QUOTE(loquelevesque26 @ Mar 9 2020, 01:33 AM)

Hi,

Im gaining interest for AXA E-Medic family plan insurance which affordable for me (Rm 270/month).

Please share your honest experience good and bad for this AXA E-Medic.

i saw some review said during claiming not so well.

Thanks

AXA E-Medic family plan is a standalone medical card, so it does not come with any life insurance or critical illness. Since it's a standalone medical card, the premium will increase every 5 years based on your age. Im gaining interest for AXA E-Medic family plan insurance which affordable for me (Rm 270/month).

Please share your honest experience good and bad for this AXA E-Medic.

i saw some review said during claiming not so well.

Thanks

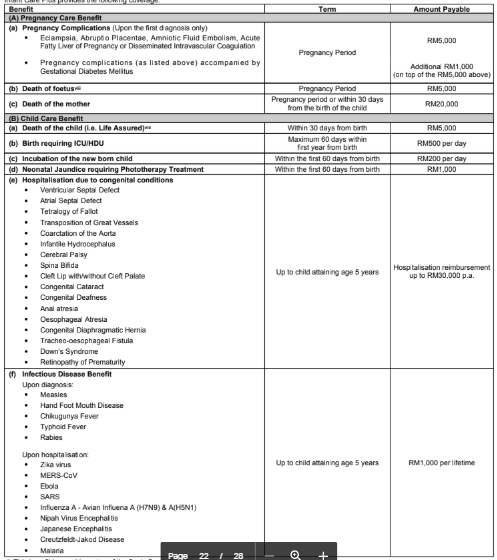

It only covers children up to 15 years old. If your children are 16 years old and above, they would be excluded from this plan.

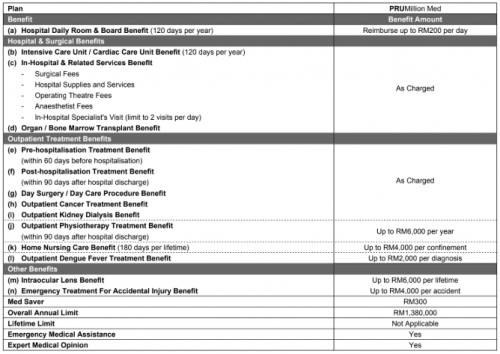

Another thing is that the annual limit for the most expensive plan is only RM100,000 which is not enough for serious illnesses like cancer. The good thing is that each family member will have his own annual limit and doesn't affect each other.

Personally, I would suggest you to get invidividual medical insurance if your budget allows because it is more future proof. Investment-linked medical insurance is more comprehensive which comes with life, critical illness coverage and waiver too.

Mar 9 2020, 12:36 PM

Mar 9 2020, 12:36 PM

Quote

Quote

0.1315sec

0.1315sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled