Any AIA agents here can confirm whether Covid is categorized as infectious disease or not?

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Feb 10 2021, 08:10 AM Feb 10 2021, 08:10 AM

Return to original view | Post

#1

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

Any AIA agents here can confirm whether Covid is categorized as infectious disease or not?

|

|

|

|

|

|

Feb 11 2021, 07:45 AM Feb 11 2021, 07:45 AM

Return to original view | Post

#2

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

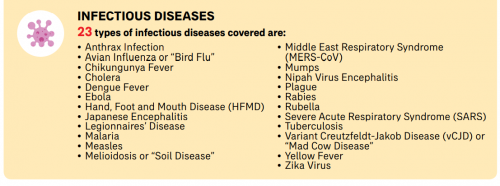

QUOTE(ckdenion @ Feb 10 2021, 09:49 PM) hi WaCKy-Angel, based on WHO (COVID-19 info by WHO), it is an infectious disease. hope the article helps. just curious why do you specifically ask AIA agents? Mind to share? QUOTE(Ewa Wa @ Feb 10 2021, 09:59 PM) Do note that Covid has 5 category: 1-5 (1 is mild 5 is very severe that on ventilator.) We need the AiA agent Rajan CFP to clarify which category is cover and which is not cover. As I heard 1 & 2 admission to private hospitals is non-coverable. QUOTE(lifebalance @ Feb 10 2021, 11:08 PM) Because i'm claiming death benefit due to Covid but its under AIA Flex PA.The agent and AIA says Covid is NOT covered under the 23 infectious diseases mentioned in the brochure, however MERS and SARS (Cov) is in the list, So since the brochure probably was old/not updated im hoping Covid is included. Otherwise i would only get 10K as opposed as 60K (+10K?) for infectious diseases. https://www.aia.com.my/en/help-support/impo...ge-no-cost.html This is the only 10K get for Covid i can claim since it was FLEX PA policy. Even the hopitalisation benefit not able to claim because AIA says it is only for non-death situation. This post has been edited by WaCKy-Angel: Feb 11 2021, 07:56 AM |

|

|

Feb 11 2021, 11:09 AM Feb 11 2021, 11:09 AM

Return to original view | Post

#3

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(lifebalance @ Feb 11 2021, 10:43 AM)  I do not see that it covers/recognize Covid-19 within the policy terms & condition as part of the infectious disease There is also no extra circular to further supplement the policy's T&C besides the extra RM10,000 that will be paid as per the link of the website. Cheers. It will probably be included later after few years when its become rare occurrence just like MERS and SARS situation. |

|

|

Oct 5 2021, 02:46 PM Oct 5 2021, 02:46 PM

Return to original view | IPv6 | Post

#4

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

I got a question about having 2 or more medical card.

One is company medical card and another is personal medical card. Company card annual limit 40K, personal card limit 100K Lets say hospital bill is 100K. Can i split using company card to claim 40K and balance 60K claim using personal card? I recalled my Accounts teacher told me can.. But afaik hospital only issue One (1) original receipt right? and insurance company wants the original receipt. So is it possible? If yes, what are the procedures? |

|

|

Oct 5 2021, 03:44 PM Oct 5 2021, 03:44 PM

Return to original view | IPv6 | Post

#5

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(lifebalance @ Oct 5 2021, 03:25 PM) You can either claim 100k under your personal or pay 60k first (40k from company card) and claim back from the 100k personal card. ohh that is how it works ya.So how to claim back? like i mentioned official receipt (total 100K bill although only claim 40K) only issue one and submitted to company card insurance liao. accept duplicate meh? |

|

|

Oct 5 2021, 04:13 PM Oct 5 2021, 04:13 PM

Return to original view | IPv6 | Post

#6

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(lifebalance @ Oct 5 2021, 04:10 PM) Cool learnt new things liao..Oh next question. I have 2 medical cards. 1st card company card have deduction/co-insurance (not sure which term suitable) due to R&B above rate so insurance only reimbursed around 90% of the bill. Can i use the 2nd card to claim the balance of above? p/s: that time i didnt know got co-insurance of 10% if above R&B rate. I thought i only need to fork out the balance of the R&B spent. Why i use company card to claim? I have this perception that company card insurance premium not bourne by me if the premium increased not really affect me so i will use company card to claim 1st. Is that correct perception? This post has been edited by WaCKy-Angel: Oct 5 2021, 04:18 PM |

|

|

|

|

|

Oct 5 2021, 04:35 PM Oct 5 2021, 04:35 PM

Return to original view | IPv6 | Post

#7

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

|

|

|

Nov 18 2021, 01:49 AM Nov 18 2021, 01:49 AM

Return to original view | Post

#8

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

...

This post has been edited by WaCKy-Angel: Nov 18 2021, 01:50 AM |

|

|

May 19 2022, 04:05 PM May 19 2022, 04:05 PM

Return to original view | Post

#9

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(henrytamfh @ May 19 2022, 03:56 PM) i have a question about cancelling life insurance policy, maybe someone here can answer. Are u sure the term they use is beneficiary?i have a life policy about 30 years ago , would like to cancel terminate it and get the cash value , as it is more than the policy payout . but when i inquire to surrender it , am told that i need to get the beneficiary signature as well else cant be done. problem is there is bad blood between beneficiary and me - so stuck at this . is there any way to go about this , surprise as i am the policy holder and paid for it all. so i basically have no rights as a policy holder ? |

|

|

May 19 2022, 04:26 PM May 19 2022, 04:26 PM

Return to original view | Post

#10

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(henrytamfh @ May 19 2022, 04:18 PM) in the surrender form - it is written Trustee No choice u need to get them to sign.though i would understand it to be beneficiary , meaning upon death that would be the beneficiary, i dont know how it is now called trustee This post has been edited by WaCKy-Angel: May 19 2022, 04:30 PM |

|

|

May 19 2022, 10:06 PM May 19 2022, 10:06 PM

Return to original view | Post

#11

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(Kakwen @ May 19 2022, 10:00 PM) Hi sifus, i am currently not on any insurance policy Insurance mainly divided into life insurance (payout when u died), medical insurance (hospital admissions).I am wondering whether anyone can gave advice on what type of insurance is worth it and necessary and what type to avoid Whether i should buy fron insurance agent or maybe online type Tq all What does "worth" means to u? Are u worried u cant afford hospital bills? Or worried what will your dependant need after u are gone? If u buy online u may not understand what u really need or what u are paying for. And also wont get dedicated person to help/advise u how to submit claims. Buy thru agent u can ask anything until u satisfied. And they will help u submit claims (although mostly will vanish so u have ro choose right agent) p/s: im not agent This post has been edited by WaCKy-Angel: May 19 2022, 10:09 PM |

|

|

May 19 2022, 10:15 PM May 19 2022, 10:15 PM

Return to original view | Post

#12

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(Kakwen @ May 19 2022, 10:08 PM) Is it worthed it to buy medical insurance for hospital in case of anything or just put money into stock and let it earn then take out if needed Insurance is about risk transfer.U wont know if u kena cancer next year or get into accident. So the question is u want to take the risk or pass the risk to insurance by paying minimal fee? Last time i bought and cancelled life insurance and medical card atleast twice (due to financial issues) thinking im young and healthy. Luckily nothing happened to me. 2 years ago i had stones and admitted for surgery. I didnt have medical card then. Luckily i have medical card from company but the limit was low. So i hard to fork out some money myself. I take it as i "paid" few years insurance. denion liked this post

|

|

|

May 19 2022, 10:27 PM May 19 2022, 10:27 PM

Return to original view | Post

#13

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(lifebalance @ May 19 2022, 10:24 PM) It doesn't work that way. Does it only applies for beneficiaries that is above legal age? Below legal age no need approval?It's funny how you're trying to beat the law enacted by Bank Negara. These safe guards are meant to be bullet proof guidelines. I'll be very interested if you have ways to bypass a trustee signature other than forging the signature. |

|

|

|

|

|

Apr 9 2023, 10:26 PM Apr 9 2023, 10:26 PM

Return to original view | Post

#14

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(Ramjade @ Apr 9 2023, 10:05 PM) lee82gx Interesting anyone knows more info about outpatient benefits?If you want outpatient only AXA have them. But I believed the number of visits are limited. https://www.generali.com.my/medical-health/...medi-outpatient Unless it's some cancer than only choice is critical illness insurance. Malaysia does not have but I think Singapore may have what you are looking for. It's call disability insurance. It's different from critical illness. This disability insurance is in case you have a disability which prevent you from working, then they will kick in. You can check out here. https://www.moneyowl.com.sg/insure/ They are salaried based and not commission based so you will get good unbias advise. Downside is the premium is charged in SGD and you need to be in person there to sign the insurance agreement. Upside They have better plans than what we have in Malaysia (cheaper, better value for money) PS I have personally look at some of their critical illness plans and no insurance company in Malaysia can match what they offer me in terms of money or value. You can joint this link https://t.me/sgfinindependence Look for the admin name Kyith. He's a nice guy. He have psoriasis. Just message him and asked him what insurance he takes for his psoriasis. Hope this helps. Pead can? |

|

|

Apr 9 2023, 10:32 PM Apr 9 2023, 10:32 PM

Return to original view | Post

#15

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

|

|

|

Apr 9 2023, 10:48 PM Apr 9 2023, 10:48 PM

Return to original view | Post

#16

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(Ramjade @ Apr 9 2023, 10:34 PM) Actually paeds generally is virus infection which mean self limiting illness. They will go away on their own. Well they cover 3 years old above. The brochure didnt mention paed does that mean considered as GP? Or when comes to paed it is consider specialist?GPs are unlimited visit while specialist are limited to 12 or 6. Depending on the plan. You can download their brochure and PD's for more info. I download it as was like wow. Finally a outpatient medical insurance.

The premium is yearly or monthly? If yearly its cheap |

|

|

Apr 9 2023, 10:52 PM Apr 9 2023, 10:52 PM

Return to original view | Post

#17

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

|

|

|

Apr 9 2023, 10:57 PM Apr 9 2023, 10:57 PM

Return to original view | Post

#18

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(Ramjade @ Apr 9 2023, 10:50 PM) Based off the PDS and brochure looks like annual premium. Quite interesting even if its 12x visit only.If see paediatrician means consultant. You can visit 12x/year if you take the premium plan. Will contact them to clarify paed consider GP or Specialist. Ramjade liked this post

|

|

|

Apr 9 2023, 11:15 PM Apr 9 2023, 11:15 PM

Return to original view | Post

#19

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

QUOTE(Ramjade @ Apr 9 2023, 11:00 PM) Pay and claim no issue.QUOTE(lifebalance @ Apr 9 2023, 11:00 PM) Ahhh still ok lah 10% co-payment better than nothing still can save min RM20/visit lol.Cheapest paed visit i went is RM80 (PPUM RM60 + 2-3 hours wait) and highest visit is RM200. Ramjade liked this post

|

|

|

Apr 9 2023, 11:34 PM Apr 9 2023, 11:34 PM

Return to original view | Post

#20

|

All Stars

21,961 posts Joined: Dec 2004 From: KL |

|

| Change to: |  0.0294sec 0.0294sec

0.39 0.39

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 02:26 AM |