QUOTE(tikaram @ Jun 4 2013, 05:16 PM)

actually the asking is still high. just the valuation is low.sometimes there got another arrangement between actual purchaser price versus SPA price.

V11 - Property Prices Discussion, Intelligent debates only pls

|

|

Jun 4 2013, 05:20 PM Jun 4 2013, 05:20 PM

Return to original view | Post

#1

|

Senior Member

5,488 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jun 4 2013, 05:32 PM Jun 4 2013, 05:32 PM

Return to original view | Post

#2

|

Senior Member

5,488 posts Joined: Jun 2008 |

|

|

|

Jun 4 2013, 05:40 PM Jun 4 2013, 05:40 PM

Return to original view | Post

#3

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(tikaram @ Jun 4 2013, 05:35 PM) the one paying 390k still untung 10k compare 400k as long as there are many the same range price, do not worry much then. the remaining as quote above : " something price is higher actually also got arrangement with buyer to push up purchase price so that no need to pay any downpayment and can get money form bank to finance renovation too". |

|

|

Jun 4 2013, 05:46 PM Jun 4 2013, 05:46 PM

Return to original view | Post

#4

|

Senior Member

5,488 posts Joined: Jun 2008 |

|

|

|

Jun 5 2013, 11:32 PM Jun 5 2013, 11:32 PM

Return to original view | Post

#5

|

Senior Member

5,488 posts Joined: Jun 2008 |

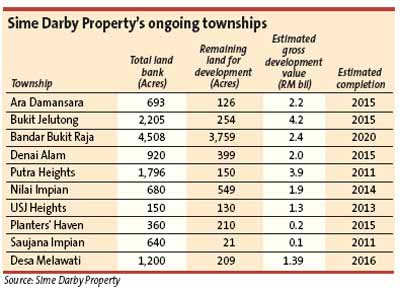

old files

|

|

|

Jun 5 2013, 11:37 PM Jun 5 2013, 11:37 PM

Return to original view | Post

#6

|

Senior Member

5,488 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jun 7 2013, 09:41 AM Jun 7 2013, 09:41 AM

Return to original view | Post

#7

|

Senior Member

5,488 posts Joined: Jun 2008 |

Why people buy Malaysian properties by referring to the Japan and amarica housing price charts?

|

|

|

Jun 7 2013, 09:49 AM Jun 7 2013, 09:49 AM

Return to original view | Post

#8

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(tikaram @ Jun 7 2013, 09:46 AM) just share ma ... got people demand to share I see. USA in certain areas are considered cheap only and it's buildings quality unsure. Japan is still very expensive laaa Malaysian properties are still cheap in the region People around me are still looking to buy good properties. Fuze |

|

|

Jun 7 2013, 01:12 PM Jun 7 2013, 01:12 PM

Return to original view | Post

#9

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(tikaram @ Jun 7 2013, 09:56 AM) More people around you wanted to buy or sell? Obviously, I always stay firm on my stand. Never flip flop as I do confident on Malaysian property mart. Identify first one :1) Kh8668 u will come at a point some up up up camp saying this again in V11. -------------------------------------------------------------------------------------- - Anytime is a good time to buy - Properties prices will always go up in the long-term - The market cannot collapse because of demand from foreigners - Mickey mouse units are the trend of the future http://sg.finance.yahoo.com/news/property-...-151909308.html -------------------------------------------------------------------------------------- |

|

|

Jun 7 2013, 02:34 PM Jun 7 2013, 02:34 PM

Return to original view | Post

#10

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(tikaram @ Jun 7 2013, 01:58 PM) Yes you do. very firm agent indeep. my cover areas? Malaysia.I need to know your area market now. More people around you wanted to buy or sell? u not yet answer me wo. people around me, some are planning to sell; but they are looking for higher price, meaning their target price has yet reached. they are willing to hold. some are looking to buy, good one. however, there are not many supply in the prime areas as many owners are not seriously to sell. lastly, I am not agent at the moment. This post has been edited by kh8668: Jun 7 2013, 02:34 PM |

|

|

Jun 7 2013, 11:29 PM Jun 7 2013, 11:29 PM

Return to original view | Post

#11

|

Senior Member

5,488 posts Joined: Jun 2008 |

|

|

|

Jun 9 2013, 04:30 PM Jun 9 2013, 04:30 PM

Return to original view | Post

#12

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(AVFAN @ Jun 9 2013, 01:51 PM) think it's better we stay away from dwelling into foreign props as this is a diff animal altogether. my experience for subsales, more higher asking price even for the same unit. the seller is not firm on their pricing nor serious to get the deal done. anyway, my gathering is subsale is slow and slower, prices holding - not falling, not rising. (developer prices going up is a given, no brainer, whether they can sell or not is another thing). can anyone shed some light on some latest transacted info: bought in 2010 (highrise) or 2011 (landed), and just sold? what is appreciation - 10%, 20%, 30%? those bought in 2008-2009 enjoyed 30-100% appr, we know. those bought in 2010 onwards are targeting at least 50% profits. |

|

|

Jun 9 2013, 04:32 PM Jun 9 2013, 04:32 PM

Return to original view | Post

#13

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(kochin @ Jun 9 2013, 02:29 PM) One thing for sure. Cost of doing business including construction is getting more expensive. correct. contractors have to mark up construction sum to protect themselves. the developers which do not own any contraction arms have to pass the costs to the buyers. Sometimes got money also no contractor to layan because of mrt. |

|

|

|

|

|

Jun 17 2013, 08:37 PM Jun 17 2013, 08:37 PM

Return to original view | Post

#14

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(icemanfx @ Jun 17 2013, 08:08 PM) Buying a property with over 15 years loan tenure is not unlike buying a car with 9 years repayment. During 30 years loan tenure, the borrower is almost certain will experience 3 or 4 recession. Unless s/he has the reserved to sustain through the bad time, s/he could be underwater or drown. Same la for the worst thing that will be happned for both is undergone to public auction if one failed to pay promptly.Real estate somehow can expect for capital appreciation but car definitely depreciate in value. Lets say the house with loan 15 years and the market value 500k. One failed to pay at year of 8. The market value if lucky with minimal appreciation of 5% pa. Roughly 150k up from 8 years ago. The auction price starts from 650k. If lucky again, many bid for it, call price will be above 650k as happened since 5 years ago. If not lucky the bid price will maybe minus 10% from market value 650k. All stated above is only assumption. Find your real case study. 15 years loan, paid back at year 8, the loan amount also starting reduced. Equity has been built up then. |

|

|

Jun 17 2013, 08:53 PM Jun 17 2013, 08:53 PM

Return to original view | Post

#15

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(debbieyss @ Jun 17 2013, 07:59 PM) The bank replied, the unit I'm targeting worth only RM250K, which means I need to fork out another RM100K (including S&P fee) to buy this unit. since you can get other asking price of RM280k, why not you go for them instead of this unit 325k?The size is around 790sf only. Yes, I agreed with you. |

|

|

Jun 21 2013, 11:07 PM Jun 21 2013, 11:07 PM

Return to original view | Post

#16

|

Senior Member

5,488 posts Joined: Jun 2008 |

全球哪裡購房最劃算?

» Click to show Spoiler - click again to hide... « |

|

|

Jun 22 2013, 10:12 AM Jun 22 2013, 10:12 AM

Return to original view | Post

#17

|

Senior Member

5,488 posts Joined: Jun 2008 |

time to collect some golds

|

|

|

Jun 27 2013, 02:15 PM Jun 27 2013, 02:15 PM

Return to original view | Post

#18

|

Senior Member

5,488 posts Joined: Jun 2008 |

1100 can go in for gold?

|

|

|

Jun 27 2013, 03:19 PM Jun 27 2013, 03:19 PM

Return to original view | Post

#19

|

Senior Member

5,488 posts Joined: Jun 2008 |

how about mining counters' share price?

gold price has to stay at least myr1,200 otherwise no profit for those mining companies. |

|

|

Jul 2 2013, 02:41 PM Jul 2 2013, 02:41 PM

Return to original view | Post

#20

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(AmayaBumibuyer @ Jul 2 2013, 02:37 PM) As a kl guy, i know if i want a house in kl i need to buy in kl ASAP. I should not wait. the private car is essential in the klang valley for any workersAs a kl guy, i believe i do not need a car. Using public transport around me is enuff. But frankly, that is not d factor of me not having a car, it is that cars are overprice. You are paying more than a 100% value of the fair value of that car. Property in kl? Fairer than the price of cars. This post has been edited by kh8668: Jul 2 2013, 02:41 PM |

|

Topic ClosedOptions

|

| Change to: |  0.0563sec 0.0563sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 01:26 PM |