QUOTE(Holocene @ Jan 9 2019, 07:07 PM)

The part about proving a point was directed towards

lifebalance.

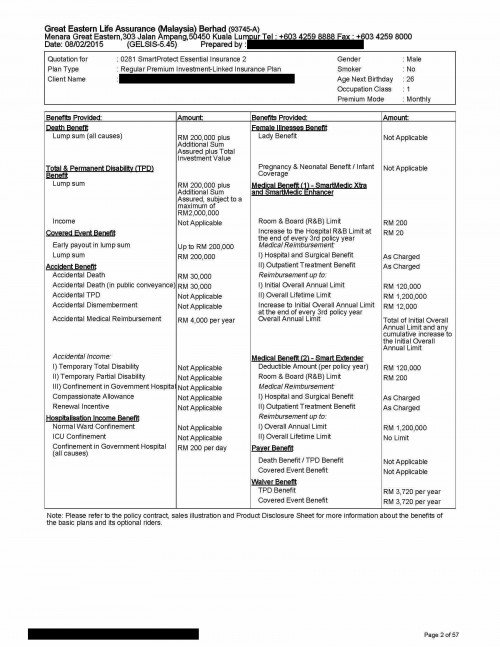

RM3,100 was what was quoted as you've shared. If etiqa's cost is more or less in line with Allianz they should be able to quote your cousin RM1,500 for the same protection and more or less similar sustainability of 28 years.

As you have past experience with NAV drop hence my reasoning for diversifying the RM1,600 into other investment vehicles. So in the situation when COI increases and the NAV decreases due to bad market, the question of if I should have a substantial amount of cash value in an ILP or do I pay as little premium as possible for the same protection and invest the rest with other financial products. Of course your earlier assessment of their performance and high sales charges is another thing you might consider.

I have to agree with you, the insurance industry is relatively sales driven and not so much on good sound advise but the good news is that BNM is in the midst of improving the professionalism of the agents in the industry. There are legit insurance agents but it really is your luck if you meet one.

As life progress and we somewhat have more to lose, our insurance needs will increase. As long as an agent is able to identify, assess and come up with a plan to manage the life risk I am sure he/she will be with you throughout your life. It's Life Insurance after all.

So in summary for your cousin's situation:

He can go with what the quotation he has with Etiqa or he could go with a lower premium and the same coverage (assuming Etiqa is able to quote that amount). Talk to the Etiqa agent to find out what his options are. 🤓

Best,

Jiansheng

I still cant get it where you got the 1500 from. For an ILP, how can the agent simply change the figure when its ficed amount of premium? They have their own policy too. As far as I concern, I the total allocated premium is 100% into the fund commencing year 5. toward they end. I am with the agent that time together with my cousin. I see the computer, the excel sheet was programmed accordingly. There no way to input any other thing except Sum assured and rider in which CI in this case.

And the premium is fixed. Why is it the premium will increase when COI and NAV drop when in the duration of chosen sustainability years?

QUOTE(lifebalance @ Jan 9 2019, 07:26 PM)

I wouldn't know where he plucks the figure from as comparison.

taking a lifetime policy is not cheap I must admit that, to sustain such policy, you have to pay 2 - 3x of the amount you're paying for a regular investment link policy, i.e Traditional policy which is guaranteed.

I will usually take my time to explain this to my clients so they don't get conned by agents who tries to sell cheap premium to get the customer to sign up without understanding how investment link policy work.

And yes you're right, the insurance company basically slowly deplete your cash value slowly to offset the insurance charges overtime if the investment doesn't grow or the insurance charges increases higher than your premium contribution + investment growth.

I would blame lack of training to the agents back then compared to the present time in terms of financial training provided to educate the market. I believe more and more agents are getting better educated right now to meet the market demand of a good financial adviser.

Still there will be bad apples within the bunch because of greed, ego and etc.

It's really dependent on your luck and fate with a good agent. Can't blame anyone for that, life insurance is still a product bought based on relationship. Majority still buys from their own relative / friends even if they're new in the industry compared to someone who is knowledgeable but whom you may not know at all.

It's a matter of preference I suppose for different individual on who should be their insurance agent.

My point is that is ILP the new trend nowadays? Because every insurance agency promoting ILP life no tomorrow. I have no objection on what the promote. What I don't like is that most of them don't bother to explain clearly on the T and C...

Is non-ILP have cash value too? Agent told me no. I doubt.

Honestly speaking, what do you think the offer from etiqa person?

QUOTE(vanitas @ Jan 9 2019, 10:57 PM)

I try to help you a bit...

- pure term life, guaranteed protection over 30 years, after that not guaranteed to renew if not mistaken.. but slightly expensive than ilp over long term, reason, you paid commissions to agent every years.. insurance company treat you as temporary customer..

- ilp, cheaper for long term, you paid agent few years good commissions, after that no more, insurance company would even give you some bonus after certain years in form of coverage or additional subscribe units on fund.. you can extend over 30 years as long as you got fund value inside, or depleted the fund value within 20 years, nothing is guaranteed despite what agent told you, you are investor, you should know..

- also the premium paid for ilp actually getting more expensive each year, not fixed, but the amount you paid for investment is fixed as long as got enough fund value to paid premium...

Suggest ask agent here send you a draft ilp for you to study.. free of charge..

I am not an agent, just trying to help you, in short, I would recommend ilp for a 30 years policy, but decision should up to your cousin, not you or me.

Thanks for your reply. Indeed clearly without all those jargon.

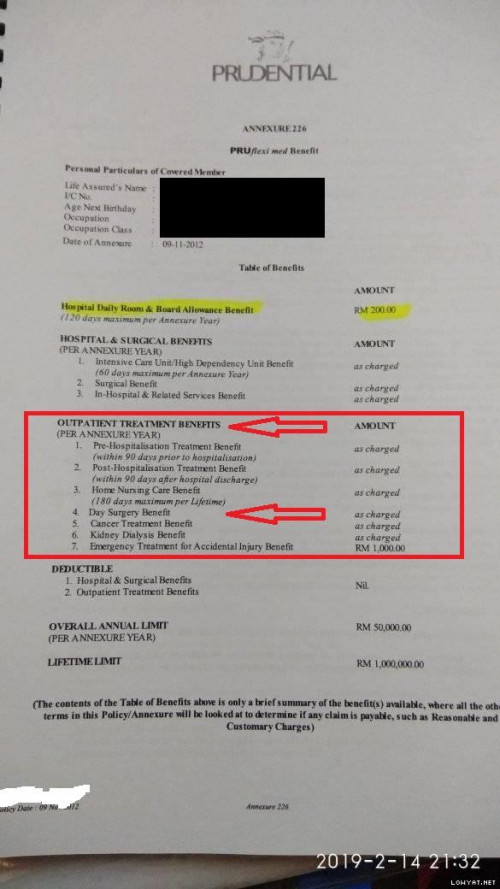

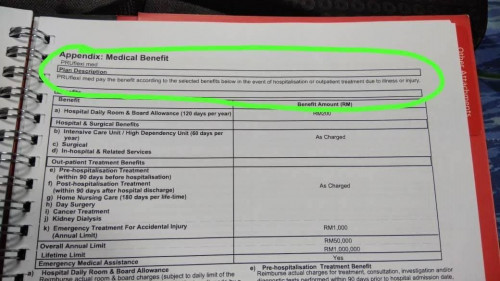

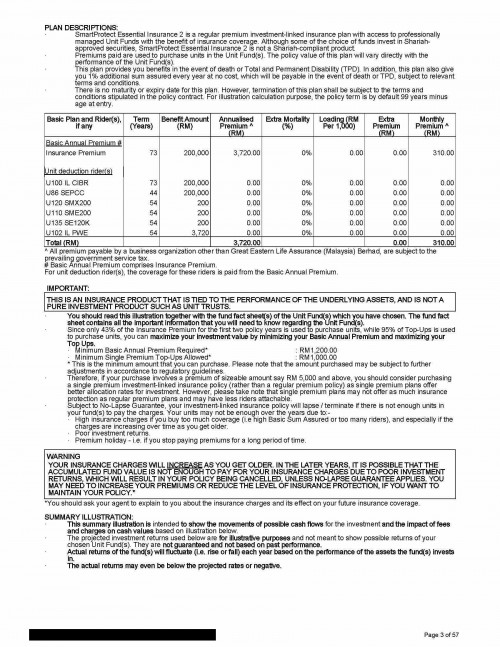

Yea, as a investor its better to know the market. But as a investor too, when I look back all the fund sheet etc etc they have, they perform real bad. Not to mentioned the SC! And the scenario they gave in the table (I had the quotation and all tables) always projected at 6% for a bond fund, 8 to 10% for the EQ. But infact, in the charts, they wont even barely touch the % given. For bond fund, 1%SC, hovering around 3%, -1% its 2%. FD better than this?

But that doesn't matter as buying Insurance is for protection, not investment. Correct but when the full amount of premium gone in to the fund...... that's the other way round.

QUOTE(JIUHWEI @ Jan 10 2019, 02:20 PM)

Very comprehensive and incredibly concise!

It's a waste you are not agent... We welcome you into our industry!

In fact, I will show this to my agents. Next time just explain like this in text messages and/or emails when asked for clarification.

In fact, I wish you will join my agency. <<< ikhlas from my heart.

To build on your explanation, ILP is flexible in the way that we can adjust the premium and time frame to stretch "just enough" to sustain through 30 years, or age 70, 80, 100...etc.

But of course, it is all projected based on past performance (usually around 6%/7% return, after accounting for deductions to cover the Cost of Insurance). Got Scenario 1 and Scenario 2 projection, which basically shows if market perform without drastic volatility (September 11, depression, etc), and the latter with terrible performance.

*actually ah, term insurance, agent get up to 40% commissions, compared to ILP at up to 25% commissions in the first year*

_____________________________

Bolded corrections:

(1) Cost of Insurance

(2) Premium

QUOTE(JIUHWEI @ Jan 10 2019, 02:53 PM)

I think aside from what was brought up in the conversations on top,

I wanted to bring another area of concern for your consideration:

Health and insurability.

While a Term insurance is great to meet objectives for a very precise time frame, an ILP is what we call a Whole life, non-participating life insurance.

What it means is that it is designed to cover till age 100 (whole life), and your fund value does not participate in the profits and losses of the insurance company (non-participating).

From there, you can choose to have your ILP sustain for 30 years, to age 70, 80, 100...etc.

Of course, the longer we stretch the time frame, the higher your premiums because it needs to stretch over a longer period of time.

Now with that in mind, cost and premiums aside,

We cannot guarantee your cousin's health at the end of the 30-year Term.

In 30 years time, is your cousin still insurable?

If no then thank you very much for your business all these years.

If yes, then let's look at the premium in 30 years for the same amount of coverage (can generate now for your consideration).

Personally, I would give this more weight in my consideration.

Do you actually tell that statement right into your customer face?

For the love of God.

This post has been edited by [Ancient]-XinG-: Jan 11 2019, 10:14 AM

Dec 23 2018, 01:41 AM, updated 6y ago

Dec 23 2018, 01:41 AM, updated 6y ago

Quote

Quote

0.2197sec

0.2197sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled