Thanks for the thread, i learnt alot of things in this few years about insurance than i would have from my insurance buddies since childhood

appreciates all the contributions made by forummers

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Jan 31 2021, 10:50 AM Jan 31 2021, 10:50 AM

Return to original view | IPv6 | Post

#1

|

Senior Member

8,188 posts Joined: Apr 2013 |

Thanks for the thread, i learnt alot of things in this few years about insurance than i would have from my insurance buddies since childhood

appreciates all the contributions made by forummers |

|

|

|

|

|

Feb 1 2021, 12:03 PM Feb 1 2021, 12:03 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 20 2021, 11:44 PM Apr 20 2021, 11:44 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

8,188 posts Joined: Apr 2013 |

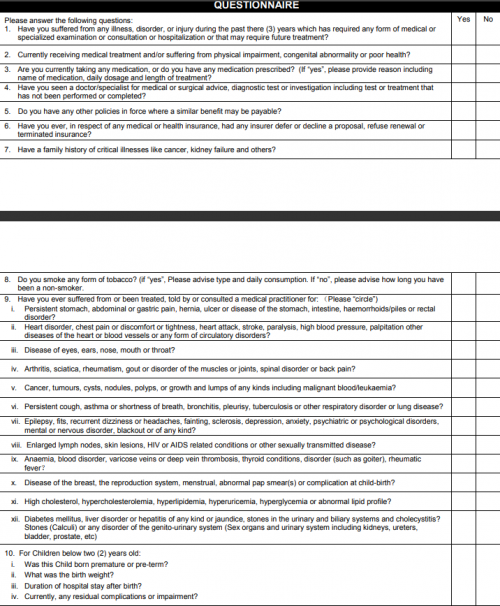

QUOTE(jhodyj @ Apr 20 2021, 09:03 PM) https://www.thestar.com.my/news/nation/2021...surance-company is this being "a material fact"?....is this "sakit perut/sakit kepala" being asked during the coverage proposal?came across this news just now. The lady didnt delcare she has depression when she apply for insurance and few years later, the lady got cancer and insurance company reject her claim because she didnt declare her depression. If i visit clinic because i sakit perut/sakit kepala but i didnt declare when apply insurance, will insurance company reject my claim if i am hospitalized in the future? is the material facts a material facts when NOT asked in the application for coverage form? QUOTE(lifebalance @ Apr 20 2021, 10:57 PM) The issue is not about the cancer critical illness payout but rather; the issue of non-disclosure. Insurance Contract runs on Principle of Utmost Good Faith. What is the principle of utmost good faith? 1. The principle of utmost good faith, uberrimae fidei, states that the insurer and the insured must disclose all material facts before the policy inception. 2. Facts which may enhance the level of risk are called material facts. 3. The insurer or insurance company needs to declare all public disclosures and investment strategies while the insured needs to declare health condition, family medical history, lifestyle, food habits, smoking and alcohol history etc. 4. In case of non-disclosure or misrepresentation of material facts, the policy can be considered null and void. 5. This principle applies to both life insurance and general insurance policies. The insurance company could have choose to NOT accept the applicant's application back then if she had declared all her health status for the insurance company to consider her application whether to accept her risk or not. below is an expanded explanation by Limster88 on the Principle above. ---------------- With that being said, as long as you can answer the questions below truthfully, there should be no problem  |

|

|

Apr 21 2021, 12:02 AM Apr 21 2021, 12:02 AM

Return to original view | IPv6 | Post

#4

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

May 18 2021, 03:22 PM May 18 2021, 03:22 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(RigerZ @ May 18 2021, 03:01 PM) Did anyone have their medical premiums increased recently? had been going on for some years already...https://www.nst.com.my/news/nation/2021/05/...urance-policies there is even an active thread about it.... medical insurance cost sudden increase 29%, normal !? https://forum.lowyat.net/topic/4753108/+180 |

|

|

May 20 2021, 10:30 PM May 20 2021, 10:30 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(guanteik @ May 20 2021, 10:04 PM) Thanks! Obviously we are referring to legit claims. Have you been able to read the news of GE recently rejecting legit claims? there are 2 policies in questions for that casei think the policy holder did not fully disclose the herself. 1 policy was after the contestability period while the other was still within the contestable period. she win 1 policy while the 2nd policy was under hearing last month....any news of the 2 policy case? |

|

|

|

|

|

Jun 7 2021, 05:03 PM Jun 7 2021, 05:03 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Oklahoma @ Jun 7 2021, 04:41 PM) guys need your help this 400 is presumed to be per year?should I cover until 99 years old, but in return pay more premium... or just cover until age 60, and in return pay less premium.. need your help which one is the more logical choice.. my current idea is, I cover until age 60 only, then from 60 onwards, use my own investments to cover medical...since 60 years old my debt should be paid off. that additional 400-500 ringgit I saved, could be invested and self-insure by the time im 60 and up.. if you had started at age 20, you saved that RM400 amount for 40 yrs at a ROI of 6%pa.... it will just be about 70k at age 60?? from age 60 to 99 yrs has 39 yrs years of possible medical issues,.....this <70k enough to cover? (excluding the medical inflation rate factor) Attached thumbnail(s)

|

|

|

Jun 7 2021, 05:12 PM Jun 7 2021, 05:12 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Oklahoma @ Jun 7 2021, 05:08 PM) Per month...I don't exactly know much more more I need to pay to cover the additional 39 years..but I assume is a few hundreds more each month.. if 400 pm MORE then would be 5k more per annum....that means the amount to be covered for this annual premium of X value + 5k more is very high.... |

|

|

Jun 29 2021, 10:39 AM Jun 29 2021, 10:39 AM

Return to original view | IPv6 | Post

#9

|

Senior Member

8,188 posts Joined: Apr 2013 |

Do take into consideration that there are high chances of premium increase every few years.... For the medical plans.

|

|

|

Jul 27 2021, 08:53 PM Jul 27 2021, 08:53 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(MUM @ Jul 27 2021, 08:37 PM) and also does this "benefits" has any sort of "coverage effect expiry date" or until total targetted pool of money being used up? AIA MALAYSIA OFFERS TWO FREE COVID-19 COVERAGE TO HELP EASE MALAYSIANS’ CONCERNS 08 June 2021 https://www.aia.com.my/en/about-aia/media-c...s-concerns.html from this A-Plus Health Medical Protection link https://www.aia.com.my/en/our-products/medi...lus-health.html mentioned,.... EXTENSIVE COVERAGE FOR COVID-19 Under this medical plan, you will receive extensive coverage for COVID-19. If you were to experience any side effects or complications from taking an approved COVID-19 vaccine that requires hospital admission, you will be covered for the cost of your medical treatments. Our COVID-19 coverage also includes hospitalisation in the event you contract COVID-19, whether it is an admission to a government or private hospital, as deemed necessary. will it meant non side effect not covered?? |

|

|

Aug 2 2021, 07:06 PM Aug 2 2021, 07:06 PM

Return to original view | Post

#11

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(1tanmee @ Jul 31 2021, 12:14 PM) Called up my agent (Great Eastern), and she said cannot do! because my policy is 3rd party, not 1st party. I was like, what?? She say like forever the policy will be under my wife's name, and in case of her demise, the policy shall lapsed. any one has any idea and can elaborate more in simple layman terms,Question is, is there any other way? what is 3rd party and what is 1st party in life/health insurance? for vehicle insurance,...i think i know,...but for life/health insurance?...i am like what?? too thanks This post has been edited by yklooi: Aug 2 2021, 07:07 PM |

|

|

Aug 2 2021, 09:18 PM Aug 2 2021, 09:18 PM

Return to original view | Post

#12

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(mini orchard @ Aug 2 2021, 09:07 PM) A contract between the two persons is referred to as a contract between 2 parties. Party A and Party B. thanks for the explanation,...When a 3rd person appeared in the contract but without any contractual duty, then he is considered a thirty party. Eg. I bought a policy for my children. I am the policy owner and the 1st party and will pay the yearly premium. My children are the 3rd party. The insurance co is the 2nd party who will pay a claim for any injury or medical claim. The money goes to the policy owner and not the 3rd party. 3rd party dont have contractual rights. The above is my opinion and a simple explaination and one must further read the contract tnc for additional or exclusion terms. All employees under a company insurance are considered 3rd party. Any claims money goes to the company. in your example,... Eg. I bought a policy for my children. I am the policy owner and the 1st party and will pay the yearly premium. My children are the 3rd party. The insurance co is the 2nd party who will pay a claim for any injury or medical claim. The money goes to the policy owner and not the 3rd party. (same situation i am having too...) so in this case, can i pass this policy to my children when they are working while i am not?......some thing like mentioned "absolute assignment"? |

|

|

Aug 2 2021, 09:29 PM Aug 2 2021, 09:29 PM

Return to original view | Post

#13

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Aug 2 2021, 09:51 PM Aug 2 2021, 09:51 PM

Return to original view | Post

#14

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(mini orchard @ Aug 2 2021, 09:40 PM) I am also curious. Let me share another old GE experience. thanks for telling.My spouse bought a life policy and named her mother as a beneficiary. When she wanted to change the beneficiary, they reject her application indicating cannot be done. Not sure of the exact reason then but they did mention is stated in the policy. So I am trying now to dig out the old policy (oredi surrendered) after reading 1tanmee case. Hope is still somewhere in the storage room. During that time, was naive and just listen what was told. my concern now is i had some ING>AIA insurance which i bought as a policy owner for my children and spouse......hopefully can use "absolute assignment" to change it years later when they can pay for their own. hopefully 1tanmee can find out what is the actual reason for not able to....other than the 3rd party thing wow,...now there is your 'OLD" case of cannot change to another beneficiary ,......wish you can manage to get the old policy and tell about the clause that mentioned "cannot be done" |

|

|

Aug 2 2021, 09:58 PM Aug 2 2021, 09:58 PM

Return to original view | Post

#15

|

Senior Member

8,188 posts Joined: Apr 2013 |

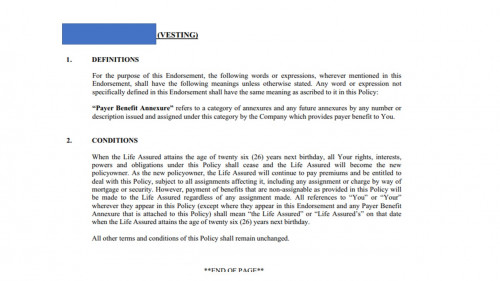

QUOTE(Ewa Wa @ Aug 2 2021, 09:51 PM) Dear YK looi, so if before 26 yrs old or lets say at 20 when my children started to work and had money of their own....can i use "absolute assignment"if talking about child policy. Your are the policy owner and ur child is the Life assured. in the policy contract we called it "Vesting Clause" when the child reaches 26yo where the payer benefit cease age. Read my print screen from policy contract. is not done by "absolute assignment" but vesting clause. Adult policy don't have this vesting clause only apply on child policy. refer my print screen for more information.  For wan tan mee's case, better refer to ur policy contract and find this statement "if the policy owner death, all her interest, power.. shall transfer to the life assured." Kindly read through the contract to clear ur doubts. Policy contract is much better than all the guessing here.  for 1tanmee case,....what if the policy owner is not yet die, cannot transfer? mind telling what type of insurance are having that now? so as to take note of them and tell my relatives and buddies about it. |

|

|

Aug 2 2021, 10:35 PM Aug 2 2021, 10:35 PM

Return to original view | Post

#16

|

Senior Member

8,188 posts Joined: Apr 2013 |

thanks all,... now i have to consider/keep in mind about Vesting clause, CONDITIONAL ASSIGNMENT and absolute assignment have some topics to ask my agents if i happens to me him... have to ask, why, and when to use and apply for it... 1tanmee liked this post

|

|

|

Aug 6 2021, 11:57 AM Aug 6 2021, 11:57 AM

Return to original view | IPv6 | Post

#17

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Aug 6 2021, 12:10 PM Aug 6 2021, 12:10 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Aug 6 2021, 12:17 PM Aug 6 2021, 12:17 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Aug 14 2021, 10:38 AM Aug 14 2021, 10:38 AM

Return to original view | Post

#20

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(delsoo @ Aug 14 2021, 10:23 AM) Hospitalizations cost in sg with Malaysia medical card.... Preferably with very high coverage.Why not source for it in SG?... Most probably easier to claim n to get follow up on claims documentation |

| Change to: |  0.1572sec 0.1572sec

0.53 0.53

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 09:13 PM |