Things are coming back hotter?

Singapore Q2 GDP surges 3.7% yoyBy Teh Shi Ning | Business Times Singapore | July 12, 2013

http://www.businesstimes.com.sg/breaking-n...37-yoy-20130712QUOTE

SINGAPORE economy grew by a larger than expected 3.7 per cent in the second quarter compared to a year ago, rebounding from the meagre 0.2 per cent year-on-year growth registered in the first quarter.

Advance estimates released by the Ministry of Trade and Industry on Friday show that Q2 GDP surged 15.2 per cent quarter-on-quarter, on a seasonally-adjusted, annualised basis, much stronger than 1.8 per cent quarter-on-quarter growth for Q1.

KL-S'pore HSR gathers momentum The Edge Property | By Fatin Rasyiqah Mustaza & Kamarul Anwar | Wednesday, 10 July 2013 13:57

http://www.theedgeproperty.com/news-a-views/11373.htmlQUOTE

KUALA LUMPUR: Some local companies are said to be talking to each other and several potential foreign partners to participate in the multi-billion ringgit high-speed rail (HSR) link connecting Kuala Lumpur to Singapore, industry analysts said. These companies include Gamuda Bhd, WCT Holdings Bhd, Malaysian Resources Corp Bhd, YTL Corp Bhd, UEM Group Bhd and MMC Corp Bhd.

"WCT and Gamuda have been heard to be in serious talks … they are planning to get joint venture partners from China," an analyst at Hong Leong Investment Bank told The Edge Financial Daily yesterday.

Malaysian Stocks First From Worst on Lowest Volatility Bloomberg | By Weiyi Lim & Ian Sayson - Jul 10, 2013 10:14 AM GMT+0800

http://www.bloomberg.com/news/2013-07-09/m...volatility.htmlQUOTE

At a time when slowing economic growth and political protests from Brazil to Turkey are spurring capital flight from emerging markets, Malaysia has turned into a refuge for equity investors.

The FTSE Bursa Malaysia KLCI Index (KLCI) was the biggest loser in Asia just four months ago as the closest elections in 55 years threatened the ruling coalition’s plans to spend $444 billion on infrastructure. Now the $478 billion stock market is the region’s best performer, after Prime Minister Najib Razak’s May 5 poll victory sparked a 4.2 percent rally in the KLCI index.

The gauge will probably rise 15 percent in the next 12 months and maintain the lowest volatility among the world’s biggest markets as Najib boosts spending to reach developed-nation per-capita income levels by 2020 and the nation’s $165 billion pension fund buys stocks, according to Samsung Asset Management. Malaysia has already weathered the 13 percent drop in the MSCI Emerging Markets Index (MXEF) as violence erupted from Sao Paulo to Istanbul to Cairo and economists predicted the weakest Chinese expansion since 1990.

The Chinese are coming! The StarProperty | Friday July 12, 2013 MYT 11:34:22 AM

http://www.thestar.com.my/News/Community/2...are-coming.aspx QUOTE

AS HE addresses an international crowd gathered at Kuala Lumpur’s Westin Hotel, it becomes apparent that Chairman Fu, with his formal demeanour and foreign-sounding title (distinctly different from the Datuks and Tan Sri’s we are used to), is an upright, sober man.

“We, as a China company, are very happy to work together with CBD Properties Sdn Bhd,” says Fu Wai Chung, founder of Chinese real estate company Hopefluent Group Holdings Ltd, with gravity.

“This joint venture company will benefit Chinese and Malaysian property buyers, developers and owners, and will make the economy grow.”

The newly established Hope CBD Realty Consultancy Sdn Bhd will market Malaysian properties to buyers from China, as well as assist Chinese developers in building projects here, among other cross-border plans.

How it all started

About a year ago, some key members of CBD Properties went on a study trip to Guangzhou.

“Alvin Ng, Daphne Chan and I saw Hopefluent’s profile, and went knocking on their door, to see whether they were interested to work together to promote Malaysia My 2nd Home (MM2H) sales,” says CBD Properties managing director Adrian Wang.

“Over the years, more and more Chinese people and companies have been coming to Malaysia.

“We liked the CBD people very much,” reciprocates Hopefluent Group executive director, Tim Lo.

“After several talks, we decided to bring the two companies together, because we understand the Malaysian market is quite attractive to Chinese residents. We can use our resources to get Chinese residents to come purchase properties in Malaysia.”

The last 10 years have seen Chinese citizens making 2,733 MM2H applications, making it the country with the highest number, followed by Bangladesh, the UK and Japan.

“Our short-term target this year is to bring in an additional 30 more applications of MM2H a month,” says Wang.

“Currently we already do 30 applications a month. The average price of properties we target to sell to Chinese investors is between RM1mil and RM2mil.

“In fact, some of them are cash purchasers, so we encourage them to take a 50% loan, so that they can buy two units instead of one; one to stay in, and one for investment.”

“We will focus on KL city properties followed by Johor Baru and Penang,” says Wang.

“Johor Baru is like Shenzhen to Hong Kong. It has a link road and ferry to Singapore, and in the future an MRT link too.”

“Penang is good for those who have stayed in Malaysia for a while. Some clients come to KL, but eventually choose Penang because of the food and the environment, where you can have a sea-facing property.”

In terms of property type, CBD mainly promotes new condos within the city.

“Compared to secondary properties, transactions are easier and more straightforward; developers also offer interesting and easy entry packages.”

Is the grass greener?

Just why are Malaysian properties so attractive to Chinese investors though? Are they so rich that not having enough property to buy at home is a problem?

“Yes, Chinese people really do have money,” Fu asserts. Consultants McKinsey & Co named China the fourth-largest population of wealthy households earning more than US$36,500 (RM116,00) a year, about RM10,000 a month. Boston Consulting Group expects Chinese households earning between US$20,000 and US$1mil to double to 280 million by 2020, meanwhile.

“These Chinese buy branded goods,” says Fu.

“Over the past few years, the money flows out from China as the Chinese are limited to buying two units of property in China per family. The Chinese have a high-level of savings, so this money will move out of the country.

“Secondly, Chinese like to buy property; that’s their culture.”

Indeed, the majority of MM2H applicants are not silver-haired retirees looking for a place to spend their golden years. Many are actually aged below 50 years old and motivated less by warmer climates or cheaper costs.

“Because of the economic boom, a lot of young people in China have become very wealthy and once they get the money, they look into is a change of lifestyle and status,” adds Wang.

“Migration is one of the ideal plans for them, or maybe to have a second residency status. The first target is maybe the US, Canada, Australia, New Zealand or Singapore, but the foreign stamp duty in Singapore is 18% while in Hong Kong, it’s 15%. This makes Chinese investors look to Malaysia.

“The distance to Australia and New Zealand, meanwhile, is far and their food is not suitable to the Chinese. Malaysia is only four hours’ flight away. When they come here, they can speak Cantonese or Mandarin, so they will adapt easily.”

Chinese residents also become more receptive after Chinese developers investing here conduct promotional campaigns back home.

This increases the number of Chinese tourists here. They come and see that this country is beautiful, stable, with no natural disasters and clean air.

“Although this has not been true these particular few days,” says Wang wryly, referring to the recent haze.

“The education is also very good in Malaysia,” he adds. “China has a one-child policy and parents want their children to have better education. So Malaysia is a good stepping stone to learn English before going to UK or Australia.”

Huge investments

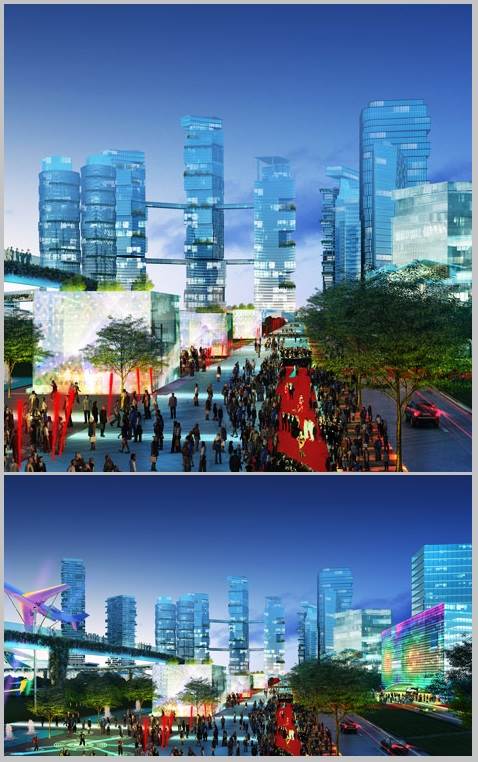

On the developer side, one of China’s biggest, Country Garden (Holdings) Ltd, has joined forces with local developer Malaysia Properties Land Sdn Bhd (Mayland) to develop townships in Rawang and Kajang.

It also bought 22.26ha of land at Danga Bay in Johor Baru for RM900mil last year, to develop a RM18bil commercial complex with a marina and hotel there.

Chinese firm Guangxi Beibu International Port Group has also partnered with IJM Corporation Bhd in a RM3bil investment to deepen and expand Kuantan port.

This will lead to more investments totalling RM5bil to build steel, aluminium and palm oil plants in Kuantan Industrial Park, part of the planned East Coast Economic Region.

On the academic front, China’s Xiamen university will open a campus in Salak Tinggi in 2015, with plans to enrol over 3,000 Chinese nationals.

There is yet more Sino-Malaysian business to be tapped, believes Hope CBD.

“Chinese developers are actually our major source of income,” says Lo.

“We assist Chinese developers to source land in Malaysia, and provide consultancy services for the Chinese developers when they have gotten land in Malaysia.”

Fears

With all these investments, one local reaction might be that of fear. What if these foreigners squeeze us out and make prices unaffordable for the rest of us? In fact, the Johor state government recently announced special property taxes for foreign property owners.

Americans and Europeans have for some time also been concerned about China’s economic dominance. Polite chatter has been underscored by a disdain for, and yet dependence on, China’s overwhelming bounty of cheap products made by overly competitive Chinese.

Malaysians are in comparison familiar.

“The advantage of working here is evident,” says Fu.

“All of us seated here, for example, are Chinese. There are cultural similarities between the two countries. When CBD went over to China, without speaking much, I realised that they are Chinese.”

It isn’t surprising then that the inauguration ceremony feels more like a diplomatic occasion than the typical launch. His measured tones suggest a renewal of ties between countrymen separated for generations; they kindle a sense of history and kinship.

Even though many Chinese on the mainland are being facilitated by this new cross-border agency’s services, will all Chinese feel the same about all this wealth moving, nay fleeing, out of their country? Are things equally warm and fuzzy on the other side of the fence?

“It’s nothing to worry about,” assures Fu. A lot of people are still creating wealth in China. And due to the borderless economy, the money surely flows out of the country, if not to Malaysia, it is to places like US.”

China’s wealth has also come with its pros and cons, says Fu. If the money didn’t flow out of the country, the inflation rate would only get higher.

“This flow of money is actually mutual,” says Fu. “There is some money flowing into China as well. The profit made in Malaysia, for example, will flow back to China for spending so, really, we should have an open mind towards the money flows.”

This post has been edited by accetera: Jul 12 2013, 12:20 PM

Jun 10 2013, 01:40 PM

Jun 10 2013, 01:40 PM

Quote

Quote

0.0497sec

0.0497sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled