Missed out some info - female, advisory consultant

Insurance Talk V5!, Anything and everything about Insurance

Insurance Talk V5!, Anything and everything about Insurance

|

|

May 22 2019, 07:49 PM May 22 2019, 07:49 PM

|

Newbie

9 posts Joined: Nov 2011 |

Missed out some info - female, advisory consultant

|

|

|

|

|

|

May 22 2019, 11:21 PM May 22 2019, 11:21 PM

|

Junior Member

804 posts Joined: May 2010 |

QUOTE(cherroy @ May 22 2019, 09:33 AM) Below statement may not please some reader (especially may be agents Thank you for the advices.This is a simple statement for sum assured needed. If my income is low, then my life "worth" is cheaper so does my insurance sum assured, as I cannot afford higher premium. Also, you need to have your own saving, for emergency, for future family planning etc. Living in single vs having a family could be big difference in term of financially. Please be minded even you have the most expensive insurance and wide coverage, there are still incident and situation that you need to pay from your own saving. PA - if happen not due to accident case, insurance won't compensate. Medical - not every medical condition is covered. eg. you have toothache and need a teeth implant or crowning which easily cost a few K per tooth. In this situation, you need to fork out own money despite having mil of coverage. It is all about income, if the premium is negligible portion of your income, then no comment, it is about personal preference. But if the insurance premium eat up large chunk of disposal income every month, one may need to rethink about it and plan more wisely, My savings now are able to last about 60 months of my current expenses (about 7k per month) if nothing big happens. Me and my gf have both agreed that we do not want to have a child in the next 5 years, so there should be more time for me to carry on increasing my income and to save more money for other purposes. I am aware that the policies include quite a lot T&C, that's why I insure more on life. As for medical, it is pretty important to me as the many of family members on my father's side were diagnosed with cancer. I already have a medical card but Im looking for a policy that covers different types of cancer. The RM664 premium isn't too much to me at the moment. I personally think that I should have that much of insurance but my gf thinks that it is not necessary now. This is why I can't really make a decision now. QUOTE(lifebalance @ May 22 2019, 10:42 AM) Good to see that you save quote a sum for yourself especially this young to last 60 over months especially most Malaysian don't even have savings to last 2 - 3 months. Sorry but I am not really clear about underlined part...Again, how did the sum came about to 1.1m for life and 500k for illness ? How was this calculated against ? What are the measures taken up ? What is your future planning from now ? Basically my monthly expenses are RM7k but they will be reduced to RM4.5k after May 2020, and further reduced to RM3.5k in Dec 2020. However, I'm expecting a mortgage payment of RM10k per month from Dec 2020 to Dec 2027, while other expenses remain unchanged. Can't say much about my income cuz I can't really control it, but I expect it to be slightly higher than my monthly income now. As for savings, I did some calculations and think that they should increase by a minimum of 30% by Dec 2020 after deducting the cost of renovation for new house. Not planning on having a child in the next 5 years, and am not sure about the expenses after having a child. |

|

|

May 22 2019, 11:25 PM May 22 2019, 11:25 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(ratloverice @ May 22 2019, 11:21 PM) Thank you for the advices. So how long are you estimating the 1.1m to last you ?My savings now are able to last about 60 months of my current expenses (about 7k per month) if nothing big happens. Me and my gf have both agreed that we do not want to have a child in the next 5 years, so there should be more time for me to carry on increasing my income and to save more money for other purposes. I am aware that the policies include quite a lot T&C, that's why I insure more on life. As for medical, it is pretty important to me as the many of family members on my father's side were diagnosed with cancer. I already have a medical card but Im looking for a policy that covers different types of cancer. The RM664 premium isn't too much to me at the moment. I personally think that I should have that much of insurance but my gf thinks that it is not necessary now. This is why I can't really make a decision now. Sorry but I am not really clear about underlined part... Basically my monthly expenses are RM7k but they will be reduced to RM4.5k after May 2020, and further reduced to RM3.5k in Dec 2020. However, I'm expecting a mortgage payment of RM10k per month from Dec 2020 to Dec 2027, while other expenses remain unchanged. Can't say much about my income cuz I can't really control it, but I expect it to be slightly higher than my monthly income now. As for savings, I did some calculations and think that they should increase by a minimum of 30% by Dec 2020 after deducting the cost of renovation for new house. Not planning on having a child in the next 5 years, and am not sure about the expenses after having a child. How long are you looking to sustain your own living expenses ? When are you planning to retire ? How long would you be planning to retire without worrying about finances ? |

|

|

May 22 2019, 11:53 PM May 22 2019, 11:53 PM

|

Junior Member

804 posts Joined: May 2010 |

QUOTE(lifebalance @ May 22 2019, 11:25 PM) So how long are you estimating the 1.1m to last you ? Do you mean the sum insured? I expect the nominee to use the 1.1m for emergency use or to use it as one of the sources of funds for his/her/their daily expenses in the future. One thing that I am going to do is that I will raise the sum insured quinquennially for about 10%.How long are you looking to sustain your own living expenses ? When are you planning to retire ? How long would you be planning to retire without worrying about finances ? Not going to retire so soon since Im just 27 this year. Will probably work for another 25-30 years...? I can't really tell how long it will take for me to save enough money for retirement. My expenses might just substantially increase one day in the future. So all I can do now is that earn and save as much as possible. Will only think about retirement later |

|

|

May 23 2019, 11:24 AM May 23 2019, 11:24 AM

|

Senior Member

1,320 posts Joined: Nov 2008 |

QUOTE(Vintage_X @ May 22 2019, 05:39 PM) I’m 38 years old, non smoking. Have you tried engaging your current servicing agent/writing agent that you purchased your existing policy from? Looking for AIA medical insurance with 1. CI, RM50k (this is a top up only as I already have RM150k from another policy) 2. Room and board 200 3. Waiver of premium May I know how much is the premium? If add on hospital income, how much is the additional premium? Thank you? |

|

|

May 24 2019, 11:23 AM May 24 2019, 11:23 AM

|

Senior Member

4,672 posts Joined: Nov 2016 |

For a 20y/o+ starter into medical insurance, which one should go for with sufficient coverage for treatment nowadays?

Besides, buying directly with insurance provider (whether online or over the phone) will cheaper by how much than buying from an agent? What are the drawback other than level of support?   |

|

|

|

|

|

May 24 2019, 12:24 PM May 24 2019, 12:24 PM

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(Jaschong @ May 20 2019, 01:18 AM) » Click to show Spoiler - click again to hide... « for insurance planning, with your age and assuming you wanna max out the tax relief, you can get a very comprehensive plan already. have to further discuss your needs to know what coverage amount suits you. QUOTE(silverviolet @ May 21 2019, 06:15 PM) yeap. consider a good deal to me.QUOTE(neverfap @ May 21 2019, 11:15 PM) » Click to show Spoiler - click again to hide... « |

|

|

May 24 2019, 12:25 PM May 24 2019, 12:25 PM

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(ratloverice @ May 22 2019, 01:00 AM) » Click to show Spoiler - click again to hide... « QUOTE(Vintage_X @ May 22 2019, 05:39 PM) » Click to show Spoiler - click again to hide... « QUOTE(#Victor @ May 24 2019, 11:23 AM) » Click to show Spoiler - click again to hide... « |

|

|

May 24 2019, 04:44 PM May 24 2019, 04:44 PM

Show posts by this member only | IPv6 | Post

#1009

|

Junior Member

32 posts Joined: Oct 2015 |

May i ask is there difference for medical card for prudential and AIA until certain age? For prudential, the agent told me MAX cover until age 85 but AIA can cover until MAX age 100 for the same premium amount. The prudential agent told every company should be the same and maybe AIA agent is not telling the truth. Just wanna know the truth.

|

|

|

May 24 2019, 05:39 PM May 24 2019, 05:39 PM

|

Junior Member

241 posts Joined: Mar 2010 |

Any insurance agent here can offer group insurance for employees of a company of about 100-200 staff in PJ?

Requirements: - Free or simplified underwriting (guaranteed acceptance for ALL employees who sign up, even if some of them were previously diagnosed with certain sickness) - Portable policy (which means after an employee resign, can take policy with him or her) - Strictly NO investment-linked products - Premium to be paid by employees who sign up (maybe by salary deduction?), not by company Be aware that you have to contact HR directly ... I can only give you the HR manager's contact and company address ... I don't have the authority to allow you to come to the company to sell the product. Reason I'm doing this is because I feel the insurance coverage provided by company is too low. Only RM10k H&S coverage for managerial level staff, lower still for lower ranking staff. PM me with details of package you can offer. Say for a premium of RM100 or RM200 (max) per month. |

|

|

May 24 2019, 06:36 PM May 24 2019, 06:36 PM

Show posts by this member only | IPv6 | Post

#1011

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(#Victor @ May 24 2019, 11:23 AM) For a 20y/o+ starter into medical insurance, which one should go for with sufficient coverage for treatment nowadays? for a starter, 1m coverage is affordable nowadays.Besides, buying directly with insurance provider (whether online or over the phone) will cheaper by how much than buying from an agent? What are the drawback other than level of support?   You will need an agent no matter what. QUOTE(stevencjh @ May 24 2019, 04:44 PM) May i ask is there difference for medical card for prudential and AIA until certain age? For prudential, the agent told me MAX cover until age 85 but AIA can cover until MAX age 100 for the same premium amount. The prudential agent told every company should be the same and maybe AIA agent is not telling the truth. Just wanna know the truth. QUOTE(GenY @ May 24 2019, 05:39 PM) Any insurance agent here can offer group insurance for employees of a company of about 100-200 staff in PJ? what you're requesting is a personal insurance with such benefit which I doubt it's possible.Requirements: - Free or simplified underwriting (guaranteed acceptance for ALL employees who sign up, even if some of them were previously diagnosed with certain sickness) - Portable policy (which means after an employee resign, can take policy with him or her) - Strictly NO investment-linked products - Premium to be paid by employees who sign up (maybe by salary deduction?), not by company Be aware that you have to contact HR directly ... I can only give you the HR manager's contact and company address ... I don't have the authority to allow you to come to the company to sell the product. Reason I'm doing this is because I feel the insurance coverage provided by company is too low. Only RM10k H&S coverage for managerial level staff, lower still for lower ranking staff. PM me with details of package you can offer. Say for a premium of RM100 or RM200 (max) per month. If under group insurance as a company with company paying then yes. |

|

|

May 25 2019, 01:02 AM May 25 2019, 01:02 AM

Show posts by this member only | IPv6 | Post

#1012

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(stevencjh @ May 24 2019, 04:44 PM) May i ask is there difference for medical card for prudential and AIA until certain age? For prudential, the agent told me MAX cover until age 85 but AIA can cover until MAX age 100 for the same premium amount. The prudential agent told every company should be the same and maybe AIA agent is not telling the truth. Just wanna know the truth. coverage term is up until 100 for medical insurance. question is can your policy cash value sustain until 100 years old, this is one of the concerns you may want to look into. to me, policy sustainability up until 80 years old is actually consider very good already. |

|

|

May 25 2019, 07:00 PM May 25 2019, 07:00 PM

|

Junior Member

32 posts Joined: Oct 2015 |

QUOTE(ckdenion @ May 25 2019, 01:02 AM) coverage term is up until 100 for medical insurance. question is can your policy cash value sustain until 100 years old, this is one of the concerns you may want to look into. to me, policy sustainability up until 80 years old is actually consider very good already. Yup.. That is y prudential agent told me there is a range from 80 to 85 depends on the economy! If the economy is good then maybe cash value can last 88 or 89...inside their apps got this range! But AIA apps dun show this range.. Just straight said until 100 yrs old! I would like to choose AIA if can last until 100 yrs old lo |

|

|

|

|

|

May 25 2019, 07:08 PM May 25 2019, 07:08 PM

Show posts by this member only | IPv6 | Post

#1014

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(stevencjh @ May 25 2019, 07:00 PM) Yup.. That is y prudential agent told me there is a range from 80 to 85 depends on the economy! If the economy is good then maybe cash value can last 88 or 89...inside their apps got this range! But AIA apps dun show this range.. Just straight said until 100 yrs old! I would like to choose AIA if can last until 100 yrs old lo There is a schedule table showing it, the agent didn't disclose it so that shows there is lack of integrity in disclosing the information to you. Another fact is that it is hard to estimate a policy to last 100 years |

|

|

May 26 2019, 01:10 PM May 26 2019, 01:10 PM

Show posts by this member only | IPv6 | Post

#1015

|

Senior Member

1,762 posts Joined: Sep 2007 From: White Base |

QUOTE(#Victor @ May 24 2019, 01:23 PM) For a 20y/o+ starter into medical insurance, which one should go for with sufficient coverage for treatment nowadays? One of the advantage if you get it from Agent is the services that you can get. Yes, you can do claim by yourself but what if one day you aren't capable to do so ? Or should I put in this way, Agent are well trained by the company to handle different kind of difficult situation you might face when you applying a Medical Card.Besides, buying directly with insurance provider (whether online or over the phone) will cheaper by how much than buying from an agent? What are the drawback other than level of support?   QUOTE(stevencjh @ May 25 2019, 09:00 PM) Yup.. That is y prudential agent told me there is a range from 80 to 85 depends on the economy! If the economy is good then maybe cash value can last 88 or 89...inside their apps got this range! But AIA apps dun show this range.. Just straight said until 100 yrs old! I would like to choose AIA if can last until 100 yrs old lo All company can allow you to last until 100 years old, but of course you need take count in the insurance charges that will increase after a few years and the cash value that you have inside. Please request the quotation from the representative agent about "Insurance Charges" and "Cash Value", it will be not guarantee but at least its an assurance to know about itThis post has been edited by HoNeYdEwBoY: May 26 2019, 01:13 PM |

|

|

May 27 2019, 04:50 PM May 27 2019, 04:50 PM

Show posts by this member only | IPv6 | Post

#1016

|

Senior Member

1,320 posts Joined: Nov 2008 |

QUOTE(stevencjh @ May 25 2019, 07:00 PM) Yup.. That is y prudential agent told me there is a range from 80 to 85 depends on the economy! If the economy is good then maybe cash value can last 88 or 89...inside their apps got this range! But AIA apps dun show this range.. Just straight said until 100 yrs old! I would like to choose AIA if can last until 100 yrs old lo The medical rider is a standard product that will cover till age 100. The ILP on the other hand, you can choose the sustainability (30 yrs, age 70, 80, 100). So what it means is, at the ILP maturity, you can have the option to continue on to keep the medical rider. But of course, at a very high COI at that age. In a sense, it's betting that I pay lower COI till age 80, and I better die by then just to avoid paying higher COI charges. Sorry ah, I'm quite blunt. But I think better to be blunt than trying to sugar coat, prancing around an issue |

|

|

May 27 2019, 06:58 PM May 27 2019, 06:58 PM

|

All Stars

12,573 posts Joined: Nov 2008 |

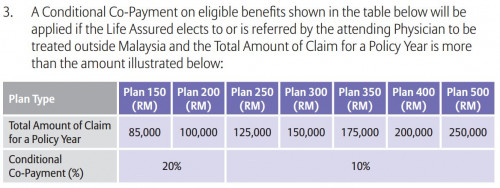

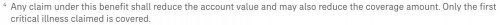

QUOTE(-kytz- @ May 5 2019, 05:17 PM) "Doctors told his family he had a month to live and recommended seeking treatment elsewhere, as the latest treatment was not available in the country. To quote my previous comment above again:The family from Selangor rushed to Singapore to seek a special treatment called chimeric antigen receptor (CAR) T-cell therapy. It involves using the body's own immune cells to recognise and attack malignant cells." https://www.nst.com.my/news/nation/2019/05/...icken-msian-boy I've been looking around at different medical plans from various insurance companies but have narrowed down to a few plans which at least cover medical treatment in Singapore/overseas. This is just a precautionary measure as I would still get treatment in Malaysia first and if something does happen down the line where an advanced treatment is only available in Singapore and not in Malaysia. 1) Allianz Medisafe Infinite Xtra (ILP Medical plan) Pros: - Covers medical treatment in Singapore based on Reasonable & Customary Charges in Singapore - No lifetime limit for treatment in Singapore (?) Cons: - Co-payment charges of 10% if the total claim per year exceeds a certain amount. Look below: - "Limit" of RM125k for Plan250 (to not incur co-payment charges) might be little?  https://www.allianz.com.my/documents/144671...f6-030d918adee7 _______________________________________________________________________________________________ 2) Prudential PRU Medic Overseas (rider) Pros: - Seek treatment in Singapore, China and Hong Kong - No co-payment charges Cons: - Limited coverage of only 5 illnesses (Surgery related to cancer, Neurosurgery, Coronary artery bypass surgery, Heart valve surgery, Organ transplant - kidney, lung, liver, heart, pancreas or bone marrow transplant). - There is a lifetime limit of RM4 million for PMO Platinum - Low annual limit of RM400k, but still more than Allianz. https://www.prudential.com.my/export/sites/...verseas_Eng.pdf ________________________________________________________________________________________________ 3) AIA Life Signature Beyond (Life insurance with CI treatment overseas) Pros - Medical treatment in any country in the world?? - No co-payment charges  Cons - The limit depends on the coverage and any claim reduces the "account value" - Basically, a portion of the life insurance coverage will be used for CI treatment - What does this "only the first critical illness claim is covered" mean?  https://www.aia.com.my/content/dam/my/en/do...brochure-fa.pdf _________________________________________________________________________________________________ Appreciate inputs from the sifus here This post has been edited by -kytz-: May 27 2019, 07:14 PM |

|

|

May 28 2019, 01:49 AM May 28 2019, 01:49 AM

|

Junior Member

87 posts Joined: Jan 2008 |

QUOTE(ckdenion @ Apr 16 2019, 04:30 PM) there you go... What's the coverage differences (pros and cons) for life insurance plan above?AIA A-Life Signature Beyond Allianz PremierLink Great Eastern Smart Legacy Prudential PRUWealth Let's say sum assured 500k, how much is the yearly premium for each of the plan? |

|

|

May 28 2019, 02:33 AM May 28 2019, 02:33 AM

Show posts by this member only | IPv6 | Post

#1019

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(stevencjh @ May 25 2019, 07:00 PM) » Click to show Spoiler - click again to hide... « QUOTE(-kytz- @ May 27 2019, 06:58 PM) » Click to show Spoiler - click again to hide... « QUOTE(christeen @ May 28 2019, 01:49 AM) » Click to show Spoiler - click again to hide... « |

|

|

May 28 2019, 10:24 AM May 28 2019, 10:24 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(christeen @ May 28 2019, 01:49 AM) What's the coverage differences (pros and cons) for life insurance plan above? The 4 plans are all death and disability insurance, premium wise depends, you may want to get individual quoteLet's say sum assured 500k, how much is the yearly premium for each of the plan? |

|

Topic ClosedOptions

|

| Change to: |  0.0549sec 0.0549sec

0.46 0.46

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 04:56 PM |