QUOTE(Daprind @ Jul 27 2022, 10:41 AM)

For those who can't save on rainy day, blame no one but themselves. Born poor, not own fault. Die poor, own mistake?

Nope, my beloved parents do not owe me anything . I am blessed they did not uphold the antique traditional mindset into my upbringing.

I just want to make it clear if a parent bring out a child in this world, that is on parent's choice / decision.

The irony of conservative parents, once children sustain themselves and never return the favor (in parent's own term), they will be automatically labelled as ungrateful son/ daughter.

this is no difference telling parents you owe it to me to raise me up,

(but i dont owe u on the other hand) by saying i did not ask to be born....

bottom line is if you can afford, you have enough , why not give it, dont wait for parents to ask.

Dont you give to charity organisations ? What is the difference now?

and again as i said unless you think your parents have more than enough

or you dont have enough yourself

or you think that money is better spent elsewhere.

QUOTE(wongmunkeong @ Jul 27 2022, 10:52 AM)

Speaking as a parent - i agree with U that children never had a say, it's the parents' choice/decision on the children's being conceived and born.

Thus, IMHO, it's the parents' duty to do their best to grow their children to be able to care for themselves and hopefully, others like their partner, own children & help out in society. All i want from my kids are to see them - f2f or video-calls, and if possible spend some time with them.

perhaps you guys have not seen poor parents being left poor in silent sufferings

and the children have the same new thinking like you guys,

you live poor is your mistake,... i have own own family to care now... etc

QUOTE(sgh @ Jul 27 2022, 03:28 PM)

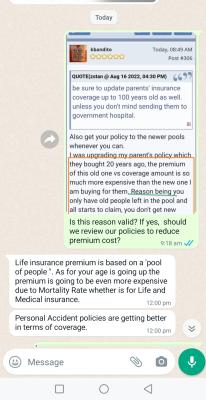

Above is indeed a very tricky issue. In Spore, a Parent Maintenance Act is passed. This mean if parents when old feel children are not feeding/looking after them etc even if they are financially capable to, the parents can sue their children in court to claim maintenance (lump sum or monthly). The fact this is passed as a law indicates the number of such cases happening in Spore. I think in Msia should be happening the same but unfortunately no corresponding law to protect the parents.

This would not have been needed if everyone thinks parents are their financial responsibility too, not just your own children ,

especially if they have so much to invest here and there ,yet they dont find the need to give parents

Worse you see them regular in giving to charities etc...

Those who oppose , dont give i supposed,

naturally must justify for what they do.

Those who give regularly would tell a different story

as you can read inside here, the minority.

When you give to parents, the help flows down the family tree,

others may benefit from it too even though

your parents may not really need. there is only good things that can come

i dont see any negatives from children's genorosity towards parents in terms of money

society would have more issues with the elderly if everyone subscribe to the diction

No, we dont need to give monthly allowance to our parents......

Oct 7 2021, 11:31 AM, updated 3 months ago

Oct 7 2021, 11:31 AM, updated 3 months ago

Quote

Quote

0.1744sec

0.1744sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled