|

|

Sep 30 2010, 09:29 AM Sep 30 2010, 09:29 AM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

QUOTE(kevinwcm @ Sep 27 2010, 11:45 PM) Hi all, I am a fresh graduate starting work in pj. I am determined to save up and invest rather than spending it away. Hi kevinwcm,So here is what I got. -I have a 2.7k salary, with around RM400 allowance, which most of the time will be used up for transportation, since I travel alot. -I got a car, and won't be changing it, just maintain it. The question is, how and what should I invest in? Coz I dun believe in putting money in bank, coz the interest rate is way too low. I believe money can generate more money itself. Hope some sifu will gimme some advise! I would suggest to invest into stock market. Do your home work by researching the listed companies' annual reports and find out potential and good quality companies then invest your spare money into those companies. After investing your money into those companies, treat them as your own business and keep the investment for long term. Then pump in stock market whenever you have extra cash, later you will find you have accumulated and growth your wealth with the stock market. If you are a newbie to stock market, maybe you should 1st start to look at blue chip companies. I can also recommend you to buy a listed close-end fund, i.e. icapital.biz Berhad of which NAV grows at an annual compounded rate of 19%. |

|

|

|

|

|

Oct 1 2010, 02:12 PM Oct 1 2010, 02:12 PM

|

Senior Member

2,854 posts Joined: Feb 2006 From: Sri Petaling ~ Kuala Lumpur |

I just wanna know , can I really do something on my money ? I got q quite heavy burden with me now and got no where to go !

Basic Salary = RM 1,800 , after deduct 8% then will RM 1,656 + RM 700 ( Fixed monthly allowance ) = RM 2,356 Car loan : RM 352 ( I drive VIVA only ) Life Insurance + Medical Card : RM 100 My bro laptop installment : RM 91.58 My own laptop : RM 242 Digi broadband : RM 88 My hp installment : RM 135.75 My dad loan ( only end at December 2011 ) : RM 1,077.94 Handphone bill : RM 100 Food : Don't talk about even .. cannot even think. Food : Don't take breakfast,lunch sometimes eat bread,if can go out and see customer,can CLAIM , at night eat roti canai Totol : RM 2,087.27 ~ After salary and deduce commitment I left RM 168.73 ~ How guys ? This post has been edited by WhiteWing: Oct 1 2010, 02:14 PM |

|

|

Oct 1 2010, 07:59 PM Oct 1 2010, 07:59 PM

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

QUOTE(gark @ Sep 28 2010, 09:42 AM) 5. Property - Property with good location can be a a good income generator provided you get at least 6-7% yield. If you did not pay for an overpriced property, with the yield above, your property loan can be fully serviced by your tenant. At the end of your loan period, you get the property for free, and bonus for capital appreciation. However there are risk of your property not rented out and if you choose to buy in a poor area. |

|

|

Oct 2 2010, 02:14 AM Oct 2 2010, 02:14 AM

|

Senior Member

941 posts Joined: Aug 2008 |

QUOTE(WhiteWing @ Oct 1 2010, 02:12 PM) I just wanna know , can I really do something on my money ? I got q quite heavy burden with me now and got no where to go ! Wow, your dad's loan killing you. Most of your expense is installment, I think you can't stop it unless you want to stop using it (Car, Hp, Laptop).Basic Salary = RM 1,800 , after deduct 8% then will RM 1,656 + RM 700 ( Fixed monthly allowance ) = RM 2,356 Car loan : RM 352 ( I drive VIVA only ) Life Insurance + Medical Card : RM 100 My bro laptop installment : RM 91.58 My own laptop : RM 242 Digi broadband : RM 88 My hp installment : RM 135.75 My dad loan ( only end at December 2011 ) : RM 1,077.94 Handphone bill : RM 100 Food : Don't talk about even .. cannot even think. Food : Don't take breakfast,lunch sometimes eat bread,if can go out and see customer,can CLAIM , at night eat roti canai Totol : RM 2,087.27 ~ After salary and deduce commitment I left RM 168.73 ~ How guys ? Anyway, try to reduce other expense or increase your income by doing free lance. I assumed you are doing sales (meet customer, fixed allowance) and should have a lot contact. Try to do something like referring customer for other business and get paid. Good luck !!! |

|

|

Oct 2 2010, 02:43 AM Oct 2 2010, 02:43 AM

|

Senior Member

5,909 posts Joined: Jan 2006 From: 06.02.58.44.23.08.03 |

WhiteWing, my advice. Take care of yourself by having proper meals instead of those unhealthy foods rather than spending so much for laptop, broadband and handphone monthly.

If i were you, i already have a laptop, i don't really have to own a fancy handphone. I believe the handphone is your personal satisfaction but if you started to worry about your monthly over-expenses, then you'll noticed that all of this things are unnecessary for you. |

|

|

Oct 2 2010, 10:52 AM Oct 2 2010, 10:52 AM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

QUOTE(maxizanc @ Oct 2 2010, 02:43 AM) WhiteWing, my advice. Take care of yourself by having proper meals instead of those unhealthy foods rather than spending so much for laptop, broadband and handphone monthly. If i were you, i already have a laptop, i don't really have to own a fancy handphone. I believe the handphone is your personal satisfaction but if you started to worry about your monthly over-expenses, then you'll noticed that all of this things are unnecessary for you. QUOTE(maxizanc @ Oct 2 2010, 02:43 AM) WhiteWing, my advice. Take care of yourself by having proper meals instead of those unhealthy foods rather than spending so much for laptop, broadband and handphone monthly. Yah I think WhiteWing should have cut some of the laptop/handphone installments if you are really desperate. Don't forget, you still not add in the transporation cost. We assume you do not use the car to travel to your company, but you still need to spend on public transport right, unless you are working to the company of which is close to your home.If i were you, i already have a laptop, i don't really have to own a fancy handphone. I believe the handphone is your personal satisfaction but if you started to worry about your monthly over-expenses, then you'll noticed that all of this things are unnecessary for you. Below is my opinion:- Car loan : RM 352 ( I drive VIVA only ) (Not going to advice you to sell the car otherwise you will incur losses and still owe the bank though you might be paying a lower installment subsequently. Since your dad's loan going to finish in a year, so you pray u can tahan to pay this 352 in the next 12 months) Life Insurance + Medical Card : RM 100 (100 in insurance is minimum, should keep this) My bro laptop installment : RM 91.58 (i'm assume you are helping your younger brother to buy laptop and assume your younger brother could be in college so he needs a laptop to do homework, ask him to work out this part himself, ask him work part time lah) My own laptop : RM 242 (if really desperate, sell your laptop and use your brother's laptop) Digi broadband : RM 88 (broadband is not that important, cut this and transfer to your food expenses) My hp installment : RM 135.75 (I assume you are paying installment for a fancy phone cost about RM2k? sell it if you desperate, so you not only got some cash to sustain your live style for the next few months till clearing your dad loan, you also lessen your burden of paying 135.75 no more each month) My dad loan ( only end at December 2011 ) : RM 1,077.94 (I don't know what happen to your dad, hope it wont happen again or else you have to find another higher pay job to cover this portion) Handphone bill : RM 100 (i think this part is high, if can cut by half) Food : Don't talk about even .. cannot even think. (don't be too harsh to yourself on food, if u sick becuz of lacking of nutrient, you will be more into trouble) Food : Don't take breakfast,lunch sometimes eat bread,if can go out and see customer,can CLAIM , at night eat roti canai |

|

|

Oct 2 2010, 12:12 PM Oct 2 2010, 12:12 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Oct 3 2010, 12:22 AM Oct 3 2010, 12:22 AM

|

Junior Member

192 posts Joined: Aug 2006 |

Guys. My monthly expenses:

Fixed: Car Loan: RM470 House Rent: RM260 Credit Card Installment: RM350 (5 months left) Phone Bill: RM50 Total: RM1150 Variable: Parking: RM50 Petrol car/bike: RM200 Food and everyday's expenses: RM750 Public Transportation: RM100 Total: RM1100 I am 25. Earn about RM2200 per month. Don't drive cars too much as i have bike but i think i'm going to take public transportation for a while now. The problem is there is so many unexpected things happened, and i have no savings and i have just settled down my personal loan lately and want to begin to save now. No more personal loan and credit card usage for me after this, regret so much. In the near future, my monthly expenses will change because of further study in Degree as a part timer soon. Fixed: Car Loan: RM470 House Rent: RM260 Education loan: RM450 Phone Bill: RM50 Total: RM1250 Variable: Parking: RM50 Petrol car/bike: RM200 Food and everyday's expenses: RM750 Public Transportation: RM100 Total: RM1100 What should i do guys? Where should i cut the expense? |

|

|

Oct 3 2010, 02:10 AM Oct 3 2010, 02:10 AM

|

Senior Member

2,854 posts Joined: Feb 2006 From: Sri Petaling ~ Kuala Lumpur |

QUOTE(almeizer @ Oct 2 2010, 02:14 AM) Wow, your dad's loan killing you. Most of your expense is installment, I think you can't stop it unless you want to stop using it (Car, Hp, Laptop). The sales are not increase and I cannot hit the target so cannot get the commission Anyway, try to reduce other expense or increase your income by doing free lance. I assumed you are doing sales (meet customer, fixed allowance) and should have a lot contact. Try to do something like referring customer for other business and get paid. Good luck !!! QUOTE(maxizanc @ Oct 2 2010, 02:43 AM) WhiteWing, my advice. Take care of yourself by having proper meals instead of those unhealthy foods rather than spending so much for laptop, broadband and handphone monthly. My handphone is a GPS phone for me .. I need to for travel to my customer place ... Once I know for 1st time then I don't use it anymore except I got new customer again.If i were you, i already have a laptop, i don't really have to own a fancy handphone. I believe the handphone is your personal satisfaction but if you started to worry about your monthly over-expenses, then you'll noticed that all of this things are unnecessary for you. QUOTE(kinwing @ Oct 2 2010, 10:52 AM) Yah I think WhiteWing should have cut some of the laptop/handphone installments if you are really desperate. Don't forget, you still not add in the transporation cost. We assume you do not use the car to travel to your company, but you still need to spend on public transport right, unless you are working to the company of which is close to your home. Sad case Below is my opinion:- Car loan : RM 352 ( I drive VIVA only ) (Not going to advice you to sell the car otherwise you will incur losses and still owe the bank though you might be paying a lower installment subsequently. Since your dad's loan going to finish in a year, so you pray u can tahan to pay this 352 in the next 12 months) - I gonna keep this. Life Insurance + Medical Card : RM 100 (100 in insurance is minimum, should keep this) - This one very important .. been buying this more than 6 years. My bro laptop installment : RM 91.58 (i'm assume you are helping your younger brother to buy laptop and assume your younger brother could be in college so he needs a laptop to do homework, ask him to work out this part himself, ask him work part time lah) - End by this month the installment. My own laptop : RM 242 (if really desperate, sell your laptop and use your brother's laptop) - Still got 6 months to go. Digi broadband : RM 88 (broadband is not that important, cut this and transfer to your food expenses) - I need it because I always travel to meet customer and I cannot don't have internet to receive my customer e-mail. My hp installment : RM 135.75 (I assume you are paying installment for a fancy phone cost about RM2k? sell it if you desperate, so you not only got some cash to sustain your live style for the next few months till clearing your dad loan, you also lessen your burden of paying 135.75 no more each month) - IF I sell it,I don't know go to my customer place since I use it as GPS + Phone feature. My dad loan ( only end at December 2011 ) : RM 1,077.94 (I don't know what happen to your dad, hope it wont happen again or else you have to find another higher pay job to cover this portion) -No eye to see and think Handphone bill : RM 100 (i think this part is high, if can cut by half) - I can use up to RM50 then I will stop. Food : Don't talk about even .. cannot even think. (don't be too harsh to yourself on food, if u sick becuz of lacking of nutrient, you will be more into trouble) - Now every morning or if lunch time I at office,I will make at least 2 milo in the company kitchen .. that it .. no rice or bread if can drink milo. Food : Don't take breakfast,lunch sometimes eat bread,if can go out and see customer,can CLAIM , at night eat roti canai |

|

|

Oct 3 2010, 12:12 PM Oct 3 2010, 12:12 PM

|

|

Staff

7,948 posts Joined: Jan 2005 From: Soviet Sarawak |

I've decided.

I'll raise my property loan repayment so i can save on interest currently, the best of ASN or ASM or any AS is around 6%, which is lower than the current BLR so what say you guys? waiting for property market bubble to burst is like waiting for uncertainty, which may or may not happen anyhow, speaking of property, i prefer buying shoplot (with good location) rather than houses as they appreciate faster and is more liquid. only thing is the interest rate for the loan is much higher than homeloan (yeah, i know there's a way around that by re-mortgaging your house) |

|

|

Oct 4 2010, 09:01 AM Oct 4 2010, 09:01 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(lucifah @ Oct 3 2010, 12:12 PM) I've decided. Not worth it to clear your property loan. You save at interest rate of about 4.8%-5%, but instead you can get a semi-guaranteed 6% from ASN. Furthermore the loan interest amount can offset your rental income (for the same property only, if you stay yourself, no savings!), so you can save on your income tax. If you have extra money consider to invest in a secondary property instead. Property type depend on your investment. I'll raise my property loan repayment so i can save on interest currently, the best of ASN or ASM or any AS is around 6%, which is lower than the current BLR so what say you guys? waiting for property market bubble to burst is like waiting for uncertainty, which may or may not happen anyhow, speaking of property, i prefer buying shoplot (with good location) rather than houses as they appreciate faster and is more liquid. only thing is the interest rate for the loan is much higher than homeloan (yeah, i know there's a way around that by re-mortgaging your house) Landed houses - Very bad yield (~2-3%), the best appreciation if the location is good. Apartment/Condo - Good yield (~6%-8%), lower appreciation, older condo don't appreciate much. Shophouse/Lot - Medium Yield, medium appreciation. Highly dependent on the economy. This post has been edited by gark: Oct 4 2010, 09:03 AM |

