QUOTE(CoronaV @ Apr 22 2020, 06:32 AM)

Company insurance comparing with medical card insurance and critical illness.

Say company gave you insurance benefits like hospitalisation according to your position and grades and also free panel clinics. Will it be necessary to have own medical insurance assume working till retirement 55 years old.

Tq

It is good to have company medical benefits. Anyhow, always a limit there. No matter reimbursement outpatient or hospitalization.

Do you know how much company coverage? Try imaging a few scenario then you can figure out.

- if appendicitis, how much may cost

- if cancer, how much may cost

Do take note, if you change of job. The benefits gone.

Suggest you ask for 55Years old medical insurance quote according to your personal info. Roughly can know the cost by that time (inflation need to be add)

Hopefully no health issue / serious illness record, so you still can get protection.

*my opinion, get personal medical plan which can cover till old age 80+/-

You still need it when company medical quota finish.

QUOTE(farizmalek @ Apr 22 2020, 10:19 AM)

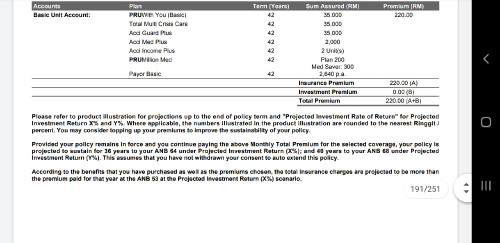

I am not sure if our insurance is ok or not.

Insurance: Prudential BSN Takaful Health Enrich Premier

Age taken: 38y (H&W), 10y (Dotter). Healthy and no illness at that time.

Now: 44y & 16y

Coverage per person: -

Age: Until 80y (If I am not mistaken)

Lifetime limit: RM4,080,000

Annual limit: RM200,000

Preferred Hospitals: Suite Room

Other Hospitals: Deluxe/Single room. Need to pay RM300 as a deposit before warded. Will get back the money from PBSN.

Warded Allowance per day: RM200

Treatments/Clinic: 90 days after warded. Pay first and claims later to PBSN

Death/Disability/Critical Illness: Will get only about RM10K. This insurance covered more on the medical only.

However, if husdand or wife is contacted with the 36 critical illness automatically both premiums will be waived by PBSN for life and no need to pay premium for dotter until she is 21 or 25 years old (Can’t remember).

If dotter is contacted with the 36 critical illness, automatically dotter premium will be waived for life by PBSN. Not sure if premiums for H&W will be waived too. Need to check later.

My opinion, it is not ok if I look into the benefits.

It will be ok if the premium just fit your budget. Something better than nothing.

Suggest you can some new plan quote and compare.

Better to have full policy review. Current policy any cancer claim limit? Kidney treatment limit? co-insurance?

My concern, if your girl contacted by 36 CI .. her medical plan will stuck forever annual limit RM200K.

Yes she got the free medical plan due to waiver. But she still young, medical charge increase from time to time.

Try check out the cancer cost by RinggitPlus year 2018 here:

https://ringgitplus.com/en/blog/sponsored/c...es-it-cost.htmlA full policy review might help you.

New plan critical illness more than 36. Upgrade or take new

Just check out the cost and benefits 1st. Compare and decide base on budget.

Most important, you and family understand the situation. No choice if budget tight, just don't regret if affordable but didn't take action.

Mar 8 2020, 09:36 PM, updated 5y ago

Mar 8 2020, 09:36 PM, updated 5y ago

Quote

Quote

0.2189sec

0.2189sec

1.20

1.20

6 queries

6 queries

GZIP Disabled

GZIP Disabled