https://www.thestar.com.my/news/nation/2021...surance-company

From the star today, what do you guys think? Honestly it makes me furious! One anxiety attack has no relation to cancer, can they do this?:

KUALA LUMPUR: The High Court here has recorded a consent judgment between a 42-year-old cancer patient and an insurance company in a RM2.5mil lawsuit she filed against the latter.

In the judgment recorded before Judicial Commissioner Liza Chan Sow Keng here on Monday (March 29), businesswoman Tan Siew Wei and Great Eastern Life Assurance (Malaysia) Bhd achieved a full and final settlement in one of the two insurance policies she is claiming for.

In the settlement, a sum of RM500,000 was to be paid by the defendant to Tan as a full and final settlement of all the claims and demands which Tan has against the defendant, in respect to the particular policy.

Tan, who was diagnosed with Stage 4 cervical cancer in 2019, had sued the company for rejecting her critical illness insurance claims on allegations that she had broken the policy clause with a non-disclosure on her mental state, where she was diagnosed with an anxiety attack in February, 2017.

She is suing the company to claim for RM500,000, which is the basic sum assured from the first life insurance policy, and another RM2mil, the basic sum assured from her second life insurance policy.

The court ordered for the settlement sum to be paid before April 1 and did not make any order as to costs.

Neither party would have any further claim against the other after the settlement is completed. The policy shall be terminated with all the benefits and rights provided under the policy to cease.

Tan's lawyer Ng Kian Nam said hearing for the RM2mil policy continues on April 14.

In the statement of claim filed on Aug 12, last year, Tan said she bought the first policy in 2015 from Great Eastern with a half a million basic sum assured and a monthly premium of RM600 payable for 20 years.

In 2018, she signed up for a second policy with a RM2mil basic sum assured and a monthly premium of RM1,666.70 payable for 61 years.

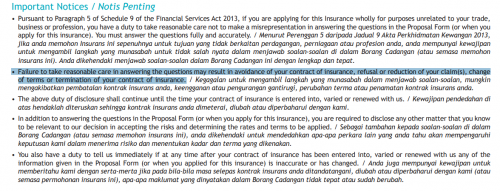

Before entering into the agreement on both policies, Tan said she had truthfully filled in her information in the forms and made full disclosures in line with the Financial Services Act on her health, including declaring that she did not have depression or anxiety at all material times.

On Dec 27,2018, the plaintiff said she gave birth to her fourth child at a private hospital in Cheras and the next year, she was diagnosed with cancer.

She subsequently made insurance claims on critical illness from the defendant, as well as other insurance companies where she had bought life insurance policies.

Tan claimed that all of the companies have compensated her, but Great Eastern had repudiated both her policies and returned her monthly premiums on grounds that she had made a non-disclosure, had a psychology consultation and had been diagnosed with anxiety attack.

In Great Eastern's statement of defence, the defendant said it had assessed and processed the plaintiff's insurance claims and found that the plaintiff did not have the right to the basic sum assured under the policies.

It claimed the plaintiff had a psychological consultation history on April 17,2014.

It further claimed the plaintiff was diagnosed with anxiety attack and was prescribed Xanax on Feb 13,2017.

The defendant claimed that Tan had consulted with another doctor on Feb 16,2017, and complained about an infection in her body.

"The defendant found that the plaintiff had the illness and is aware of the illness as early as February, 2014.

"She, however, failed to disclose the diagnosis, treatment or the illness in her forms," it added.

Great Eastern said it had rejected the plaintiff's claims through its letters dated June 18,2019 and returned her premiums via direct credit.

"Therefore, the defendant's rejection of liability on the plaintiff's claim was valid, lawful and justifiable," it said.

Lawyers Wong Hok Mun and Chris Lim appeared for the defendant in the proceeding.

This post has been edited by adey64: Mar 31 2021, 12:14 AM

Great Eastern rejected critical illness in news, What do you think?

Mar 31 2021, 12:10 AM, updated 5y ago

Mar 31 2021, 12:10 AM, updated 5y ago

Quote

Quote

0.0243sec

0.0243sec

0.47

0.47

6 queries

6 queries

GZIP Disabled

GZIP Disabled