QUOTE(pinksapphire @ Sep 10 2013, 04:39 AM)

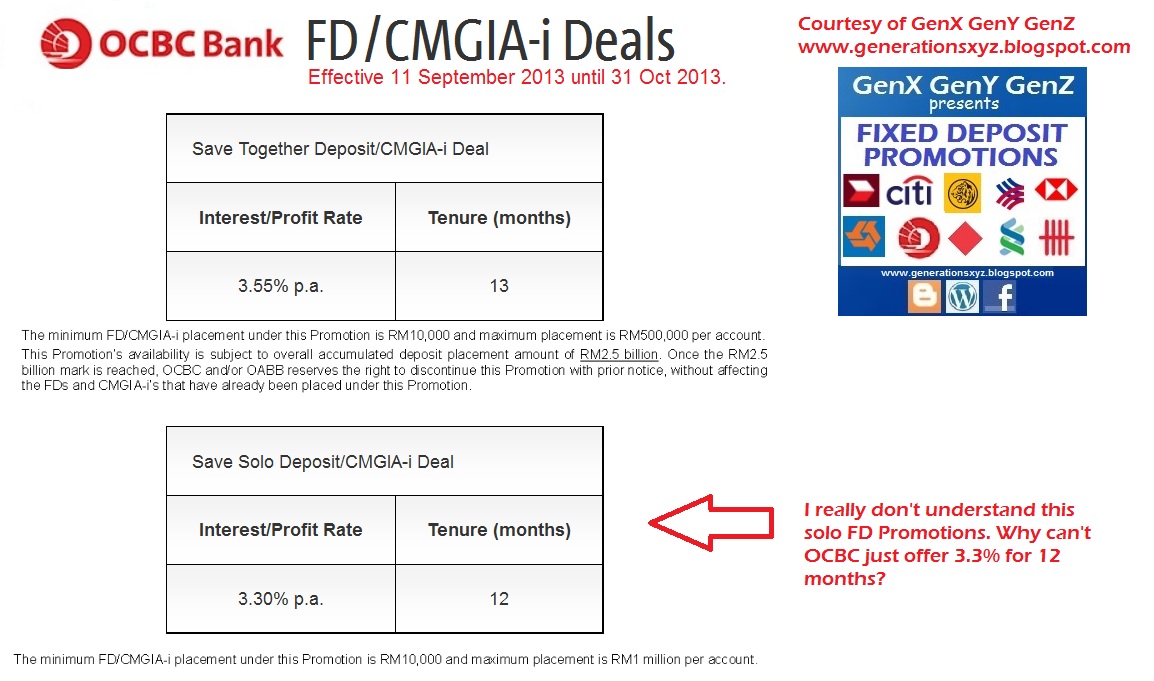

Can't wait to see what OCBC will offer after their current promo ends tomorrow.

If nothing's good, gotta start deciding where to place my funds after that, sigh.

Hi was trying to reply your post other foreign currency but cant because the forum is "full". The only foreign currency comparable to RM deposit is Aus dollar follow by NZ, the rest gave very low rates.If nothing's good, gotta start deciding where to place my funds after that, sigh.

Usually when bank close the offer earlier because either they have reached the target or they plan to lower the rates. My opinion is Ocbc will lower the rate judging by the recent promo only 3.3% for 9 months...

Sep 10 2013, 02:22 PM

Sep 10 2013, 02:22 PM

Quote

Quote

0.1524sec

0.1524sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled