I am not sure if our insurance is ok or not.

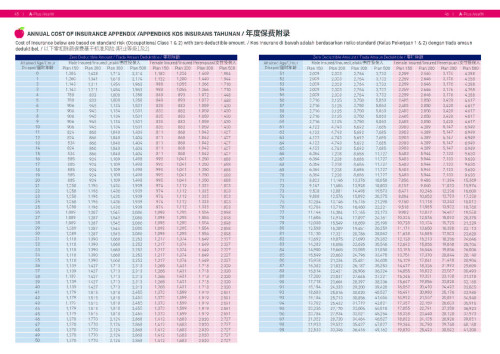

Insurance: Prudential BSN Takaful Health Enrich Premier

Age taken: 38y (H&W), 10y (Dotter). Healthy and no illness at that time.

Now: 44y & 16y

Coverage per person: -

Age: Until 80y (If I am not mistaken)

Lifetime limit: RM4,080,000

Annual limit: RM200,000

Preferred Hospitals: Suite Room

Other Hospitals: Deluxe/Single room. Need to pay RM300 as a deposit before warded. Will get back the money from PBSN.

Warded Allowance per day: RM200

Treatments/Clinic: 90 days after warded. Pay first and claims later to PBSN

Death/Disability/Critical Illness: Will get only about RM10K. This insurance covered more on the medical only.

However, if husdand or wife is contacted with the 36 critical illness automatically both premiums will be waived by PBSN for life and no need to pay premium for dotter until she is 21 or 25 years old (Can’t remember).

If dotter is contacted with the 36 critical illness, automatically dotter premium will be waived for life by PBSN. Not sure if premiums for H&W will be waived too. Need to check later.

Insurance Talk V6!, Everything about Insurance

Apr 22 2020, 10:19 AM

Apr 22 2020, 10:19 AM

Quote

Quote

0.1964sec

0.1964sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled