QUOTE(Nemozai @ May 29 2017, 08:33 PM)

QUOTE(Avangelice @ May 30 2017, 12:44 AM)

In light of the MYR correlation, the funds and allocation might be very different in version 4FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

May 30 2017, 09:14 AM May 30 2017, 09:14 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Nemozai @ May 29 2017, 08:33 PM) QUOTE(Avangelice @ May 30 2017, 12:44 AM) In light of the MYR correlation, the funds and allocation might be very different in version 4 |

|

|

|

|

|

May 30 2017, 10:01 AM May 30 2017, 10:01 AM

Show posts by this member only | IPv6 | Post

#5102

|

Senior Member

2,437 posts Joined: Sep 2016 |

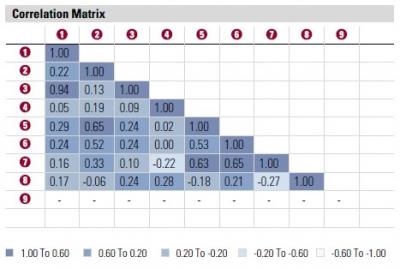

QUOTE(yklooi @ May 29 2017, 08:35 PM) sure will post the interface once it is ready... thanks you idyllrain, now I can see more details how my funds correlated in the portfolio..... seems like I might need to cut down my KGF to 10% and reduce my EISC to 5% and move the cut % to increase EIGL .....for next year portfolio. ## number 9 is my coming few week to add , havent start yet....

### upload the correction, seen better oledi This post has been edited by ironman16: May 30 2017, 10:18 AM |

|

|

May 30 2017, 10:06 AM May 30 2017, 10:06 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

May 30 2017, 10:09 AM May 30 2017, 10:09 AM

Show posts by this member only | IPv6 | Post

#5104

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

May 30 2017, 11:25 AM May 30 2017, 11:25 AM

|

Senior Member

5,274 posts Joined: Jun 2008 |

|

|

|

May 30 2017, 12:36 PM May 30 2017, 12:36 PM

|

All Stars

10,859 posts Joined: Jan 2003 From: Sarawak |

how u guys get those tables so pretty? which excel sheet to use?

|

|

|

|

|

|

May 30 2017, 12:40 PM May 30 2017, 12:40 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

|

|

|

May 30 2017, 12:54 PM May 30 2017, 12:54 PM

Show posts by this member only | IPv6 | Post

#5108

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

May 30 2017, 12:56 PM May 30 2017, 12:56 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

|

|

|

May 30 2017, 12:58 PM May 30 2017, 12:58 PM

Show posts by this member only | IPv6 | Post

#5110

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

May 30 2017, 12:59 PM May 30 2017, 12:59 PM

|

Senior Member

843 posts Joined: Apr 2008 |

These FSM managed portfolios are quite interesting.

If the option of subscribing to managed ports in FSM SG is open to me, should I consider the FSM SG over FSM MY? |

|

|

May 30 2017, 01:26 PM May 30 2017, 01:26 PM

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Holyboy27 @ May 30 2017, 12:59 PM) These FSM managed portfolios are quite interesting. FSM SG. Reason:If the option of subscribing to managed ports in FSM SG is open to me, should I consider the FSM SG over FSM MY? 1) cheaper fees 2) wider selection 3) preserve the wealth (RM will depreciate against any currency in the long run) |

|

|

May 30 2017, 01:34 PM May 30 2017, 01:34 PM

|

Junior Member

255 posts Joined: Apr 2008 |

|

|

|

|

|

|

May 30 2017, 01:53 PM May 30 2017, 01:53 PM

|

Junior Member

69 posts Joined: Apr 2008 |

QUOTE(yklooi @ May 29 2017, 08:35 PM) sure will post the interface once it is ready... thanks you idyllrain, now I can see more details how my funds correlated in the portfolio..... seems like I might need to cut down my KGF to 10% and reduce my EISC to 5% and move the cut % to increase EIGL .....for next year portfolio. 1. Fund's sales charge + management fees 2. FSM managed portfolio subscription fee + portfolio management fee |

|

|

May 30 2017, 01:53 PM May 30 2017, 01:53 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(ben3003 @ May 30 2017, 12:36 PM) Use Morningstar Malaysia > http://my.morningstar.com/ap/main/default.aspxRegister an account and create portfolio with all the funds you want, then follow the instruction below. The correlation table is inside the xray this portfolio pdf document QUOTE(idyllrain @ May 29 2017, 05:00 PM) You can copy paste the URL in the window of the Morningstar Portfolio X-Ray into a new tab, and change the "USD" at the end of the URL address to "MYR" to make it calculate performance based on Ringgits. Then click on the PDF link to open the PDF report with the correlations and it will be in MYR. QUOTE(Holyboy27 @ May 30 2017, 12:59 PM) These FSM managed portfolios are quite interesting. For now, FSM SG. The fund selection is much wider, that in itself is a good enough reason. Their mandate is also broader where MAPS can buy ETFs on top of just unit trusts like Managed PortfolioIf the option of subscribing to managed ports in FSM SG is open to me, should I consider the FSM SG over FSM MY? At the moment also, FSM MY does not allow partial redemption which makes it tricky if you need funds for emergency purposes. FSM SG's MAPS allow partial redemption |

|

|

May 30 2017, 01:56 PM May 30 2017, 01:56 PM

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Steven7 @ May 30 2017, 01:34 PM) I can have more confidence if:1) price of goods which went up can come down. Do you see price of goods coming down? 2) subsidy is remove and where did it go to? 3) year in year out, request extra money in January for budget made in Oct 4) debts increasing 5) history have shown us how much the RM depreciate 6) even indon rupiah and thb baht beat our RM which should not logically happen. This post has been edited by Ramjade: May 30 2017, 02:14 PM |

|

|

May 30 2017, 01:58 PM May 30 2017, 01:58 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(chosie @ May 30 2017, 01:53 PM) Does this mean the managed portfolio has double fees charge? In a way yes, but your understanding is not so accurate. There is no double sales charge, for managed portfolio you only pay subscription fees and not sales charge.1. Fund's sales charge + management fees 2. FSM managed portfolio subscription fee + portfolio management fee The "additional fee" charged by FSM for managed portfolio is the 0.5% portfolio management fee per annum. The unit trust fund manager charges annual management fee and trustee fee as usual. That's why robo advisor is cheaper in this sense, they charge portfolio management fee also, but the underlying assets are ETFs which has minimal management fee. But in the end, one should compare nett returns. If low cost but low net return, what's the point? |

|

|

May 30 2017, 02:08 PM May 30 2017, 02:08 PM

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(Ramjade @ May 30 2017, 01:56 PM) I can have more confidence if: 1) price of goods which went up can come down. Do you see price of goods coming down? 2) subsidy is remove and where did it go to? 3) year in year out, request extra money in January for budget made in Oct 4) debts increasing 5) history have shown us how much the RM depreciate 6) even indon rupiah and thb baht beat our RM which should not logically should not happen. QUOTE even indon rupiah and thb baht beat our RM which should not logically should not happen. What does that tell you? This post has been edited by wodenus: May 30 2017, 02:09 PM |

|

|

May 30 2017, 02:25 PM May 30 2017, 02:25 PM

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(dasecret @ May 30 2017, 01:58 PM) In a way yes, but your understanding is not so accurate. There is no double sales charge, for managed portfolio you only pay subscription fees and not sales charge. Precisely. If a fund can beat ETF, buy fund instead of ETF.The "additional fee" charged by FSM for managed portfolio is the 0.5% portfolio management fee per annum. The unit trust fund manager charges annual management fee and trustee fee as usual. That's why robo advisor is cheaper in this sense, they charge portfolio management fee also, but the underlying assets are ETFs which has minimal management fee. But in the end, one should compare nett returns. If low cost but low net return, what's the point? QUOTE(wodenus @ May 30 2017, 02:08 PM) RM long term view is downhill movement. |

|

|

May 30 2017, 02:33 PM May 30 2017, 02:33 PM

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(Ramjade @ May 30 2017, 02:25 PM) Two countries with lower growth rates have more "expensive" currency than one country with a higher growth rate, and you say rightly that logically that should not happen.. So your conclusion from that is that the currency of the country with the higher growth rate, and is currently a lot cheaper than the currencies of the countries with lower growth rates.. should be going downhill. An interesting conclusion. |

| Change to: |  0.0270sec 0.0270sec

0.57 0.57

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 12:22 PM |