continued from

https://forum.lowyat.net/topic/2722457/+2500Guide to Fixed Deposits as well as list down the top ones in the market.

http://savemoney.my/fixed-deposit-rates-comparison-tool/http://savemoney.my/best-fd-rates-in-malay...1-for-one-year/Malaysia Major Commercial Banks and Foreign Banks Fixed Deposit / Time Deposit Rates as of June 2013.

Bank - FD rates for 1 month, 3 months, 6 months and 12 months.

Affin Bank - 3.05%, 3.1%, 3.25% and 3.6%

Alliance Bank - 3%, 3%, 3.1% and 3.2%. FD Gold 12 months 3.3% (Interest paid monthly).

AmBank - 2.95, 3%, 3.10% and 3.15% (REVISED DOWN). Am50Plus 12 mths 3.25% (Interest paid monthly, FREE PA).

Citibank - 2.8%, 2.9%, 2.9% and 3.05%

CIMB Bank - 3%, 3.05%, 3.1% and 3.15%

Hong Leong Bank - 2.9%, 2.95%, 2.95% and 3.1%

HSBC Bank - 2.75%, 3%, 3% and 3.15%

Maybank - 3%, 3.05%, 3.1% and 3.15%

OCBC Bank - 2.75%, 2.85%, 2.9% and 3.05%

RHB Bank - 3%, 3.05%, 3.1% and 3.2%. (Revised down January 2012).

Public Bank - 3%, 3.05%, 3.1% and 3.15%. PB Golden 50 Plus 12 months 3.25%.

Standard Chartered Bank - 2.9%, 2.95%, 2.95% and 3.10% (Revised down January 2012 and May 2012)

UOB Bank - 2.9%, 2.95%, 2.95% and 3.10% (Revised down on 15 December 2011)

The highest over the counter FD rate for 12 months is by Affin Bank at 3.6%.

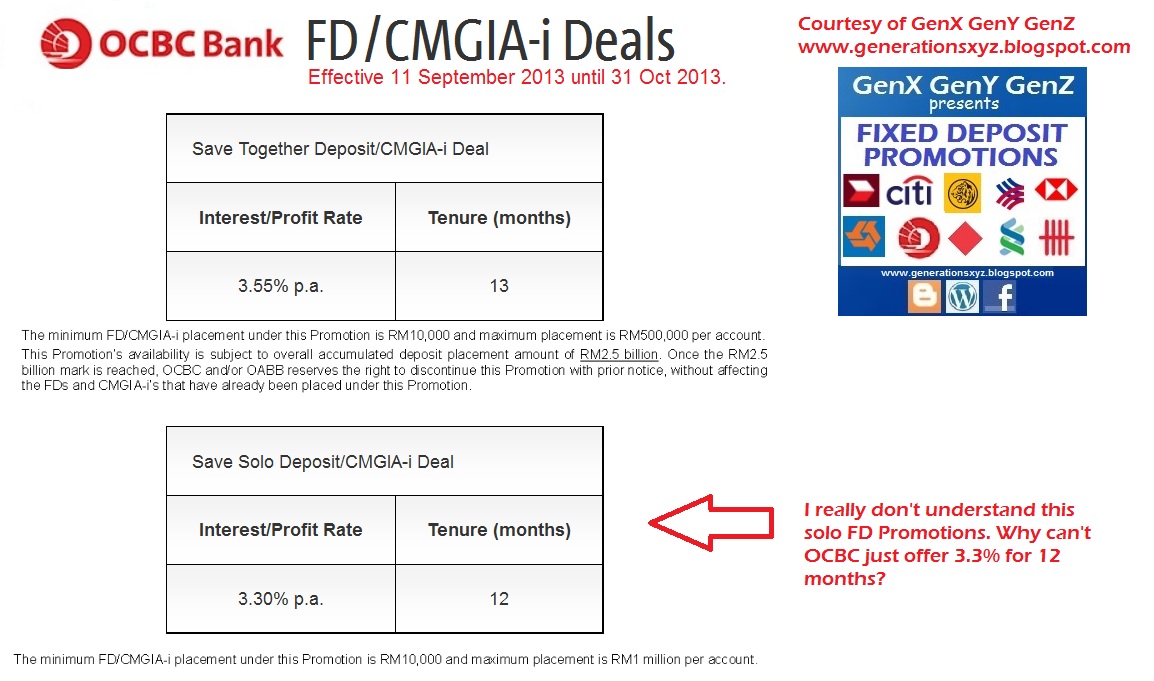

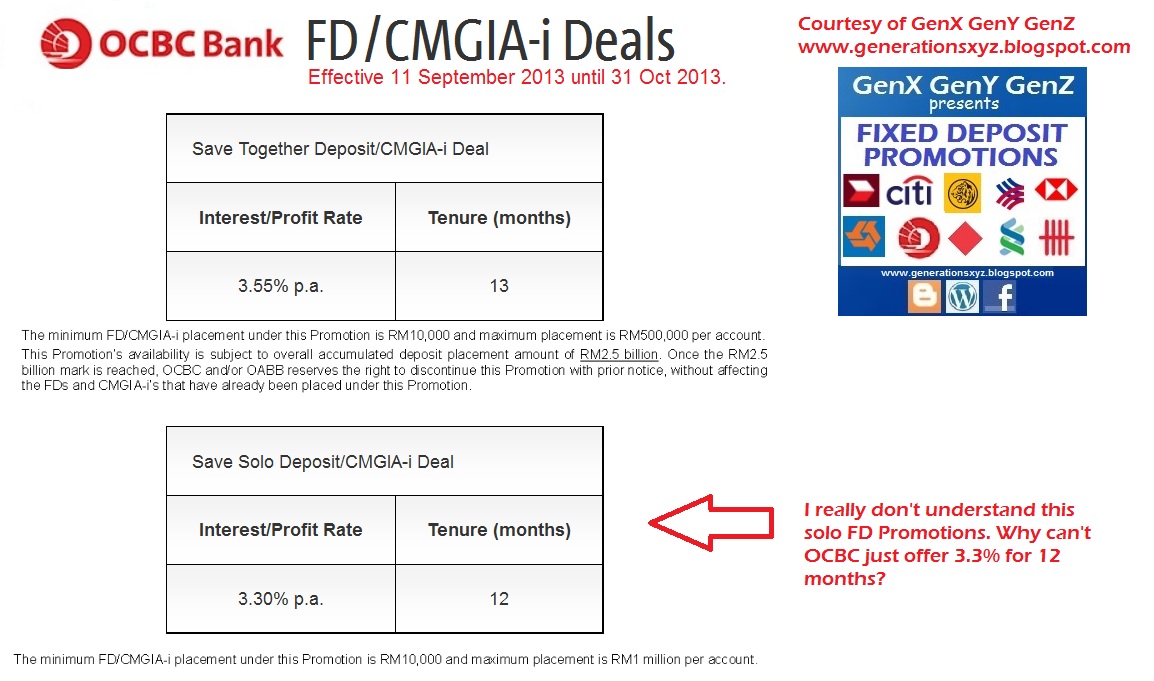

OCBC Bank - Combo Plan 3 Months FD 4.2% Ends 31 October 2013. OCBC has reduced the interest rate from 4.5% to 4.2% for their latest Mega Save Promo (formerly called Combo FD Promo Plan). One still needs to deposit 1/3 of the total amount into CASA which includes Smart Saver.

OCBC Bank Joint Account FD Promo. 3.55% for 13 Months FD. Ends 31 October 2013 (Previously 3.7% until 10 Sep 2013). Minimum Fresh Fund RM10K. Hong Leong Islamic Bank Promotion until 31 October 2013

Hong Leong Islamic Bank Promotion until 31 October 20136 Months - 3.3%

9 Months - 3.4%

12 Months - 3.5%

Hong Leong Bank states that the effective rate for the 6 month s FD is 3.3% and 3.38% for the non-PB and PB Fixed Deposit promo respectively BUT it is really lower because the 6% equivalent to FD amount to be earmarked for 3 months into CASA was not taken into consideration.

MACH by Hong Leong Bank - Mach by HLB is offering up to 3.4% for 12 months Fixed Deposit. But why go deposit there when we can get 3.6% 12 months standard board rate at Affin Bank.

affin bank

affin bankGENERAL INVESTMENT ACCOUNT-i

DEPOSIT BAND GROSS RATE PSR CUSTOMER’S INDICATIVE RATE

1 - 2 months 3.44% (89:11) 3.061%

3 - 5 months 3.52% (88:12) 3.097%

6 - 8 months 3.88% (84:16) 3.259%

9 - 11 months 4.14% (81:19) 3.353%

12 - 14 months 4.40% (82:18) 3.608%

15 - 60 months 4.58% (79:21) 3.618%

Refer to

http://www.affinbank.com.my/rates/ratesislamic.htmBanker's Cheque Fee purely for FD Upliftment/Withdrawal (Do not combine with other accounts, i.e. Savings Account)

Affin - FREE

Alliance - FREE

AmBank - RM2.15

Bank Rakyat - FREE

CIMB - FREE

Citibank - RM0.15

HLB - RM5.15 (PB Customers RM0.15)

HSBC - RM5 same day or RM2 next day (no RM0.15 Stamp Duty??)

Maybank - RM5 or RM5.15?

MBSB - FREE

OCBC - FREE

PBB - RM2.15

RHB - RM5.15

SCB - RM2.15

UOB - RM0.15 (in Penang) or RM2.15 (in Klang Valley!!!???) Conflicting reports.

WEBSITE FOR FD RATES & LATEST PROMO http://generationsxyz.blogspot.com/p/fixed-deposit.html

Oct 2 2013, 11:09 PM

Oct 2 2013, 11:09 PM

Quote

Quote

0.0316sec

0.0316sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled