QUOTE(asil66 @ Jun 24 2020, 01:04 PM)

Hi, I tried calling their branches multiple times but nobody pick up the phone. May I know what documents they need ya, other than the application form and IC?

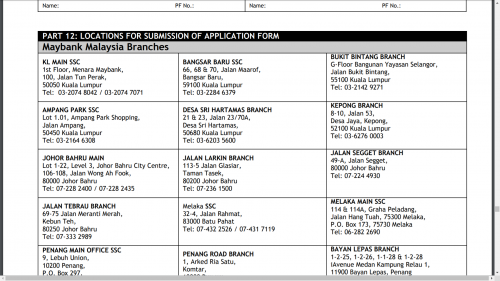

Ok, before I proceed, let me tell you something: Some of the branches may have moved or closed down or have their phone number changed. (At least for my case, the Butterworth SSC branch in Penang was relocated from the Jalan Selat area to the main Jalan Bagan Luar road further south, so the address in the application form was the old one and the phone number has changed as well).

You should NOT rely solely on the branch address and phone numbers stated in the application form without verifying the branch existence on Google Map, i.e. you need to so do some homework. I am not sure about your area, but in any case, don't follow the application form's address and phone number blindly.

Back to your question, for my case, I brought a lot of documents related to my university (I am still a uni student) such as my offer letter, hostel's address proof etc. but the branch officer said there's no need for them.

In the end, you only bring along:

i) Proof of Address (latest utility bill with your name and mailing address included) (For uni students or those without such bills, you may use your Maybank (they prefer other bank) account statement for the last 3 months)

ii) Proof of purpose to open account (some members here claim that it's optional, but I presented my IBKR account information, including the account confirmation letter and the activity statement and the counter officer accepted it). I believe submitting such documents will enhance your success rate of opening an offshore banking account, at least you show your willingness to co-operate with the bank and not hiding information.

iii) IC (they will print a copy if your IC and verify it, but you can bring along your own copy just in case).

iv) Your thumb. They will take your thumbprint electronically.

Different branch may have different ways of handling such applications, so it's still a good idea to call them in advance. In case you do not know, most branches close earlier during the RMCO period. In my area branches close at around 2:30 to 3p.m.. (They no longer close at 4:30 p.m., which's the usual case). So, you may want to call them in the mornings.

This post has been edited by TOS: Jun 24 2020, 05:47 PM

Jun 22 2020, 09:33 PM

Jun 22 2020, 09:33 PM

Quote

Quote

0.0255sec

0.0255sec

0.60

0.60

6 queries

6 queries

GZIP Disabled

GZIP Disabled