Thanks for New Thread.

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Jan 31 2021, 03:52 PM Jan 31 2021, 03:52 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

35 posts Joined: Feb 2012 |

Thanks for New Thread.

|

|

|

|

|

|

Jan 31 2021, 04:01 PM Jan 31 2021, 04:01 PM

Return to original view | Post

#2

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(Pohziliang96 @ Jan 31 2021, 03:41 PM) New thread wow Pohziliang96, medical card alone is incomplete. If single status, is crucial to ensure financial independent even during critical conditions like C.HA.S ( Cancer, Heart Attack, Stroke) etc. After hospital treatment cost paid off using medical card, these conditions may force us to stop working or unpaid for certain period (3-5yrs).If I’m gonna be alone forever(no kids, wife), should I buy life insurance? Or medical card is enough? This post has been edited by KLlang: Jan 31 2021, 04:03 PM |

|

|

Feb 1 2021, 08:17 AM Feb 1 2021, 08:17 AM

Return to original view | IPv6 | Post

#3

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(TaiGoh @ Jan 31 2021, 08:19 PM) Hi guys, TaiGoh, yes, high deductible is cheaper but the premium amount saved is not significant compare to a RM300 deductible for age 32. Also, every upgrade/ lower deductible in future is subject to 120 days waiting and 2 years contestability period.Currently holding a SmartProtect Essential with SmartMedic Xtra plan with Great Eastern since 2012. Thinking to spend some time to review the insurance plan that I bought because normally I just follow what insurance agent suggested. Currently is 32 years old, working low risk job, non-smoker. Want to ask a few questions hope sifus here can clear my doubts: 1. If my company provide a company medical card with 80k annual limit, is that okay to sign up for deductible plan with deductible 80k for example? I assume I can change plan in the future to non-deductible plan without issue right (For example when I retired)? 2. Just wondering is there a way we can 'DIY' to compare the plans offered by different companies, or we straight talk to agent and ask for quotation then compare? 3. Personally prefer Prudential or AIA over Great Eastern. Just wondering is that still worth to switch since I already holding a policy with Great Eastern? I assume the benefits, premium, and claiming process should be almost the same across these three companies right? 4. What is the recommended R&B, I assume RM150 will be too low and RM200 onwards should be acceptable right? Thanks a lot! This post has been edited by KLlang: Feb 1 2021, 08:19 AM |

|

|

Feb 1 2021, 11:41 AM Feb 1 2021, 11:41 AM

Return to original view | IPv6 | Post

#4

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(MUM @ Feb 1 2021, 08:46 AM) Thanks for the inputs. MUM, the variance is only about 400-800 per year for a 2mil medical card. the deductible is 75k. use simple math 400 vs 75k, which one will you take? Btw, what is the variance In premium per year between a 80k deductible n a non deductible plan for his age? |

|

|

Feb 3 2021, 03:33 PM Feb 3 2021, 03:33 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

35 posts Joined: Feb 2012 |

During pandemic, so far, does insurance company still give guaranteed yearly renewal to standalone medical card holder without underwriting?

Anyone come across this? |

|

|

Feb 3 2021, 09:58 PM Feb 3 2021, 09:58 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

35 posts Joined: Feb 2012 |

|

|

|

|

|

|

Feb 3 2021, 10:08 PM Feb 3 2021, 10:08 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(lifebalance @ Feb 3 2021, 03:44 PM) All medical benefit insurance requires an underwriting unless it's a Guaranteed Issue by the insurance company to you (normally provided you've been with them (the insurance company as a policy holder) for many years with no health issue/claims). Otherwise it's quite impossible. Thanks lifebalance. Not to mentioned new sign-up, my concern is long time existing policy holder with same company. Company are expose to higher risk since customer may recovered from COVID but didn't declare to company. However, there are guaranteed renewal medical card out there as well as non-portfolio withdrawal products. Just not "without any underwriting required". For other health history/ claims, company will receive claim and records from policy holder. But for COVID, customer may recover before yearly renewal and not submit any claim at all since is cover by gov. How agent handle this actually? |

|

|

Feb 8 2021, 04:45 PM Feb 8 2021, 04:45 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

35 posts Joined: Feb 2012 |

I heard AIA 1st covid hospitalization claim is 65k.

This post has been edited by KLlang: Feb 8 2021, 06:04 PM |

|

|

Feb 11 2021, 04:39 PM Feb 11 2021, 04:39 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(clowve @ Feb 11 2021, 02:08 PM) Hey guys, I'm very new to this and have a few questions to ask. Looking at your situation, I guess you have not visit GP nor Hospital to diagnose the condition (lump/ sebaceous cyst).Some background info: I have an insurance plan that is an "Investment Linked Policy" by Great Eastern Life called "SmartProtect Essential 2". As my mother was the one to secure this for me, I am unsure as to what degree this insurance covers me. The agent that sold this to her is her friend and is chinese-speaking and I am unable to communicate my questions. Situation: I have a lump that I have found that I would like to get checked out. But seeing as I am very new to all this, I am unsure how to go about this process or if it is even covered by this particular insurance. The condition is suspected to be a sebaceous cyst but I have not seen a doctor about this as of yet as I am unsure how and where the insurance steps in. I am also concerned as I have been told over the phone that this policy only covers "36 critical illnesses" and offers no coverage on "early detection". This worries me. Questions: 1. Is it possible for process of diagnosis to be covered by this insurance? I'm afraid to be stuck with a preliminary bill prior to actual treatment. Any experienced people, kindly advice. 2. If it is not possible to have the process of the diagnosis covered by the insurance, how do I go about this? Is it possible to go to a GP in say, a small clinic, and then continue onto one of the "Panel of Hospitals"? If the process of diagnosis is not covered, I would like to minimize the costs as much as possible prior to actual hospital admission. 3. What are the necessary information I would need to obtain from the diagnosis phase to progress onto the admission/treatment phase? Which ones will have involvement of the insurance company? Apologies if these are silly questions to some of you. I am very new to this and the entire process has been such a blur to me. Hopefully some of you will be able to help shed some light and guide me. Immediately, you need doctor advise on further examination/ investigation and it's treatment. With these information, then we able to advise you better over the insurance coverage. Concurrently, you can share the summary of benefit here in SmartProtect Essential 2 (SPE 2), there are different medical insurance riders can be attached in the same plan. clowve liked this post

|

|

|

Feb 20 2021, 06:52 PM Feb 20 2021, 06:52 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(ivych @ Feb 20 2021, 07:54 AM) hii do you know any good insurance plans that cover pre existing conditions/illnesses? google isnt helping much:( Hi ivych, unfortunately, pre-existing conditions/illness is fall under general exclusion in all companies. But, do not feel down, there are non-medical underwriting plans available.You may share what the specific pre-existing conditions are, then we may enlighten you here. |

|

|

Feb 20 2021, 07:16 PM Feb 20 2021, 07:16 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(pharaoh5312 @ Feb 18 2021, 06:09 PM) Hi sifu, really new to this so sorry if I sound very stupid (because I am lol) Hi pharoah5312,I'm 24 and wish to buy a medical insurance very soon. I have a few concerns that I would like to be cleared: 1. Which company in the big three (Great Eastern, AIA, Prudential) or any other companies has the easiest claim policy and no drama and no fuss on unable to claim stuff like that. Plus which has also the most hospitals that accept their medical card. Assuming all the other confounding variables that may affect this are standardised/ignored. (example of confounding variables: type of plan i might get, cheap or expensive plan) 2. Do you think if it is worth it to include "critical illness" and "waiver of premium" in the plan? And if I already have the "critical illness" plan should I still get a life insurance? 3. Should I do a full body checkup before I sign up for a medical insurance plan? Or should I not leave any record in any hospitals so that the company won't be able to dig them up Thank you sifus. I'll appreciate any help 1. Do you agree? medical insurance claim involve doctors, hospital, customer, agent and insurance company. It is important for a successful claim shall be done within medically necessary and customary & reasonable charges among all parties above. 2. It is completely depend on an individual needs. 3. Good to be health conscious since young. Check-up done or not in past 6 months, make sure it is properly declare in the proposal. The normal process require check up (if any) is only after proposal sign up and submit. |

|

|

Mar 8 2021, 11:25 PM Mar 8 2021, 11:25 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

35 posts Joined: Feb 2012 |

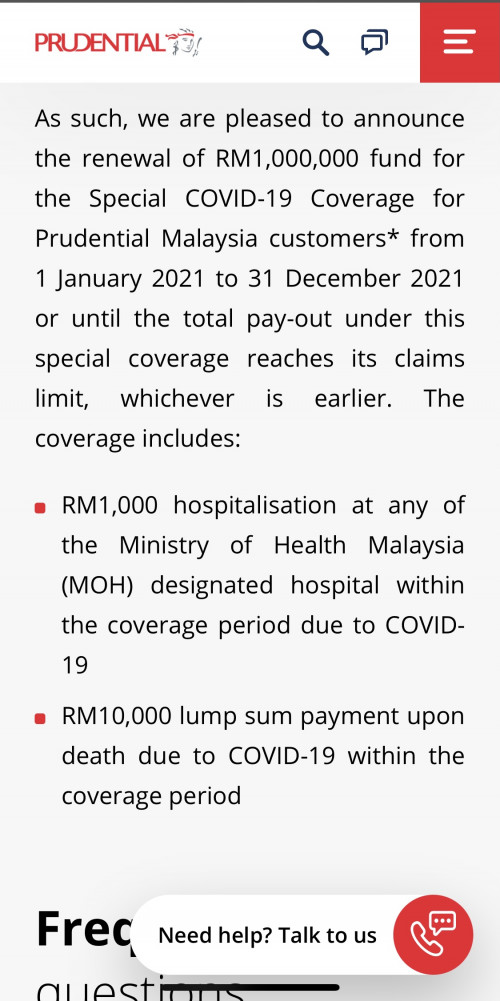

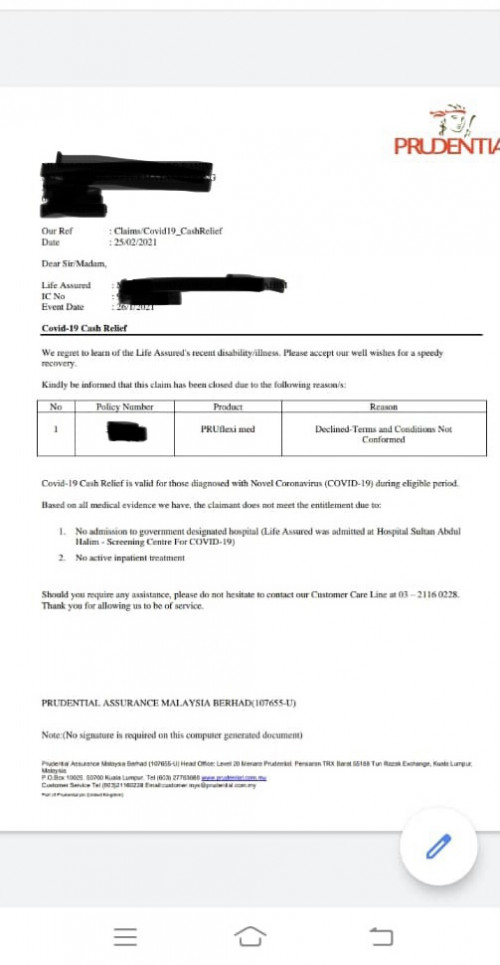

QUOTE(daidragon12 @ Mar 8 2021, 07:10 PM)   Any prudential expert here? My bro claim was rejected on the basis he was not admitted to gov hosp, but to quarantine centre. It is not his choice where he was sent to. Any way can appeal this case? Pretty disappointed of this rule and he never claim anythg in the past 7 years oso. Recently i was admitted because of back pain during lifting heavy object and the claim was denied too. I got all the relevent docs from the hosp. In my 9 years of paying the premium, the only thing i claimed was dengue fever which costed me RM600. Please share is your brother case meeting all these criteria 1. Positive? 2. Require quarantine? If yes, home or center? 3. lung inflammation that require active treatment? Below is the KKM category of covid patient, category 3 and above is claimable. Pelan rawatan bagi pesakit COVID-19 di Malaysia adalah berdasarkan 5 tahap atau kategori klinikal pesakit iaitu: Kategori 1 : Tidak bergejala Kategori 2 : Bergejala tanpa radang paru-paru Kategori 3 : Bergejala dengan radang paru-paru Kategori 4 : Bergejala dengan radang paru-paru dan memerlukan bantuan oksigen Kategori 5 : Pesakit kritikal dengan komplikasi kepada pelbagai organ (multiorgan) reference: http://covid-19.moh.gov.my/semasa-kkm/1120...laysia-27112020 Hope this able to enlighten each other. This post has been edited by KLlang: Mar 8 2021, 11:26 PM tyenfei liked this post

|

|

|

Mar 16 2021, 10:47 PM Mar 16 2021, 10:47 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(kumarz84 @ Mar 15 2021, 05:26 PM) 1y/oDeath/Total Permanent Disability RM100,000 Children Illness RM50,000 Critical Illness (160 illnesses) RM100,000 Personal Accident RM100,000 Accident Medical bill RM5,000 UNLIMITED Medical Card R&B 200 Parent Payor waiver This post has been edited by KLlang: Mar 16 2021, 10:48 PM |

|

|

|

|

|

Mar 17 2021, 10:30 AM Mar 17 2021, 10:30 AM

Return to original view | IPv6 | Post

#14

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(guanteik @ Mar 17 2021, 09:35 AM) Thanks for the information; in fact my memory served me wrong, there's no such thing as guarantee returns after reviewing the policy again. Before making any decision or changes, is highly recommended to get a professional review/ 2nd opinion.Unfortunately, with this high premium I am paying for Allianz insurances (8 premiums for 4 persons!) but getting horrible returns is something I want to get rid of. Thanks again. |

|

|

Mar 22 2021, 05:46 PM Mar 22 2021, 05:46 PM

Return to original view | Post

#15

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(ragk @ Mar 22 2021, 05:32 PM) I have a protection plan from AIA (A-Life Signature Beyond), it cost me 1.3k per month, already paid for around 2.5 years. ragk,Recently i review my financial status and i realize the cost of this plan was build up from A-Life Signature Beyond-RM555 + A-Plus CriticalReset-RM759 per month. The initial motive i bought this plan was for the 500k protection (A-Life Signature Beyond) for my family, i do aware i have the reset plan, but i didn't aware that it cost more than my main protection. So it came to my mind to cancel this plan (i dun mind the sunken cost) and go for pure protection, because 9k per year just for reset is too much imo. But on 2nd though, i already paid for the 2 years 50% premium, if i continue to pay what im paying now, but withdraw 9k from my account every year, will the the reset plan still sustain? Is this approach possible instead of cancelling it? A-Plus CriticalReset is an optional rider that can be attached to A-Life Signature Beyond regular premium Investment-Linked Insurance plan. Is a unit deducting rider that pays the coverage amount in the event you are being diagnosed with any one of the 39 critical illnesses. It is up to 200% payable sum assured for Stroke, Cancer or Heart Attack, thereafter the coverage shall terminate. It is a pure protection on top of death coverage. ckdenion liked this post

|

|

|

Mar 22 2021, 10:12 PM Mar 22 2021, 10:12 PM

Return to original view | Post

#16

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(ragk @ Mar 22 2021, 06:13 PM) ok understood, thanks! ragk,Yes it's an additional protection, if i understand correctly, the reset grant me protection twice (which mean i still entitled for protection if 2nd illness were discovered). But the reset payment alone is more than my main plan. Yes. If it is not what you want, you can contact the servicing agent to remove the reset rider itself. This change normally will not affect the basic death coverage. This post has been edited by KLlang: Mar 22 2021, 10:13 PM |

|

|

Mar 23 2021, 06:42 AM Mar 23 2021, 06:42 AM

Return to original view | Post

#17

|

Junior Member

35 posts Joined: Feb 2012 |

|

|

|

Mar 23 2021, 11:04 PM Mar 23 2021, 11:04 PM

Return to original view | Post

#18

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(ragk @ Mar 23 2021, 04:35 PM) I know i have CI coverage, but misunderstood on the combination ragk,i tot my plan is A-Life Signature (Accident + Death + disablility + CI) + CriticalReset (Reset only), but actually is A-Life Signature (Accident + Death + disablility ) + CriticalReset (Reset + CI) usually i like to ask around, whos know what she might hiding from me, and also getting different opinion from diff ppl often giving new insight If only A-Life Signature basic sum assured (BSA), it only cover death and total permanent disability. It also provide indemnity of BSA x2, x3, x4 or x6 for accidental death, public transport accidental death, oversea accidental death and natural disaster accidental death if I'm not mistaken. NO personal accident (PA) nor accidental medical reimburse coverage. CriticalReset rider cover 39 CI. It also has a Reset feature that restores the coverage back to 100% after 3 years from the date of diagnosis of a critical illness or covered surgery in which the rider coverage amount is fully claimed. The restored coverage amount will only be payable upon Stroke, Cancer or Heart Attack, hereafter the coverage shall terminate. |

| Change to: |  0.0249sec 0.0249sec

0.45 0.45

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 11:58 AM |