QUOTE(calvin_kenni @ Mar 8 2019, 10:56 AM)

Hello sifu2 semua

i am a father of a kid, staying with wife in kl

monthly commitment includes house instalment ~4.5k for 35 years, car 800 for 9 years

working at government sector.

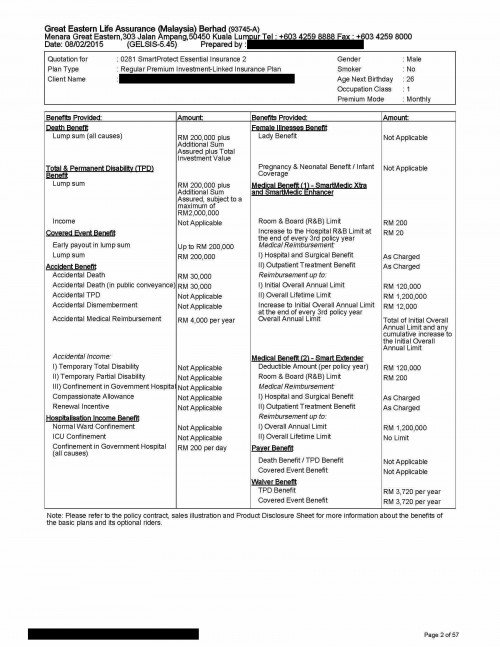

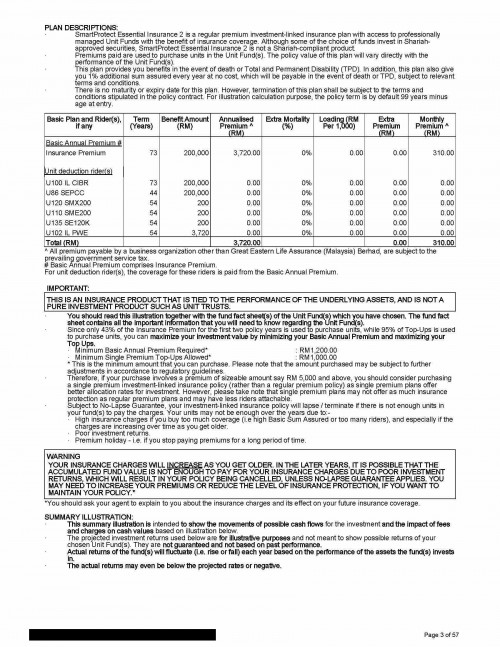

I had a policy of medical insurance from GE, inforced since 2015. Paying about rm310 per month

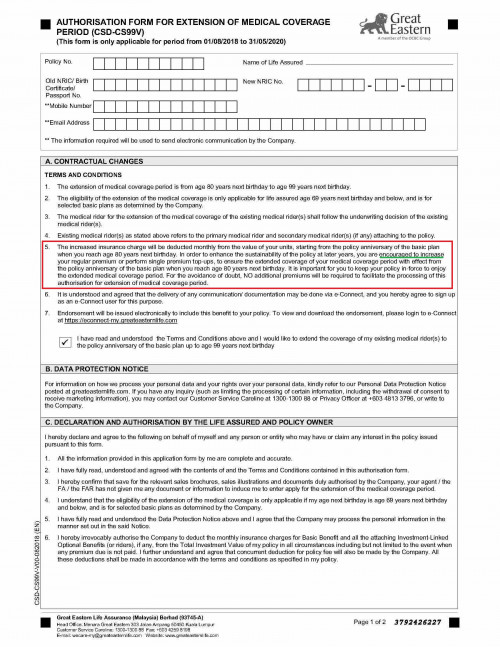

Recently the agent sent me a letter to extend my benefits from 80 years insured period to 100 years

Provided that i live til age of 85 and then only died of some sinister illness at that time, the offer seems legit.

However, how applicable and sensible will this decision be?

My thoughts are this

1. i am sure that this ILP is going to ask for more money from me to stay insured within the next 10-20 years, as the fund performance is some what lacklustre. Don't get me wrong, i do understand that purchasing an insurance is i need that coverage, because i can't afford the risks in future.

- so if i were to increase the insured period, some how these top ups premium to prevent my policy getting lapsed is going to be higher than expected

2. i do notice that the terms said that the premium will be paid at the expense of whatever remaining units left in my policy only at the age of 80 onwards, if i choose to extend the insured period.

- but then again, personally, i don't think there will be any units left in the policy even before i step into age 80;

- this means that i will need to top up way sooner and much more before age 80

- i do worried that if i do so, then i can't' afford the monthly premium - this is due to the fact that i can't calculate the premium increment as the market is so unpredictable and changes always.

3. am i under/over insured?

4. anyone had other views on this? or am i missing out on other points/aspect here?

Thank you

attached are my policy details

» Click to show Spoiler - click again to hide... «

1&2)Yes, Great Eastern is currently running an exercise to upgrade all existing policies from age 80 to age 99, the insurance chargers will only be charge after age 80. However, one should take into consideration that by the time you are age 80, due to time value of money, the insurance chargers will be very affordable(provided no increase of the projection). By right, we wouldn't be able to see what's our state of health condition when we are age 80 by now, so I'd advice you to go for the extension of the coverage to age 99 because the insurance chargers for it will not be "activated" until the you are more than 80 years old which is more than 50 years from now.

In case if you wouldn't want to continue the extension or simply can't afford the premium when age >80, you can just simply fill up a form to remove the rider from age 80-99 and voila, your policy benefit back to your current one, so there is no harm to get the extension.

3)You are not over insured. 4 most crucial parts in insurance planning are medical planning, debt cancellation, income protection and saving. You are having

-Medical planning- very sufficient, an extension to age 99 is advisable.

-Debt cancellation, it might not be sufficient, your monthly commitment of RM5.3k will be bear by your wife alone shall anything happened to you OR you have to fully commit to the RM5.3k monthly commitment without splitting shall something happened to your wife for the next 33 years.

-Income Protection - 45 Critical Illness protection is vital to replace your income upon diagnosis of the above 45 critical illness. Why? Well, who is the one going to pay for the monthly commitment shall either one of you fall sick? If the answer is insurance, RM200,000 that you are having will be able to cover it for about 3 years excluding your child's expenses, additional expenses when one fall sick, child education fee etc.

-Saving - put the rest of your money into investment/saving, be it property/ unit trust/ saving plan of your choice with different length.

Last but not least, please get your coverage accordingly to your budget, you can get top up of your insurance protection with certain special short term plan at very affordable price like RM300/month for RM500,000 life coverage with 45 Critical Illness coverage. you might no need to have a whole life RM500,000 coverage which protecting you from age 26 to age 99 because 25/30 years later, your children may grown up/ your house has been fully paid. 30 years tenure insurance is crucial to protect your prime period mostly between the age of 25-55, thus it can help you to save some premium for other purposes like saving etc.

QUOTE(calvin_kenni @ Mar 8 2019, 11:16 AM)

tq for the replies

seems like not a good choice to increase the insured period

i am a father of a kid, staying with wife in kl

monthly commitment includes house instalment ~4.5k for 35 years since 2017, 1 car 800 for 9 years since 2018

(mrta of 6 years only)

working at government sector.

wife and i each earn about 5.5k each month

wife and i each holds a policy of 310/month each

no other commitments

Feb 25 2019, 04:37 PM

Feb 25 2019, 04:37 PM

Quote

Quote

0.1716sec

0.1716sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled