A FEW weeks ago, Mr Tan, a regular client, came by the office. He was excited about a new investment he had made, in an insurance savings plan.

He was confident it would give him good returns while offering substantial insurance protection.

Mr Tan had acted without first seeking our advice, which was unusual. However, that was not what rattled me most.

First, some background about Mr Tan. Now in his mid-forties, Mr Tan became our client about six years ago. Even then, he had been saving and investing for a good 20 years. He was an easy client to advise because he understood the fundamentals of good investment. He did not rely on luck – he looked instead to hard work and sound advice when deciding where to put his money.

This clear-eyed approach had served him so well that Mr Tan was already able to retire.

So when he came to the office describing his latest investment, I was very concerned as I am familiar with this product.

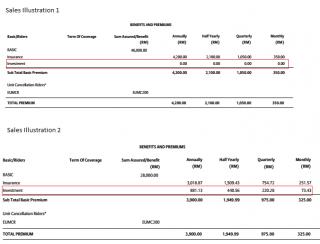

“The agent explained to me that I could buy the insurance policy by paying RM50,597 a year for five years. That means a total investment of RM252,985. Under the plan, I get RM3,960 annually for first 5 years and RM7,920 for next 19 years. At the end of 25 years, I get an additional RM398,362. That’s a total of RM568,642.

“It’s win-win. I’m protecting myself. I’m also investing for the future. And should anything happen to me, my children will get the money.”

I have often written and talked about insurance savings plans with one clear message: seek advice first. Thankfully, I was able to persuade him to leave the documents with me so that I could have a closer look

As I scrutinised the paperwork, I saw what I had anticipated – that the deal was not as sweet as it had sounded.

Under Mr Tan’s plan, with annual returns and the lump-sum payment at the end the client gets back RM568,642 for an investment of RM252,985.

A key point to note is that insurance savings plans always demonstrate their worth by using ringgit values and not percentages.

It is very difficult to compare a ringgit value return to the fixed deposit rate, which is what most people would use as a benchmark.

Very often, these plans offer death coverage. In Mr Tan’s case, it was to the amount between RM136,000 to RM424,000 . This plays on a person’s natural fear of mortality.

If anything happens to the client, that money is paid to the family. This is a comforting thought – the client now feels that they are securing their future as well as helping their children’s.

I called Mr Tan and asked to meet urgently. I explained my serious reservations to him and presented alternatives. “Mr Tan, why don’t you optimise what you have by buying a term insurance policy for a smaller premium to cover you for the same amount?”

“You can always invest the difference in an investment that can earn you a return of up to 8% per annum. You have been achieving that kind of return for your liquid investments for the past 10 years. At the end of 25 years, you will get something like RM1,153,439.”

“This is so much more compared with RM568,642 that you get from the insurance plan. This plan is suitable for those who need forced saving and don’t have investing knowledge to invest their saving. However, it is definitely not for you.”

For a while, Mr. Tan stared at me blankly. Then it all clicked and he said, “I should never have invested in this. Thankfully, I’m still within the ‘cooling-off’ period. I can get my money back.”

Relieved he was willing to accept the advice, I relaxed. Over a cup of coffee, I asked him what really happened as he was usually so careful.

He sighed. “I don’t know. When my banker came to see me, he brought an insurance agent with him. They were very convincing, talking about saving money and leaving something for my family. I was so taken by their presentation that inside my head, everything jammed.”

I smiled at the word “jammed” because I knew exactly what had happened.

Mr Tan was a man who was used to straightforward investments. However, this was a hybrid – an investment combined with insurance. It was presented to him in a polished package, with many emotional factors. He became confused and couldn’t objectively dissect the benefits the way he usually would have.

As we parted, Mr Tan said: “I completely forgot what you have told me time and again: that insurance is not the same as investment. Insurance companies can give me coverage and protection. But that does not mean they are experts in making my money grow.”

With even a seasoned investor like Mr Tan taken in, I couldn’t help but think of all the younger, less experienced players. This is what I would advise:

If you are presented with an investment opportunity, you must be clear about:

● What you’re investing in exactly;

● What is the annualised return on your investments, and

● What terms and conditions you are agreeing to.

If you are not comfortable or not confident that you understand everything fully, never be pushed into agreeing. Seek advice or reject the offer outright. It is your right.

TLDR insurance is not investments, even if the plan is called investment linked policy.

Dec 1 2013, 09:41 PM, updated 10y ago

Dec 1 2013, 09:41 PM, updated 10y ago

Quote

Quote

0.3656sec

0.3656sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled