Click here to Fixed Deposit Rates in Malaysia V2 Thread

Malaysia Major Commercial Banks and Foreign Banks Fixed Deposit / Time Deposit Rates as of 1st July 2012.

Bank - FD rates for 1 month, 3 months, 6 months and 12 months.

Affin Bank - 3.05%, 3.1%, 3.25% and 3.6%

Alliance Bank - 3%, 3%, 3.1% and 3.25%. FD Gold 12 months 3.3% (Interest paid monthly).

AmBank - 3%, 3%, 3.15% and 3.2%. Am50Plus 12 mths 3.25% (Interest paid monthly, FREE PA).

Citibank - 2.9%, 3.00%, 3.0% and 3.10%

CIMB Bank - 3%, 3.05%, 3.1% and 3.15%

Hong Leong Bank - 2.9%, 2.95%, 2.95% and 3.1%

HSBC Bank - 2.75%, 3%, 3% and 3.15%

Maybank - 3%, 3.05%, 3.1% and 3.15%

OCBC Bank - 2.85%, 2.95%, 3% and 3.10%

RHB Bank - 3%, 3.05%, 3.1% and 3.2%.

Public Bank - 3%, 3.05%, 3.1% and 3.15%. PB Golden 50 Plus 12 months 3.25%.

Standard Chartered Bank - 2.90%, 2.95%, 2.95% and 3.10%

UOB Bank - 2.9%, 2.95%, 2.95% and 3.10%

Fixed / Time Deposit and Savings Account Promotions 2013.

Please call the nearest bank to reconfirm the rates (go to the bank website for bank contact number where you can also get the contact number of the branch nearest to you) before going to the bank to check if promotions are still valid.

Alliance Bank Step Up Promo until 31 January 2013.

Contributed by ronnie.

» Click to show Spoiler - click again to hide... «

Please note that you have to deposit 10% into CASA too when calculating the effective interest rate.

*

HSBC Amanah Term Deposit-i 5% Deposit Drive Promotion until 18 January 2013 for NEW Premier and Advance Accounts

One of the condition is that we must deposit 30% into Premier Account-i or Advance Account-i which pays miserable interest rate.

Click on link below to read my article on the HSBC Deposit Drive Promo where I touched on the T&C and calculated that the maximum effective interest rate for Premier Account is only 3.627%!!!

HSBC 5% Term Deposit i Promotion Until 18 January 2013

HSBC New Branch Opening Promo - Tabuan Jaya, Senawang, Cheng and Kubang Kerian/Kota Bahru Branches

Contributed by tbheng

QUOTE(tbheng @ Jun 25 2012, 02:01 PM)

I've just returned from HSBC Amanah Kota Damansara.

Took their new branch opening offers: 5% 3 month TD-i for non-premier category.

The requirements and process seems rather straight forward.

Required the following 2 products to be openned:

1. Term Deposit-i: min RM5k, max RM50k.

2. Amanah Advance Acct-i: min RM100.

(I have highlighted about the T&C said min RM500, the teller said RM100 is enough. RM500 is for Amanah Advance Acct-i alone.).

She said the TD-i slips will be ready when my cheque cleared. I requested her to mail it to me instead of collecting at branch.

I also requested for internet banking. It is FOC.

I was given a big golf umbrella and recycle bag as welcome gifts.

This should be the highest FD rate for the moment. Highly recommended.

.Took their new branch opening offers: 5% 3 month TD-i for non-premier category.

The requirements and process seems rather straight forward.

Required the following 2 products to be openned:

1. Term Deposit-i: min RM5k, max RM50k.

2. Amanah Advance Acct-i: min RM100.

(I have highlighted about the T&C said min RM500, the teller said RM100 is enough. RM500 is for Amanah Advance Acct-i alone.).

She said the TD-i slips will be ready when my cheque cleared. I requested her to mail it to me instead of collecting at branch.

I also requested for internet banking. It is FOC.

I was given a big golf umbrella and recycle bag as welcome gifts.

This should be the highest FD rate for the moment. Highly recommended.

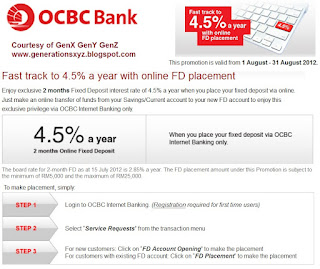

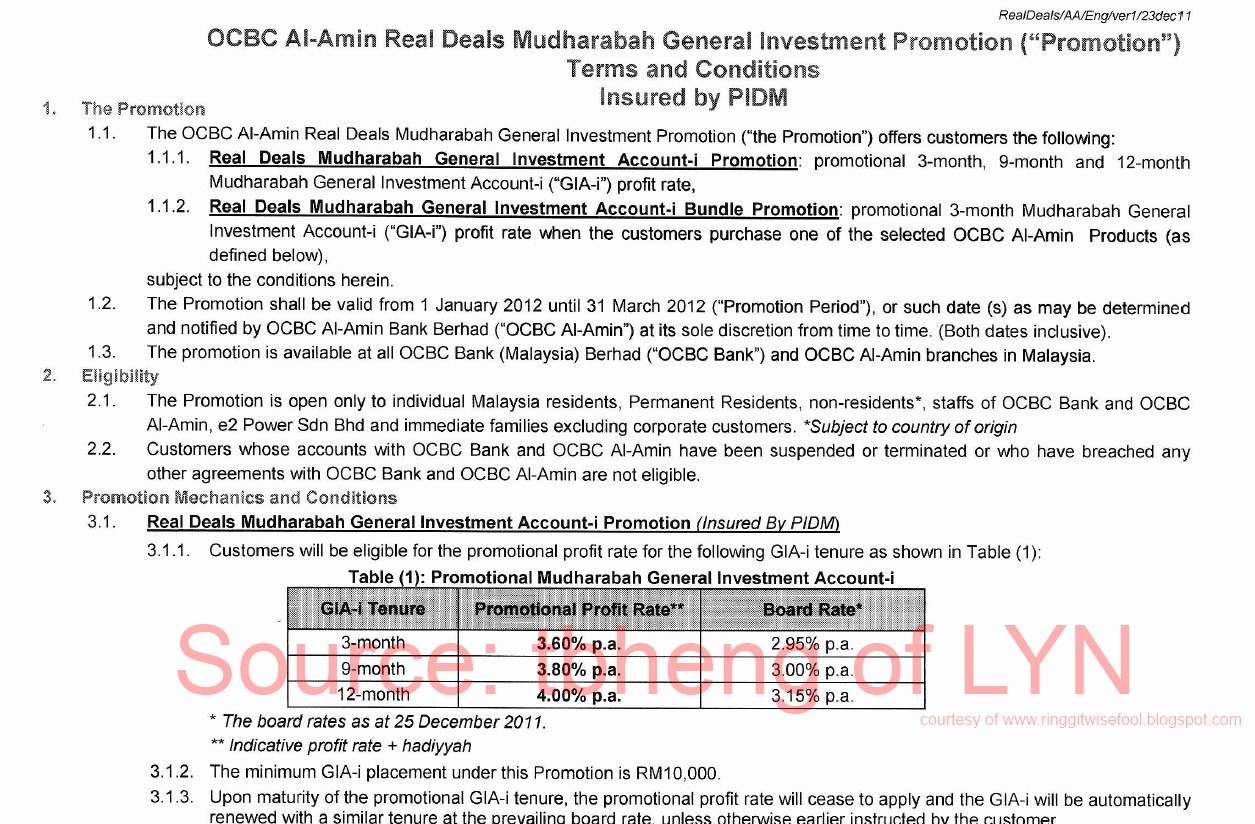

OCBC Bank Malaysia Promotion until end December 2012.

Combo FD and Savings - 3 Months FD 4.0% (Minimum Fresh Fund RM10K) where 20%(Minimum RM2K) equivalent amount deposited into FD must be deposited into a NEW Savings Account and maintained for 90 days. Click here to read my comments at my FD Page

*

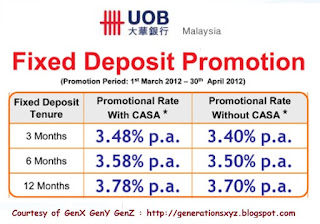

UOB Bank Latest Fixed Deposit Promotion Rates - Minimum RM10K.

QUOTE(BoomChaCha @ Dec 17 2012, 03:14 PM)

UOB FD Promo Rates - Effective from 15 December 2012 until end of February 2013

3 Months: 3.5 %

9 Months: 3.65 %

Minimum and maximum fresh fund: RM 10K, RM 5 Millions

*3 Months: 3.5 %

9 Months: 3.65 %

Minimum and maximum fresh fund: RM 10K, RM 5 Millions

Hong Leong Bank Latest Step Up Fixed Deposit Promotion Rates

QUOTE(cherroy @ Nov 19 2012, 04:44 PM)

I just came across HL leaflet that got 12 months FD with step up FD 4.28% (for 4Q),

1Q 3.08%

2Q 3.18%

3Q 3.28%

3Q 4.28%.

1Q 3.08%

2Q 3.18%

3Q 3.28%

3Q 4.28%.

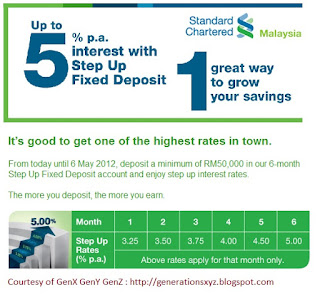

Other Promotions

Some banks are also offering step up interest rates (with or without condition, e.g. some banks require that you deposit x amount in savings or current account), so you better average them out and I would think they still won't be able to beat Affin 12 months Fixed Deposit rate of 3.6%.

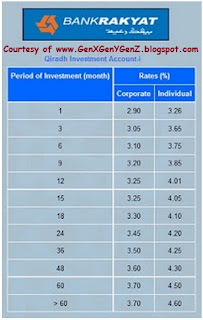

Other Similar FD Accounts - Bank Rakyat Qiradh General Investment Account-i.

Click here to read my article on Bank Rakyat Qiradh General Investment Account-i

Click here to read my article on Bank Rakyat Qiradh General Investment Account-iTo read my comments and see more FD promos click >>> Malaysia Latest Fixed Deposit Board and Promotion Interest Rates by Major Commercial and Foreign Banks

To learn more on The Best and Highest Paying Savings Account in Malaysia for Adult, Kid, Parent and Grandpa click >> The Best Savings Accounts in Malaysia

Click here to read my article titled Australia Education, Term Deposit, Savings Account and Credit Card Interest Rates In this article I have tables of interest rates from several banks in Australia and also a Table for UOB, OCBC and RHB Foreign Currecny Time Deposit Interest Rates.

Click here to read my article Premier Priority Privilege Banking Accounts. This updated revised article now include comments for OCBC Premier and StanChart Priority Banking Account.

Banker's Cheque Fee purely for FD Upliftment/Withdrawal (Do not combine with other accounts, i.e. Savings Account)

Affin - FREE

Alliance - FREE

AmBank - RM2.15

Bank Rakyat - FREE

CIMB - FREE

Citibank - RM0.15

HLB - RM5.15 (PB Customers RM0.15)

HSBC - RM5 same day or RM2 next day (no RM0.15 Stamp Duty??)

Maybank - RM5 or RM5.15?

MBSB - FREE

OCBC - FREE

PBB - RM2.15

RHB - RM5.15

SCB - RM2.15

UOB - RM0.15 or RM2.15 Conflicting reports.

Click here to my new blog called Fixed Deposit Malaysia where I have published an article to show you how you can combine OCBC FD Promotions to earn more money AND how you can continue earning 5% interest if you had opened a joint account earlier where the FD is maturing before 31 December 2012.

This post has been edited by Gen-X: Dec 30 2012, 12:33 AM

Aug 1 2012, 02:18 PM, updated 13y ago

Aug 1 2012, 02:18 PM, updated 13y ago

Quote

Quote

0.3147sec

0.3147sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled