Round 11....

Let's start.

V11 - Property Prices Discussion, Intelligent debates only pls

V11 - Property Prices Discussion, Intelligent debates only pls

|

|

May 31 2013, 09:07 AM, updated 13y ago May 31 2013, 09:07 AM, updated 13y ago

Show posts by this member only | Post

#1

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

Round 11....

Let's start. |

|

|

|

|

|

May 31 2013, 09:12 AM May 31 2013, 09:12 AM

Show posts by this member only | Post

#2

|

Senior Member

829 posts Joined: Dec 2010 |

LOL... this is endless... V11...i guess its not too late to join the party!

|

|

|

May 31 2013, 09:17 AM May 31 2013, 09:17 AM

Show posts by this member only | Post

#3

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

|

|

|

May 31 2013, 09:18 AM May 31 2013, 09:18 AM

Show posts by this member only | Post

#4

|

All Stars

10,722 posts Joined: Nov 2011 |

warming here....

u will come at a point some up up up camp saying this again in V11. -------------------------------------------------------------------------------------- - Anytime is a good time to buy - Properties prices will always go up in the long-term - The market cannot collapse because of demand from foreigners - Mickey mouse units are the trend of the future ---------------------------------------------------------------------------------------- read more here why they said that? |

|

|

May 31 2013, 09:19 AM May 31 2013, 09:19 AM

Show posts by this member only | Post

#5

|

All Stars

13,759 posts Joined: Jun 2011 |

|

|

|

May 31 2013, 09:19 AM May 31 2013, 09:19 AM

Show posts by this member only | Post

#6

|

Junior Member

443 posts Joined: Jun 2010 |

v11 already...huh hebat...

|

|

|

|

|

|

May 31 2013, 09:20 AM May 31 2013, 09:20 AM

Show posts by this member only | Post

#7

|

Senior Member

1,359 posts Joined: Nov 2010 |

Market to Be More Active after GE13

http://www.theedgemalaysia.com/property/24...after-ge13.html Price still going up for Landed and High Rise. |

|

|

May 31 2013, 09:28 AM May 31 2013, 09:28 AM

Show posts by this member only | Post

#8

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

anybody notice residential rental rates are slightly creeping up?

and would appreciate admin can pin a thread for lawyer's V3. V2 ended quite some time ago and i find it very useful. This post has been edited by kochin: May 31 2013, 09:30 AM |

|

|

May 31 2013, 09:40 AM May 31 2013, 09:40 AM

Show posts by this member only | Post

#9

|

Senior Member

829 posts Joined: Dec 2010 |

TheEdge didnt mention about Penang? I guess Penang will be similar to GKL.

|

|

|

May 31 2013, 09:41 AM May 31 2013, 09:41 AM

|

Senior Member

829 posts Joined: Dec 2010 |

|

|

|

May 31 2013, 09:41 AM May 31 2013, 09:41 AM

|

Senior Member

986 posts Joined: May 2012 |

QUOTE(kochin @ May 31 2013, 09:28 AM) anybody notice residential rental rates are slightly creeping up? I noticed 2 out of the 5 I'm tracking dropped their asking by 10% early this month. Something is brewing in the background... I can feel the fear... LOL!!!!and would appreciate admin can pin a thread for lawyer's V3. V2 ended quite some time ago and i find it very useful. This post has been edited by Rooney1985: May 31 2013, 09:42 AM |

|

|

May 31 2013, 09:45 AM May 31 2013, 09:45 AM

|

Junior Member

213 posts Joined: Sep 2009 |

Sg Buloh area going up.

|

|

|

May 31 2013, 09:47 AM May 31 2013, 09:47 AM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(Rooney1985 @ May 31 2013, 09:41 AM) I noticed 2 out of the 5 I'm tracking dropped their asking by 10% early this month. Something is brewing in the background... I can feel the fear... LOL!!!! boss,rental rates or selling price? personally i would rather target property on uptrend pricing rather than downtrend. unless you are getting your unit at a super discount from market value, else what is the back-up plan to prevent further decline in prices? |

|

|

|

|

|

May 31 2013, 09:50 AM May 31 2013, 09:50 AM

|

Junior Member

159 posts Joined: Apr 2013 |

QUOTE(kochin @ May 31 2013, 09:28 AM) Yes i notice it! I dont think that property market will collapse. Governement intervention in term of bnm restriction on making loan and 3rd house policy is actually slowing the market a bit. I know its not affecting most of people in this forum but the amateur player already stop buying at the moment. Having difficulties in applying loan has put some pressure to the owners that want to sell their house. This resulted to most of the owner have to lower down their price bit by bit. For example i managed to buy a house in klang valley 90k below market price. Yes! The demand is there but there is limitation for normal people to buy. Only investor with clean and strong cashflow can enter the market. Since govt pressure manage to force some of the owner to lower down the value, i believe the bubble wont burst in the near future. To me - as investor this should be a buying signal because you can take advantage in getting good property at discount price (considering not many people can buy property now due to very strict requirement to make loan). I believe The cycle will go up soon - maybe in 1-2 years, where many people can easily obtain loan from commercial bank again. And that will be the selling signal where we should dispose to collect our capital and get ready to reinvest! |

|

|

May 31 2013, 09:52 AM May 31 2013, 09:52 AM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

rising property price..... alarming but not panic mode yet.

rising rental rates..... all hell breaks loose. |

|

|

May 31 2013, 09:54 AM May 31 2013, 09:54 AM

|

Senior Member

986 posts Joined: May 2012 |

QUOTE(kochin @ May 31 2013, 09:47 AM) boss, well the 10% drop in monetary terms is around 400K to 500K... If I picked them up in the past 6 months I would have to fork out that extra... looking at rental rates is fine... IF I were to pick up the property now, that's already profit to me... converted to 10K rental pm, that's 40 to 50 months rental. In terms of loan payment saved... 450K loan for 20yrs is equivalent to RM2,800 p.m... in terms of FD rates that's around RM1K p.m... So you tell me whether I should look at rental or price first? LoL...rental rates or selling price? personally i would rather target property on uptrend pricing rather than downtrend. unless you are getting your unit at a super discount from market value, else what is the back-up plan to prevent further decline in prices? Plan to prevent further decline in prices is... don't buy when the risk of decline is high... (like now)... So in 6 months time, it dropped 10%, lets see what happens in the next three to six months. Like I've always said, I'm in no rush now, just relax la... See who can wait longer... I don't have to pay interest on my funds, however, these fellas have to or will have to very very very soon... LOL... Its nice to see the greedy suffer. This post has been edited by Rooney1985: May 31 2013, 09:59 AM |

|

|

May 31 2013, 10:21 AM May 31 2013, 10:21 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(Rooney1985 @ May 31 2013, 09:41 AM) I noticed 2 out of the 5 I'm tracking dropped their asking by 10% early this month. Something is brewing in the background... I can feel the fear... LOL!!!! i can see that the re negotiators i know now having a lot of free time, much more than few months ago.good for them, more time for self and family! |

|

|

May 31 2013, 10:57 AM May 31 2013, 10:57 AM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(Rooney1985 @ May 31 2013, 09:54 AM) well the 10% drop in monetary terms is around 400K to 500K... If I picked them up in the past 6 months I would have to fork out that extra... looking at rental rates is fine... IF I were to pick up the property now, that's already profit to me... converted to 10K rental pm, that's 40 to 50 months rental. In terms of loan payment saved... 450K loan for 20yrs is equivalent to RM2,800 p.m... in terms of FD rates that's around RM1K p.m... So you tell me whether I should look at rental or price first? LoL... 4 to 5 mil prop?Plan to prevent further decline in prices is... don't buy when the risk of decline is high... (like now)... So in 6 months time, it dropped 10%, lets see what happens in the next three to six months. Like I've always said, I'm in no rush now, just relax la... See who can wait longer... I don't have to pay interest on my funds, however, these fellas have to or will have to very very very soon... LOL... Its nice to see the greedy suffer. ouch. way beyond my league. boss, one more Q. you mentioned 2/5 dropped. what about the other 3? increasing or stagnant then? |

|

|

May 31 2013, 11:15 AM May 31 2013, 11:15 AM

|

Senior Member

986 posts Joined: May 2012 |

QUOTE(kochin @ May 31 2013, 10:57 AM) 4 to 5 mil prop? The other 3 stagnant, but the fella is fishing, sometimes will ask slightly lower (3-5%) then back up (through agents though, so I guess it could be agents at work rather than owner giving green light) ... Those 3 I don't track so closely and ready to drop from list ... Have to find a replacement. Anyway, the principal is the same for other properties as well (in my opinion).ouch. way beyond my league. boss, one more Q. you mentioned 2/5 dropped. what about the other 3? increasing or stagnant then? |

|

|

May 31 2013, 11:23 AM May 31 2013, 11:23 AM

|

Junior Member

324 posts Joined: Apr 2013 |

I do prefer commercial lots lo.

Good in renting and also high demand |

|

|

May 31 2013, 11:29 AM May 31 2013, 11:29 AM

|

Junior Member

551 posts Joined: May 2013 |

QUOTE(Rooney1985 @ May 31 2013, 11:15 AM) The other 3 stagnant, but the fella is fishing, sometimes will ask slightly lower (3-5%) then back up (through agents though, so I guess it could be agents at work rather than owner giving green light) ... Those 3 I don't track so closely and ready to drop from list ... Have to find a replacement. Anyway, the principal is the same for other properties as well (in my opinion). Stagnant: Sentul & Mutiara Damansara?Drop: Cheras & Puchong? |

|

|

May 31 2013, 11:29 AM May 31 2013, 11:29 AM

|

Senior Member

2,004 posts Joined: Mar 2011 |

Sorry... Wait a minute... Who are those actually bet on the going down side since the first few version anyway? Are they still around here betting on going down?

|

|

|

May 31 2013, 11:33 AM May 31 2013, 11:33 AM

|

Senior Member

1,359 posts Joined: Nov 2010 |

|

|

|

May 31 2013, 11:35 AM May 31 2013, 11:35 AM

|

Senior Member

986 posts Joined: May 2012 |

|

|

|

May 31 2013, 11:40 AM May 31 2013, 11:40 AM

|

Senior Member

2,024 posts Joined: Apr 2013 |

woah woah...here goes the games....I will be having fun watching.

|

|

|

May 31 2013, 11:58 AM May 31 2013, 11:58 AM

|

Junior Member

349 posts Joined: Feb 2013 From: KL |

Is this discussion referring to new launches or the secondary market?

I notice that new launch prices keep going up but the secondary market is open field depending on the unit and location. I have concerns about continuous stream of new launches when there are so many already built units empty. |

|

|

May 31 2013, 12:02 PM May 31 2013, 12:02 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(Aventador360 @ May 31 2013, 11:58 AM) Is this discussion referring to new launches or the secondary market? am referring to general property prices both new launches and/or secondary market.I notice that new launch prices keep going up but the secondary market is open field depending on the unit and location. I have concerns about continuous stream of new launches when there are so many already built units empty. |

|

|

May 31 2013, 12:22 PM May 31 2013, 12:22 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

|

|

|

May 31 2013, 12:49 PM May 31 2013, 12:49 PM

|

Senior Member

1,359 posts Joined: Nov 2010 |

QUOTE(tikaram @ May 31 2013, 12:22 PM) I thought we are here " Intelligent debates only pls " Ok will talk to him. Before that make sure you preach what you said. Dont cakap x serupa bikin. Its really disgusting coming fr an old man like you.Why your gang Worgen keep talk not so intelligent here? Can u talk talk to him? |

|

|

May 31 2013, 01:01 PM May 31 2013, 01:01 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

Worgen = Kochin gor?

----------------------------------------------------------- faReZheLmi quote: To me - as investor this should be a buying signal because you can take advantage in getting good property at discount price (considering not many people can buy property now due to very strict requirement to make loan). I believe The cycle will go up soon - maybe in 1-2 years, where many people can easily obtain loan from commercial bank again. And that will be the selling signal where we should dispose to collect our capital and get ready to reinvest! ============================================================================= @ faReZheLmi above refer. Maybe better not buying now...buying later?...more fire sales ma. This post has been edited by tikaram: May 31 2013, 01:10 PM |

|

|

May 31 2013, 02:07 PM May 31 2013, 02:07 PM

|

Senior Member

7,446 posts Joined: Sep 2008 |

This thread will feature a nathan rothschild wannabe coz he will say something else and do something else coz he thinks he can influence market.kekeke

|

|

|

May 31 2013, 02:48 PM May 31 2013, 02:48 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

u guy very free ka.... we are not interested on personal attacking la... that one is so yesterday...

i try to ignore u guy.... also keep kacau me..... jangan main main la... this is " Intelligent debates only " |

|

|

May 31 2013, 03:13 PM May 31 2013, 03:13 PM

|

Senior Member

2,024 posts Joined: Apr 2013 |

QUOTE(Aventador360 @ May 31 2013, 11:58 AM) Is this discussion referring to new launches or the secondary market? yalo....secondary slow in Penang...I notice that new launch prices keep going up but the secondary market is open field depending on the unit and location. I have concerns about continuous stream of new launches when there are so many already built units empty. |

|

|

May 31 2013, 03:32 PM May 31 2013, 03:32 PM

|

Senior Member

986 posts Joined: May 2012 |

http://biz.thestar.com.my/news/story.asp?f...11&sec=business

An indicator of where property market is going for 2013??? |

|

|

May 31 2013, 03:39 PM May 31 2013, 03:39 PM

|

Senior Member

829 posts Joined: Dec 2010 |

|

|

|

May 31 2013, 03:40 PM May 31 2013, 03:40 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

actually who or what party stand to gain the most in the event of a property downturn?

|

|

|

May 31 2013, 03:44 PM May 31 2013, 03:44 PM

|

Senior Member

2,024 posts Joined: Apr 2013 |

|

|

|

May 31 2013, 04:12 PM May 31 2013, 04:12 PM

|

Senior Member

986 posts Joined: May 2012 |

QUOTE(kochin @ May 31 2013, 03:40 PM) I wouldn't ask who would gain but rather who would lose the most. My feel, its gonna be the financially weak and greedy property flippers who entered late and are still in the market... current conditions look like a stalemate in asking prices and available funds/ affordability of the market.... If the downturn follows... well... good luck.Those who bought for own stay and what they can comfortably afford have nothing to fear in the downturn. Those who bought for own stay on a stretched budget may have to cut back on consumption in situations where job losses arises in the downturn. Those with ready funds can go on mega sale shopping spree at the expense of the first category (the biggest losers). Agents will probably be out of jobs as well cos, in downturn everything goes... Its exactly like a situation of mega sale, everything is just on the shelf and its for sale. You don't need sales people to help you out or explain. They're so desperate to sell and recuperate funds that they're not going to share the consideration with agents... Furthermore, those with funds will take an approach of whoever more desperate gets slaughtered more... From the looks of the secondary market it seems that a lot of people stuck and can't get out, like they missed the window to exit... now that its peaked... well... what follows? Anyone working in developer companies may face retrenchment. Even those in related industries (as per the earlier article on furniture). Those holding developer stocks may also suffer if developer's books are not healthy... Sooo... before up camp ask questions (which they always love to)... which category you fall into? (Already have a feeling some up camp gonna ask which category I'm in)... But isn't it already obvious? Anyway... this is not to scare everyone out there... just one of the possible outcomes.. may be opposite... your life, your decision. This post has been edited by Rooney1985: May 31 2013, 04:17 PM |

|

|

May 31 2013, 04:23 PM May 31 2013, 04:23 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(Rooney1985 @ May 31 2013, 04:12 PM) I wouldn't ask who would gain but rather who would lose the most. My feel, its gonna be the financially weak and greedy property flippers who entered late and are still in the market... current conditions look like a stalemate in asking prices and available funds/ affordability of the market.... If the downturn follows... well... good luck. lol. i am asking who stand to make the most because am trying to see whether there's any opportunity for myself to benefit from a property downturn.Those who bought for own stay and what they can comfortably afford have nothing to fear in the downturn. Those who bought for own stay on a stretched budget may have to cut back on consumption in situations where job losses arises in the downturn. Those with ready funds can go on mega sale shopping spree at the expense of the first category (the biggest losers). Agents will probably be out of jobs as well cos, in downturn everything goes... Its exactly like a situation of mega sale, everything is just on the shelf and its for sale. You don't need sales people to help you out or explain. They're so desperate to sell and recuperate funds that they're not going to share the consideration with agents. Anyone working in developer companies may face retrenchment. Even those in related industries (as per the earlier article on furniture). Those holding developer stocks may also suffer if developer's books are not healthy... Sooo... before up camp ask questions (which they always love to)... which category you fall into? (Already have a feeling some up camp gonna ask, so what category you're in?)... But isn't it already obvious? am not really bothered by who loses the most as it wouldn't benefit me in anyway. as to which category i belong to, i was classified by someone as a DDD camper. but i would like to term myself as a property enthusiast. it doesn't really bother me so much whether property prices goes north or south or sideways. i believe some are ridiculously overpriced. and i can't fathom why some props are not moving north as it should commands. but in hindsight, i do hope for higher property prices on overall because i dislike the fact that we are cheaper than most of our neighbouring countries. it belittles our purchasing power and our option to migrate (eg a kiasuland fella can buy our props but not necessary vice versa). |

|

|

May 31 2013, 04:32 PM May 31 2013, 04:32 PM

|

Senior Member

7,446 posts Joined: Sep 2008 |

This thread will feature a nathan rothschild wannabe coz he will say something else and do something else coz he thinks he can influence market.kekeke

|

|

|

May 31 2013, 04:33 PM May 31 2013, 04:33 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

|

|

|

May 31 2013, 04:37 PM May 31 2013, 04:37 PM

|

Senior Member

986 posts Joined: May 2012 |

QUOTE(kochin @ May 31 2013, 04:23 PM) lol. i am asking who stand to make the most because am trying to see whether there's any opportunity for myself to benefit from a property downturn. Fair comments... however, purchasing power is more a result of the competitiveness of the country in terms of resource utilisation rather than property prices. Too much corruption, lack of transparency, leakages as well as other factors leading to an unfriendly business environment is reducing the RM's purchasing power... The higher the property prices in Malaysia doesn't mean that you're purchasing power is increasing, it just makes it worst for the locals... for all you know currency exchange may out perform increase in property prices... property prices increase 50% but RM currency drops 80% its still cheaper for foreigners to buy. The Euro zone is already a fine example of this... countries that wannabe great have failed because they just aren't competitive enough to join the big boys. am not really bothered by who loses the most as it wouldn't benefit me in anyway. as to which category i belong to, i was classified by someone as a DDD camper. but i would like to term myself as a property enthusiast. it doesn't really bother me so much whether property prices goes north or south or sideways. i believe some are ridiculously overpriced. and i can't fathom why some props are not moving north as it should commands. but in hindsight, i do hope for higher property prices on overall because i dislike the fact that we are cheaper than most of our neighbouring countries. it belittles our purchasing power and our option to migrate (eg a kiasuland fella can buy our props but not necessary vice versa). Kiasu land's currency is larger because for every RM invested there, the returns are higher than in Boleh land... funds are not left idle and people are not lazing around. Ofcourse there are also other factors, livability, pollution, safety, cleanliness, transport systems etc, etc... unfortunately Bolehland loses out on every front... therefore my conclusion is the prices in Bolehland are at a delusional high and the only way is down??? That's my take la, obviously anything can happen, the govt suddenly cleans up the whole nation in 1 months time... (not impossible) and we really start competing on a global stage. |

|

|

May 31 2013, 04:38 PM May 31 2013, 04:38 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(joeblows @ May 31 2013, 04:33 PM) not really the type of answers i'm trying to look for.it's true that someone who have least exposure to banks, developers and property may suffer less compared to others who are more vested in those. but is there any industries or profession which actually benefits correspondingly with direct property downturn? eg.... when a prop drops 100k, does someone stands to pocket a % of that 100k through other means? |

|

|

May 31 2013, 04:43 PM May 31 2013, 04:43 PM

|

Senior Member

986 posts Joined: May 2012 |

QUOTE(kochin @ May 31 2013, 04:38 PM) not really the type of answers i'm trying to look for. There are industries that profit from downturns... but in regards to your example of the 100K loss?.. no because in the first place this 100K was not added value in the first place but resulting from speculation. If 100K was added to the value in terms of renovations and this was the loss when sold during downturn then the purchaser has made that renovation (i.e. it cost him nothing). However, he would have to consider the total package value as certain price components that went into the property in non value added and paying for non-value added components is what adds to the uncompetitiveness of the nation.it's true that someone who have least exposure to banks, developers and property may suffer less compared to others who are more vested in those. but is there any industries or profession which actually benefits correspondingly with direct property downturn? eg.... when a prop drops 100k, does someone stands to pocket a % of that 100k through other means? Very interesting question too... this would also mean that any subsequent market transaction that is below the last market transaction would mean that anything above this is consider non-value added pricing (why pay more when one can buy it cheaper)... well once this happens the spiral starts. Hope that answers your question. This post has been edited by Rooney1985: May 31 2013, 04:46 PM |

|

|

May 31 2013, 04:47 PM May 31 2013, 04:47 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(Rooney1985 @ May 31 2013, 04:37 PM) Fair comments... however, purchasing power is more a result of the competitiveness of the country in terms of resource utilisation rather than property prices. Too much corruption, lack of transparency, leakages as well as other factors leading to an unfriendly business environment is reducing the RM's purchasing power... The higher the property prices in Malaysia doesn't mean that you're purchasing power is increasing, it just makes it worst for the locals... for all you know currency exchange may out perform increase in property prices... property prices increase 50% but RM currency drops 80% its still cheaper for foreigners to buy. The Euro zone is already a fine example of this... countries that wannabe great have failed because they just aren't competitive enough to join the big boys. humour me along rooney boss for i think you do have some economic flair.Kiasu land's currency is larger because for every RM invested there, the returns are higher than in Boleh land... funds are not left idle and people are not lazing around. Ofcourse there are also other factors, livability, pollution, safety, cleanliness, transport systems etc, etc... unfortunately Bolehland loses out on every front... therefore my conclusion is the prices in Bolehland are at a delusional high and the only way is down??? That's my take la, obviously anything can happen, the govt suddenly cleans up the whole nation in 1 months time... (not impossible) and we really start competing on a global stage. i believe a vast % contributing to our rise in property prices is because of our poor performing currency exchange. while pricing could be high, what's stopping it to go higher IF our currency performs worse? on the other hand, if strong economy kicks in, cost of doing businesses might actually go down with better transparency and less corruption. this in return lowers cost of production including cost of construction. but this would not translate to lower property prices still as with better economy, i believe consumer would spend more too. but i do believe they would spend wiser. can i sum it that poor currency, property price rise in tandem and citizens suffer. good economy, property price rises in tandem and ties in with citizens' affordability? This post has been edited by kochin: May 31 2013, 04:50 PM |

|

|

May 31 2013, 04:59 PM May 31 2013, 04:59 PM

|

Senior Member

986 posts Joined: May 2012 |

QUOTE(kochin @ May 31 2013, 04:47 PM) humour me along rooney boss for i think you do have some economic flair. True to a certain extent that increased property prices are due to currency exchange, but we also have to consider where these resources that go into building are coming from? locally? or imported? if imported by all means factor that into the price.. if locally... well something must be wrong somewhere that the prices are so high (corruption maybe... again not competitive)i believe a vast % contributing to our rise in property prices is because of our poor performing currency exchange. while pricing could be high, what's stopping it to go higher IF our currency performs worse? on the other hand, if strong economy kicks in, cost of doing businesses might actually go down with better transparency and less corruption. this in return lowers cost of production including cost of construction. but this would not translate to lower property prices still as with better economy, i believe consumer would spend more too. but i do believe they would spend wiser. can i sum it that poor currency, property price rise in tandem and citizens suffer. good economy, property price rises in tandem and ties in with citizens' affordability? If economy together with currency strengthens then well all should be rosy as long as this economic and currency strength is a resulting from competitive advantages... if not then again its just delusional... I see no reason to disagree with your conclusion... maybe, for good economy, property will rise in terms of foreign currencies... but will remain affordable for citizens... again due to exchange rate (purchasing power). |

|

|

May 31 2013, 06:56 PM May 31 2013, 06:56 PM

|

Senior Member

2,856 posts Joined: Jan 2010 |

|

|

|

May 31 2013, 07:17 PM May 31 2013, 07:17 PM

|

Senior Member

2,024 posts Joined: Apr 2013 |

|

|

|

May 31 2013, 07:25 PM May 31 2013, 07:25 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

|

|

|

May 31 2013, 07:32 PM May 31 2013, 07:32 PM

|

Senior Member

829 posts Joined: Dec 2010 |

I just wonder... those ppl that think its going to be bubble soon owns any property?

If yes, why you still owning it? |

|

|

May 31 2013, 07:33 PM May 31 2013, 07:33 PM

|

Senior Member

829 posts Joined: Dec 2010 |

|

|

|

May 31 2013, 09:47 PM May 31 2013, 09:47 PM

|

Senior Member

2,024 posts Joined: Apr 2013 |

|

|

|

May 31 2013, 09:48 PM May 31 2013, 09:48 PM

|

Senior Member

2,024 posts Joined: Apr 2013 |

|

|

|

May 31 2013, 11:41 PM May 31 2013, 11:41 PM

|

Junior Member

551 posts Joined: May 2013 |

QUOTE(kochin @ May 31 2013, 04:38 PM) not really the type of answers i'm trying to look for. You do have a crazy idea to achieve this, don't you? it's true that someone who have least exposure to banks, developers and property may suffer less compared to others who are more vested in those. but is there any industries or profession which actually benefits correspondingly with direct property downturn? eg.... when a prop drops 100k, does someone stands to pocket a % of that 100k through other means? |

|

|

Jun 1 2013, 01:21 AM Jun 1 2013, 01:21 AM

|

Senior Member

829 posts Joined: Dec 2010 |

|

|

|

Jun 1 2013, 07:57 AM Jun 1 2013, 07:57 AM

|

Senior Member

1,359 posts Joined: Nov 2010 |

QUOTE(tikaram @ May 31 2013, 09:18 AM) warming here.... Are you serious on this? But why are you still looking at Tropicana Metro Park, One Amerin Residency@Balakong and CloudTree @ Cheras. You also bought 2 bijis C180, 2 bijis Empire Damansara and 2 bijis JadeHill. You really got 2bijis. Salute. u will come at a point some up up up camp saying this again in V11. -------------------------------------------------------------------------------------- - Anytime is a good time to buy - Properties prices will always go up in the long-term - The market cannot collapse because of demand from foreigners - Mickey mouse units are the trend of the future ---------------------------------------------------------------------------------------- read more here why they said that? P/s : all this you bought for friends? https://forum.lowyat.net/index.php?showtopi...&#entry60744128 This post has been edited by worgen: Jun 1 2013, 07:58 AM |

|

|

Jun 1 2013, 11:34 AM Jun 1 2013, 11:34 AM

|

Senior Member

1,979 posts Joined: Mar 2005 |

QUOTE(Aventador360 @ May 31 2013, 11:58 AM) Is this discussion referring to new launches or the secondary market? in fact, a lot of places you go will have many empty units....I notice that new launch prices keep going up but the secondary market is open field depending on the unit and location. I have concerns about continuous stream of new launches when there are so many already built units empty. |

|

|

Jun 1 2013, 11:47 AM Jun 1 2013, 11:47 AM

|

Senior Member

1,979 posts Joined: Mar 2005 |

QUOTE(kochin @ May 31 2013, 04:23 PM) lol. i am asking who stand to make the most because am trying to see whether there's any opportunity for myself to benefit from a property downturn. hhmmm, you're very funny. you do realize in a coin there's 2 situation, yet you say you are only interested to know opportunity instead of losses, when both are actually related side by side. your replies is a bit stupid, no offence. the moment you admitted it wont benefit you anyway, i think it's very obvious you arent a investor or whatever that the people here claim they are.am not really bothered by who loses the most as it wouldn't benefit me in anyway. as to which category i belong to, i was classified by someone as a DDD camper. but i would like to term myself as a property enthusiast. it doesn't really bother me so much whether property prices goes north or south or sideways. i believe some are ridiculously overpriced. and i can't fathom why some props are not moving north as it should commands. but in hindsight, i do hope for higher property prices on overall because i dislike the fact that we are cheaper than most of our neighbouring countries. it belittles our purchasing power and our option to migrate (eg a kiasuland fella can buy our props but not necessary vice versa). but you are right on 1 thing, the property some are ridicilous. |

|

|

Jun 1 2013, 01:13 PM Jun 1 2013, 01:13 PM

|

Junior Member

349 posts Joined: Feb 2013 From: KL |

Does anyone have any thoughts of MK11 in Mont Kiara? Is it a good buy at 700psf? I know that Kenny Heights is coming up in front of it and will block most of the good views but....it is a pretty nice place, stupid private lift foyer though

|

|

|

Jun 1 2013, 04:57 PM Jun 1 2013, 04:57 PM

|

Senior Member

829 posts Joined: Dec 2010 |

QUOTE(Aventador360 @ Jun 1 2013, 01:13 PM) Does anyone have any thoughts of MK11 in Mont Kiara? Is it a good buy at 700psf? I know that Kenny Heights is coming up in front of it and will block most of the good views but....it is a pretty nice place, stupid private lift foyer though For own stay ...why not? |

|

|

Jun 1 2013, 04:59 PM Jun 1 2013, 04:59 PM

|

Junior Member

349 posts Joined: Feb 2013 From: KL |

|

|

|

Jun 1 2013, 06:08 PM Jun 1 2013, 06:08 PM

|

Senior Member

2,856 posts Joined: Jan 2010 |

QUOTE(Aventador360 @ Jun 1 2013, 01:13 PM) Does anyone have any thoughts of MK11 in Mont Kiara? Is it a good buy at 700psf? I know that Kenny Heights is coming up in front of it and will block most of the good views but....it is a pretty nice place, stupid private lift foyer though Mk10 better choice |

|

|

Jun 2 2013, 03:29 PM Jun 2 2013, 03:29 PM

|

All Stars

13,759 posts Joined: Jun 2011 |

|

|

|

Jun 2 2013, 04:07 PM Jun 2 2013, 04:07 PM

|

Senior Member

2,856 posts Joined: Jan 2010 |

|

|

|

Jun 2 2013, 04:11 PM Jun 2 2013, 04:11 PM

|

All Stars

13,759 posts Joined: Jun 2011 |

|

|

|

Jun 2 2013, 06:20 PM Jun 2 2013, 06:20 PM

|

Junior Member

349 posts Joined: Feb 2013 From: KL |

|

|

|

Jun 2 2013, 09:50 PM Jun 2 2013, 09:50 PM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

i 2nd zuiko on this.

mk10 is a much better product compared to mk11. nevertheless, your choice, your $$$, your decision. cheers! |

|

|

Jun 2 2013, 09:58 PM Jun 2 2013, 09:58 PM

|

Senior Member

1,359 posts Joined: Nov 2010 |

Magna Prima graduating to billion-ringgit projects

http://www.starproperty.my/index.php/prope...nggit-projects/ More interesting project coming in Bukit Jalil and Jalan Ampang. Property Price up up up again. |

|

|

Jun 2 2013, 11:07 PM Jun 2 2013, 11:07 PM

|

All Stars

13,759 posts Joined: Jun 2011 |

QUOTE(worgen @ Jun 2 2013, 09:58 PM) Magna Prima graduating to billion-ringgit projects Magna is definitely not a gd dev. Hav been to most of their projects and the finish products r s*cks.http://www.starproperty.my/index.php/prope...nggit-projects/ More interesting project coming in Bukit Jalil and Jalan Ampang. Property Price up up up again. |

|

|

Jun 2 2013, 11:29 PM Jun 2 2013, 11:29 PM

|

Junior Member

209 posts Joined: Aug 2010 |

|

|

|

Jun 3 2013, 12:15 AM Jun 3 2013, 12:15 AM

|

Senior Member

2,856 posts Joined: Jan 2010 |

QUOTE(worgen @ Jun 2 2013, 09:58 PM) Magna Prima graduating to billion-ringgit projects The one in Bukit Jalil is seri Jalil 3 storey link, which almost completedhttp://www.starproperty.my/index.php/prope...nggit-projects/ More interesting project coming in Bukit Jalil and Jalan Ampang. Property Price up up up again. |

|

|

Jun 3 2013, 12:17 AM Jun 3 2013, 12:17 AM

|

Senior Member

2,856 posts Joined: Jan 2010 |

|

|

|

Jun 3 2013, 12:21 AM Jun 3 2013, 12:21 AM

|

Junior Member

207 posts Joined: Mar 2009 |

what are your opinions on the bougainvilla bukit bintang apartment? Apparently KLFID is right on our doorstep so property prices should increase folds then ?

|

|

|

Jun 3 2013, 08:00 AM Jun 3 2013, 08:00 AM

|

Senior Member

2,024 posts Joined: Apr 2013 |

|

|

|

Jun 3 2013, 08:36 AM Jun 3 2013, 08:36 AM

|

All Stars

10,314 posts Joined: Dec 2009 From: Malaysia |

QUOTE(wwwcomment @ Jun 2 2013, 11:29 PM) for starters, mk10 site is bigger than mk11 yet having less unit.mk10, being on slightly elevated ground, have higher height compared to mk11. it's elevated deck at the podium stretches more than 1km. each unit comes with steam bath. and of course, it also scored higher quality rating by bca between these 2. mk11 main focal was the architectural and it's floating deck podium. some may find it's facade too commercial like. while mk10 do seems boring but at least it would stand the test of time being the boring old look. but don't get me wrong, both are good product except i prefer 10 over 11. 11 is more expensive being smaller unit and launched later. QUOTE(zuiko407 @ Jun 3 2013, 12:17 AM) what about seni?and the upcoming competition from icon, concerto, verdana? QUOTE(soules83 @ Jun 3 2013, 08:00 AM) 700psf, not 700sf. |

|

|

Jun 3 2013, 09:39 AM Jun 3 2013, 09:39 AM

|

Senior Member

548 posts Joined: Sep 2005 |

hi guys,

which area should avoid condo? over supply? anyone have the reference?? is kuchai consideR? |

|

|

Jun 3 2013, 10:07 AM Jun 3 2013, 10:07 AM

|

Senior Member

595 posts Joined: Mar 2006 |

|

|

|

Jun 3 2013, 10:43 AM Jun 3 2013, 10:43 AM

|

Newbie

3 posts Joined: Jun 2013 |

good sharing, steven83

|

|

|

Jun 3 2013, 11:39 AM Jun 3 2013, 11:39 AM

|

Junior Member

209 posts Joined: Aug 2010 |

QUOTE(kochin @ Jun 3 2013, 08:36 AM) for starters, mk10 site is bigger than mk11 yet having less unit. good explanation. thxmk10, being on slightly elevated ground, have higher height compared to mk11. it's elevated deck at the podium stretches more than 1km. each unit comes with steam bath. and of course, it also scored higher quality rating by bca between these 2. mk11 main focal was the architectural and it's floating deck podium. some may find it's facade too commercial like. while mk10 do seems boring but at least it would stand the test of time being the boring old look. but don't get me wrong, both are good product except i prefer 10 over 11. 11 is more expensive being smaller unit and launched later. |

|

|

Jun 3 2013, 11:46 AM Jun 3 2013, 11:46 AM

|

Junior Member

551 posts Joined: May 2013 |

|

|

|

Jun 3 2013, 03:48 PM Jun 3 2013, 03:48 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

QUOTE(kochin @ May 31 2013, 04:38 PM) not really the type of answers i'm trying to look for. Yes, since the market is overpriced it will (I believe) correct violently and for a short season properties may be underpriced (a la US housing market in 08 and 09). it's true that someone who have least exposure to banks, developers and property may suffer less compared to others who are more vested in those. but is there any industries or profession which actually benefits correspondingly with direct property downturn? eg.... when a prop drops 100k, does someone stands to pocket a % of that 100k through other means? Someone who has very little (or no) exposure to trouble, will stand to gain easily 100k from buying at the trough and holding. |

|

|

Jun 3 2013, 03:52 PM Jun 3 2013, 03:52 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

QUOTE(kochin @ Jun 3 2013, 08:36 AM) for starters, mk10 site is bigger than mk11 yet having less unit. MK 10 units are big though.mk10, being on slightly elevated ground, have higher height compared to mk11. it's elevated deck at the podium stretches more than 1km. each unit comes with steam bath. and of course, it also scored higher quality rating by bca between these 2. mk11 main focal was the architectural and it's floating deck podium. some may find it's facade too commercial like. while mk10 do seems boring but at least it would stand the test of time being the boring old look. but don't get me wrong, both are good product except i prefer 10 over 11. 11 is more expensive being smaller unit and launched later. what about seni? and the upcoming competition from icon, concerto, verdana? 700psf, not 700sf. Agree that it is more "value for money" (LOL as if any property is value for money now) than MK 11 but even in any sort of property market, big condo units are slower to shift. An investor needs to be patient. Rental for bigger unit also typically lower psf than smaller unit and lower demand (due to high cost they have limited takers, mostly expat, as locals who can afford the monthly rent already bought their own residence) and the cost of furnishing is usually far higher. |

|

|

Jun 3 2013, 05:05 PM Jun 3 2013, 05:05 PM

|

Junior Member

418 posts Joined: Dec 2005 From: The Inside Out |

Just don't buy house. Rent until the banks collapse due to their own terrible lending standards and then get in cheap.

Don't pay a high price just because banks are reckless. |

|

|

Jun 3 2013, 05:26 PM Jun 3 2013, 05:26 PM

|

Senior Member

1,359 posts Joined: Nov 2010 |

|

|

|

Jun 3 2013, 05:35 PM Jun 3 2013, 05:35 PM

|

Senior Member

7,446 posts Joined: Sep 2008 |

|

|

|

Jun 3 2013, 06:08 PM Jun 3 2013, 06:08 PM

|

Senior Member

1,359 posts Joined: Nov 2010 |

|

|

|

Jun 3 2013, 06:29 PM Jun 3 2013, 06:29 PM

|

Junior Member

349 posts Joined: Feb 2013 From: KL |

If the banks collapse as severely as some of you insinuate no one will be spared. Please take note of what has happened in Cyprus. All of your immense cash holdings in your accounts will be receive haircuts if lucky and if the banks go under as so many of you are hoping then your deposits are only insured for up to RM250,000.00. SO what exactly are you hoping for and exactly how much money do you have tucked in your mattress ???

|

|

|

Jun 3 2013, 07:08 PM Jun 3 2013, 07:08 PM

|

Junior Member

89 posts Joined: Dec 2012 |

hi, im so sorry to change the subject....but i have a question to ask, lets say if i buy now mentari court at sunway for 150k for investment, what is the price 10 yrs down the road. and lets say if i dont wanna sell it after i purchase it, what is the limit price that can be reach...how far it will go.

|

|

|

Jun 3 2013, 07:20 PM Jun 3 2013, 07:20 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

QUOTE(Aventador360 @ Jun 3 2013, 06:29 PM) If the banks collapse as severely as some of you insinuate no one will be spared. Please take note of what has happened in Cyprus. All of your immense cash holdings in your accounts will be receive haircuts if lucky and if the banks go under as so many of you are hoping then your deposits are only insured for up to RM250,000.00. SO what exactly are you hoping for and exactly how much money do you have tucked in your mattress ??? What makes you think my money is in Malaysian banks? |

|

|

Jun 3 2013, 07:21 PM Jun 3 2013, 07:21 PM

|

Senior Member

595 posts Joined: Mar 2006 |

QUOTE(AMINT @ Jun 3 2013, 05:35 PM) Haha. I think many person waiting will collapsed first after seeing more and more properties are beyond reach before the banks collapse I don't think so, if the property price are beyond reach. Who will collapsed first? There are so many property for rent....they can even bargain for a cheaper rent. A very clear point is the auction houses are increasing, do you think the bank won't afraid? Do you think investor aren't afraid? Fundamental will judge the future, good show ahead, stay fun with the game and I will be watching the event.This post has been edited by Steven83: Jun 3 2013, 07:27 PM |

|

|

Jun 3 2013, 07:22 PM Jun 3 2013, 07:22 PM

|

Senior Member

595 posts Joined: Mar 2006 |

|

|

|

Jun 3 2013, 07:28 PM Jun 3 2013, 07:28 PM

|

Junior Member

349 posts Joined: Feb 2013 From: KL |

You are smart indeed.

The Ringgit has been strengthening against many currencies in the last 12 months. So which currency are you holding? The following currencies have weakened against the Ringgit in the last 6 months. AUD SGD STG USD I seriously need your counsel. Gold also has co me down. I believe that you are the answer to my financial success. Advise me! Unless now you are going to say that you are inequities? QUOTE(Steven83 @ Jun 3 2013, 07:22 PM) |

|

|

Jun 3 2013, 07:40 PM Jun 3 2013, 07:40 PM

|

Junior Member

349 posts Joined: Feb 2013 From: KL |

Sorry for being a bit rude but I think that if the market collapses then it's going to be pretty dismal for everyone. I hope we all prosper irregardless.

|

|

|

Jun 3 2013, 07:41 PM Jun 3 2013, 07:41 PM

|

Senior Member

595 posts Joined: Mar 2006 |

QUOTE(Aventador360 @ Jun 3 2013, 07:28 PM) You are smart indeed. Smart or not I dunno as far as I know is look for opportunity globally. I can't advice much on your status as I not sure about your strategy. Firstly I already left AUD for quite some time and move to other currency and I work on equities instead of putting the cash in the oversea FD. For gold, you could enter now but don't expect to have much gain as US has over sell the gold. The gold can now maintain its status is because of the demand from asian. I'm not specialize in metal stuff, but I feel that if you have the extra. No harm to hold the gold for 1 year, you should be able to see the gain by next year.... but note that nothing is perfect...even comes to property therefore...look at the news and chart often. And...please be careful with any government policy...they are deadly. If u want to know something from me, as return I will want something from you. Therefore you could pm your advice and info to me, we can share our founding.The Ringgit has been strengthening against many currencies in the last 12 months. So which currency are you holding? The following currencies have weakened against the Ringgit in the last 6 months. AUD SGD STG USD I seriously need your counsel. Gold also has co me down. I believe that you are the answer to my financial success. Advise me! Unless now you are going to say that you are inequities? |

|

|

Jun 3 2013, 07:49 PM Jun 3 2013, 07:49 PM

|

Senior Member

595 posts Joined: Mar 2006 |

QUOTE(Aventador360 @ Jun 3 2013, 07:40 PM) Sorry for being a bit rude but I think that if the market collapses then it's going to be pretty dismal for everyone. I hope we all prosper irregardless. anything is possible, and I don't hope to see Msia market collapse. But by looking at China company is moving in Msia job market.....I had bad feelings about this...as even China market already slowing down by looking on the data...China won't be as nice as US or JAP or Germany....looks at their human right policy...and how they treat their own people. They going to do a mess on our land soon....THanks to our so so great government. |

|

|

Jun 3 2013, 07:52 PM Jun 3 2013, 07:52 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

QUOTE(kumbaya @ Jun 3 2013, 07:08 PM) hi, im so sorry to change the subject....but i have a question to ask, lets say if i buy now mentari court at sunway for 150k for investment, what is the price 10 yrs down the road. Who knows? If anyone have such a crystal ball he would be a billionaire already.QUOTE(kumbaya @ Jun 3 2013, 07:08 PM) and lets say if i dont wanna sell it after i purchase it, what is the limit price that can be reach...how far it will go. No such thing as a limit, positive or negative.So far as rental properties go, it could be positive, double in value. It could be negative, stagnant in value, your rental just covering your interest and unit maintenance costs (yearly taxes, maintenance of things in the unit, paint, cleaning, etc). After a certain period it may have some slight appreciation but after taking off interests costs and opportunity cost you may be at the losing end. Any where between the two. For budget prop, lower chance of scenario (2) occurring, and probably not too difficult to find tenants. But managing tenants for low cost is very headache. |

|

|

Jun 3 2013, 11:22 PM Jun 3 2013, 11:22 PM

|

Junior Member

192 posts Joined: Dec 2010 |

|

|

|

Jun 4 2013, 10:19 AM Jun 4 2013, 10:19 AM

|

Senior Member

1,458 posts Joined: Jul 2011 |

QUOTE(kumbaya @ Jun 3 2013, 07:08 PM) hi, im so sorry to change the subject....but i have a question to ask, lets say if i buy now mentari court at sunway for 150k for investment, what is the price 10 yrs down the road. and lets say if i dont wanna sell it after i purchase it, what is the limit price that can be reach...how far it will go. Ask me? Let me predict.... price will sky high to $400k but hardly get buyers coz many foreigners staying..sellers have to sell below mv..maybe sell $200k coz most buyers are investors n want to nego kaw2.... ok end if crystall ball.... |

|

|

Jun 4 2013, 01:02 PM Jun 4 2013, 01:02 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Steven83 @ Jun 3 2013, 07:21 PM) I don't think so, if the property price are beyond reach. Who will collapsed first? There are so many property for rent....they can even bargain for a cheaper rent. A very clear point is the auction houses are increasing, do you think the bank won't afraid? Do you think investor aren't afraid? Fundamental will judge the future, good show ahead, stay fun with the game and I will be watching the event. No need wait until bank collapse.. if interest rate goes up 1%.. already lots of over leveraged people collapse... then the property prices will come down naturally.There is a cycle for all investment, property included. Look at those people saying investing in gold sure win one..now? The collapse in bond is already starting.... signalling higher interest rate to come. JGB bonds interest went up from 0.3% to 1.2% briefly before BOJ suppressing action brought it down back to 0.85%. Similarly hit is Europe, US and emerging market bonds. This post has been edited by gark: Jun 4 2013, 01:11 PM |

|

|

Jun 4 2013, 01:37 PM Jun 4 2013, 01:37 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

QUOTE(Dern @ Jun 1 2013, 12:47 PM) hhmmm, you're very funny. you do realize in a coin there's 2 situation, yet you say you are only interested to know opportunity instead of losses, when both are actually related side by side. your replies is a bit stupid, no offence. the moment you admitted it wont benefit you anyway, i think it's very obvious you arent a investor or whatever that the people here claim they are. What happen to our belove Dern post? I think i gave +99 and Like... Got missing?but you are right on 1 thing, the property some are ridicilous. Got deleted again by that BIAS moderator? Okok... Like this Dern comment very much. a coin there's 2 situation.....see this property cycle? the even worst one for Japan.... +99 from me for Dern above comment. Attached thumbnail(s)

|

|

|

Jun 4 2013, 01:45 PM Jun 4 2013, 01:45 PM

|

Senior Member

7,446 posts Joined: Sep 2008 |

Arent you DDD guys tired of saying property prices will go down but IT HAS NOT GONE DOWN SINCE I DUNNO... 2008? I have been monitoring this thread since 2011. after year 2011 ended, property prices have not gone down. ok now is 2012 and DDD keep saying property prices will go down. after year 2012 ended, property prices still have not gone down. ok now is 2013 and DDD keep saying property prices will go down. WTF ler.huhuhu. Like dat every year keep saying the same thing but it didnt happen. What happened was this: PROPERTY PRICES GONE UP.

I am glad to state a few props here FROM DEVELOPERS (not subsales) have gone up. These are not recently launch phases but the exact ones launched before and price was increased: 1) nadayu 92 2) elements@ampang 3) tropicana metropark How about you DDD guys? Show me la at least 3 props from developers that have gone down in price. I am just stating the facts here. If I believe that propert price will go down, I will say it out loud. But from current scenario, I seriously dont see how that could be the case This post has been edited by AMINT: Jun 4 2013, 01:54 PM |

|

|

Jun 4 2013, 01:57 PM Jun 4 2013, 01:57 PM

|

Senior Member

1,239 posts Joined: Jan 2003 From: SMK Kepong Baru, KL |

QUOTE(AMINT @ Jun 4 2013, 01:45 PM) Arent you DDD guys tired of saying property prices will go down but IT HAS NOT GONE DOWN SINCE I DUNNO... 2008? I have been monitoring this thread since 2011. after year 2011 ended, property prices have not gone down. ok now is 2012 and DDD keep saying property prices will go down. after year 2012 ended, property prices still have not gone down. ok now is 2013 and DDD keep saying property prices will go down. WTF ler.huhuhu. Like dat every year keep saying the same thing but it didnt happen. What happened was this: PROPERTY PRICES GONE UP. LOL BRO.. I know how u feel.. my dad too told bubble will burst in 2008.. wait son.. then 2010..same advice wait son.. now..dad THE BUBBLE DIDNT BURST LEH!!!!I am glad to state a few props here FROM DEVELOPERS (not subsales) have gone up. These are not recently launch phases but the exact ones launched before and price was increased: 1) nadayu 92 2) elements@ampang 3) tropicana metropark How about you DDD guys? Show me la at least 3 props from developers that have gone down in price. I am just stating the facts here. If I believe that propert price will go down, I will say it out loud. But from current scenario, I seriously dont see how that could be the case |

|

|

Jun 4 2013, 02:00 PM Jun 4 2013, 02:00 PM

|

Senior Member

1,239 posts Joined: Jan 2003 From: SMK Kepong Baru, KL |

we have to understand msia economy are spesel one. whatever go up will not go down UNLESS... u knw lah..

|

|

|

Jun 4 2013, 02:59 PM Jun 4 2013, 02:59 PM

|

Senior Member

7,446 posts Joined: Sep 2008 |

QUOTE(takeshi99 @ Jun 4 2013, 01:57 PM) LOL BRO.. I know how u feel.. my dad too told bubble will burst in 2008.. wait son.. then 2010..same advice wait son.. now..dad THE BUBBLE DIDNT BURST LEH!!!! Hehe. Thats why la. My bro last time said the same thing. Now joining me buying every year. |

|

|

Jun 4 2013, 03:25 PM Jun 4 2013, 03:25 PM

|

Senior Member

1,801 posts Joined: Aug 2012 |

As far as I know after GE till now....... Contractors and developers that i know are moving forward, getting more busy...... Will the price drop?.....

|

|

|

Jun 4 2013, 04:48 PM Jun 4 2013, 04:48 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

QUOTE(AppreciativeMan @ Jun 4 2013, 04:25 PM) As far as I know after GE till now....... Contractors and developers that i know are moving forward, getting more busy...... Will the price drop?..... i gave another view to balance updeveloper 1) more time/ busy to " promote" it. 2) spend more money on marketing 3) offer better this and that dibs la, discount la ..... 4) more dirty ways 5) need to launch more faster eg using option sales. Even before VP obtain etc etc. |

|

|

Jun 4 2013, 05:10 PM Jun 4 2013, 05:10 PM

|

Senior Member

7,446 posts Joined: Sep 2008 |

QUOTE(tikaram @ Jun 4 2013, 04:48 PM) i gave another view to balance up Talk3 but no isi. Give examples la which properties prices already gone down.developer 1) more time/ busy to " promote" it. 2) spend more money on marketing 3) offer better this and that dibs la, discount la ..... 4) more dirty ways 5) need to launch more faster eg using option sales. Even before VP obtain etc etc. |

|

|

Jun 4 2013, 05:16 PM Jun 4 2013, 05:16 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

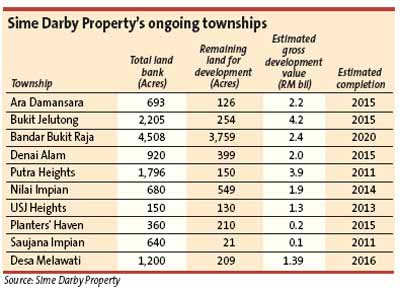

this one lagoon suites some one pay a bit cheaper la.

another project sime darby got people comment new launching is cheaper than old launching la. ---> https://forum.lowyat.net/index.php?showtopi...2&hl=denai+alam Just 2 example one is sub-sales and one new launch - sharing is caring This post has been edited by tikaram: Jun 4 2013, 05:20 PM Attached thumbnail(s)

|

|

|

Jun 4 2013, 05:19 PM Jun 4 2013, 05:19 PM

|

Senior Member

7,446 posts Joined: Sep 2008 |

|

|

|

Jun 4 2013, 05:20 PM Jun 4 2013, 05:20 PM

|

Senior Member

5,488 posts Joined: Jun 2008 |

|

|

|

Jun 4 2013, 05:22 PM Jun 4 2013, 05:22 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

QUOTE(kh8668 @ Jun 4 2013, 06:20 PM) actually the asking is still high. just the valuation is low. oh.....sometimes there got another arrangement between actual purchaser price versus SPA price. very good... something price is higher actually also got arrangement with buyer to push up purchase price so that no need to pay any downpayment and can get money form bank to finance renovation too. |

|

|

Jun 4 2013, 05:23 PM Jun 4 2013, 05:23 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

|

|

|

Jun 4 2013, 05:32 PM Jun 4 2013, 05:32 PM

|

Senior Member

5,488 posts Joined: Jun 2008 |

|

|

|

Jun 4 2013, 05:35 PM Jun 4 2013, 05:35 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

QUOTE(kh8668 @ Jun 4 2013, 06:32 PM) the one paying 390k still untung 10k compare 400kthe remaining as quote above : " something price is higher actually also got arrangement with buyer to push up purchase price so that no need to pay any downpayment and can get money form bank to finance renovation too". This post has been edited by tikaram: Jun 4 2013, 05:37 PM |

|

|

Jun 4 2013, 05:40 PM Jun 4 2013, 05:40 PM

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(tikaram @ Jun 4 2013, 05:35 PM) the one paying 390k still untung 10k compare 400k as long as there are many the same range price, do not worry much then. the remaining as quote above : " something price is higher actually also got arrangement with buyer to push up purchase price so that no need to pay any downpayment and can get money form bank to finance renovation too". |

|

|

Jun 4 2013, 05:44 PM Jun 4 2013, 05:44 PM

|

All Stars

10,722 posts Joined: Nov 2011 |

|

|

|

Jun 4 2013, 05:46 PM Jun 4 2013, 05:46 PM

|

Senior Member

5,488 posts Joined: Jun 2008 |

|

|

|

Jun 4 2013, 06:01 PM Jun 4 2013, 06:01 PM

|

Senior Member

7,446 posts Joined: Sep 2008 |

|

|

|

Jun 4 2013, 07:05 PM Jun 4 2013, 07:05 PM

|

Senior Member

1,780 posts Joined: Nov 2010 |

Five stone for auction, this must be a joke.

http://www.iproperty.com.my/propertylistin...ominium_ForSale Long time don't post...cause the price so stuborn.. This post has been edited by Nikmon: Jun 4 2013, 07:05 PM |

|

|

Jun 4 2013, 07:29 PM Jun 4 2013, 07:29 PM

|

Senior Member

1,801 posts Joined: Aug 2012 |

QUOTE(tikaram @ Jun 4 2013, 04:48 PM) i gave another view to balance up Since u speak more politely I'll reply......developer 1) more time/ busy to " promote" it. 2) spend more money on marketing 3) offer better this and that dibs la, discount la ..... 4) more dirty ways 5) need to launch more faster eg using option sales. Even before VP obtain etc etc. What is there to balance? What's most important is end result..... Regardless developer is busy promoting, marketing, offer better discount or whatever, if the end result is project sellable......U think price will still drop? Jus ask yourself, a DDD also buying (well, regardless it's selective or not, it's still a demand in market) what else will a NNN (Neutral) and UUU do? Oversupply? Maybe yes, but so what? Once again I repeat..... I'm not a supporter of UUU, but I'm a realistic person, I'm more of NNN. I never deny price is high, but nobody can guarantee price will drop (unless u regard slows drop).... Not to mention how much it can drop.... What if its from now, 600psf, it went up another 20%, which equivalent to 720psf.... Then it starts to drop.... But drop how much? 5%? 10%? 15%? 20%? How sure? If it drop only 15%, u may be correct it dropped, but u still need to buy higher price.... |

|

|

Jun 4 2013, 08:16 PM Jun 4 2013, 08:16 PM

|

Senior Member

1,359 posts Joined: Nov 2010 |

QUOTE(tikaram @ Jun 4 2013, 04:48 PM) i gave another view to balance up __________________________________________________________________________________developer 1) more time/ busy to " promote" it. 2) spend more money on marketing 3) offer better this and that dibs la, discount la ..... 4) more dirty ways 5) need to launch more faster eg using option sales. Even before VP obtain etc etc. Jadehills - Developed by Gamuda, Can anyone provide some insights? tikaram Posted May 15 2013, 10:38 AMPost #541 QUOTE(rongfu @ May 6 2013, 01:57 PM)change to : 1) Gita Bayu 2) Jade Hills 3) Country Height MRT could be very near here also. I think I will keep and not selling my unit. https://forum.lowyat.net/topic/2812459 ___________________________________________________________________________________ https://forum.lowyat.net/topic/1647237/+540 ___________________________________________________________________________________ Again, tikaram oh tikaram...are you so stupid not to sell and keep your unit if you know market is going down? Your Jadehills developer never do the followings: 1) more time/ busy to " promote" it. 2) spend more money on marketing 3) offer better this and that dibs la, discount la ..... 4) more dirty ways 5) need to launch more faster eg using option sales. Even before VP obtain etc This post has been edited by worgen: Jun 4 2013, 09:26 PM |

|

|

Jun 4 2013, 08:25 PM Jun 4 2013, 08:25 PM

|

Senior Member

1,864 posts Joined: Apr 2011 |

QUOTE(AMINT @ Jun 4 2013, 01:45 PM) Arent you DDD guys tired of saying property prices will go down but IT HAS NOT GONE DOWN SINCE I DUNNO... 2008? I have been monitoring this thread since 2011. after year 2011 ended, property prices have not gone down. ok now is 2012 and DDD keep saying property prices will go down. after year 2012 ended, property prices still have not gone down. ok now is 2013 and DDD keep saying property prices will go down. WTF ler.huhuhu. Like dat every year keep saying the same thing but it didnt happen. What happened was this: PROPERTY PRICES GONE UP. 1 of these days the price sure will go down. Just a matter of time. So, the DDD camp will be right one day.Cannot be denied, the 2013 property prices is not as hot as before. Investors are more cautious. Banks are also more cautious by rejecting more loan applications. But the prices are still either up up up, or maintain very steady. As long as investors has stable employment, they can service their loan and has continued holding power The only way malaysia property market will collapse is the world economy take a hard beating. And the effect spreads to malaysian economy. The last property slump in Malaysia is because of the Asia currency crisis in 1997/8. That time many companies were affected, and many properties went to auction. So to see a property market collapse now, you will have to have economies of China down, Europe down, USA down, Asia down. Then malaysian economy will be affected badly, and companies start to retrench, landlord hard to find tenant, foreign investors put up fire sale, and eventually property market will collapse But world economy doesn't look that way now. Although export in all countries are softening, but it doesn't look catastrophic. The property price does not seem to be falling in 2013. But nowadays everything is very fluid, so it may look very different in 6 months time. |

|

|

Jun 4 2013, 11:27 PM Jun 4 2013, 11:27 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

QUOTE(EddyLB @ Jun 4 2013, 08:25 PM) 1 of these days the price sure will go down. Just a matter of time. So, the DDD camp will be right one day. This opinion is not grounded in any sort of reality. Cannot be denied, the 2013 property prices is not as hot as before. Investors are more cautious. Banks are also more cautious by rejecting more loan applications. But the prices are still either up up up, or maintain very steady. As long as investors has stable employment, they can service their loan and has continued holding power The only way malaysia property market will collapse is the world economy take a hard beating. And the effect spreads to malaysian economy. The last property slump in Malaysia is because of the Asia currency crisis in 1997/8. That time many companies were affected, and many properties went to auction. So to see a property market collapse now, you will have to have economies of China down, Europe down, USA down, Asia down. Then malaysian economy will be affected badly, and companies start to retrench, landlord hard to find tenant, foreign investors put up fire sale, and eventually property market will collapse But world economy doesn't look that way now. Although export in all countries are softening, but it doesn't look catastrophic. The property price does not seem to be falling in 2013. But nowadays everything is very fluid, so it may look very different in 6 months time. Malaysia can easily crash despite some of the other larger economies not being affected, or at most suffering only a small blip. Shouldn't even compare with 1997 Asian crisis - at the time the debt was much less, and Mahadey used all our EPF money to bail out the troubled companies. This time though, all the money in EPF two times over isn't even enough to bail out Syed Mohktar nevermind other cronies. Look at Spain. Look at Greece. Look at Vietnam. Greece and Spain economy is in the toilet, but Germany is still going strong. England is recovering. US and China are still okay. Doesn't your theory say that all the big nations must be in trouble before the small nations get hurt? Closer to home, Vietnamese real estate market just crashed 20% last year. Eh, how come? No effect to Malaysia one? USA didn't go bankrupt as well? Interconnection is not always as it seems, you need to look at debt to gdp ratio. And Malaysian debt - household, government and corporate, is very very high. |

|

|

Jun 4 2013, 11:29 PM Jun 4 2013, 11:29 PM

|

Senior Member

1,091 posts Joined: Sep 2012 |

QUOTE(AMINT @ Jun 4 2013, 01:45 PM) Arent you DDD guys tired of saying property prices will go down but IT HAS NOT GONE DOWN SINCE I DUNNO... 2008? I have been monitoring this thread since 2011. after year 2011 ended, property prices have not gone down. ok now is 2012 and DDD keep saying property prices will go down. after year 2012 ended, property prices still have not gone down. ok now is 2013 and DDD keep saying property prices will go down. WTF ler.huhuhu. Like dat every year keep saying the same thing but it didnt happen. What happened was this: PROPERTY PRICES GONE UP. Prices has gone down from subsales right? Or are you still denying it?I am glad to state a few props here FROM DEVELOPERS (not subsales) have gone up. These are not recently launch phases but the exact ones launched before and price was increased: 1) nadayu 92 2) elements@ampang 3) tropicana metropark How about you DDD guys? Show me la at least 3 props from developers that have gone down in price. I am just stating the facts here. If I believe that propert price will go down, I will say it out loud. But from current scenario, I seriously dont see how that could be the case Why look at developers? They have strong holding power. Stronger than you, anyway, since they have a fat profit margin. By the time developers start reducing price from launch price - you will be in too much deep sh1t to worry, as a speculator. |

|

|

Jun 4 2013, 11:31 PM Jun 4 2013, 11:31 PM

|

Senior Member

630 posts Joined: Oct 2010 |

Eventually it will come down but the question is when? How much patience you have and how much bullets you have when it collapse. To me is like catching the big fish after waited the whole night. It might not be this nioght but for sure one night will come for you to catch the big fish. You can be instant millionaire when you enter at the right time!

|

|

|

Jun 5 2013, 12:13 AM Jun 5 2013, 12:13 AM

|

Senior Member

7,446 posts Joined: Sep 2008 |

QUOTE(joeblows @ Jun 4 2013, 11:29 PM) Prices has gone down from subsales right? Or are you still denying it? well i am.not denying bro. Dunno why all my props keep increasing in price while DDD camp keep saying price went down. Dunno if i am just lucky or really price hasnt dropped.Why look at developers? They have strong holding power. Stronger than you, anyway, since they have a fat profit margin. By the time developers start reducing price from launch price - you will be in too much deep sh1t to worry, as a speculator. |

|

|

Jun 5 2013, 12:15 AM Jun 5 2013, 12:15 AM

|

All Stars

13,759 posts Joined: Jun 2011 |

QUOTE(AMINT @ Jun 5 2013, 12:13 AM) well i am.not denying bro. Dunno why all my props keep increasing in price while DDD camp keep saying price went down. Dunno if i am just lucky or really price hasnt dropped. Just tat some r not so lucky. Well done bro. If u think u can, u can. And u hav done it. Too bad for some believers in ddd. |

|

|

Jun 5 2013, 01:04 AM Jun 5 2013, 01:04 AM

|

Senior Member

7,446 posts Joined: Sep 2008 |

QUOTE(ManutdGiggs @ Jun 5 2013, 12:15 AM) Just tat some r not so lucky. Well done bro. If u think u can, u can. And u hav done it. Too bad for some believers in ddd. Ya maybe la. I also didnt wanna point out subsale price earlier (even though mr.joeblows bashed me for doing so) because all the subsales i have all increased in price. So i just quoted the same units from developer also increased in price, apatah lagi for subsales for good props. I think the difference here is good props vs bad props. Bad aka tahi props of course dont have good demand. Good props do. I am getting irritated by agents who keep calling me to sell some of my props and i can tell u the price that they r offering keep increasing month after month. |

|

|

Jun 5 2013, 01:10 AM Jun 5 2013, 01:10 AM

|

Senior Member

1,979 posts Joined: Mar 2005 |

QUOTE(AMINT @ Jun 5 2013, 12:13 AM) well i am.not denying bro. Dunno why all my props keep increasing in price while DDD camp keep saying price went down. Dunno if i am just lucky or really price hasnt dropped. nolah, not you are denying, it's just that people dont even give a damn about why all "your props" keep increasing....not to mention they are jealous. they just dont have all the time in the world to keep replying bullshit things to announce to the world on what they have. usually a person who do such things, they tend to have nothing but due to feeling insecure, they have to create stories to show to people they have tonnes of properties... |

|

|

Jun 5 2013, 01:12 AM Jun 5 2013, 01:12 AM

|

Senior Member

1,979 posts Joined: Mar 2005 |

QUOTE(AMINT @ Jun 5 2013, 01:04 AM) Ya maybe la. I also didnt wanna point out subsale price earlier (even though mr.joeblows bashed me for doing so) because all the subsales i have all increased in price. So i just quoted the same units from developer also increased in price, apatah lagi for subsales for good props. I think the difference here is good props vs bad props. Bad aka tahi props of course dont have good demand. Good props do. I am getting irritated by agents who keep calling me to sell some of my props and i can tell u the price that they r offering keep increasing month after month. poor you, "irritated" by "agents" calling you. you sure those agents didnt call you for any "service" ? coz some people they have mental problem, they want to believe what they want to believe, so when people speak to them on the phone, they also believe what they want to believe what that person is speaking...no choice lah, some people are born this way... ya true, agents keep increasing price, but in actual fact, nobody want to buy...sometimes they agents have to do some drama a bit to push up the price, when in actual fact, majority dont even bothered to buy....that's why you notice some of them are so free keep posting BS things in lowyat...i mean that is also a way to lead their lived la, but it's really wasted. This post has been edited by Dern: Jun 5 2013, 01:14 AM |

|

|

Jun 5 2013, 02:10 AM Jun 5 2013, 02:10 AM

|

Senior Member

7,446 posts Joined: Sep 2008 |

QUOTE(Dern @ Jun 5 2013, 01:12 AM) poor you, "irritated" by "agents" calling you. you sure those agents didnt call you for any "service" ? coz some people they have mental problem, they want to believe what they want to believe, so when people speak to them on the phone, they also believe what they want to believe what that person is speaking... Well up to u on what to believe as i cant force u. The agents that called me have ready buyers. But i wasnt interested coz i know the value of good props can go even higher.no choice lah, some people are born this way... ya true, agents keep increasing price, but in actual fact, nobody want to buy...sometimes they agents have to do some drama a bit to push up the price, when in actual fact, majority dont even bothered to buy....that's why you notice some of them are so free keep posting BS things in lowyat...i mean that is also a way to lead their lived la, but it's really wasted. |

|

|

Jun 5 2013, 08:06 AM Jun 5 2013, 08:06 AM

|

Senior Member

1,864 posts Joined: Apr 2011 |