Anyone FIRE without owning a house? Is it doable? Reason why I want to ask this is because I think house is a terrible investment, it won’t appreciate already compared to 2008 time due to property oversupply. Plus, have to pay mortgage interest which is 2x the house price, no rental yield due to own stay. 1 mil house need to pay almost 2mil after 35 years.

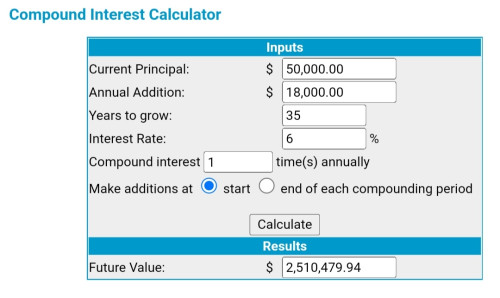

If let’s say we have 1million capital, instead of buying a house. Can’t we just put it to the equity market? US index fund, ASM, EPF etc and let it work? Assuming a conservative 6% average annual return from S&P500, 1 million capital will yield 60k a year or 5k per month. Then use part of the passive income to pay rent at whatever place we like. The remaining use for daily expenses or reinvest it.

Can this method work?? Why I never hear people talk about this before? Rent in Malaysia isn’t too expensive anyway. 2-3k can get a decent place.

FI/RE - Financial Independence / Retire Early

Jul 24 2022, 09:17 PM

Jul 24 2022, 09:17 PM

Quote

Quote

0.1149sec

0.1149sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled