This would be the first time moving to a new thread becomes an issue...

This post has been edited by JIUHWEI: Jan 31 2021, 01:46 PM

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Jan 31 2021, 01:32 PM Jan 31 2021, 01:32 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

1,305 posts Joined: Nov 2008 |

This would be the first time moving to a new thread becomes an issue...

This post has been edited by JIUHWEI: Jan 31 2021, 01:46 PM |

|

|

|

|

|

Feb 11 2021, 01:25 PM Feb 11 2021, 01:25 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(WaCKy-Angel @ Feb 11 2021, 07:45 AM) Because i'm claiming death benefit due to Covid but its under AIA Flex PA. Hi, The agent and AIA says Covid is NOT covered under the 23 infectious diseases mentioned in the brochure, however MERS and SARS (Cov) is in the list, So since the brochure probably was old/not updated im hoping Covid is included. Otherwise i would only get 10K as opposed as 60K (+10K?) for infectious diseases. https://www.aia.com.my/en/help-support/impo...ge-no-cost.html This is the only 10K get for Covid i can claim since it was FLEX PA policy. Even the hopitalisation benefit not able to claim because AIA says it is only for non-death situation. I believe I can help to shed some light on this situation. The nature of a PA policy (Personal Accident) is to cover for events that are accidental. A guide to what qualifies as an "accident" is easy to remember: 1. It is sudden (secara tiba2) 2. It is violent (got blood exit the body) 3. It is external impact (something from outside of your body hit you) As you can see, there are PA products such as the Flex PA that extends its coverage to certain infectious diseases. And that was an extension of its coverage, even though some may not fulfill those descriptions to qualify as an "accident". Do you have a Health Insurance policy or a Life Insurance policy? Maybe our friends here can help you better with those claims. |

|

|

Mar 31 2021, 10:35 AM Mar 31 2021, 10:35 AM

Return to original view | IPv6 | Post

#3

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(adey64 @ Mar 31 2021, 12:33 AM) Any insider can share how insurance know about past medical history if not declared? Eg life insured admitted for minor procedure at Hospital X covered under own company policy and not declare it when apply for his new personal medical card plan. No need for insider... Then in the future he admitted to another branch of Hospital X but with his own medical card this time, can the insurance trace his previous admission from the other branch? Is there a database all the insurance companies shares that know about past treatments? Doctor's report will mention. Quite common sense. |

|

|

Apr 13 2021, 06:33 PM Apr 13 2021, 06:33 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(Hedgychat @ Apr 13 2021, 01:14 AM) Hi all! Would like to ask, how do I decide how long should my insurance sustainability period be? At age 24, the difference of having a policy sustaining between to age 70 and to age 80 is rather negligible (in the grand scheme of things). Most insurance agent that I talk to recommend a plan with sustainability until I am age 70, aka same premium until age 70. But I understand that the fixed premium is sustain frm cash value in the investment link product.. And may need to top up if the funds is finish.. Im only 24yrs old now. If I'm confident in doing my own investment, is it advisable for me to opt for maybe shorter sustainability ie until 50 yrs old, so that I pay lower premium, and use the extra amount for investment so that I can afford the higher premium when I extend my sustainability later on? What are the cons of short sustainability period? If someone can elaborate? Saving the difference would get you... a couple Starbucks drinks a month? I applaud you for being so engaged and involved in managing your finances. But in the context of your question, in your retirement planning and accumulations, would you also include an amount to pay for your insurance needs beyond age 70? |

|

|

Apr 19 2021, 05:58 PM Apr 19 2021, 05:58 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(DragonReine @ Apr 16 2021, 12:56 PM) A question to sifus: That's great! It means your company takes care of its employees!I'm in my 30s currently employed in a company that covers my medical, which I'm unlikely to leave until retirement and the company is powerful enough to be unlikely to disappear/go bankrupt. Is it financially wise and feasible to apply for a medical card when? What are the risks of applying a card when I'm older (say, in my 40s)? With that in mind, I would like to point out that despite having an excellent employee benefit program, we might want to check with HR if the employee health insurance benefit is transferable (which means should you leave the company, can the health coverage be transferred to be continued on an individual basis). I think that's the first thing we want to clarify. Secondly, I'd like to also point out that no matter what age you choose to start your individual medical insurance, we first have to make sure that our health qualifies to be insured, or in other words, are we insurable when we decide to pick up a health insurance? It is only when our health qualifies, then we qualify to purchase a health insurance policy. |

|

|

Aug 6 2021, 12:48 PM Aug 6 2021, 12:48 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(yklooi @ Aug 6 2021, 12:10 PM) Thanks Stage 3 and onwards. Any idea "must" be from what stage of covid19 then can qualify for claims of hospitalisation? Btw, just to confirm,... It is hospitalizations cost not just some amount of beneficial monetary compensation or support like RM10k It is on a pay and claim basis. yklooi liked this post

|

|

|

|

|

|

Aug 6 2021, 02:58 PM Aug 6 2021, 02:58 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(MUM @ Aug 6 2021, 02:03 PM) If diarrhea or headache, prolonged incidences cannot be admitted? Yes of course a diarrhea or headache can be symptoms of more severe underlying illnesses. Covid19 stage 1 or 2 is "minor", cannot lead to complication to other stages? And Covid-19 stage 1 and 2 is considered "minor" and it is also possible that if left untreated, can lead to more severe stages. For a diarrhea and headache, we can take the steps of a Dengue infection. First, we go to the clinic because we're showing symptoms such as (for diarrhea) exhaustion, dehydration, on top of frequent trips to the toilet; (for dengue) fever, exhaustion, pains and aches. Then, the GP may confirm on the condition and in turn refer us to the hospital. That's when we go to the hospital and be admitted based on the GP referral letter, and a further diagnosis by the specialist. For Covid-19, as of now, the hospitals are filled with patients (stages 3 and up) across the spectrum of the variants. As opposed to exposing you to the other, more severe patients (more aggressive Covid-19 variants), it is actually in your best interest to either quarantine yourself either at home or at a hotel... health-wise. I believe rn, we have a choice to quarantine between 1. quarantine centers (i think it's free) is at the lowest tier of comfort 2. Hotel rooms 3. Your own home (highest tier of comfort). Why do I say your own homes is at the highest tier of comfort? - you are with your loved ones. - in the worst case scenario, you are surrounded by your loved ones. - someone who loves and cares for you is right there, all the time. Can we all agree that this is the worst time to be sick and/or die? Proper funerals cannot be held, we will be physically isolated from everyone we know and love.. Whatever rituals you may or may not have in mind will be thrown out the window, replaced by the SOP for death, handled by people who probably do not agree with the SOPs and are exhausted from handling "just another body". Ewa Wa liked this post

|

|

|

Aug 9 2021, 01:04 PM Aug 9 2021, 01:04 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(mini orchard @ Aug 6 2021, 03:42 PM) A simple explaination for a layman to understand instead of shooting insurance terminology. Thank you. I always believed a good agent should go down to level of a layman in explaning things instead of expecting the layman to understand terminology. We are the insured ourselves also, and go through the same procedures as well. This is just some sharing from handling claims over the years. And I believe this info will help a lot of readers here too. |

|

|

Aug 11 2021, 02:42 PM Aug 11 2021, 02:42 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(thisisavatar @ Aug 10 2021, 09:20 PM) Kalau ada 1 yg "best", other companies yg "not the best" boleh tutup semua. Best dari segi harga... yourself. - because the premiums you pay, you pay to yourself. Come time to claim, you claim from yourself juga. Best dari segi coverage... yourself. - because apa2 pon, you won't reject yourself too. Siap cover Covid Stage 1 and Stage 2 juga. Best dari segi conveniece... yourself juga. - Credit card, e-wallet, cash, you won't deny yourself access to your own money in times of need, right? You can check on the various platforms such as ringgitplus or imoney to have a good idea on what products are out there. Then perhaps you can approach the respective insurance company websites to maybe download a digital brochure to understand further too. Should you require further clarifications, then maybe you can scout here to see who are the reps of the respective insurers. Or you can check your social media, see which one of your friends is in the insurance business. Note: Insurance products can be quite sophisticated, and often times come with extra features that may work to your benefit in more than 1 aspect of your finances when optimized. |

|

|

Aug 16 2021, 11:00 AM Aug 16 2021, 11:00 AM

Return to original view | IPv6 | Post

#10

|

Senior Member

1,305 posts Joined: Nov 2008 |

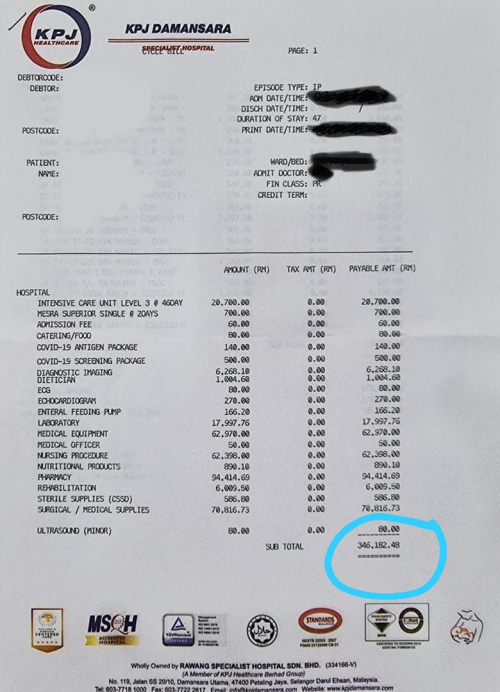

QUOTE(ping325 @ Aug 15 2021, 11:06 AM) bro...these are case to case basis.... The picture you uploaded... let me share you a real life example.... Scenario 1 - real case of my friend in negeri sembilan A close friend of mine get covid positive , he also have insurance plan with prudential. when he admitted to hospital , doctor say he is just mild case nothing to worry about...just quarantine at home. but he die die want to be admitted , he say he pay himself he just want to make sure 100% treated. He is panic and scared to die , he worried that his stage will escalate to stage 3 or 4. Well, of course doctor welcome him , since he mentioned self pay. THEREFORE , THIS SCENARIO CANNOT CLAIM INSURANCE ALREADY. he just panic and dont want to die... he stays around 1 week and total bill around 60k. Will the bill amount same when claim using medical card ? Scenario 2 Someone kena covid and private hospital say he need immediate treatment then different case. later on the bill charged 200k , for this case can be claim by prudential as long as the covid coverage promotion still ongoing. claim limit is according to the limit of medical card you bought. whether it is cashless or reimbursement ? i advise standby cash first if suddenly cashless cannot use ------------------------------------------------------------------------------------------------------------------------------------------------------------------- The screenshot of the 300k is very brief , we cant just judge the book by its cover. it can be the customer pay himself and he want the best treatment and budget not an issue , so hospital charge gao gao full-fledged servicing. when it comes to use medical card , it is subject to necessary treatment ONLY. So back to your question : Is there any medical card willing to cover this amount? For prudential , yes , subjected that is it necessary covid treatment & the covid promotion still ongoing. *subjected to cashless or reimbursement basis  That is the sub-total. As clearly stated in the picture that went viral and you chose to upload The actual total is over 600k. Yes, the person paid it himself. After all, he was hospitalized for close to 2 months consecutively. Just for education sake, KKM has been playing an active role in managing and regulating ceiling prices that private hospitals can charge for whatever services or procedures. Should there be unreasonable charges, you can actually call up the hospital and have it reversed or refunded. Your statements seem to undermine the ministry's efforts and also subject to libel and slander against KPJ Damansara Hospital (which my customers frequent and I have a good working relationship with members of its staff). May I so humbly suggest (with your best interests at heart) that you either amend or remove your posting above. ckdenion liked this post

|

|

|

Aug 16 2021, 01:32 PM Aug 16 2021, 01:32 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(mini orchard @ Aug 16 2021, 11:54 AM) How would a patient know the charges are not reasonable ? If patient claim using medical insurance through the hospital, the insurance company (this is standard across all insurers) will have its own medical team to assess the itemized billing to ensure it makes sense before approving the guarantee letters. So patients won't have to worry about such issues. Can a patient request for a review based on a 'similar' treatment of another hospital charges ? If patient pay it themselves, the patient can check it with the hospital billing first before bringing it up to consumer rights groups. It is not rare to have charges reduced, but they are done on a case-by-case basis. Apart from that, some logic and common sense la. For example an elderly female patient goes in for a knee surgery. As part of the diagnosis, a pap-smear was done and charged to the patient. Not logic la. On top of that, should the patient make a claim on the insurance policy and there are items that were not payable or rejected, patient can query the hospital. My team and I have made several successful attempts at reversing such charges over the years. |

|

|

Aug 16 2021, 03:21 PM Aug 16 2021, 03:21 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

1,305 posts Joined: Nov 2008 |

|

|

|

Aug 16 2021, 05:46 PM Aug 16 2021, 05:46 PM

Return to original view | IPv6 | Post

#13

|

Senior Member

1,305 posts Joined: Nov 2008 |

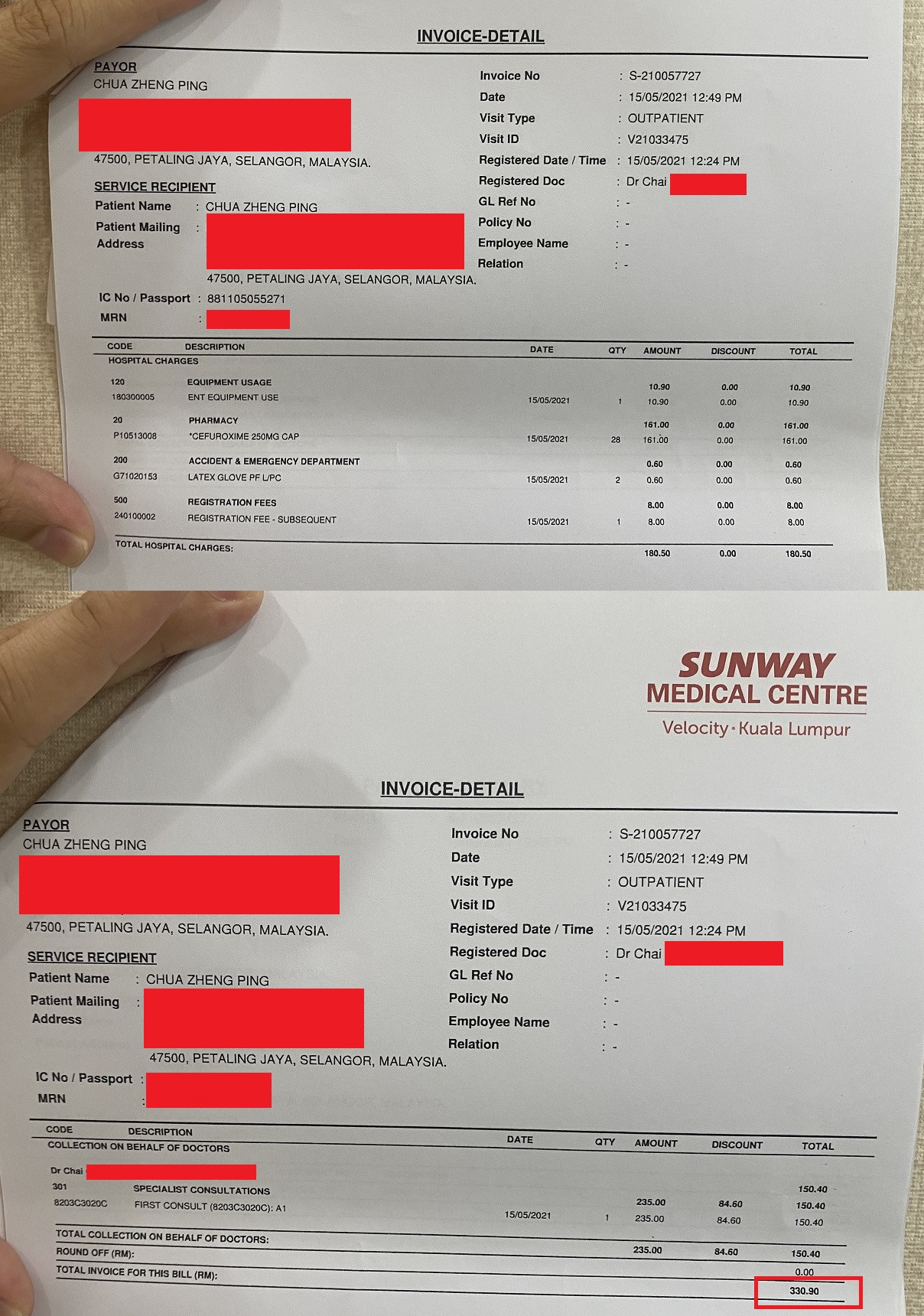

QUOTE(ping325 @ Aug 16 2021, 04:44 PM) hi jiunwei , thanks for the heads up , i edited the post regarding the screenshot address to super911 post. My friend, the issue is not regarding consent but rather your smear campaign against private hospitals and the doctors working in said private medical facilities. ----------------------------------------------------------------------------------------------------------------------------------- Regarding my earlier post: The screenshot of the 300k is very brief , we cant just judge the book by its cover. it can be the customer pay himself and he want the best treatment and budget not an issue , so hospital charge gao gao full-fledged servicing. when it comes to use medical card , it is subject to necessary treatment ONLY. Modified post : The screenshot of the 300k is very brief , we cant just judge the book by its cover. it can be the customer pay himself and he want the best treatment and budget not an issue , so hospital charge gao gao full-fledged servicing with prior customer consent. when it comes to use medical card , it is subject to necessary treatment ONLY. ----------------------------------------------------------------------------------------------------------------------------------- Very sorry , i didn't elaborate clearly and deep enough. Maybe i share my bill recently which i walked in to sunway velocity. And also my friend who self paid for covid admission , billed 60k for 1 week stay. [ both self pay ] During May 2021 ,I'm having a mild tonsillitis & i decided to walk in private hospital for treatment, i already know it is not covered under medical card. I do not want to go to clinic and want a proper ENT specialist consultation. Yes agreed that each of the itemised item billing is standard & according to KKM ceiling prices. Itemised charges also reasonable. The difference is the doctor keep pushing me to add more itemised item during consultation, which will make the bill sky high if i didn't rejected. Inside consultation , he did mention normal medication with one week rest at home will be ok normally , but i have to endure the pain. Afterwards , he offered me if i want to treat it immediately by giving me more expensive pharmacy item + Tonsillectomy if i really don't want to endure the pain. Is it medical necessary ? he says nop for now but it is best if I have budget for it to make sure everything 100% cured immediately. The doctor actually show me all the itemised billing inside room from his pc, before i agree and consent to go for it. The bill was like few hundred vs 20k...in the end i choose few hundred. If I'm a millionaire of course i would have go for 20k. For my friend case, he don't have budget issue and want the best treatment for covid. Already pre-mentioned to the doctor. Therefore, she almost ticked all itemised options including priority equipment usage , good meal and good solo room to stay. She get billed for 60k ( non ICU stay , stage 2 ) for one week only. [Self pay-voluntarily admission]  Consultation is pretty much standard , the killing part is hospital charges where it can be added up until very long itemised which makes the bill very expensive. Yes, stronger medication and/or some procedures can cut short your recovery. It comes at a price too. The doctor is giving you advice based on his profession, and the option is up to you. I believe the doctor's advice is quite fair from what you stated above. It goes on to show how much our gov is subsidizing our general hospitals, considering foreigners take Malaysia as a healthcare tourism destination of choice! I don't think we get to choose what items to consume in a hospital, other than maybe type of room and personal hygiene kit, etc. The necessary services are ordered by the doctors as well as the tools and venues required for whatever procedures/treatments to be carried out. I doubt we can anyhow tell the doctors and nurses which ones to omit. Regarding Covid-19 admissions, I doubt there is any shared room in private hospitals for Covid-19 admissions, of any stage. Again, my friend, I believe it is in your best interest to remove your posts smearing the good work that our friends and colleagues in the private medical practices are doing. There has been so much progress away from the malpractice that you are implying, by both the ministry as well as private sector and their service providers. To wipe out years and years of mutual effort and progress... I think it is quite unfair. |

|

|

|

|

|

Aug 19 2021, 04:44 PM Aug 19 2021, 04:44 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

1,305 posts Joined: Nov 2008 |

|

|

|

Aug 21 2021, 11:18 AM Aug 21 2021, 11:18 AM

Return to original view | IPv6 | Post

#15

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(ckdenion @ Aug 20 2021, 05:20 PM) hi stevenX, your GE friend is just simply giving you inaccurate info. I'd did claims for AIA, Allianz, AXA, GE, HLA, Manulife and Prudential, so far there's nothing about "very hard to claim" issue. also the 100% claimable might be a lil misleading as well, not everything is claimable and subject to reasonable charges as well. just make sure you approach an agent that you trust the most first. Yes, the above is accurate. Items in a Covid-19 bill such as the PPE worn by the doctors and nurses cannot be claimed. Personal hygiene kits are also not claimable. Every insurer will require the same things when processing a claim: 1. Original receipts 2. Itemized billing statements 3. Claim form 4. Medical report 5. Physician's statement 6. Insured banking account details And all the above, make sure that the insured's signature is consistent as well. Should the insured be unable to perform a signature due to his/her current condition, a thumbprint will suffice as well. ckdenion liked this post

|

|

|

Aug 22 2021, 01:05 PM Aug 22 2021, 01:05 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(ckdenion @ Aug 21 2021, 03:30 PM) thanks for the additional info, bro. just want some clarification, if admission due to covid, is the covid related items say PPE suit, face mask, face shield claimable? i know if admission/surgery due to non-covid, those are not claimable. what about if it is due to covid? Even if its due to Covid, those are not claimable as well. It is unfortunate that those items are deemed not claimable, with the reason being those gears are essential to protect the medical service providers, as opposed to necessary for the well-being of the patients. Our unions brought it up against the company last year and this was the reply, which despite being a bitter pill to swallow, it is in-line with policy wording. AIA being the only insurer that does not exclude coverage on diseases requiring quarantine by law, it is already a blessing in disguise. However, we do our best to social distance, limit our outdoor exposures, and continue to cater our level best on platforms such as this, for everybody's benefit. In times such as this, helping each other is essentially helping ourselves too. I am actually very grateful to forum contributors like yourself, providing accurate info and advice without prejudice, and embodying the whole person concept of the MDRT. |

|

|

Aug 23 2021, 10:03 AM Aug 23 2021, 10:03 AM

Return to original view | IPv6 | Post

#17

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(mini orchard @ Aug 22 2021, 03:08 PM) The insurer cant expect the doctors to perform 'naked'. Is not only to protect the medical officers but at the same time to further protect the patient from any further infections by 'outsiders'. Yes, such argument was brought up during the meet. If the patient gets further infection, it will only prolong the stay and the claim will shoot up. Is like saying in a one to one meet only 1 requires to wear mask. Based on the insurers reasoning, then is better for the patient to wear to quicken the recovery. The insurer is not expecting the doctors to perform 'naked' as you say. The insurer does not have jurisdiction in that subject, that is up to KKM to decide. Yes, we are the ones receiving treatment. However, the principle of indemnity does not extend to include cover for preventive measures, including masks, mobility support, and vitamin supplements, nor are they responsible for how a hospital is run. The customer to provide coverage for is you and me, not the hospital and its faculty. All SOP measures have been announced by the government to mask up, social distance, sanitize, and stay home. And I have also mentioned here before, this period is the worst period to get sick and die because in some districts and states such as Selangor, even when we die, burial will be carried out according to SOP. Our loved ones will hardly be given the opportunity for a last visit, let alone a funeral according to any of our wishes. In fact, insurers have been looking for ways to do more for its customers. Among the initiatives pre-pandemic, is to not require a physical medical card at all major private hospitals anymore. Did you know you can just pass your IC over to hospital admin and just mention your insurer, and the hospital will be able to link up with your insurer from their insurance portal? Furthermore, few insurers are also running programs like AIA Vitality to reward their customers for staying active and making healthy lifestyle choices such as attending to annual health-checks. Getting vaccinated is now also part of the point-based reward system in AIA Vitality. It is obvious that there is relatively very little study on the Covid-19 disease, and the covered items on the insurance side is also less than ideal at the moment as pointed out. But with more data and reference points, we should see progress and further fine-tuning with regard to the overall handling and management on Covid-19 treatment and subsequently an improved claims experience in due time. |

|

|

Aug 24 2021, 02:12 PM Aug 24 2021, 02:12 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(ffsynx @ Aug 24 2021, 09:07 AM) Good day everyone, I was quoted below with monthly premium of RM317: A-LIFE IKHTIAR FULL PAY@70 | Coverage amount:RM50K A-PLUS DISABILITYCARE-i | Coverage amount:RM50K A-PLUS CRITICALCARE-i | Coverage amount:RM30K A-PLUS CONTINUATOREXTRA-i | Coverage amount:RM4K A-PLUS TOTAL HEALTH | Coverage amount:RM1.5mil A-PLUS MEDICARE-i | Coverage amount:RM0 Background of myself: Male, Non-Smoker, 33 y.o, IT industry Is this a standard premium for the above coverage? QUOTE(adele123 @ Aug 24 2021, 01:17 PM) You need to balance between how much you need vs how much you can afford. If you worry that this sounds expensive, you can ask other agents to quote similar coverage and see what is the pros and cons. You have to be careful that if someone else say they are cheaper, are they really cheaper but actually the policy cant sustain until end of term. It is often a price issue on the consumers end when such a post comes up. You are talking about premium but are you considering if you are having enough coverage? If CI is only 30k, is that enough for you. Or death coverage 50k, is that enough? If not enough, how will you address the difference? From among the most common intentions are: "Is the agent cheating me?" "Am I being conned?" "Is there a better rate elsewhere?" And it is equally common that consumers end up with quotations such as the above. As what adele123 pointed out, perhaps you want to consider a meaningful sum of coverage as opposed to having a wide range of coverage but of insignificant value. Frankly, your policy looks like you're trying to get crumbs of everything. It is usually a result of poor fact finding and a lack of objective. Kindly reconsider. |

|

|

Aug 24 2021, 02:39 PM Aug 24 2021, 02:39 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(BacktoBasics @ Aug 24 2021, 02:29 PM) hey guys, I bought medical card from a friend's friend who is an agent for AIA. With the MyAIA customer portal, you can track your claims status in real time as well as perform certain changes and updates on your own. I am not happy with this agent's services as this agent is usually hard to be contacted and less than willing to help me with my queries on the claims. Any idea on how to change agent for my policy? Is there any drawbacks on doing so? How would her commission from me will be transfered to the new agent? You may register at https://www.aia.com.my/en/my-aia/myaia-login.html |

|

|

Aug 25 2021, 02:01 PM Aug 25 2021, 02:01 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

1,305 posts Joined: Nov 2008 |

QUOTE(avelian @ Aug 25 2021, 11:51 AM) I have a question if im not sure anyone can answer. Assuming a person has passed away, is there a way i can find out what insurance company he has insurance with? I checked out life Insurance Association of Malaysia and they said that i have to call each company. Any other way apart from that? Thank you 1. Call up each insurance company, provide the IC number of the deceased to check for any active policies like what others here have mentioned. 2. Mention that the deceased has deceased, on what date. (Some insurers won't even layan if you are not the policyholder) If there is an active policy, during this MCO period, it is likely that you will need to make an appointment with the service center, and the CS rep will require you to bring these documents: 1. Death Cert of the deceased 2. Proof of relationship (between you and the deceased) 3. Police report and/or death report (report from doctor who pronounced the patient dead) 4. Post-mortem report (stating cause of death) At the service center, a death claim form will have to be filled out. The CS rep will assist with this. May the lord comfort you during this difficult time. |

| Change to: |  0.0364sec 0.0364sec

0.30 0.30

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 03:42 PM |