1. Visa Infinite

•5x Timeless Bonus Points on overseas retail spend

•Annual Loyalty Rewards on cumulative spend

•Lifetime Annual Fee Waiver with minimum spend of RM30,000 within a 12-month period

•Complimentary Priority Pass membership card access to lounges worldwide

•Air Miles redemption via Enrich Rewards Program and AirAsia BIG

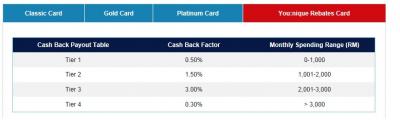

2. Cash Back Platinum

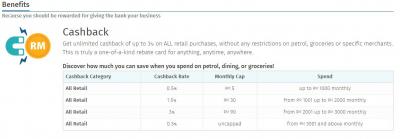

•Up to 2.0% cash back* on anything, anywhere, anytime.

•Enjoy 0% interest immediately on all your spending for the first 3 months.

•Automatic annual fee waiver i.e. spend a minimum of RM5,000 or swipe 12 times within a 12-month period.

•Timeless Bonus Points that do not expire. 2x Timeless Bonus Points on overseas spend.

•Air Miles via Enrich Rewards Program with Malaysia Airlines.

•Unlimited complimentary access to KLIA Plaza Premium Lounge.•Up to 2.0% cash back* on anything, anywhere, anytime.

•Enjoy 0% interest immediately on all your spending for the first 3 months.

•Automatic annual fee waiver i.e. spend a minimum of RM5,000 or swipe 12 times within a 12-month period.

•Timeless Bonus Points that do not expire. 2x Timeless Bonus Points on overseas spend.

•Air Miles via Enrich Rewards Program with Malaysia Airlines.

•Unlimited complimentary access to KLIA Plaza Premium Lounge.

They might not the best offer card in the market but neither not a bad one. I usually get about cash back of RM68.xx on the Plat card for spending RM5000 on everything monthly.

Any card holders here?

Aug 18 2012, 11:53 AM, updated 7 months ago

Aug 18 2012, 11:53 AM, updated 7 months ago

Quote

Quote

0.2903sec

0.2903sec

0.66

0.66

6 queries

6 queries

GZIP Disabled

GZIP Disabled