|

|

Oct 4 2010, 11:48 AM Oct 4 2010, 11:48 AM

|

Senior Member

1,262 posts Joined: Aug 2005 From: Mars |

QUOTE(mnhma @ Oct 3 2010, 12:22 AM) Fixed: Car Loan: RM470 House Rent: RM260 Education loan: RM450 Phone Bill: RM50 Total: RM1250 Variable: Parking: RM50 Petrol car/bike: RM200 Food and everyday's expenses: RM750 Public Transportation: RM100 Total: RM1100 What should i do guys? Where should i cut the expense? |

|

|

Oct 5 2010, 04:13 PM Oct 5 2010, 04:13 PM

|

Junior Member

163 posts Joined: Apr 2010 |

QUOTE(buylowsellhigh @ Oct 5 2010, 02:42 AM) Hi kevin, you may want to consider unit trust. My approach has a twist where I utilise technical analysis to buy on trend (buy low and sell high). When market turns down, I switch to bond fund. Hi all!http://belirendahjualtinggi.wordpress.com Pardon me I am a green horn. Hope to learn from you guys. How volatile is the bond market at the present moment? If I want to invest in bond fund, what's your recommendation? How much do I start with? What are their charges, commission etc? Thanks in anticipation. Nomen |

|

|

Oct 6 2010, 04:06 AM Oct 6 2010, 04:06 AM

|

Junior Member

95 posts Joined: Oct 2010 |

QUOTE(nomen @ Oct 5 2010, 04:13 PM) Hi all! Hi Nomen, in some cases, bond unit trust is better than Fixed deposit and there is also more flexibility. However, it is not very popular as the comission for the agent is really small. The sales charge is only 0.25% for public mutual, public islamic sector bond fund. Even when the market turns down, and it is safer to go to bond, you don't often hear the agents asking you to switch. Annual fee is up to 0.83%. Total return last year was 5%, quite comparable or better than fd. This year is looking better. performance is not volatile, in fact for the last year, it looks like a straight line up. Minimum investment is Rm 1,000. you can add a minimum of rm 100 anytime. you can make direct debit instruction from bsn, public bank and maybank for disciplined investment.Pardon me I am a green horn. Hope to learn from you guys. How volatile is the bond market at the present moment? If I want to invest in bond fund, what's your recommendation? How much do I start with? What are their charges, commission etc? Thanks in anticipation. Nomen the stock market is going up now, so now is actually the time to go equity fund. Find an agent that has the expertise to advise when trend is shifting so you can then protect your gain by going to bond. I am happy to answer any questions, feel free to pm me. For a faster response, please email me. |

|

|

Oct 6 2010, 03:08 PM Oct 6 2010, 03:08 PM

|

Junior Member

163 posts Joined: Apr 2010 |

QUOTE(buylowsellhigh @ Oct 6 2010, 04:06 AM) Hi Nomen, in some cases, bond unit trust is better than Fixed deposit and there is also more flexibility. However, it is not very popular as the comission for the agent is really small. The sales charge is only 0.25% for public mutual, public islamic sector bond fund. Even when the market turns down, and it is safer to go to bond, you don't often hear the agents asking you to switch. Annual fee is up to 0.83%. Total return last year was 5%, quite comparable or better than fd. This year is looking better. performance is not volatile, in fact for the last year, it looks like a straight line up. Minimum investment is Rm 1,000. you can add a minimum of rm 100 anytime. you can make direct debit instruction from bsn, public bank and maybank for disciplined investment. I am much obliged for your kind reply.the stock market is going up now, so now is actually the time to go equity fund. Find an agent that has the expertise to advise when trend is shifting so you can then protect your gain by going to bond. I am happy to answer any questions, feel free to pm me. For a faster response, please email me. I plan to open 2 accounts to go into Unit Trust Fund Investment for a start. One Equity Account & One Bond Account to switch from equity to bond during a down trend as you had advised but I need to find sometime one with expertise. There are lots of bonds to choose from but how do I differentiate which bond is a junk bond. As for Equity fund, since I am a beginner I would only go for a low risk appetite. I do hope to get some tips contribution from you and other experienced investors from this forum as well. Thank You. Nomen |

|

|

Oct 8 2010, 10:16 PM Oct 8 2010, 10:16 PM

|

Junior Member

95 posts Joined: Oct 2010 |

QUOTE(nomen @ Oct 6 2010, 03:08 PM) I am much obliged for your kind reply. Ho Nomen, sorry for the late reply.I plan to open 2 accounts to go into Unit Trust Fund Investment for a start. One Equity Account & One Bond Account to switch from equity to bond during a down trend as you had advised but I need to find sometime one with expertise. There are lots of bonds to choose from but how do I differentiate which bond is a junk bond. As for Equity fund, since I am a beginner I would only go for a low risk appetite. I do hope to get some tips contribution from you and other experienced investors from this forum as well. Thank You. Nomen The first thing you want to focus on is selecting the right unit trust company The second most important or maybe the first? is selecting a unit trust consultant. You need a unit trust consultant who can help you to maximize your profit, not just his/hers. Then the last one is selecting the fund, it is not the other way around. I will follow up with other posts. Added on October 8, 2010, 11:00 pm QUOTE(buylowsellhigh @ Oct 8 2010, 10:16 PM) Ho Nomen, sorry for the late reply. The key to to success in unit trust invetsment is timing/switching, i.e. when to move from equity fund to bond fund and vice versa. If you do it well, God willing, it will be very profitable. The key then is to find a unit trust company that let you switch easily without incurring unnecessary charges. Then you need to find a unit trust consultant that can tell you when to switch, unless you have the expertise. The first thing you want to focus on is selecting the right unit trust company The second most important or maybe the first? is selecting a unit trust consultant. You need a unit trust consultant who can help you to maximize your profit, not just his/hers. Then the last one is selecting the fund, it is not the other way around. I will follow up with other posts. Some unit trust company doesn't encourage switching, you pay the sales charge when you come back in again even though you have paid it before. You need to be able to do it easily without asking permission or paying the sales charge again. The unit trust consultant that can advise you about market timing or when to switch should have some fundamental knowledge such as -Intermarket relationship -Market sentiment -Sound knowledge and experience in technical analysis I have my bias, I will PM you some details. This post has been edited by buylowsellhigh: Oct 8 2010, 11:00 PM |

|

|

Oct 9 2010, 11:19 AM Oct 9 2010, 11:19 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(buylowsellhigh @ Oct 8 2010, 10:16 PM) Ho Nomen, sorry for the late reply. I disagree The first thing you want to focus on is selecting the right unit trust company The second most important or maybe the first? is selecting a unit trust consultant. You need a unit trust consultant who can help you to maximize your profit, not just his/hers. Then the last one is selecting the fund, it is not the other way around. I will follow up with other posts. Added on October 8, 2010, 11:00 pm The key to to success in unit trust invetsment is timing/switching, i.e. when to move from equity fund to bond fund and vice versa. If you do it well, God willing, it will be very profitable. The key then is to find a unit trust company that let you switch easily without incurring unnecessary charges. Then you need to find a unit trust consultant that can tell you when to switch, unless you have the expertise. Some unit trust company doesn't encourage switching, you pay the sales charge when you come back in again even though you have paid it before. You need to be able to do it easily without asking permission or paying the sales charge again. The unit trust consultant that can advise you about market timing or when to switch should have some fundamental knowledge such as -Intermarket relationship -Market sentiment -Sound knowledge and experience in technical analysis I have my bias, I will PM you some details. Although selecting the good unit trust company is important. Selecting a right UT which suit to individual risk appetite is the most important and which is always the one dictates how well your invested money is doing. Under a good unit trust company, there is a fund register 20% gain from last year performance, there is also a fund register 30% losses since launched 2 years ago. Some even 40-50% since first day launching, even come from a big reputable and good UT company. The key to success of a investment is always the right investment, not timing. Althought timing does help, and sometimes very important. Timing a unit trust is just like timing a stock goes up and goes down and your earn between from it. This is very difficult and most people won't able to do it in real life. There is a good unit trust or fund that has been register hefty gain since start 10 years + ago, which you don't need to time the market at all to have a 200% gain over the last 10+ years. Although timing can maximise the profit, it could minimise the profit as well. It works both well. Try to time the market, is like try to more clever than the market. Although sometimes, we can time the market, as it doesn't need rocket science or specific analysis to know the market is too high, just like bond is going up non-stop for the last year or so until now, which common sense does tell us bond price is a bit high now. In ordinary market condition, timing the market is always a bad practice, and may minimise your profit instead maximise it. Invest in UT is about long term investment. It is not advisable to invest long term based on TA alone. Long term investment is all about fundamental issue. |

|

|

Oct 9 2010, 05:01 PM Oct 9 2010, 05:01 PM

|

Junior Member

154 posts Joined: May 2008 |

UT not recommended unless u really have no idea on how to invest your money.

UT fees & commissions will be there irrespective of the funds performance. Up or down the UT fund managers are making money out of u. If u still want to buy then look for low cost UT, typically index type fund or better still put your money in index linked ETF. Invest periodically. When price is high u get less units and when low u get more units. In the long run your cost will average. (dollar cost averaging). So this will eliminate the timing issue. Money used for this investment should be for long term saving. (Retirement,children's education fund etc.) Not money you are going to use next year or so. |

|

|

Oct 9 2010, 05:38 PM Oct 9 2010, 05:38 PM

|

Junior Member

95 posts Joined: Oct 2010 |

I can sympathize with xu7jp and cherroy view indeed. The view is correct for most people since timing the market is a skill possessed by a select few. At some point I felt the same way and was contented with putting my hard earned money in a safe but low return investment vehicle. Our conclusion is shaped by our assumptions and our assumptions are based on our knowledge. Once our knowlede expands, so will our assumptions and therefore our conclusion. I think it is best to say that if you can't find a person or a way to relaiably time the market then just stick to what most people do.

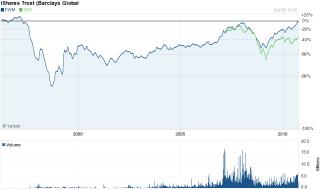

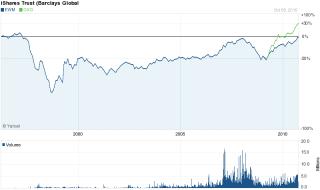

As for me, the charts below speaks for themselves. The first one is how my system, pure TA, signals the bottom of the market in early 2009 and the second one is how KLSE is doing now. The system determines the cycle direction, momentum, strength, and also how the other asia pacific bourses are performing. The system was developed to tell me when the market is starting an uptrend, downtrend or moving sideways and by taking into account various market behavior over decades. there is demand for such timing advise for those who do not want to dabble in the stock market. If anyone has more detailed question not related to this thread feel free to PM me. The question I ask myself is which one is safer, letting my profit disappear during a bear (downturn) market or protecting it if we can?. I think each of us know the answer. Anyhow, best of luck to all. Early 2009. note also how my system called the market top early 2008.  Now  Source: http://belirendahjualtinggi.wordpress.com This post has been edited by buylowsellhigh: Oct 9 2010, 06:38 PM |

|

|

Oct 10 2010, 01:07 AM Oct 10 2010, 01:07 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(buylowsellhigh @ Oct 9 2010, 05:38 PM) I can sympathize with xu7jp and cherroy view indeed. The view is correct for most people since timing the market is a skill possessed by a select few. At some point I felt the same way and was contented with putting my hard earned money in a safe but low return investment vehicle. Our conclusion is shaped by our assumptions and our assumptions are based on our knowledge. Once our knowlede expands, so will our assumptions and therefore our conclusion. I think it is best to say that if you can't find a person or a way to relaiably time the market then just stick to what most people do. No offence, it is too late to talk about this.As for me, the charts below speaks for themselves. The first one is how my system, pure TA, signals the bottom of the market in early 2009 and the second one is how KLSE is doing now. The system determines the cycle direction, momentum, strength, and also how the other asia pacific bourses are performing. The system was developed to tell me when the market is starting an uptrend, downtrend or moving sideways and by taking into account various market behavior over decades. there is demand for such timing advise for those who do not want to dabble in the stock market. If anyone has more detailed question not related to this thread feel free to PM me. The question I ask myself is which one is safer, letting my profit disappear during a bear (downturn) market or protecting it if we can?. I think each of us know the answer. Anyhow, best of luck to all. Early 2009. note also how my system called the market top early 2008. What concern whatever TA, or fundamental POV is where we are going now. We can look back and put tons of theory and TA on it, but this doesn't address what we are most concerning now. Everytime we make investment, is what next. Not looking back on what system pointed out which is signal this and that. No offence. If this has been posted during 2008, to signal high so that people get out of market, I congratulated. If this has been posted during early 2009, signal bottom has been formed and guide people to buy, I congratulated. Often TA or a lot of TA tehory doesn't address top or bottom was formed after market trend has been formed later on, aka too late. It doesn't address the current issue. Just like now, I ask where is TA currently pointing to which direction? This is the answer we want. The correct way to prove a TA works or not, is posting now what TA is pointing us to. Then we look back after 6 months or so, and this process repeating, only then the validity of the TA has more credibility. We can have tons of TA theory out there to prove 2007-2008 was the market high and 2008-2009 was the market bottom. As look back is easy, going forward is not. |

|

|

Oct 10 2010, 03:16 AM Oct 10 2010, 03:16 AM

|

Junior Member

95 posts Joined: Oct 2010 |

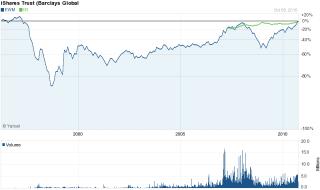

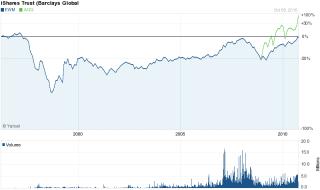

QUOTE(cherroy @ Oct 10 2010, 01:07 AM) No offence, it is too late to talk about this. RIGHT NOWWhat concern whatever TA, or fundamental POV is where we are going now. We can look back and put tons of theory and TA on it, but this doesn't address what we are most concerning now. Everytime we make investment, is what next. Not looking back on what system pointed out which is signal this and that. No offence. If this has been posted during 2008, to signal high so that people get out of market, I congratulated. If this has been posted during early 2009, signal bottom has been formed and guide people to buy, I congratulated. Often TA or a lot of TA tehory doesn't address top or bottom was formed after market trend has been formed later on, aka too late. It doesn't address the current issue. Just like now, I ask where is TA currently pointing to which direction? This is the answer we want. The correct way to prove a TA works or not, is posting now what TA is pointing us to. Then we look back after 6 months or so, and this process repeating, only then the validity of the TA has more credibility. We can have tons of TA theory out there to prove 2007-2008 was the market high and 2008-2009 was the market bottom. As look back is easy, going forward is not. Actually no offense. I thought I have answered your question before you actually asked it since I posted the chart that shows how it looks like NOW. Now it is pointing up. That's the red curve pointing up, it is showing the current trend. That's all I need. That's me going foward. I will remain bullish until when it changes direction. The past data is to show how the system performed in the past since the system does not attempt to curve fit future data. It was designed knowing that market has many personality. As an investor myself it doesn't make sense to me to create a system that cheats me or curve fit future data on current data. the way i test the system is to actually take out some data and see how the system works at critical juncture. FORWARD TESTING, BLIND DATA. One of many examples below. I loaded data till May 2009. So basically the system is blind to the fact that we had a confirmed bull run in 2009 until present. But already in April-May 2009, once we had a confirmed long trem trend, away from the violent whipsaw previously seen at the bottom, (I am not interested in short term trend), the red curves turned up. Definitely not too late.  This is another signal from my system. The price bar turns blue already in April, indicating positive long term momentum. Again, the system is blind to any data beyond May 2009.  So we don't have to wait 6 months to test the system, this is called forward testing. I can forward test on any index anytime with consistent result as there is no curve fitting element at all in my system. HEALTHY SKEPTICISM I am not interested in a system that predicts, just a system that can tell me what the trend is now. I know that this is a paradigm shift for many, having a TA system that actually works and i can truely sympathize with the skepticism, maybe I have not seen enough but I myself have not seen any system like mine before this! There are just a few UTC who guide their clients with TA, but I don't know how their system works. It definitely took me hundreds of dollars (not ringgit) of books, 10 years, hundred of dollars of software to finally come with the understanding and the system. How it works? If I have some time to explain to you, you will see how it is simple, but that's my trade secrets. BACK TO RIGHT NOW AGAIN Forget about the stuff I said about forwrad testing if you think I am not being upright here. I have shown how the system would have done in the PAST and I have shown NOW. That is much more already than what the so called "experts" are doing. Again, right now, we are in an uptrend, not at the bottom, definitely not at the top. Some may say that this is easy to say, but is it? I still hear a lot of people are still scared to go into the market now. And I sure don't hear people screaming "we are in a bull run now, get in..get in..before it's too late" We will only hear about it when it's too late actually. So basically I am saying what many are not saying, we are in a bull run. Feel free to judge me on that now or whenever. The fact of the matter is many can't see the trend even if they are staring at it. That's the service I provide, answering the question you are asking, what about now. I can do this again and again and again...but of course it can't be free anymore. I believe we think in a similar way, we want answer that almost every investor wants, what is the current trend? should I go in? should i hold? should I exit? This has taken a bit of my time. Anything more, feel free to email/PM me. This post has been edited by buylowsellhigh: Oct 10 2010, 04:55 AM |

|

|

Oct 10 2010, 10:17 AM Oct 10 2010, 10:17 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(buylowsellhigh @ Oct 10 2010, 03:16 AM) RIGHT NOW Investors just want this short answer for any TA.Actually no offense. I thought I have answered your question before you actually asked it since I posted the chart that shows how it looks like NOW. Now it is pointing up. That's the red curve pointing up, it is showing the current trend. That's all I need. That's me going foward. I will remain bullish until when it changes direction. Then we can evaluate how good the system is, after commit in real life investing. No point looking back to say how good the system is. A system can be foolproof for years but can stumble with unpredictable market trend. Forward testing is not reflecting the real situation out there, although you can key in many variable as we wish. When the signal changing direction it may prompt you to sell, but the do you sell? Also, signal can change within weeks as well due to unpredictable market movement. I don't mean to criticise, just blindly believe any TA is always a bad practice. TA is the one to guide and give clue how the market trend. It doesn't predict the future market trend. Also most TA is based on indices, and even index surge to all time high like KLCI to surpass 1500, it doesn't address still large portion of stocks especially 2nd liner stocks are underwater. Unless one is trading in Index ETF, Index future, then the TA only applicable. Also, index doesn't represent every stocks out there. Anyone with some mathematical skill can always create different kind of TA by using historical data as reference to prove the validity of TA. Just like we know the result of 2 x 3 = 6. So it is not difficult to create a system to find out the answer (?) of 2 x ? = 6. Because TA being created by looking back what had happend and based on pattern it showed. Anyway, I don't mean to criticise about TA, as any TA is always good to give some indication. But blindly believe any system is always a bad practice to start with (other may disagree or not, never mind, just my pov which I would like to highlight) This issue is a bit OT with this topic, so I think better post this kind of issue elsewhere. Cheers. This post has been edited by cherroy: Oct 10 2010, 10:33 AM |

|

|

Oct 10 2010, 11:17 AM Oct 10 2010, 11:17 AM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

The discuss of applying TA into investment is off topic from personal financial managment. Any further discussion about TA should be in other thread, not here.

When people ask about how to efficiently utilise the spare cash on hand, so we could suggest few asset classes such as securities, properties, unit trusts/mutual funds and fixed deposit. IMHO, I think those who is not savvy in financial knowledge, I'd recommend them to go for trust fund. Of course, picking a right trust fund is ultimate to grow your fund, and who is the fund manager is the most important factor to be sucess in investing unit trust. Check the fund track record for up to 5 till 10 years. Another factor we need to take into account while investing trust funds is the fees incurred. If the trust fund is to benchmark with certain index like KLCI Index, but the trust fund's return is equal or less than the benchmark, so after deducting the fees the return from the trust fund is indeed lower than the benchmark. Then it is recommended to buy index fund. |

|

|

Oct 10 2010, 03:52 PM Oct 10 2010, 03:52 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

agree that this is not the place discuss TA, but since alredi started, I join in the fun too

regarding the one who started TA, if the system is as good as its claims, might as well play futures however, his nickname does not seem to agree with charts presented, now go to new high, precaution is necessary unless play breakout but a minor pullback, does create a safer buy low entry level atm, agree with his assessment coz I advocate buy high, sell higher! but be ready when market turns, imo depends on the policy in us (nov2) I personally invest in pbb growth fund, I DO not invest regularly, BUT I invest after pullback is confirmed & enter when there is a doji

http://www.publicmutual.com.my/application...erformance.aspx http://www.publicmutual.com.my/application...erformance.aspx from the above, ewm moves similar to klse, then can compare other etfs - use eyes & google to research on how to find them

s&p500 = spy, bolehland = ewm

spy vs VGSIX Vanguard REIT Index Inv

spy vs VSMGX Vanguard LifeStrategy Moderate Gr Inv

spy vs VWELX Vanguard Wellington Inv

ewm vs WisdomTree Middle East Dividend (GULF)

ewm vs iShares MSCI Australia Index (EWA)

ewm vs Vanguard Total Stock Market ETF (VTI)

ewm vs Vanguard FTSE All-World ex-US ETF (VEU)

ewm vs Vanguard REIT Index ETF (VNQ)

ewm vs Vanguard Total Bond Market ETF (BND)

ewm vs CurrencyShares Japanese Yen Trust (FXY)

ewm vs Global X/InterBolsa FTSE Colombia 20 ETF (GXG)

ewm vs iShares Barclays 3-7 Year Treasury Bond (IEI)

ewm vs ProShares Ultra Silver (AGQ)

ewm vs Direxion Daily Real Estate Bull 3X Shrs (DRN)

seek & u shall find |

|

|

Oct 10 2010, 05:19 PM Oct 10 2010, 05:19 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

I believe TA is not actually an Universal Tool that you can practise throughout the world.

If you are just a US investor , then TA could be quite close in the sense IF there is a big correction in Malaysia market, it does not have any impact on your US stocks by using TA. However, on the reverse IF you spot some bullishness of some Malaysia stocks , but there happens to be a big DOW correction, most likely the bullish TA charts would be diminishing or turning into negative. BTW, Malaysia is quite a small market, even the sharks ( manipulators ) would be able to create a Bullish Chart with the purpose of dumping their stocks. IF TA analysts shout for bullishness of a stock, maybe time for you to take profit, or on a stand by to sell out. Frankly I also wonder anyone is making good money by using purely TA on Malaysia Future Market ? Again , Dow is also impacted by the unemployment reports ? So TA is not actually standing alone, correct me if I am wrong. This post has been edited by SKY 1809: Oct 10 2010, 05:43 PM |

|

|

Oct 10 2010, 05:54 PM Oct 10 2010, 05:54 PM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

QUOTE(sulifeisgreat @ Oct 10 2010, 03:52 PM) agree that this is not the place discuss TA, but since alredi started, I join in the fun too I'm not sure how TA works nor I interested to know about TA. I'm also investing currently but I don't rely on TA. I'm more tend to buy and hold for long term and my investing strategy is value investing. Since I'm buying for long term, I don't think TA will work for my style. Please take note that the world 2nd richest man Warren Buffet is the only genuine investor in the top 2 richest (he could be now or in the future to be out of 10 most richest since he is donating most of his wealth), but he does not depend on TA at all. He follows Benjamin Graham's advice strictly as Graham had once said "Investing in a stockmarket is most intelligent it is most business like". If you are getting into a good business by spending RM20 mil and sell it the next day for RM22 mil and make a 10% profit, and it is indeed what technical analyst will prompt to do so. But I believe if Warrent Buffet works in this way by selling 10% profit each time within short term period, I don't think he would be as what he is today.regarding the one who started TA, if the system is as good as its claims, might as well play futures however, his nickname does not seem to agree with charts presented, now go to new high, precaution is necessary unless play breakout but a minor pullback, does create a safer buy low entry level atm, agree with his assessment coz I advocate buy high, sell higher! but be ready when market turns, imo depends on the policy in us (nov2) I personally invest in pbb growth fund, I DO not invest regularly, BUT I invest after pullback is confirmed & enter when there is a doji Since it's the thread for those who have questions on how to utilise their cash instead of putting into FD, apparently most of them are beginners in financial world so we should give recommendation or suggestion to be simple and neutral. Don't have to say TA or FA or whatever other investing methods is more good for doing investment. Moreover, the discussion about the what so-called TA or FA doesn't seems match the topic in this thread. Thus I think it's appropriate to move those TA discussion to those investment thread. This post has been edited by kinwing: Oct 10 2010, 05:56 PM |

|

|

Oct 10 2010, 09:23 PM Oct 10 2010, 09:23 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

I have read up on value investing, wb & FA stuff. but is graham as rich as wb?

more likely wb was at the right place & at the right time, something like li ka shing otherwise, all of graham followers occupy the forbes top 100 rich list do u even follow wb method 100% or r u just cherry picking? furthermore, y dun u just follow what he buys & maybe can be the top 2 richest also instead of reinventing the wheel & putting wb concept into bolehland context, it does save the work & hassle just to follow wb doesn't want to set aside the collateral, and wants existing derivatives contracts to be exempted from the rules. http://articles.moneycentral.msn.com/Inves...px?post=1747221 he states that his favorite holding period is forever http://www.fool.com/investing/value/2010/0...fett-sells.aspx wb does buy & sell, he does not keep EVERYTHING long term, remember ptr? http://finance.yahoo.com/news/Warren-Buffe...104421.html?x=0 anyway, I not here to start a topic on criticizing wb! just that some of his followers r hypocrites, only follow certain things abt wb & not follow in full I do not take things at face value after staying in bolehland for so long. if govt says vote bn is good for rakyat, do u do / dun agree? I read those anti wb to get a better perspective on investment & trading, which leads me to TA & etc for bolehland, I just buy & hold those 1st liner & good track record unit trust. I dun trade much in bolehland there are topics on securities, properties, unit trusts/mutual funds and fixed deposit, if someone would just use the search function well, u can help those newbies out by showing them the way how u tackle this topic & get this topic back in track QUOTE(kinwing @ Oct 10 2010, 05:54 PM) I'm not sure how TA works nor I interested to know about TA. I'm also investing currently but I don't rely on TA. I'm more tend to buy and hold for long term and my investing strategy is value investing. Since I'm buying for long term, I don't think TA will work for my style. Please take note that the world 2nd richest man Warren Buffet is the only genuine investor in the top 2 richest (he could be now or in the future to be out of 10 most richest since he is donating most of his wealth), but he does not depend on TA at all. He follows Benjamin Graham's advice strictly as Graham had once said "Investing in a stockmarket is most intelligent it is most business like". If you are getting into a good business by spending RM20 mil and sell it the next day for RM22 mil and make a 10% profit, and it is indeed what technical analyst will prompt to do so. But I believe if Warrent Buffet works in this way by selling 10% profit each time within short term period, I don't think he would be as what he is today. Since it's the thread for those who have questions on how to utilise their cash instead of putting into FD, apparently most of them are beginners in financial world so we should give recommendation or suggestion to be simple and neutral. Don't have to say TA or FA or whatever other investing methods is more good for doing investment. Moreover, the discussion about the what so-called TA or FA doesn't seems match the topic in this thread. Thus I think it's appropriate to move those TA discussion to those investment thread. |

|

|

Oct 10 2010, 09:45 PM Oct 10 2010, 09:45 PM

|

Junior Member

95 posts Joined: Oct 2010 |

I didn't realise how hot this topic can be. How did we get sidetrack into TA huh? hehe..

Anyway, not to say whose right and wrong, just to sum it up, when it comes to personal financial management, different people have different knowledge, experience, perception, style, personality, etc. I guess what is right for someone may not be right for others. And it shows in this thread. There are some basic principles that applies to all but the approcah can still vary. Some prefer Fundamental Analysis, some Technical Analysis, it is indeed part of financial management. And I guess there are very few who have spent years and years trying both and are qualified to judge both. I am definitely not one of those, so I reserve any criticism on Fundamental Analysis. I guess I was seen as coming off too strong initially, such that it triggered quite some reaction, my apology. At the same time, ithe discussion has given me some important points I need for my presentation, thank you. I welcome further enquiry as some of you have done through emails or even open minded discussion. I do appreciate that. I look forward to participate in more open minded discussion. |

|

|

Oct 11 2010, 12:37 AM Oct 11 2010, 12:37 AM

|

Senior Member

559 posts Joined: Mar 2010 From: Ipoh/Kuala Lumpur |

QUOTE(sulifeisgreat @ Oct 10 2010, 09:23 PM) I have read up on value investing, wb & FA stuff. but is graham as rich as wb? As I noticed someone is trying to over-emphasis on TA, so I brought Warren Buffet as one of the FA type to neutralise the investment style. Whether anyone should have agreed how Warren Buffet works his way out base on Graham's theories or any other investment guru such as philip fisher, it is always up to them to find out the topics instead of some one is trying to sell something too hard over here.more likely wb was at the right place & at the right time, something like li ka shing otherwise, all of graham followers occupy the forbes top 100 rich list do u even follow wb method 100% or r u just cherry picking? furthermore, y dun u just follow what he buys & maybe can be the top 2 richest also instead of reinventing the wheel & putting wb concept into bolehland context, it does save the work & hassle just to follow wb doesn't want to set aside the collateral, and wants existing derivatives contracts to be exempted from the rules. http://articles.moneycentral.msn.com/Inves...px?post=1747221 he states that his favorite holding period is forever http://www.fool.com/investing/value/2010/0...fett-sells.aspx wb does buy & sell, he does not keep EVERYTHING long term, remember ptr? http://finance.yahoo.com/news/Warren-Buffe...104421.html?x=0 anyway, I not here to start a topic on criticizing wb! just that some of his followers r hypocrites, only follow certain things abt wb & not follow in full I do not take things at face value after staying in bolehland for so long. if govt says vote bn is good for rakyat, do u do / dun agree? I read those anti wb to get a better perspective on investment & trading, which leads me to TA & etc for bolehland, I just buy & hold those 1st liner & good track record unit trust. I dun trade much in bolehland there are topics on securities, properties, unit trusts/mutual funds and fixed deposit, if someone would just use the search function well, u can help those newbies out by showing them the way how u tackle this topic & get this topic back in track Added on October 11, 2010, 12:46 am QUOTE(buylowsellhigh @ Oct 10 2010, 09:45 PM) I didn't realise how hot this topic can be. How did we get sidetrack into TA huh? hehe.. I'm not sure if the discussion is leading to a genuine one. I always noticed some one who is promoting something too hard in the forum (not only this forum, any other forums that I been also caught in this kind of promotion).Anyway, not to say whose right and wrong, just to sum it up, when it comes to personal financial management, different people have different knowledge, experience, perception, style, personality, etc. I guess what is right for someone may not be right for others. And it shows in this thread. There are some basic principles that applies to all but the approcah can still vary. Some prefer Fundamental Analysis, some Technical Analysis, it is indeed part of financial management. And I guess there are very few who have spent years and years trying both and are qualified to judge both. I am definitely not one of those, so I reserve any criticism on Fundamental Analysis. I guess I was seen as coming off too strong initially, such that it triggered quite some reaction, my apology. At the same time, ithe discussion has given me some important points I need for my presentation, thank you. I welcome further enquiry as some of you have done through emails or even open minded discussion. I do appreciate that. I look forward to participate in more open minded discussion. For example when one is promoting TA analysis, and some forumers who are interesting would post more queries and they would be told to PM or email. Then the forumers would be told in the PM or email to buy a TA software with a cost of few thousand Ringgit. Or those who are interested about the timing strategy and they are led to the direction that it is a good timing to buy. When the forumers ask what to buy since it is good time to buy, they were told "buy Public XXX Fund lah, PM I will help you this". Don't you smell something fishy over here? This post has been edited by kinwing: Oct 11 2010, 12:46 AM |

|

|

Oct 11 2010, 03:17 AM Oct 11 2010, 03:17 AM

|

Senior Member

1,360 posts Joined: Mar 2010 |

QUOTE(lucifah @ Sep 27 2010, 11:13 PM) for 3 minutes, just ignore the blue tag looks like you are on a 5-digit monthly income. i'm currently nearing my thirties. what i do and how much i earn shouldn't be important, rigth? currently, 1. i maxed out my ASB investment 2. HP repayment about RM 800, another 2 yrs left <-- my only liability, currently 3. property loan repayment = RM 2k per month, 9.5 yrs left i've been saving almost 60% of my salary. my ASB goes from zero to max within 5 years. i don;t desire many things but i still do spend normally - a new phone every year, this and that, fine watches, bicycles, gadgets, etc etc now my big problem: i just don't have any idea what else to do with the money. pls help. atm, i just dump my extra money into ASM or ASW which earns me about 6% return annually. and to quote from a popular pop song "i wanna be a billionaire, so freaking bad... bla bla bal bala bal" and oh yeah. i'm single. w/o insurance (never believe in insurance) be more adventurous and go for some high risk investment. higher the risk, higher the returns |

|

|

Oct 12 2010, 06:30 AM Oct 12 2010, 06:30 AM

|

Junior Member

227 posts Joined: Jan 2006 |

Hi Im a Diploma student from KDU, just graduated and now working as a chef in restaurant.I am earning about 1300+ after all the deduction of SOCSO and others, the problem with me is that I hardly keep track on my bank account because I know every time I go to atm i know there's money.In my line, I hardly go out lepak with my friends due to my working hour (3pm-1am)...feeling not satisfy i will always buy myself beers as reward for myself, and also spend a lot on my gf and also stuff like computer thingy. Its really hard for me to save.

|

|

|

Oct 12 2010, 05:24 PM Oct 12 2010, 05:24 PM

|

Senior Member

941 posts Joined: Aug 2008 |

QUOTE(anthonywongy @ Oct 12 2010, 06:30 AM) Hi Im a Diploma student from KDU, just graduated and now working as a chef in restaurant.I am earning about 1300+ after all the deduction of SOCSO and others, the problem with me is that I hardly keep track on my bank account because I know every time I go to atm i know there's money.In my line, I hardly go out lepak with my friends due to my working hour (3pm-1am)...feeling not satisfy i will always buy myself beers as reward for myself, and also spend a lot on my gf and also stuff like computer thingy. Its really hard for me to save. U know ur problem then what advise u expect from us? Just change ur spending habit or have zero saving. |

|

|

Oct 12 2010, 10:54 PM Oct 12 2010, 10:54 PM

|

Senior Member

8,653 posts Joined: Sep 2005 From: lolyat |

QUOTE(anthonywongy @ Oct 12 2010, 06:30 AM) Hi Im a Diploma student from KDU, just graduated and now working as a chef in restaurant.I am earning about 1300+ after all the deduction of SOCSO and others, the problem with me is that I hardly keep track on my bank account because I know every time I go to atm i know there's money.In my line, I hardly go out lepak with my friends due to my working hour (3pm-1am)...feeling not satisfy i will always buy myself beers as reward for myself, and also spend a lot on my gf and also stuff like computer thingy. Its really hard for me to save. cut down the beer, spend lesser on gf will do |

|

|

Oct 13 2010, 12:49 PM Oct 13 2010, 12:49 PM

|

Senior Member

533 posts Joined: Jun 2010 |

QUOTE(anthonywongy @ Oct 12 2010, 06:30 AM) Hi Im a Diploma student from KDU, just graduated and now working as a chef in restaurant.I am earning about 1300+ after all the deduction of SOCSO and others, the problem with me is that I hardly keep track on my bank account because I know every time I go to atm i know there's money.In my line, I hardly go out lepak with my friends due to my working hour (3pm-1am)...feeling not satisfy i will always buy myself beers as reward for myself, and also spend a lot on my gf and also stuff like computer thingy. Its really hard for me to save. I will advise you to cut down the beer expenses,coz beer price in M'sia is really high.You can save a lot. So,what course u study in KDU ? have you made study loans when you studied ? You need to do financial management wisely. |

|

|

Oct 15 2010, 03:22 AM Oct 15 2010, 03:22 AM

|

Junior Member

11 posts Joined: Oct 2010 |

Try to invest your earning to get more earning for you ....

btw, do you ever read the inflation killer article from insurance and financial review site? click on link to get the full detail. it works for me |

|

|

Oct 15 2010, 03:37 AM Oct 15 2010, 03:37 AM

|

Junior Member

227 posts Joined: Jan 2006 |

alright thanks a lot for most of the advice!

Added on October 15, 2010, 3:45 amoh ya my dad is calling me to open one gold account,so im wondering whether its worth it anot, after what i red on the inflation killer i think its good cuz i can see the gold's value is going up. This post has been edited by anthonywongy: Oct 15 2010, 03:45 AM |

|

|

Oct 16 2010, 05:28 PM Oct 16 2010, 05:28 PM

|

Junior Member

206 posts Joined: Sep 2010 |

QUOTE(anthonywongy @ Oct 15 2010, 03:37 AM) alright thanks a lot for most of the advice! 2 ways of conventional savings method when pay day comes:-Added on October 15, 2010, 3:45 amoh ya my dad is calling me to open one gold account,so im wondering whether its worth it anot, after what i red on the inflation killer i think its good cuz i can see the gold's value is going up. a) spend 1st.. then whatever left in payroll account are my savings b) set aside an amount (it can be as little as RM100) on pay day... then spend whatever left.. even spend all also nvm, at least RM100 sudah saved. 80% of employees adopt method (a) .. this will NEVER work!! After 10 years, your bank account will still be ZERO.. TRUST me.... Bro, do yourself and your family a favour, go adopt savings method (b) ..... go sign up a forced savings plan... if dunno how, then PM me |

|

|

Oct 16 2010, 07:10 PM Oct 16 2010, 07:10 PM

|

|

Elite

15,855 posts Joined: Jan 2003 |

QUOTE(nemoexcel @ Oct 16 2010, 05:28 PM) 2 ways of conventional savings method when pay day comes:- nemoexcel,a) spend 1st.. then whatever left in payroll account are my savings b) set aside an amount (it can be as little as RM100) on pay day... then spend whatever left.. even spend all also nvm, at least RM100 sudah saved. 80% of employees adopt method (a) .. this will NEVER work!! After 10 years, your bank account will still be ZERO.. TRUST me.... Bro, do yourself and your family a favour, go adopt savings method (b) ..... go sign up a forced savings plan... if dunno how, then PM me Come on... Option (b) is called "Pay Yourself First". Anyone can Google and find out more information on this method?? PM you?? It is VERY SIMPLE. Setup auto-deduction of certain percentage of your pay check to an A/C that you have NO ATM card and on a bank that is VERY INCONVENIENT for you to get to and withdraw money. Dreamer |

|

|

Oct 16 2010, 08:15 PM Oct 16 2010, 08:15 PM

|

Senior Member

8,653 posts Joined: Sep 2005 From: lolyat |

QUOTE(nemoexcel @ Oct 16 2010, 05:28 PM) 2 ways of conventional savings method when pay day comes:- on the bolded sentence, is this indirectly promoting saving investment? a) spend 1st.. then whatever left in payroll account are my savings b) set aside an amount (it can be as little as RM100) on pay day... then spend whatever left.. even spend all also nvm, at least RM100 sudah saved. 80% of employees adopt method (a) .. this will NEVER work!! After 10 years, your bank account will still be ZERO.. TRUST me.... Bro, do yourself and your family a favour, go adopt savings method (b) ..... go sign up a forced savings plan... if dunno how, then PM me |

|

|

Oct 17 2010, 11:13 AM Oct 17 2010, 11:13 AM

|

Senior Member

1,262 posts Joined: Aug 2005 From: Mars |