QUOTE(prescott2006 @ Feb 26 2021, 12:06 PM)

Should I buy now or wait after deliver?

this is very subjective , because me myself just had my first baby, now he is two month old

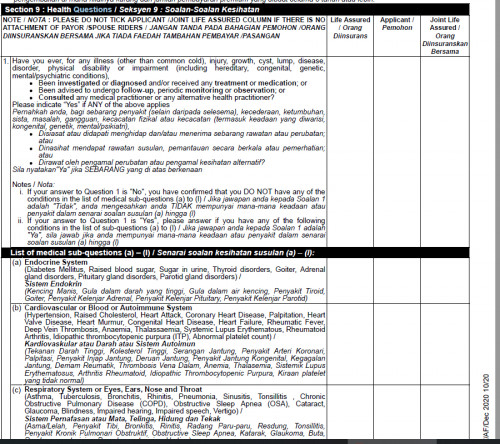

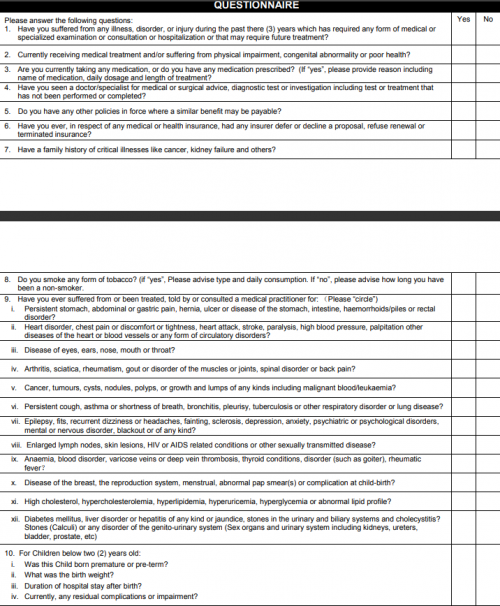

i purchase after born , because mummy got some issue on glucose side which get rejected

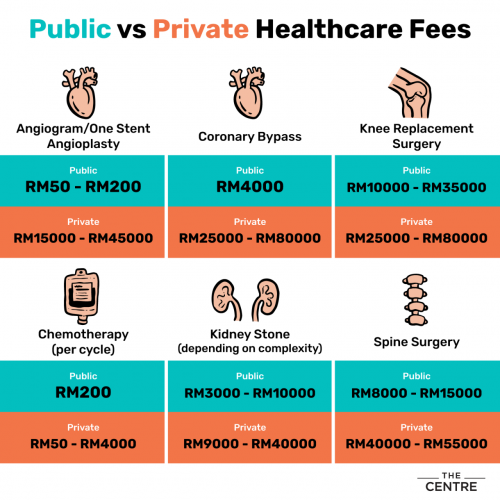

my baby born healthy at sunway hospital , except with high jaundice [baby yellow] , the photo-theraphy caused me 1k burned

if i did purchase during pre-born , i can saved money on this phto-theraphy and this is just

ONE of many of the coverage stated

maybe i explain two scenario below :

Assume Ahmad child born on september 2021

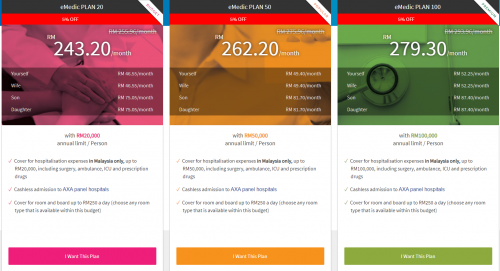

Assume Ahmad plan to purchase life insurance of RM100 per month for his baby with standard coverage [ life , medical card , accident .... ]

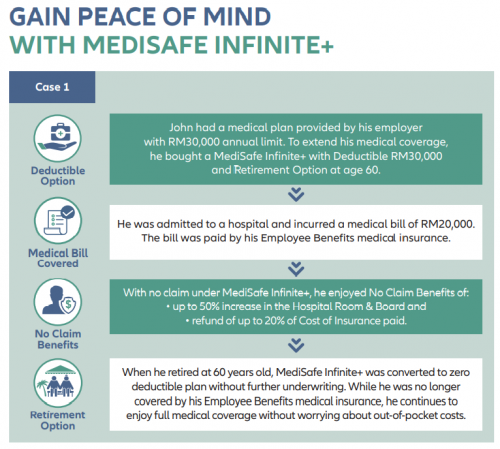

Scenario 1Ahmad purchase insurance now for his baby inside stomach

march 2021 he need to start paying already

RM100 for march , april , may , june , july , august = RM 600

on top of that he need to purchase a rider [ addon ] to cover risk during pregnancy - infant care plus

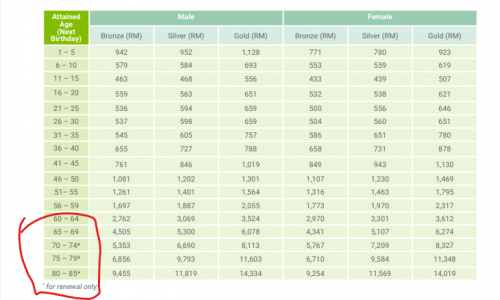

Lets assume one time payment of RM800 [ this cost is depend on mummy age , the younger the cheaper ]

which mean he paid extra RM 600 + RM800 compare to scenario 2

the good things is he have piece of mind basically your baby is insured if anything happen;

most of the complication area already covered quite comprehensive, even after born still insured because you purchase pre-born

on top of that , the rm100 life he paid means standard life benefit coverage for his baby is secured after born as well

Scenario 2Ahmad purchase insurance after baby born

He only start paying on september onwards RM100

He saved RM 1400 compare to scenario 1 , this money can buy baby accessorises already

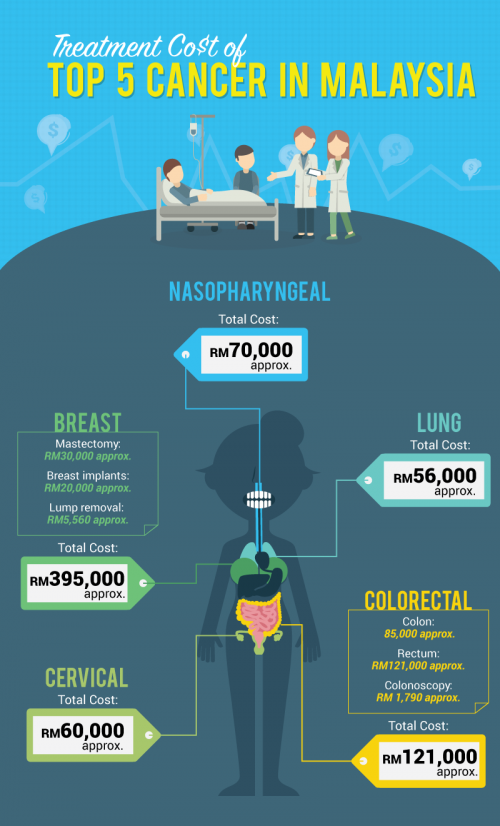

however , if complication happens before or after birth , then he need to take the risk

which is bear all the medical fees or send to government hospital

if nothing happen of course this scenario saved him RM1400

*take note that he no longer can purchase infant care plus add on after baby born*other sifu may add on your advise? of course purchase during pre-born is better , but also it costs more

how to assess or how much you willing to take the risk is really up to your budget

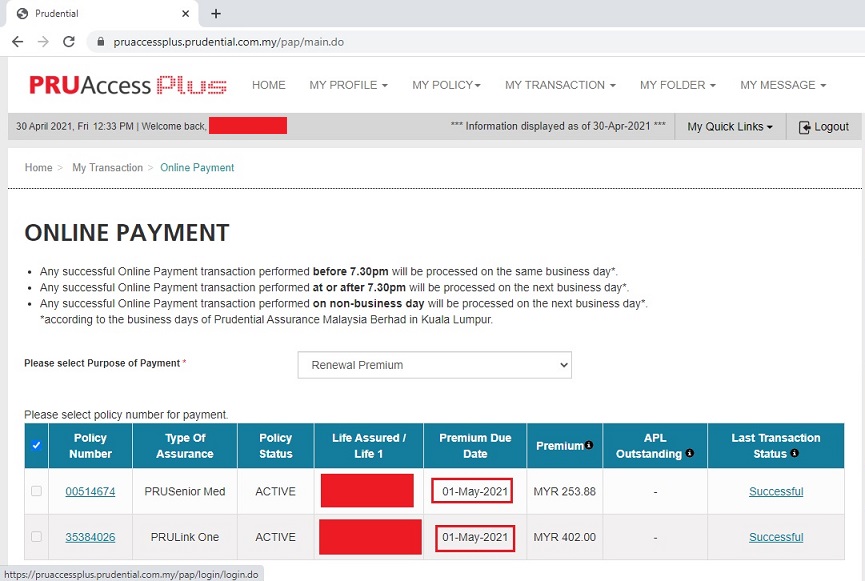

the true purpose of life insurance is to buy during healthy and claim when not healthy.

if baby something happens during pregnancy or after born , its very hard to purchase insurance anymore

This post has been edited by ping325: Feb 26 2021, 06:31 PM

Jan 31 2021, 10:43 AM, updated 5y ago

Jan 31 2021, 10:43 AM, updated 5y ago

Quote

Quote

0.2850sec

0.2850sec

0.56

0.56

6 queries

6 queries

GZIP Disabled

GZIP Disabled