I will be abit real on a few things. In principle, overseas hospitalisation sounds good but unless you get the rarest of rarest disease, seeking medical treatment overseas is not a fun experience.

Being away from home, away from most family member, away from familiar food etc. The good thing malaysia medical facilities is really not bad for the price point. Look, our fellow indonesians friends do frequent malaysia for treatment.

The thing about ILP is like a all-in-one plan (i use nasi lemak as analogy for today). When you eat nasi lemak you want the basic, rice, cucumber, sambal, ikan bilis, maybe1/4 egg. For the ILP you can add on egg, chicken rendang, squid if you feel like it. But everything you add on there is price tagged to it.

Standalone is standalone. Some maybe got some add-on, but usually very limited.

Other explanation on the add-ons (the eggs, chicken rendang or the squid) where i would like to give another point of view but Ramjade criticised the premium waiver rider.

------LONG EXPLANATION-------

Premium Waiver Rider (disclaimer, i didnt buy this on my own policy, some strongly believe in it, i'm half half, leaning towards saving some money and not paying for it)

Let me explain how it works. In the event of CI or TPD, the insurance company will help you pay the premium on. so example your premium is RM3,000, then they help you pay RM3,000

So let's say you bought an ILP plan, RM3,000 is the premium, then touch wood, one day kena CI, then the company pay the RM3,000 premium on behalf of you.

what's the catch?

1) you get charged some charges when you add on this benefit. just like you tambah telur for your basic nasi lemak.

2) the premium waiver does not mean you dont need to pay a single cent. now this part where most agent can't explain

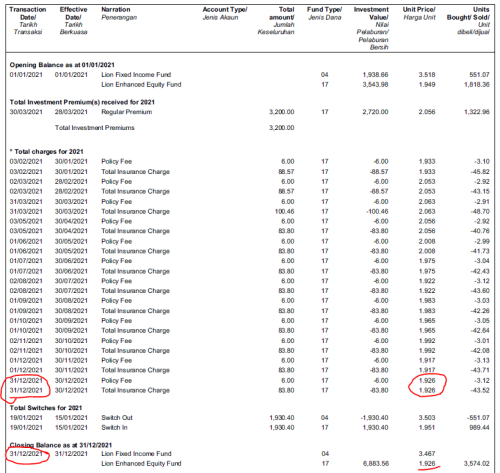

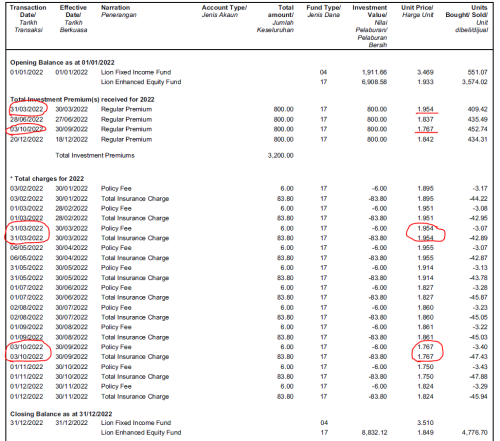

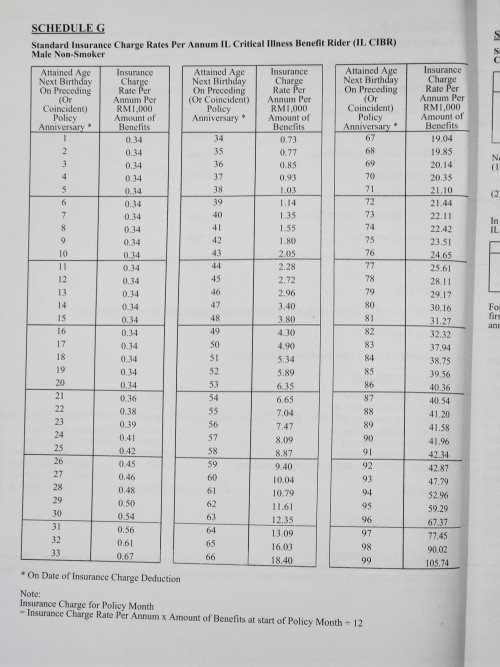

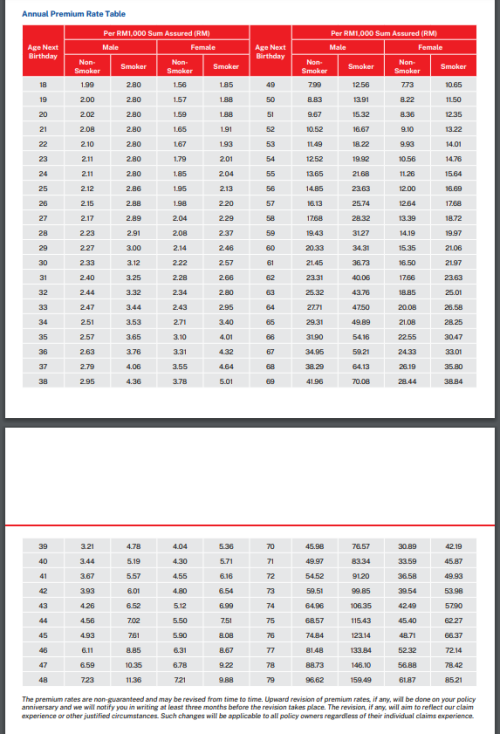

in many post before, there's some explanation by different poster that actually while the premium you pay for the ILP is level, you will expect it to increase when the company increase their rates (not because you got older, because the claims experience deteriorate). now go back to this RM3,000 example... so every month the insurance company will still charge you what they call insurance charge, regardless of whether the person is paying his premium or he kena CI / TPD where the company is paying on behalf.

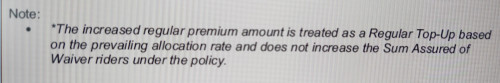

when the insurance company increase the rates for medical plan, what they mean is they increase the insurance charge. so when your RM3,000 premium is not enough to cover these charges, you will need to increase your premium. SO, even if there's one person who kena CI or TPD and wants to continue with the medical plan, that person actually need to pay an increased premium. say example the final premium is RM3,600 per year instead of RM3,000 per year, what happens is that person need to pay RM600 on his own, the RM3,000 will still be paid by the company.

Then you will be like.... "WAH insurance company cheat me...told me dont need to pay, now i need to pay". before you go there... when you bought the insurance, what you buy is the company pay RM3,000 on your behalf, NOT RM3,600. so they pay you according to what they charge you also.

so is the premium waiver still important? some view it as yes... at least you dont have to pay that RM3,000.

BUT they only pay if i kena late stage CI or TPD, when i'm like "one leg into the coffin". is it valuable? Let me explain who this is for... the idea of a premium waiver is that if you are sick or TPD, you dont need to pay premium on your own as you may be unable to work or bear the financial burden. but if you are NOT that sick, that also means eventually you will be able to work again, earn a living and continue to pay premium.

so there's a reason why most company premium waiver covers late stage CI and not early stage CI. anyway, everything has a price, even if another company say, "OK, we cover for early stage CI", that just means consumer pay more

higher probability of happening means higher chance insurance company need to pay a claim means it's more expensive.

insurance company not a charity...

Jargon: Late Stage CI means more serious CI condition, this is the simpler coverage. Early Stage CI means not as serious but still serious, usually insurance companies now have the option to attach Early CI coverage but not for their premium waiver, just if you want a lumpsum pay out upon this early stage CI.

---EXPLANATION OVER-----

Are you 100% certain on this? I have purchased a policy at RM3,000 and now paying RM3,440 per annum. There is a Premium Waiver Extra rider. Are you 100% certain this is limited only to the RM3,000 initially? Wouldn't the PWE rider cost increase once I had begun paying higher premiums?

Or are you referring to a situation where the premiums are increased AFTER you kena TPD/CI and have been claiming from the PWE?

Apr 29 2021, 07:46 PM

Apr 29 2021, 07:46 PM

Quote

Quote

0.0242sec

0.0242sec

0.82

0.82

7 queries

7 queries

GZIP Disabled

GZIP Disabled