» Click to show Spoiler - click again to hide... «

QUOTE(lifebalance @ Sep 11 2022, 10:20 PM)

Your question doesn't seem to have relevance.

1. What does fund value to 80 years have to do with comparing with term insurance?

2. What does your argument on ILP being treated as a term insurance has relevance with a guarantee renewal policy?

3. What is being wasted?

4. Your ending statement saying your agent's opinion that 30 to 40 years later, doesn't matter if the ILP has sufficient fund value or not.

What is he right about? And as compared to what fact is your agent opinion referring to?

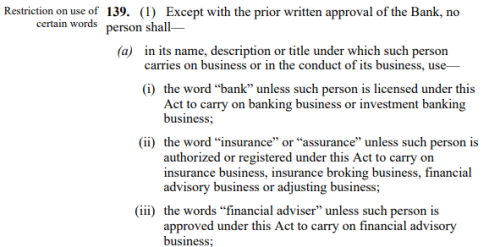

I have two proposals here, both having same insurance premium RM2640 p.a., 1 with Excess / Co-insurance another don't

What puzzled me was that the both policy despite having huge difference of life / TPD coverage RM100K vs RM15K, their self sustaining year (in blue font colour below) will end at about the same time after the policy commencement year.

47th year or 45th year under Scenario Y (2% p.a.)

55th year or 57th year under Scenario X (5% p.a.) Why or should I ask sifu here, is this normal? Or the agent can easily propose something that last longer by having other things cut or raise my expected premium ?

Policy 1:

Basic TokioMarine-iLifeSecure 2 = 100,000

Rider(s) for Life Assured

AcciShield = 100,000

iComprehensive Critical Iilness = 300,000

iHealth Income 100 / per day

iMediCare = Plan300

Saver/Co-Saver Option

= Co-Saver 10% Coinsurance: Min RM500 MAX RM3000

iLife Waiver Plus

Rider(s) for Proposer iPayor Waiver 19

Total Premium (including SST, if any): 2,640.00

Projected Investment Return Projected Sustainability Years

Scenario Y% per annum (2%/p.a.)

Scenario X% per annum (5%/p.a.)

This table above shows the projected number of years before your policy is expected to lapse due to insufficient total fund value, subject to the provision of No Lapse Guarantee.

Scenario Y% = 47 years

Scenario X% = 55 years Policy 2:

Basic TokioMarine-iLifeSecure 2 = 15000

Rider(s) for Life Assured

AcciShield = 15,000

iComprehensive Critical Iilness = 300,000

iHealth Income 100 / per day

iMediCare Plan 300

Saver/Co-Saver Option = None

iLife Waiver Plus

Rider(s) for Proposer iPayor Waiver 19

Total Premium (including SST, if any): 2,640.00

Projected Investment Return Projected Sustainability Years

Scenario Y% per annum (2%/p.a.)

Scenario X% per annum (5%/p.a.)

This table above shows the projected number of years before your policy is expected to lapse due to insufficient total fund value, subject to the provision of No Lapse Guarantee.

Scenario Y% = 45 years

Scenario X% = 53 years

Apr 22 2021, 12:06 AM

Apr 22 2021, 12:06 AM

Quote

Quote

0.0271sec

0.0271sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled