Is there any new product that can cover a 60+ years old with heart disease and diabetes history?

Insurance Talk V5!, Anything and everything about Insurance

Insurance Talk V5!, Anything and everything about Insurance

|

|

Jan 23 2019, 10:18 AM Jan 23 2019, 10:18 AM

Return to original view | Post

#1

|

Senior Member

1,181 posts Joined: May 2005 |

Is there any new product that can cover a 60+ years old with heart disease and diabetes history?

|

|

|

|

|

|

Feb 12 2019, 05:17 PM Feb 12 2019, 05:17 PM

Return to original view | Post

#2

|

Senior Member

1,181 posts Joined: May 2005 |

Looking for RM400k term life.

33 yo, male, non-smoker. hyperthyroid history - Etiqa i-secure and ezy-secure don't accept me for that reason in the online application. |

|

|

Feb 18 2019, 10:31 AM Feb 18 2019, 10:31 AM

Return to original view | Post

#3

|

Senior Member

1,181 posts Joined: May 2005 |

My friend is an actuary in Pru, I was told they only price 15% medical cost increase for the next three years, and leave everything constant for 4th year onwards.

Since insurance co can revise premium anytime, expect that to happen when medical costs escalate, which is almost certain. So no point looking at the insurance charges projection in a 30 years table. |

|

|

Jun 13 2019, 10:50 AM Jun 13 2019, 10:50 AM

Return to original view | Post

#4

|

Senior Member

1,181 posts Joined: May 2005 |

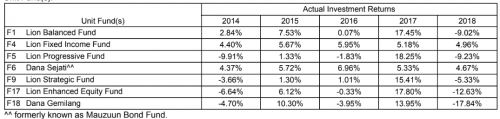

This is Great Eastern's latest fund performance.

On a 5-year CAGR basis, the Fixed Income Fund made 5.2% average per year, the Balance Fund made 3.4%/year, and the Progressive Fund made -0.8%/year (negative). They need to sack the fund managers for not able to outperform idiot-proof fixed income fund. I know last year was tough but 5-year CAGR performance of that is abso-effing-lutely unacceptable.  |

|

|

Sep 10 2019, 06:00 PM Sep 10 2019, 06:00 PM

Return to original view | Post

#5

|

Senior Member

1,181 posts Joined: May 2005 |

QUOTE(Chounz @ Sep 10 2019, 05:55 PM) Hi guys, i just got to know that my medical card will be subject for fee revision for every 3/5 years. Nope. wondering if there any medical card plan can actually lock the premium? i.e same rate i will be paying from now until I 70-80 years old? Because if the insurance company is to be honest and price in the 6% medical cost growth every year until you die in say 50 years, a RM1,000 quotation under current regime would cost RM50,000. |

|

|

Sep 11 2019, 10:18 AM Sep 11 2019, 10:18 AM

Return to original view | Post

#6

|

Senior Member

1,181 posts Joined: May 2005 |

And don't get lured into a perceivably cheaper medical premium. There is chance that the insurance company has not reviewed pricing for long time, and then realised the money pool gets unsustainable. The only option is then reprice the premium.

Which mean what's cheap today may be more expensive than the competitors when they reprice. I think this happened recently with one of the insurance company. While it is difficult to track, ideally we should see the repricing history of the insurance company. If the assumption is that every company will price the medical at the same price over the long term, then there is limited motivation to shop around. Insurance is all about pooled risk, you need a sustainable pool (low claim, healthy participants, etc) for the pool the be sustainable and remains reasonably priced. |

|

|

Dec 11 2019, 10:49 AM Dec 11 2019, 10:49 AM

Return to original view | Post

#7

|

Senior Member

1,181 posts Joined: May 2005 |

QUOTE(ckdenion @ Dec 11 2019, 01:25 AM) hi prescott2006, very nicely given info. in terms of over-insured/under-insured, it also depends on a few planning for example: since your son is still a minor, then you will like to factor in his future education fund + living expenses into your life insurance amount. of course you can follow the rule of thumb that most will use which is 10x your annual gross income. there is not right or wrong, just plan something that suits your needs the most. The 10-year rule of thumb is a lazy method, but i'm aware that no insurance agent will want to go through that process of explaining what's needed.Life insurance is for income replacement. I've just recently topped up my life coverage, and my method of arriving to the coverage amount is to look at: - Any shortfall of my MRTA/ MLTA in my mortgages - The amount that I'm currently paying for the household expenses. - Potential additional expenses to be incurred by the wife if touch wood i'm gone, this includes for the kids etc - An amount that can afford her to not work for a period of time The life coverage should theoretically reduces as i age, as most commitment would have been paid. So I will structure my plan to cancel or reduce the coverage as i deem fit. Not doing all those calculation, there is no way anyone can advice you if you are under/ over-insured. |

|

Topic ClosedOptions

|

| Change to: |  0.1121sec 0.1121sec

0.41 0.41

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 06:43 AM |