Checking in

A Further 21 Great Investment Quotes

March 29, 2017

Author : AMP Capital Investors Limited

https://www.fundsupermart.com.my/main/resea...es-29-Mar--8166eUT / POEMs / Phillip Mutual Berhad UT discussion, Coz' Fundsupermart not cheapo enuf'!

https://forum.lowyat.net/topic/4268975as at 23/6/19, .... latest polarzbearz file....post 15976, page 799,

https://forum.lowyat.net/index.php?showtopi...&#entry91302147polarzbear files for MAC version 32 bits and 64 bits

post# 539

https://forum.lowyat.net/index.php?showtopi...&#entry83747364

As of 8:30PM, 21 Dec 2018 again another website change 1 Nov 2020, we can no longer get NAV prices from the old link at

https://www.fundsupermart.com.my/main/fundi....tpl?id=MYKNGGF This means that if you're using the old Windows or Mac versions of this spreadsheet, it will no longer retrieve the latest prices since that page is no longer there.

possible solution, check out post 15983, page 800 by Idyllrain (this may not work again since 1 Nov 2020 change)

https://forum.lowyat.net/topic/4193169/+15980#entry91305801per updated new updated Excel links in posting# 23392 by Polarzbearz on 10 Oct 2020, (Read from page 1170, post 23392 to 23405 for more tips)

https://forum.lowyat.net/topic/4193169/+23380#entry98481881Polarzbearz made another patch to cater for the new website change on 1 Nov 2020,....read post 23618, page 1181

idyllrain added in post 23619 & 23620 too

https://forum.lowyat.net/topic/4193169/+23600#entry98758263Polarzbearz file that Can zoom in/out from YEAR down to WEEK, plus added legends to see the fund at overview chart. Values are hidden for obv reasons

page 702, post 14033

https://forum.lowyat.net/topic/4193169/+14020#entry89196345Retired fund IRR troubleshooting for Polarzbearz file.....

post 7225

https://forum.lowyat.net/topic/4193169/+7220https://forum.lowyat.net/topic/4193169/+7440QUOTE(idyllrain @ May 29 2017, 05:00 PM)

You can copy paste the URL in the window of the Morningstar Portfolio X-Ray into a new tab, and change the "USD" at the end of the URL address to "MYR" to make it calculate performance based on Ringgits. Then click on the PDF link to open the PDF report with the correlations and it will be in MYR.

Post# 5088,

https://forum.lowyat.net/topic/4193169/+5080where is the morning star's tool

Post# 5119, page 256

https://forum.lowyat.net/topic/4193169/+5120how to get the NAVs into excel sheet....by forummer "honsiong"

page 166, post 3309

https://forum.lowyat.net/topic/2064127/+3300#entry91840595The Perils Of Forecasting And The Need For A Disciplined Investment Process

https://www.fundsupermart.com.my/main/resea...ss-31-May--84226 Steps To Fixing Your Portfolio Amidst A Market Crash December 10, 2008

Investors who suffered serious losses in their portfolios should not be panicking now. Instead, it may be a good time to re-look your portfolios and do a bit of doctoring.

https://www.fundsupermart.com.my/main/resea...arket-Crash-147currency appreciation does not grow in tandem against ALL currencies....

http://www.bangkokpost.com/business/news/1...t-tourist-staysHere’s What You Can Do To Lock In Investment Profits [16 Jun 17]

https://secure.fundsupermart.com/fsm/articl...7-?locale=en_ustwo old wives’ tales that may possibly cloud an investors’ decision

2 Big Mistakes Investors Make in Unit Trust Investments

*Unit Trusts with Lower NAVs Are Better Buys

*Frequent Dividend Declaration Indicates That the Fund Is Doing Well

https://www.fundsupermart.com.my/main/resea...June-2017--8510How EPF calculates its dividend?

formula.....

page 152, post 3023

(page 151, post 3006)

EPF DIVIDEND, EPF

https://forum.lowyat.net/topic/2705461/+3020advise to newbies.....

https://forum.lowyat.net/topic/4344627/+0#entry85476209To cut loss or to invest more in a dipping market depends on the.....

post 12613

https://forum.lowyat.net/topic/4193169/+12600where to get the mkts PER

Post 12619

https://forum.lowyat.net/topic/4193169/+12600Introduction to Portfolio Management

https://secure.fundsupermart.com/main/resea...?articleNo=4383what is 3yrs volatility %

post# 7330

https://forum.lowyat.net/topic/4193169/+7320#entry85816344Do You Really Understand Risk Diversification?

https://secure.fundsupermart.com.hk/fsm/art...ification-14649How to measure a portfolio's Risks (youtube)

page 742, post 14821

https://forum.lowyat.net/topic/4193169/+14820How Did Dollar Cost Averaging (DCA) Fare Over The Past 100 Years?

https://www.fundsupermart.com.my/main/resea...100-Years--2069QUOTE(walkman660 @ Oct 13 2017, 05:32 PM)

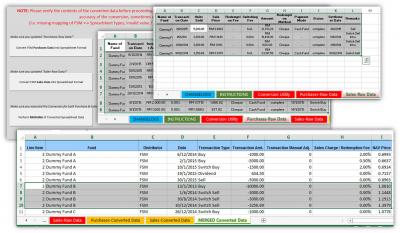

https://ufile.io/cco0janyone need simple version of excel file can download from the link above , pm me if have any doubt

sample per page 452, post 9031

Sui Jau's ....

"The most important advice I would give to anyone who hasn't started (be it man or woman) and is being held back is to starting investing now, but use a small amount. Something you are comfortable with even if you suffer losses. It can be as little as one thousand dollars because that is usually all you need to start investing into a unit trust. Then, as you invest, you will see how markets and such affect your returns and you will be able to learn from your experiences without suffering too much heartache compared to if you placed your entire life savings into the market and lose half of it in a market crash. The key thing is you have to accumulate investing experience. No amount of prior reading up and accumulating of knowledge can compare with actual investing experience which can only be built up by using your own money to invest. You have to experience the emotional pull that comes from market ups and downs and learn how to handle your emotions during those times. And learning from mistakes made is the greatest teacher."

https://secure.fundsupermart.com/main/resea...SJBlog_20141031

to bad....the link to Sui Jau's blog in Fundsupermart SG website has ceased to function from 17 December 2018....

The benefits of staying invested....

http://affinhwangam.com/benefits-of-staying-invested/many links to articles on "rebalancing"

post# 9946

https://forum.lowyat.net/topic/4193169/+9940...."do I need to report or pay tax if I earned from these investments dividends and appreciation?"

https://forum.lowyat.net/topic/4436982According to the IRB, the net profit gained from the share market is taxable if the transaction is done repeatedly.

https://www.thestar.com.my/news/nation/2012...e-to-be-taxing/Medical bills, rent and shares

https://www.thestar.com.my/news/nation/2012...oJb2ioapQOMa.99FSM HK/SG without opening bank a/c.....read page 550

https://forum.lowyat.net/topic/4193169/+11000some forummers keep bond funds in their port for this.....post 12137

https://forum.lowyat.net/topic/4193169/+12120#entry88080593how to best utilize that FI asset in the port........post 12008

https://forum.lowyat.net/topic/4193169/+12000how to DIY calculate the dividend....post 12217

https://forum.lowyat.net/topic/4193169/+12200to invest a little money for short term what is best?

post 1569

https://forum.lowyat.net/topic/3004579/+1560#entry88150112how to invest if you have xxxk in saving

post# 2

https://forum.lowyat.net/topic/4632367/+0#entry89846565Investment is a Plan … not a Procedure or a Product

https://kclau.com/investment/investment-is-a-plan/How do you choose from many different types of investment available in Malaysia?

https://ringgitohringgit.com/types-of-inves...le-in-malaysia/How Good Are Unit Trusts as Investments?

https://www.fimm.com.my/pdf/seminar%20slide...Investments.pdfsome example of how bad a fund can drop in a day....page 654

https://forum.lowyat.net/index.php?showtopi...&#entry88490028BADDEST Year for me....2018

2018 year in review.....some details of the effect of this BAD year

https://www.fundsupermart.com.my/fsmone/art...n-Review-Part-1....see how much a fund can drop in 2018.....

"....As of 31 December 2018, there are 204 equity funds on our platform with full year return in 2018. 202 (99.0%) of the equity funds posted losses while merely 2 (1.0%) of the funds clocked positive returns......"

https://www.fundsupermart.com.my/fsmone/art...erciless-MarketOut of the 764 Malaysian stocks that have a full year return for 2018, we see more than 40% of them posting losses exceeding -30% while there were only less than 20% of the listed companies delivering positive returns in 2018.

https://www.fundsupermart.com.my/fsmone/art...n-Review-Part-2How to get price/value direct pulled from Bloomberg into your google sheet (cannot use on MS Excel) by forummer Roarus

post 552, page 28

eUT / POEMs / Phillip Mutual Berhad UT discussion, Coz' Fundsupermart not cheapo enuf'!

https://forum.lowyat.net/topic/4268975/+540#entry97514611Mathematical calculation to shows ASB loan is worth it.....

page 164.

https://forum.lowyat.net/topic/667676/+3260#entry88820644post 31,

https://forum.lowyat.net/topic/4621490/+20unless the top up is significant and the returns is huge,...else no impact to the ROI of portfolio

page 1080

https://forum.lowyat.net/topic/4193169/+21580if really scares and want to take profits to protect the profit...

page 1083

https://forum.lowyat.net/topic/4193169/+216405 Common Misconceptions on Unit Trust Investing

https://howtofinancemoney.com/unit-trust-misconceptionNot Sure How To Choose A Fund?

It is without question that we always want to select the best fund for our portfolios.

In the minds of many, the “best-in-class” fund tends to be the one that can offer investors the highest returns among its peers.

....but just looking purely at returns alone, however, does not reveal much about a fund.

https://secure.fundsupermart.com/fsm/articl...-right-this-wayHow to pick quality funds?

https://secure.fundsupermart.com.hk/fsm/art...ity-Funds-14724Not Sure How To Choose A Fund? Right This Way.

https://secure.fundsupermart.com/fsm/articl...-right-this-way3 indicators to determine the capability of a FM

https://secure.fundsupermart.com.hk/fsm/art...s-Ability-14755Retirement investing do's and don'ts

https://finance.yahoo.com/news/retirement-i...-120101675.htmlMindsets for your investing success

https://www.thestar.com.my/business/busines...esting-success/Wall Street's in record ground. What do investors do now?

https://sg.finance.yahoo.com/news/wall-stre...-040547028.htmlSSPN dividend calculation

page 97, post 1921 by former Rapple

https://forum.lowyat.net/topic/1819492/+1920cut off date for dividend calculation

page 136, post 2718 by former Jefftan4888

https://forum.lowyat.net/topic/1819492/+2700linking sspn to bank islam

page 127, post 2527

https://forum.lowyat.net/topic/1819492/+2520SSPN withdrawal

page 115, post 2294

post 2297 lagi easy....

SSPN, Skim Simpanan Pendidikan Nasional

https://forum.lowyat.net/topic/1819492/+2280SSPN a/c to Bank Islam ATM FAQs

http://www.bankislam.com.my/home/assets/up...BMC-amended.pdfEPF dividend calculation....

page 133, post 2654, by Orangutan

https://forum.lowyat.net/topic/2705461/+2640EPF dividend is based on 1 day of the month + .....

page 14, post 277 & 279, 280, 282, 283.....

https://forum.lowyat.net/topic/4745820/+260post 4072, page 204 by believe ...confirmed it...

https://forum.lowyat.net/topic/2705461/+4060#entry95545562How to Calculate EPF Dividend?

https://1-million-dollar-blog.com/how-to-ca...e-epf-dividend/how to open a singapore CIMB fastsaver account from Malaysia in details?

page 141, post 2801, by forumer mrbean12345

Opening a Bank Account in Singapore

https://forum.lowyat.net/topic/1440794/+2800and

page 145, post 2884, by forumer sohailili

https://forum.lowyat.net/topic/1440794/+2880#entry97994711a more appropriate correct phrase/reason to buy medical insurance when younger compared to older...

from post 1259 ~ 1263, page 63 ~ 64

Insurance Talk V6!, Everything about Insurance

https://forum.lowyat.net/topic/4919324/+1240For a fresh graduate, which should be the priority - medical insurance or term/whole life insurance?

read post 1455 to 1461

https://forum.lowyat.net/topic/4919324/+1440Are You a Myopic Investor?

The Myopic Investor

– blindsided by temporary losses, they were unable to look at the longer horizon and unable to figure out the better choice.

In 1995, Benartzi and Thaler came up with myopic loss aversion (MLA) to explain the equity premium puzzle, where the S&P 500 earned over 6 percent annually more than Treasury bills from the studied period of 1889 to 1978.

MLA combines two factors – loss aversion and mental accounting. The former is explained above, while mental accounting deals with aggregation – whether securities are evaluated individually or as a portfolio, and how often they are evaluated. They defined a myopic investor as one who frames decisions and outcomes narrowly, i.e., making short-term choices rather than adopting long-term policies, and evaluating his gains and losses frequently.

https://secure.fundsupermart.com/fsm/articl...myopic-investorWhat is momentum investing?

In practice, momentum investing involves the decision of purchasing stocks that have been performing relatively stronger and selling stocks that have been performing relatively weaker. In another word, momentum investing encourages one to buy high and sell higher. In fact, the concept of momentum investing can be explained by the first law of motion discovered by Sir Issac Newton which stated that “an object at rest stay at rest and an object in motion stays in motion with the same speed and in the same direction unless acted upon by an unbalanced form”. Similarly, in the stock market, a rising market tends to attract more buyers whereas a falling market tends to attract sellers, which can be explained by a few behavioral biases such as overconfidence and herding effect.

https://www.fundsupermart.com.my/main/resea...-Investing-9289Search for the Holy Grail: Buying Low, Selling High?

Buy low and sell high. This phrase has been repeated and emphasised for ages yet it is easier said than done.

In this thought experiment, we explore the possibility of this strategy and evaluate how well it works.

https://secure.fundsupermart.com/fsm/articl...ow-selling-highThings Investors Need To Be Cautious About

The DCA method requires investors to conduct long-term investment in a very disciplined manner and be tolerant of market fluctuations throughout the investment horizon. If an investor loses his patience and stops investing regularly or sells the assets, it will result in failure of the DCA method.

The DCA method cannot demonstrate its full effectiveness in a strong bull market. Moreover, unless the investor intends to use the DCA method for saving purpose or is short of sufficient investment capital, the method is usually not as effective when used on fixed income funds as it is on equity funds. This is because the price volatility of fixed income funds is relatively lower than that of equity funds, and in the long run, the coupon income generated from fixed income funds tends to bolster the net asset value steadily.

The DCA method offers other advantages as well. Firstly, the method can help lower the average investment cost for each unit. Even if the fund price falls below the initial subscription price, the investor's loss will still be lower compared to using the lump sum investing strategy, thus reducing the risk of capturing the wrong market timing. Secondly, the initial investment amount using the DCA method is lower than that of lump sum investing. In this way, investors can achieve both their savings and investment goals at the same time depending on their cash flow status. This method is particularly suitable for investors who tend to invest regularly with a steady income (such as a salary).

Unlocking the code of your financial freedom

Read more at

https://www.thestar.com.my/business/busines...IJc0TbfRAvOb.99Banks to report cash transactions above RM25k as at Jan 1, 2019

Read more at

https://www.thestar.com.my/business/busines...6d4upPbFtXUz.99Why THB is stronger than MYR?

Ringgit, oh ringgit

https://www.thestar.com.my/business/busines...ggit-oh-ringgit Lower OPR doesn't mean cheaper financing for all, especially for new applicants

https://forum.lowyat.net/topic/4956590Enjoy yourself, it's later than you think ~~~~ song and lyrics page 915

This post has been edited by yklooi: Nov 1 2020, 05:45 PM Attached File(s) Benefits_Of_Staying_Invested.pdf

Benefits_Of_Staying_Invested.pdf ( 937.47k )

Number of downloads: 343 Positioning_in_a_Market_Correction_Mar_2018_Affin.pdf

Positioning_in_a_Market_Correction_Mar_2018_Affin.pdf ( 1001k )

Number of downloads: 307

Feb 9 2017, 11:11 AM, updated 8y ago

Feb 9 2017, 11:11 AM, updated 8y ago

Quote

Quote

0.0196sec

0.0196sec

0.53

0.53

6 queries

6 queries

GZIP Disabled

GZIP Disabled