QUOTE(echoesian @ Jan 6 2012, 03:55 PM)

Boss, it is just like FD, but they put it in different term..Fixed Deposit Rates in Malaysia V2, Read 1st post to find highest rate.

Fixed Deposit Rates in Malaysia V2, Read 1st post to find highest rate.

|

|

Jan 6 2012, 04:07 PM Jan 6 2012, 04:07 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

|

|

|

|

|

|

Jan 6 2012, 04:10 PM Jan 6 2012, 04:10 PM

|

Senior Member

1,332 posts Joined: Oct 2005 |

|

|

|

Jan 6 2012, 04:17 PM Jan 6 2012, 04:17 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(turion64 @ Jan 6 2012, 04:10 PM) No, I do not have account with Bank Rakyat, but probably I willhave one soon. I just called Bank Raykat an hour ago, they said they calculate interest rate based on monthly basis, but not on daily basis. So this means that FD depositors can get more money. And they can pay interest to depositors on monthly basis. For example, if I put RM 10,000.00 into their 1 year FD tenure for 4.01 % rate, so I will get RM 401 interest after one year. RM 401 / 12 months = RM 33.41, so every month I will get RM 33.41, this RM 33.41 will deposit in my Bank Raykat saving account. But Bank Rakyat is not under PIDM Also, I heard Bank Raykay is not a bank, it is a financial institution like "korperasi"... This post has been edited by BoomChaCha: Jan 6 2012, 05:00 PM |

|

|

Jan 6 2012, 05:27 PM Jan 6 2012, 05:27 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(aeiou228 @ Jan 6 2012, 12:13 PM) Aiyo..aunty sylille so "geng", one or 2 posts only, her standard of language immediately adopted by FD thread. well, her term Musical Chair is most appropriate, take current OCBC and UOB 3, 9 and 12 months tenure for example. Deposit in any of these three promos now and come next month HSBC got offer 8.88% for 1 year, we all loose out, but the one having his FD maturing next month will be laughing at us, hahaha.I like gark's " Opportunity Fund" too. I like gark's term "deploy", his FDs are on stand by where any of his squadron are ready to go (to be deployed) to seek some actions immediately and if necessary, reinforcements can be sent in and ETA all predetermined QUOTE(gchowyh @ Jan 6 2012, 12:53 PM) Unfortunately, I do not see the outlook as too optimistic as besides UOB, Ambank also revised the 12 months FD from 3.3% to 3.2% in September. Yah, and also Ambank got no offer for Top Rate FD for months. Just to add, Alliance also lowered their FD Gold rate for 12 months in October last year.Anyhow, let us check back after 3rd & 9th month.. For discussion sake, if a bank wants new funds, the best time is to start their promo in April. Reason being: 1. Many people went for the SCB 5% in October (I was at a HLB branch that time and an uncle withdrew RM1M to go deposit at SCB, whereas me on the other hand, was depositing into HLB Junior FD to get 4.5% because I thought interest rate won't be going up this year ) 2. And on 3 January 2012, the Priority Banking hall I was at was packed with many aunties and uncles waiting for their turn to withdraw their funds. Point is many shifted their funds to SCB in October and now that offer is offer, they are shifting it elsewhere. 3. Taking note that SCB offer was for only 3 months, now many would also move their funds to OCBC where the average 3 months FD comes out to be 4.3% (Edited) which is pretty good. So come April, there will be many people looking for places to shift their funds again. Having said that, I think the best offer will be in the 4th quarter where the banks would compete for fresh funds to have more cash for their year end report. QUOTE(MilesAndMore @ Jan 6 2012, 01:21 PM) As the Advisor, your invaluable past knowledge is precious and when the time comes for you to deploy your funds, we will follow you to your chosen bank.QUOTE(gark @ Jan 6 2012, 01:28 PM) Walao.. I am not freaking rich leh.. see, you did conclude you are freaking rich, hahahaSo... I don;t belong to this FD club lar hor... you belong to the FRMONBWFDP club Too bad that I can't be going for higher risk investment for at least a decade (that is I have yet to get lung or throat cancer and die) as one by one of my children are (or should be) entering college QUOTE(turion64 @ Jan 6 2012, 02:10 PM) Bro Gen-X, The Bank Rakyat's Qiradth investment account is it a FD? Because it sounds too good to be true. QUOTE(BoomChaCha @ Jan 6 2012, 04:17 PM) I just called Bank Raykat an hour ago, they said they pay interest Bro turion64, click here to read Bank Rakyat's history. It was under the supervision of BNM in 2002 and since then under numerous Ministries based on monthly basis. But it is not under PIDM BoomChaCha, the Bank Rakyat guy told you that deposits not insured by PIDM? I think it is safe lah since it is placed under government. This post has been edited by Gen-X: Jan 6 2012, 06:33 PM |

|

|

Jan 6 2012, 05:31 PM Jan 6 2012, 05:31 PM

|

Senior Member

1,188 posts Joined: Sep 2008 |

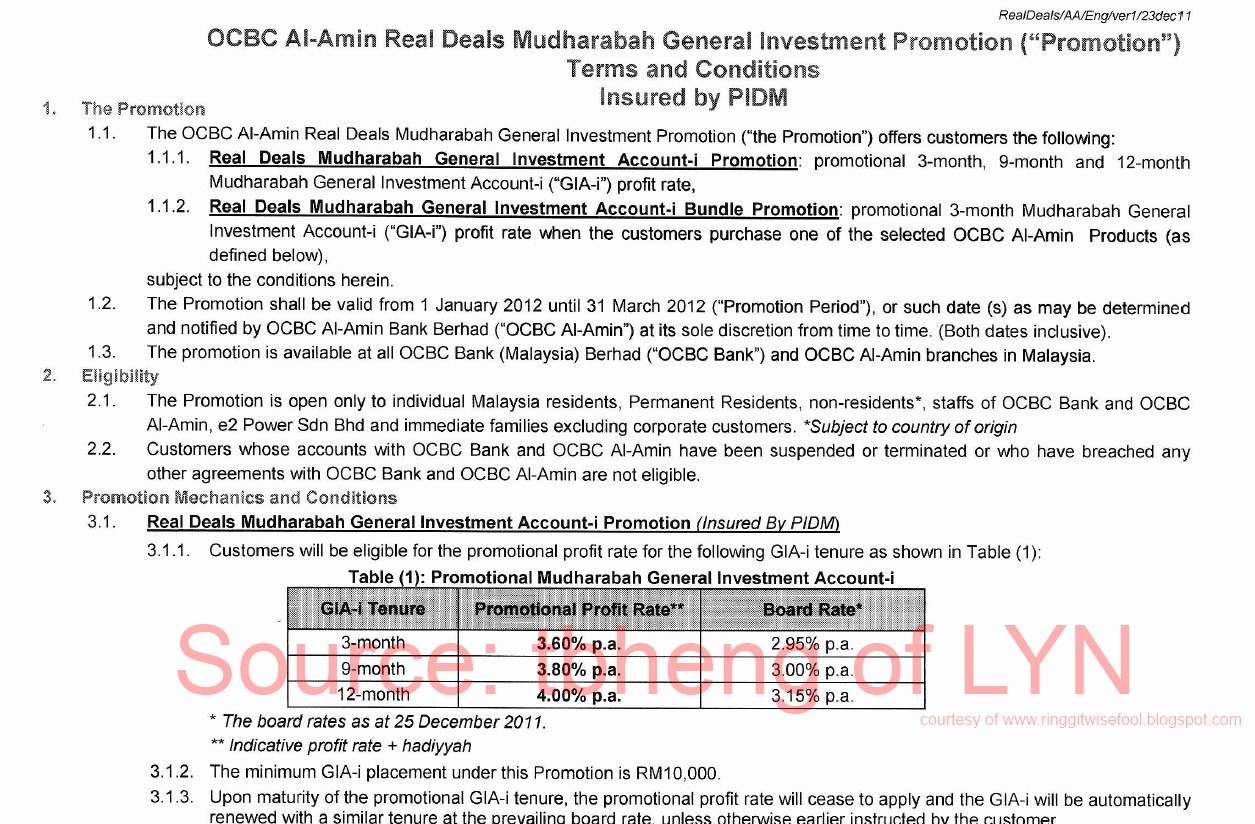

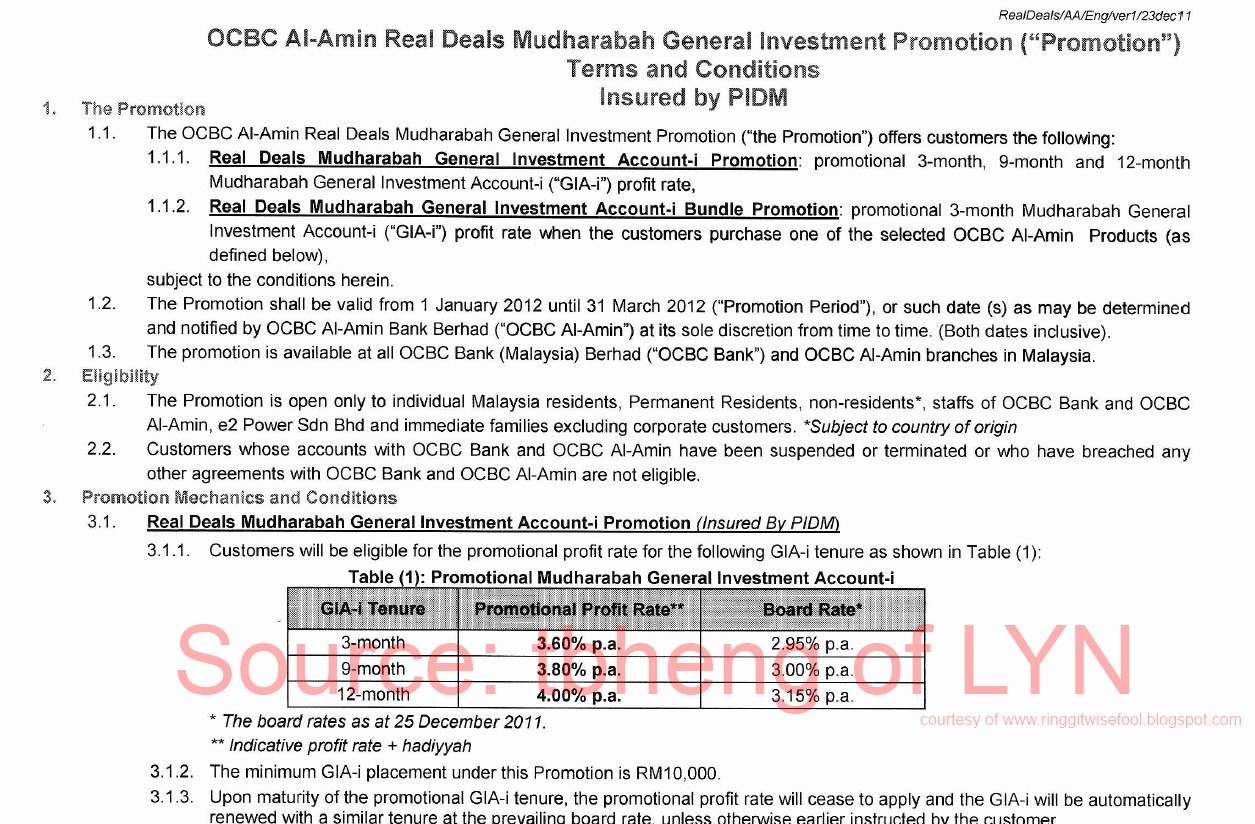

Okay, here is my encounter with OCBC...

This morning, I withdrawn from SCB eSaver and headed to OCBC with the intention on 5% & 3.8% FD promo. (As it is the best combo so far.) The RM said they just got a new memo yesterday that combo promo is not allowed as per clause "4.3. This Promotion is not valid with any other promotion or other promotions as specified by OCBC Bank from time to time". I told some friends got it, she said at end Jan, the backend will revalidate and rectify accordingly. So I left with option of 5% & 2.95% for 3-month which give effective 3.98% p.a. Of course she tried promoting some investment plan with 4.5% guaranteed returns but no uplift for the next 5-year. Hmm, this does not suit me. At the end, I decided on 9-month 3.8% promo just to avoid the frequent "musical chair" spin. When the RM brought up the form, I was surprise to see the 12-month 4.0% Real Deals promo!!! I was like huh? Is this some kind of joke or what? This is NEW... I verified and confirmed it is the current promo. She says "Yes". Great! I know this is an Islamic product and based on indicative profit sharing concept. It is covered by PIDM. I have tried similar product in AmBank last year. At the end I loaded all my fund onto this 12-month GIA-i for 4% p.a. Save me some energy to stare at the musical chair for the next 12 months. Of course I open multiple contracts just in case I uplift some as opportunity fund, there are interests paid as long as it is over 3-month. If not because of the RM took the wrong form, I din even know this existed. I went home to search for this promo, but cant find it online. I scanned the form here for those who are interested.  OCBC_GIA_i_Real_Deal_Q1_2012.pdf ( 1.66mb )

Number of downloads: 352

OCBC_GIA_i_Real_Deal_Q1_2012.pdf ( 1.66mb )

Number of downloads: 352 |

|

|

Jan 6 2012, 05:35 PM Jan 6 2012, 05:35 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(tbheng @ Jan 6 2012, 05:31 PM) At the end I loaded all my fund onto this 12-month GIA-i for 4% p.a. Save me some energy to stare at the musical chair for the next 12 months. Of course I open multiple contracts just in case I uplift some as opportunity fund, there are interests paid as long as it is over 3-month. If not because of the RM took the wrong form, I din even know this existed. Wow! Thank you for the pdf file. But, too long lah, too lazy to read, will just trust you on the 4% rate.I went home to search for this promo, but cant find it online. I scanned the form here for those who are interested.  OCBC_GIA_i_Real_Deal_Q1_2012.pdf ( 1.66mb )

Number of downloads: 352

OCBC_GIA_i_Real_Deal_Q1_2012.pdf ( 1.66mb )

Number of downloads: 352You know what, good bullet when they want to rectify my 5% thingy and maybe can insist that they instead backdate my early deposit to this GIA product. aeiuo228, see, if wait 3 days, get 4% for a year. This post has been edited by Gen-X: Jan 6 2012, 05:41 PM |

|

|

|

|

|

Jan 6 2012, 05:43 PM Jan 6 2012, 05:43 PM

|

Senior Member

1,188 posts Joined: Sep 2008 |

|

|

|

Jan 6 2012, 05:50 PM Jan 6 2012, 05:50 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(Gen-X @ Jan 6 2012, 05:27 PM) BoomChaCha, the Bank Rakyat guy told you that deposits not insured by PIDM? I think it is safe lah since it is placed under government. The Bank Rakyat staff only told me that they were not under PIDM,they did not mention their FD was insured by PIDM or not. Added on January 6, 2012, 5:57 pm QUOTE(tbheng @ Jan 6 2012, 05:43 PM) The pdf is only 2 page mah... Ouh...oh... In fact the focus is at the top of page 1 that says: 3-month 3.6% 9-month 3.8% 12-month 4.00%. Now the new promo from OCBC is 4.00% rate for 12 months terms? Any terms and conditions like need to bundle with OCBC's saving account and current account? Minimum FD placement is RM 10K? Do you know what is the maximum bullet that allows us to shoot? This post has been edited by BoomChaCha: Jan 6 2012, 06:36 PM |

|

|

Jan 6 2012, 06:06 PM Jan 6 2012, 06:06 PM

|

Senior Member

1,332 posts Joined: Oct 2005 |

QUOTE(BoomChaCha @ Jan 6 2012, 04:17 PM) No, I do not have account with Bank Rakyat, but probably I will I also just went to the counter and the staff told me the interest rate is not fixed and it 'fluctuates'.have one soon. I just called Bank Raykat an hour ago, they said they calculate interest rate based on monthly basis, but not on daily basis. So this means that FD depositors can get more money. And they can pay interest to depositors on monthly basis. For example, if I put RM 10,000.00 into their 1 year FD tenure for 4.01 % rate, so I will get RM 401 interest after one year. RM 401 / 12 months = RM 33.41, so every month I will get RM 33.41, this RM 33.41 will deposit in my Bank Raykat saving account. But Bank Rakyat is not under PIDM Also, I heard Bank Raykay is not a bank, it is a financial institution like "korperasi"... for example : if u sign up for 12 mth 4.01% tenure, it is not guaranteed 4.01%. and the staff told me it does fluctuates as much as 1%. but never more than that. hence now i am considering OCBC promo. QUOTE(Gen-X @ Jan 6 2012, 05:27 PM) 3. Taking note that SCB offer was for only 3 months, now many would also move their funds to OCBC where the average 3 months FD comes out to be 4.225% which is pretty good. So come April, there will be many people looking for places to shift their funds again. |

|

|

Jan 6 2012, 06:12 PM Jan 6 2012, 06:12 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(turion64 @ Jan 6 2012, 06:06 PM) I also just went to the counter and the staff told me the interest rate is not fixed and it 'fluctuates'. Thanks for the info on the fluctuation. Second confirmation. Decided to remove Bank Rakyat's "fd" chart in 2nd Post and in my blog.for example : if u sign up for 12 mth 4.01% tenure, it is not guaranteed 4.01%. and the staff told me it does fluctuates as much as 1%. but never more than that. hence now i am considering OCBC promo. i thought OCBC 3 mth tenure is 3.5% ? how does that work out to 4.225% ? should be (5% + 3.6% )/2 = 4.3% QUOTE(tbheng @ Jan 6 2012, 05:43 PM) The pdf is only 2 page mah... Bro read that, is the clauses below that, hahaIn fact the focus is at the top of page 1 that says: 3-month 3.6% 9-month 3.8% 12-month 4.00%. Also, I have posted below pic in my blog, if you are not agreeable to it, I will remove it. 1st post too.  This post has been edited by Gen-X: Jan 6 2012, 06:14 PM |

|

|

Jan 6 2012, 06:18 PM Jan 6 2012, 06:18 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(turion64 @ Jan 6 2012, 06:06 PM) I also just went to the counter and the staff told me the interest rate is not fixed and it 'fluctuates'. Oh... for example : if u sign up for 12 mth 4.01% tenure, it is not guaranteed 4.01%. and the staff told me it does fluctuates as much as 1%. but never more than that. The Bank Rakyat staff did not tell me about the rate fluctuation.. The rate will fluctuate as much as 1%? This mean we could get 3.01% rate at the end of the year... I think we can forget it... Let's focus on OCBC 4% FD rate for 12 months term... |

|

|

Jan 6 2012, 06:26 PM Jan 6 2012, 06:26 PM

|

Senior Member

3,294 posts Joined: Dec 2005 |

QUOTE(tbheng @ Jan 6 2012, 05:31 PM) Okay, here is my encounter with OCBC... Luckily I did not go to UOB just now This morning, I withdrawn from SCB eSaver and headed to OCBC with the intention on 5% & 3.8% FD promo. (As it is the best combo so far.) The RM said they just got a new memo yesterday that combo promo is not allowed as per clause "4.3. This Promotion is not valid with any other promotion or other promotions as specified by OCBC Bank from time to time". I told some friends got it, she said at end Jan, the backend will revalidate and rectify accordingly. So I left with option of 5% & 2.95% for 3-month which give effective 3.98% p.a. Of course she tried promoting some investment plan with 4.5% guaranteed returns but no uplift for the next 5-year. Hmm, this does not suit me. At the end, I decided on 9-month 3.8% promo just to avoid the frequent "musical chair" spin. When the RM brought up the form, I was surprise to see the 12-month 4.0% Real Deals promo!!! I was like huh? Is this some kind of joke or what? This is NEW... I verified and confirmed it is the current promo. She says "Yes". Great! I know this is an Islamic product and based on indicative profit sharing concept. It is covered by PIDM. I have tried similar product in AmBank last year. At the end I loaded all my fund onto this 12-month GIA-i for 4% p.a. Save me some energy to stare at the musical chair for the next 12 months. Of course I open multiple contracts just in case I uplift some as opportunity fund, there are interests paid as long as it is over 3-month. If not because of the RM took the wrong form, I din even know this existed. I went home to search for this promo, but cant find it online. I scanned the form here for those who are interested.  OCBC_GIA_i_Real_Deal_Q1_2012.pdf ( 1.66mb )

Number of downloads: 352

OCBC_GIA_i_Real_Deal_Q1_2012.pdf ( 1.66mb )

Number of downloads: 352 |

|

|

Jan 6 2012, 06:27 PM Jan 6 2012, 06:27 PM

|

Senior Member

1,188 posts Joined: Sep 2008 |

QUOTE(BoomChaCha @ Jan 6 2012, 05:50 PM) The Bank Rakyat staff only told me that they were not under PIDM, No, no other bundle product required. I just opened the GIA-i acct only.they did not mention their FD was insured by PIDM or not. Added on January 6, 2012, 5:57 pm Ouh...oh... Now the new promo from OCBC is 4.00% rate for 12 months terms? Any terms and conditions like need to bundle with OCBC's saving account and current account? Minimum FD placement is RM 10K? Do you know what is the maximum bullet that allows us to hit? |

|

|

|

|

|

Jan 6 2012, 06:36 PM Jan 6 2012, 06:36 PM

|

Senior Member

1,332 posts Joined: Oct 2005 |

QUOTE(Gen-X @ Jan 6 2012, 06:12 PM) Thanks for the info on the fluctuation. Second confirmation. Decided to remove Bank Rakyat's "fd" chart in 2nd Post and in my blog. No problem bro should be (5% + 3.6% )/2 = 4.3% Bro read that, is the clauses below that, haha Also, I have posted below pic in my blog, if you are not agreeable to it, I will remove it. 1st post too.  QUOTE(BoomChaCha @ Jan 6 2012, 06:18 PM) Oh... After reading tbheng OCBC pdf chart, can't help but notice the 12mth tenure 4% is based on profit rate. (the promotional profit rate have 2 ** on it that stated "indicative profit rate + hidayyah)The Bank Rakyat staff did not tell me about the rate fluctuation.. The rate will fluctuate as much as 1%? This mean we could get 3.01% rate at the end of the year... I think we can forget it... Let's focus on OCBC 4% FD rate for 12 months term... I remember the bank rakyat staff kept telling me the 12mth tenure of their product will pay out "profit" instead of using the word "interest" Could this OCBC based on same islamic profit sharing principles? Any bros can clarify? |

|

|

Jan 6 2012, 06:41 PM Jan 6 2012, 06:41 PM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

Islamic FD always uses the term "profit" .. normally possible to be slightly higher than conventional FD

|

|

|

Jan 6 2012, 06:42 PM Jan 6 2012, 06:42 PM

|

Senior Member

860 posts Joined: Jan 2003 From: Petaling Jaya |

|

|

|

Jan 6 2012, 07:00 PM Jan 6 2012, 07:00 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(turion64 @ Jan 6 2012, 06:36 PM) No problem bro ** lndicative profit rate + hadiyyahAfter reading tbheng OCBC pdf chart, can't help but notice the 12mth tenure 4% is based on profit rate. (the promotional profit rate have 2 ** on it that stated "indicative profit rate + hidayyah) I remember the bank rakyat staff kept telling me the 12mth tenure of their product will pay out "profit" instead of using the word "interest" Could this OCBC based on same islamic profit sharing principles? Any bros can clarify? I am curious what does the above term mean? Why OCBC changes their FD promotion very fast? Who knows next week they come out with 5.0% promo? |

|

|

Jan 6 2012, 07:04 PM Jan 6 2012, 07:04 PM

|

Senior Member

1,332 posts Joined: Oct 2005 |

|

|

|

Jan 6 2012, 07:12 PM Jan 6 2012, 07:12 PM

|

Senior Member

2,145 posts Joined: Mar 2009 From: 1BORNEO |

So the OCBC 5% is not real??

|

|

|

Jan 6 2012, 07:13 PM Jan 6 2012, 07:13 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(turion64 @ Jan 6 2012, 07:04 PM) So, this 4% return rates is not guaranteed, and it could be less....Thanks Bro Real Deals Mudharabah General lnvestment Account-i Promotion (Insured By PIDM) Just noticed this is not a FD plan, it is an investment plan... Should we go for it..? Is OCBC trying to fool us..? This post has been edited by BoomChaCha: Jan 6 2012, 07:19 PM |

|

Topic ClosedOptions

|

| Change to: |  0.0278sec 0.0278sec

0.49 0.49

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 08:16 AM |