Fixed Deposit Rates in Malaysia V2 Thread

Fixed Deposit Rates in Malaysia V3 Thread

Fixed Deposit Rates in Malaysia V4 Thread

WEBSITE FOR FD RATES & LATEST PROMO

http://generationsxyz.blogspot.com/p/fixed-deposit.html

credit to Gen-X

Notice / Disclaimer:-

Call & Visit the respective banks for confirmation & latest promotion.

We are not liable to any misinformation which might cause any financial or opportunity loss (which include FD rates & any others information)

Members Recruitment for FD Group Deposit Campaign

- Please refer / PM to BoomChaCha if Interested

Objective: To consolidate all members' funds to bargain for a better FD rate with the bank

Minimum FD deposit: RM 50K per member

Target total FD amount: 2.5 million or more

FD Tenure: Tentatively 1 year

Recruitment Deadline: 31 May 2014

No Obligation: Members can retreat anytime before we negotiate to the bank

Prohibition: Members who registered after March 2014 are not allowed to join this campaign

Disclaimer: No guarantee will success in this group FD plan

Plan (BoomChaCha brain storm only)

(1) Consolidate at least RM 1 million fund from all participating members.

(2) Appoint representative to negotiate with the bank.

(3) As suggested by Warrior HJebat, after bank says OK, then representative generates and PM confidential code (for bank to recognize members' identities purpose) to each participating member so that members can place their FDs at special rate by submitting the code to the bank. Each member will get one unique code only.

(4) Members can place FDs in their local bank branches.

Any suggestions are very welcome..Thank You.

others country Interest Rate

Singapore at 0.05%, if deposit for 1 year can get around 0.25%.

China almost at par with Malaysia.

Thailand. 2.5%.

UK 0.5%.

ECB 0.25%

Guide to Fixed Deposits as well as list down the top ones in the market.

http://savemoney.my/fixed-deposit-rates-comparison-tool/

http://savemoney.my/best-fd-rates-in-malay...1-for-one-year/

CASA stands for Current Account / Savings Account

Over The Counter FD Rates - Credit to cybpsych

| Bank | 1 mth | 3 mths | 6 mths | 12 mths | Others | Notes |

| Affin | 3.05% | 3.10% | 3.25% | 3.60% | ||

| Alliance | 3.00% | 3.00% | 3.10% | 3.20% | FD Gold 3.30% | Interest paid monthly |

| AmBank | 2.95% | 3.00% | 3.10% | 3.15% | Am50Plus 3.25% | Interest paid monthly, FREE PA |

| Citibank | 2.80% | 2.90% | 2.90% | 3.05% | ||

| CIMB | 3.00% | 3.05% | 3.10% | 3.15% | ||

| Hong Leong | 2.90% | 2.95% | 2.95% | 3.10% | ||

| HSBC | 2.75% | 3.00% | 3.00% | 3.15% | ||

| Maybank | 3.00% | 3.05% | 3.10% | 3.15% | ||

| OCBC | 2.75% | 2.85% | 2.90% | 3.05% | ||

| RHB | 3.00% | 3.05% | 3.10% | 3.20% | Revised down Jan 2012 | |

| Public | 3.00% | 3.05% | 3.10% | 3.20% | PB Golden 50 Plus 3.25% | |

| Standard Chartered | 2.90% | 2.95% | 2.95% | 3.10% | Revised down Jan & May 2012 | |

| UOB | 2.90% | 2.95% | 2.95% | 3.10% | Revised down on 15 Dec 2011 |

[/quote]

Alliance Bank Straight Forward Fixed Deposit Promo 3.45% 6 Months. No CASA condition. Ends 31 March 2014.

Alliance Bank has extended their FD Promo until end of March. So, maybe you may want to consider signing up with Alliance Bank and get their Debit Card were you can earn up to 2% cash back from your transactions. credit to Gen-X

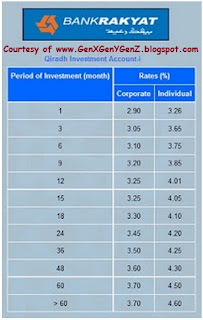

[SIZE=7]Bank Rakyat FD rate as March 2014

QUOTE(adolph @ Mar 21 2014, 01:40 AM)

1 month = 3.20%

2 month = 3.20%

3 month = 3.60%

4 month = 3.60%

5 month = 3.60%

6 month = 3.65%

7 month = 3.65%

8 month = 3.65%

9 month = 3.75%

10 month = 3.75%

11 month = 3.75%

12 month = 3.90%

15 month = 3.95%

18 month = 4.00%

24 month = 4.10%

36 month = 4.15%

48 month = 4.20%

60 month = 4.40%

> 60 month = 4.50%

Affin Bank FD Promo Up to 4.18% and Horse Figurine Contest - Ends 30 April 20142 month = 3.20%

3 month = 3.60%

4 month = 3.60%

5 month = 3.60%

6 month = 3.65%

7 month = 3.65%

8 month = 3.65%

9 month = 3.75%

10 month = 3.75%

11 month = 3.75%

12 month = 3.90%

15 month = 3.95%

18 month = 4.00%

24 month = 4.10%

36 month = 4.15%

48 month = 4.20%

60 month = 4.40%

> 60 month = 4.50%

http://3.bp.blogspot.com/-kru2Q6Q84GU/UsOW...motion+2014.jpg

The 4.18% interest rate is only applicable if you deposit RM100K into CASA.

credit to Gen-X

UOB Bank FD Promos - Ends April 2014

3 Months - 3.35%

12 Months - 3.55%

13 Months - 3.65%

All 3 promos above needed to deposit 8% into CASA for Min 3 months (lockup)

Bank Simpanan Nasional 1 Year FD Promo - No PIDM

3.95% p.a., min FD placement is RM 10K, but need to put additional 15% fund in a saving account.

This 15% fund in saving account will be "locked" and cannot withdraw for 1 year just like FD.

Saving account interest rate is approximately 0.4% p.a.

Effective rate is 3.486%

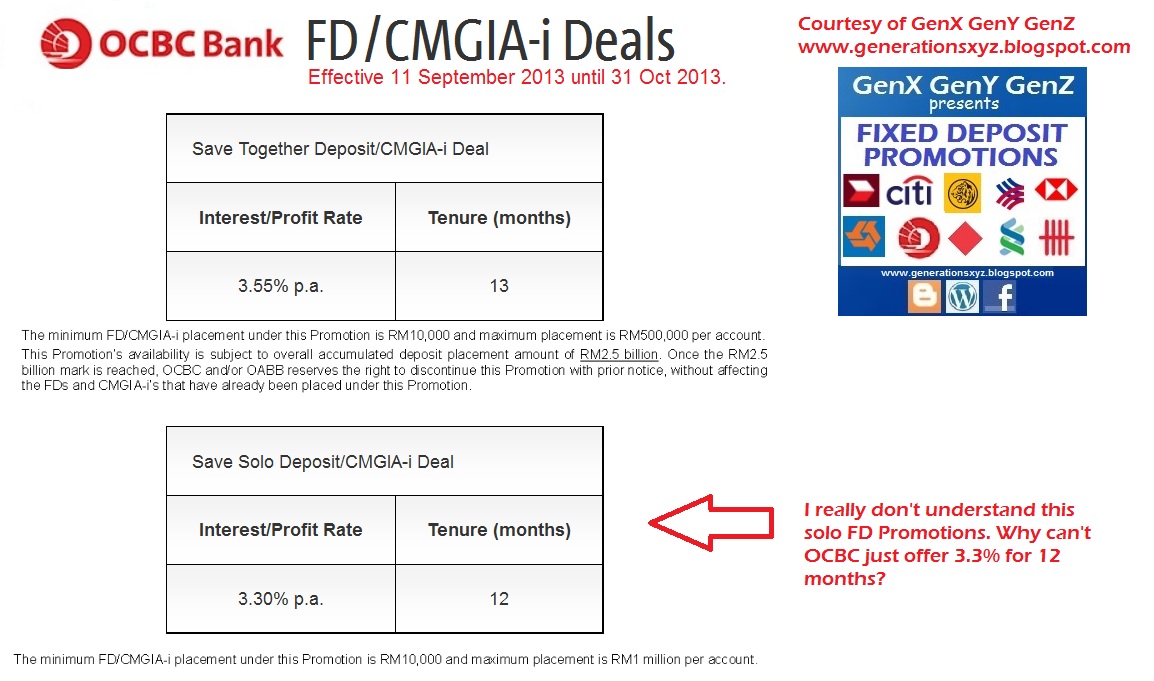

OCBC Bank - Savings Deal - 3 Months FD 4.28% until 31st March 2014.

OCBC is offering a new combo plan called Savings Deal where you can earn up to 4.28% for 3 months FD. However, this time you need to deposit equivalent amount into CASA unlike the previous Combo Plan where one only requires 1/3 equivalent of the FD amount to be deposited into CASA.

(Condition for the Promo: At least half the placement of the FD amount is to be earmarked in a CASA account for 3 months.)

OCBC Bank Straight Forward FD Promo. No CASA thing. Valid until 31 March 2014 - credit to Gen-X

3 months - 3.1% NO NEED FRESH FUND

12 months - 3.3% NO NEED FRESH FUND

Am Bank FD Promo - Will end on 31 March 2014 (Updated) - Credit to BoomChaCha

(A) 3.38% for 6 months tenure

(B) 3.70% for 18 months tenure

Terms & Conditions

(i) Regardless of new or existing customers

(ii) Must take both (A) & (B)

(iii) Minimum fresh fund RM 10K. FD fund will split 50% and 50% into (A) & (B) respectively.

(iv) FD interest will deposit into AM Bank saving account every 6 months.

PB FD Rush Promo - Valid from 1 March to 30 April or Upon reaching RM 1 Billion fund size, whichever is earlier

MayBank CASA“Rewards & Bonus” Campaign -- Up to 4% p.a. for Islamic Accounts

QUOTE(BoomChaCha @ Mar 21 2014, 01:41 PM)

MayBank CASA “Rewards & Bonus” Campaign -- Up to 4% p.a. for Islamic Accounts

Promotion Period: 1 March to 31 July 2014

Term and Condition: Cannot withdraw fund until 30th September 2014

Win Monthly Prizes: 75x iPad Air, 75x iPhone 5S, 15x 24K Gold Coin

Minimum Placement: RM 5K

Maximum Placement: RM 1 million

[attachmentid=3899240] [attachmentid=3899241]

Note that the interest credit is done within TWO months of end of campaign (by 30thSept 2014).

Source:

http://www.maybank2u.com.my/

Home > Promotions > Accounts & Banking > Casa “Rewards & Bonus” Campaign

Banker's Cheque Fee purely for FD Upliftment/Withdrawal (Do not combine with other accounts, i.e. Savings Account)Promotion Period: 1 March to 31 July 2014

Term and Condition: Cannot withdraw fund until 30th September 2014

Win Monthly Prizes: 75x iPad Air, 75x iPhone 5S, 15x 24K Gold Coin

Minimum Placement: RM 5K

Maximum Placement: RM 1 million

[attachmentid=3899240] [attachmentid=3899241]

Note that the interest credit is done within TWO months of end of campaign (by 30thSept 2014).

Source:

http://www.maybank2u.com.my/

Home > Promotions > Accounts & Banking > Casa “Rewards & Bonus” Campaign

Affin - FREE

Alliance - FREE

AmBank - RM2.15

Bank Rakyat - FREE

CIMB - FREE

Citibank - RM0.15

HLB - RM5.15 (PB Customers RM0.15)

HSBC - RM5 same day or RM2 next day (no RM0.15 Stamp Duty??)

Maybank - RM5 or RM5.15?

MBSB - FREE

OCBC - FREE

PBB - RM2.15

RHB - RM5.15

SCB - RM2.15

UOB - RM0.15 (in Penang) or RM2.15 (in Klang Valley!!!???) Conflicting reports.

WEBSITE FOR FD RATES & LATEST PROMO

http://generationsxyz.blogspot.com/p/fixed-deposit.htmlcredit to Gen-X

Notice / Disclaimer:-

Call & Visit the respective banks for confirmation & latest promotion.

We are not liable to any misinformation which might cause any financial or opportunity loss (which include FD rates & any others information)

This post has been edited by davinz18: Mar 22 2014, 12:56 PM

Sep 9 2013, 06:35 PM, updated 12y ago

Sep 9 2013, 06:35 PM, updated 12y ago

Quote

Quote

0.2212sec

0.2212sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled