QUOTE(Gen-X @ Sep 17 2012, 09:41 PM)

Bro, FD interest rate did go above 10% in 1997/98 crisis but for a very short period like

gark mentioned. That time was really hard for everyone, no cash flow and foreign banks withdrew loan facilities. Many people were laid off. But we learn from it. Now youngsters who have yet to experience a major economy crisis who think market can go up forever will be in for a ride of their life if another major crash comes.

I sold most of my stocks just before the crash and went in again near the bottom but that round did not make much because when it rebounded did not take the handsome profit in full but expected it to go back to same previous high (greedy)

Even wrote about it in my blog with graph too.

Even wrote about it in my blog with graph too.And like gark mentioned, I was worried our purchasing power will be reduced significantly, so bought my first and only Rolex watch in 1998, haha. Now my no longer in production Rolex watch has become a collector's item

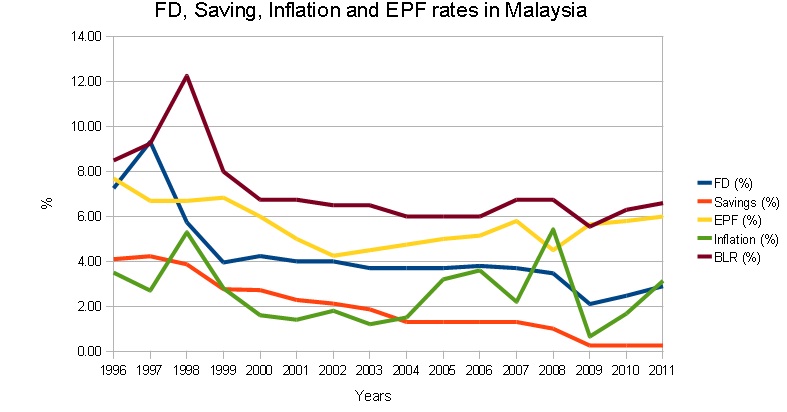

I found this chart from the internet.

Another one.

Just read your blog and I was surprised that you too remembered vividly what Tun Daim said about he bought shares for pocket money only and asked the stocks speculators to be cautioned then the next day, KA-BOOM...... hahaha...

Bought my first and only Tag Heuer too, courtesy from the mid 90's super bull run.

Now no more wearing watch, use smart phone clock better.

QUOTE(plumberly @ Sep 18 2012, 09:05 AM)

"Business loans dip" says today's The Star.

What can we infer from that w.r.t. future FD rates ?

Maybe what we are seeing now with the lower FD rates was the result of the decline in business loans some months ago.

My look ahead then is to go for the longer terms FD rather than 1 - 3 months.

Your view ?

On the contrary, I would rather go for short terms for all my next renewals. As Gen-x said, there is a possibility of shopping spree in the near future if not as rock bottom as in 1998.

This post has been edited by aeiou228: Sep 18 2012, 12:15 PM

This post has been edited by aeiou228: Sep 18 2012, 12:15 PM

Aug 2 2012, 03:53 PM

Aug 2 2012, 03:53 PM

Quote

Quote

0.0576sec

0.0576sec

0.73

0.73

7 queries

7 queries

GZIP Disabled

GZIP Disabled