tuan tuan dan puan puan

alex looking for standalone critical illness policy.

coverage RM120k. Early payout allowed. Please quote tq

Insurance Talk V5!, Anything and everything about Insurance

Insurance Talk V5!, Anything and everything about Insurance

|

|

Jan 26 2019, 11:41 PM Jan 26 2019, 11:41 PM

Return to original view | Post

#1

|

Senior Member

2,275 posts Joined: Jun 2010 |

tuan tuan dan puan puan

alex looking for standalone critical illness policy. coverage RM120k. Early payout allowed. Please quote tq |

|

|

|

|

|

Feb 11 2019, 01:54 PM Feb 11 2019, 01:54 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

2,275 posts Joined: Jun 2010 |

hi, finding senior medical insurance for my dad.

pls quote 67, male, smoker, mild hypertension (but controlled). tq |

|

|

Feb 11 2019, 09:16 PM Feb 11 2019, 09:16 PM

Return to original view | Post

#3

|

Senior Member

2,275 posts Joined: Jun 2010 |

Want to ask.... Let's say my ILP monthly premium is Rm300 per month... Insurance charge is rm100 per month...

Assuming that I already in the 7th year, which means 100% premium allocation to purchase unit.... Question: can I contribute variable premium from this stage onwards? E. G... Contribute Rm200 per month... Since inside got some cash value buffer... If do it between y1 to T6, how will it affect agent distribution cost? Tq |

|

|

Feb 12 2019, 01:47 PM Feb 12 2019, 01:47 PM

Return to original view | Post

#4

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(lifebalance @ Feb 11 2019, 10:17 PM) You may contribute or change your premium contribution at any point of time, just be aware that your policy may lapse faster than usual if you reduce your premium contribution. I can track my cash value. So as long as it is above water, no prob right?If you do it between year 1 - 6, it just reduces the amount of commission your agent earns as well as your policy being lapsed at a faster rate. |

|

|

Feb 12 2019, 08:01 PM Feb 12 2019, 08:01 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

2,275 posts Joined: Jun 2010 |

good ah....

my premium 300 agent eat 50%+ first two years each month insurance charge eat 90+ so i give lesser premium la |

|

|

Feb 15 2019, 10:25 AM Feb 15 2019, 10:25 AM

Return to original view | IPv6 | Post

#6

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE QUOTE(alexkos @ Feb 11 2019, 09:16 PM) Want to ask.... Let's say my ILP monthly premium is Rm300 per month... Insurance charge is rm100 per month... Assuming that I already in the 7th year, which means 100% premium allocation to purchase unit.... Question: can I contribute variable premium from this stage onwards? yes you can, if contribute lesser, then it will result in lesser cash value. if contribute more than the premium, the extra will be allocated to a suspend account (meaning it will be allocated to units, it will just sit in an account and do nothing), at the next due this extra amount will then go to the premium contribution. E. G... Contribute Rm200 per month... Since inside got some cash value buffer... If do it between y1 to T6, how will it affect agent distribution cost? you contribute lesser, agent distribution cost will just follow the percentage. example if that particular year your premium paid is only 80%, that year agent only get 80%. but it will be considered as overdue (if you contribute lesser), if any other months you paid back the overdue premium, then agent will get back their commission. Tq ic, so even if i pay lesser in first 2 years, and then payback subsequent premium later, my agent will still get his full distribution cost, betul? wah like that....confirm eat... |

|

|

|

|

|

Feb 15 2019, 10:26 AM Feb 15 2019, 10:26 AM

Return to original view | IPv6 | Post

#7

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(Holocene @ Feb 14 2019, 03:04 PM) Here's an analogy for you. but standalone medical later age 50+ fuiyo cost soars like rocketWhen you go to a mixed rice/nasi kandar shop, Investment linked plans (ILP) are basically the plate and a medical insurance/card is the dishes/kuah you order with the dish. But if you mean what's the difference between a medical card attached to an ILP vs a standalone medical card, then biggest difference is as per below: Cost: - ILP more expensive - standalone cheaper Coverage: - depends as ILP has high and low coverage options That's a straight forward way to look at it. Best, Jiansheng |

|

|

Feb 15 2019, 01:34 PM Feb 15 2019, 01:34 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(cherroy @ Feb 15 2019, 10:40 AM) Medical insurance be it standalone or ILP, their medical premium soar together with ages one, little different. Really oh? I compare d.... Standalone and my ilp... Both got projected cost.... For some weird reason my ilp medical card charge is substantially lower. No didn't count the investment portion. Purely insurance charge.In ILP, you don't see the total ILP premium soar as much, because it may utilise the portion of investment to pay for the medical premium portion. ILP (100%) = Investment in Unit trust (x%) + medical premium (y%) So each year the % is tweak between so the the total ILP premium become stable throughout as long as possible, until it reaches unsustainable figure, by then insurance company may send notification of need to top up aka premium being adjusted upward to sustain the medical insurance coverage. Focus column F and G. Everything bao at age 60 only need pay rm6706. 97 insurance charge. But standalone medical card Fuiyo..... 5 digit This post has been edited by alexkos: Feb 15 2019, 01:38 PM Attached thumbnail(s)

|

|

|

Feb 15 2019, 08:03 PM Feb 15 2019, 08:03 PM

Return to original view | Post

#9

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(cherroy @ Feb 15 2019, 04:01 PM) ILP, insurance company can earn extra from the investment portion through unit trust, range from sales charges of 3~5%, annual management fee range from 0.5~1.5% for unit trust company (when if unit trust is also run by them) so, i try to make sure my investment portion is low, like can do-able?Also, in ILP, more money in tied up early on, as compared to standalone that you pay as needed. So, in ILP, they can give you some premium that is more competitive compared to standalone. Just like you go to buy fast food, a value set meal vs ala-carte. Set one generally got extra a little bit or little bit cheaper, as you buy more stuff. So ILP vs standalone, both insurance cost also rise together with age. As more age, more risk in term of medical insurance perspective. Please do not use the word "everything bao", <--- this is never a right word in insurance and insurance company never stated in their T&C nor use such kind of word. It only gives wrong impression as well as potential misleading as well. Often dispute arise from here. Also, those figure (premium at age 60) is projected not absolute, be it ILP and standalone. i can calculate my annual insurance charge (colum F &G). So i only pay that amount as my premium. i also ask the fund to change it to fixed income fund, annually they eat me 0.5% of available investment portion. I check d, they don't have sales charge for this one. I'll minimize this portion anyway because I only contribute just enough premium to cover insurance charge. So my concern is, once you hit age 50 and beyond, itu standalone medical card can feel the fire d..... insurance charge is a lot higher than ILP one. Don't believe, compare it yourself. Also, which standalone medical card can give annual 1m limit? i apologize for 'bao'. I was referring to ILP (life, med, CI, income, waiver) This post has been edited by alexkos: Feb 15 2019, 08:07 PM |

|

|

Feb 16 2019, 07:26 PM Feb 16 2019, 07:26 PM

Return to original view | Post

#10

|

Senior Member

2,275 posts Joined: Jun 2010 |

U look at standalone plan, distribution cost is 15% perpetually.....wheras ilp ceases from 7th year onwards.

So, standalone annual limit 200k can tahan or not? Great Eastern got 0.5% annual charge for fixed income fund... Sui. |

|

|

Feb 17 2019, 03:24 PM Feb 17 2019, 03:24 PM

Return to original view | Post

#11

|

Senior Member

2,275 posts Joined: Jun 2010 |

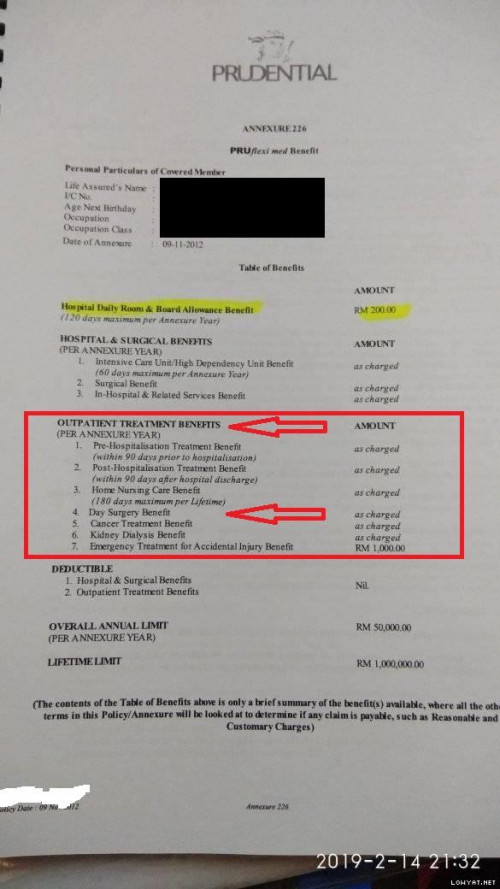

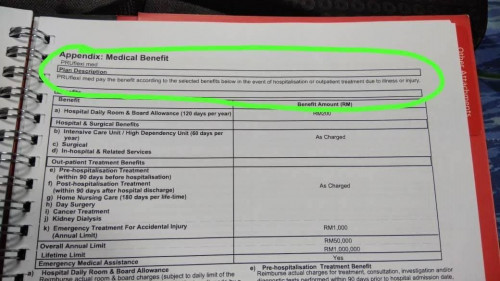

QUOTE(max880930 @ Feb 17 2019, 02:07 PM) ATTENTION: PRUDENTIAL BUYER can confirm?PRUDENTIAL CONFIRMED THEY WILL NOT COVER OUTPATIENT/DAY SURGERY! NO GUARANTEE LETTER FOR DAY SURGERY/OUTPATIENT Iam PAYOR FOR 7 years of Pruflexi med. Heres the Pru hotline: 03-2116 0228. you guys can call and verify it. OUTPATIENT: NOT COVER. RAI: Radioiodine day surgery: NOT COVER! Hospital response..Prudential is like that... PHOTO from policy as prove. Prudential buyer..please BEWARE AND CHECK WITH YOUR AGENT OR INSURANCE.  btw, i heard agent say even RM200k annual limit is too little....must have RM1m annual limit... is it true? This post has been edited by alexkos: Feb 17 2019, 05:05 PM |

|

|

Feb 17 2019, 08:36 PM Feb 17 2019, 08:36 PM

Return to original view | Post

#12

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(max880930 @ Feb 17 2019, 07:56 PM) CONFIRM!. THIS PLAN IS SINCE 2012 PRU LIFE, Pruflexi medical card. You can call PRU customer line to confirm this. Outpatient treatment/day surgery is not cover unless accident ONLY. I have calling voice recorded. I EVEN FOUND, in the policy it mention Outpatient treatment is cover but by calling in or agent they say its not cover! ic...if accident only then no choice....got such word in the policy? |

|

|

Feb 18 2019, 08:39 AM Feb 18 2019, 08:39 AM

Return to original view | Post

#13

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(max880930 @ Feb 17 2019, 09:03 PM) YES. AND ITS NOT COVER.. PRUDENTIAL IS DAMN INTERESTING LOUSY. WHO EVER buy PRUDENTIAL better double check it. Although its mention in policy book they can even deny it. due to illness or injury means? accident no bao? |

|

|

|

|

|

Feb 18 2019, 07:21 PM Feb 18 2019, 07:21 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

2,275 posts Joined: Jun 2010 |

So...whats the suggested annual limit for medical card? Is 200k enough?

|

|

|

Mar 3 2019, 05:04 PM Mar 3 2019, 05:04 PM

Return to original view | Post

#15

|

Senior Member

2,275 posts Joined: Jun 2010 |

i think long time about annual limit d....and i find annual limit 1m gooding.

why? 1) want 100k annual limit only? Good for now only....how about 30 years later? 2) google KPJ or any private hospital bill....at most only 100k....lucky wor...but leh, that is only if we do 1 treatment per year....what if 2 or 3 treatments together? 3) one insurance criteria is not to be underinsured.... |

|

|

Mar 3 2019, 05:05 PM Mar 3 2019, 05:05 PM

Return to original view | Post

#16

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(xPrototype @ Mar 3 2019, 04:48 PM) Hi guys, first time buying insurance here lol you kasih screenshot itu projected tables until age 60 put here let us see....see how much insurance charge they eat then we decideCurrently 25 years old I was quoted by an AIA agent for medical insurance Rm260 premium per month. A-Lifelink 2 Life / TPD ( shared) 100k Critical illness 100k Annual limit 1.5mil I think these details are enough ? |

|

|

Mar 23 2019, 04:59 PM Mar 23 2019, 04:59 PM

Return to original view | Post

#17

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

Mar 26 2019, 05:05 PM Mar 26 2019, 05:05 PM

Return to original view | Post

#18

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(ckdenion @ Mar 26 2019, 04:40 PM) unit trust funds' price? yes, and then ah, you see, this is how ILP worksyou masuk premium they buy for you (offer price) then you need to pay for insurance charge they use bid price? wah like that my bid-ask spread lose kau kau? |

|

|

Mar 26 2019, 06:34 PM Mar 26 2019, 06:34 PM

Return to original view | Post

#19

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

Mar 26 2019, 06:44 PM Mar 26 2019, 06:44 PM

Return to original view | Post

#20

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

Topic ClosedOptions

|

| Change to: |  0.1173sec 0.1173sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 08:21 PM |